Estimated Dividends

Using Fidelity’s Position’s page download, it is easy to see the pay dates for the month of December. I usually check this in mid-November to get a rough idea of the December dividend forecast. This is also a helpful way to remember whether the market goes up or goes down in December, I know we will have income.

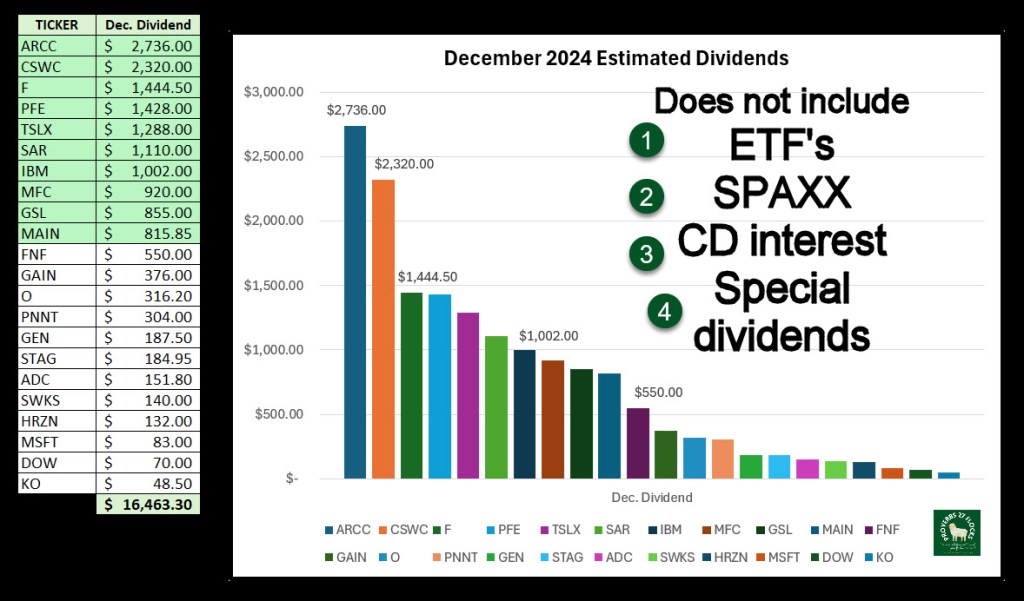

The following graph, using the download into Excel, is my rough forecast for December’s dividends. YTD 2024 dividends through the end of November have already exceeded the total through November 2023, so dividend growth continues at a nice pace. The reason this is important is simple: the price of almost everything is going up. If tariffs are implemented for China, Mexico, and Canada, it is likely to get worse for some products in the short-term.

It is important to note that this graph does not include unannounced ETFs like VYM, SCHD, DTD, and DGRO. It also doesn’t show income from SPAXX, CDs, or any special dividends. ETFs tend to declare their dividends for the quarter close to the end of the month. For example, the Ex-Dividend date for VYM in December 2023 was 12/18/2023. This was probably announced the day before that date.

I expect SCHD to announce their quarterly dividend sometime this week. DGRO announced their December 2023 dividend on 12/20/2023. When you add those dividends to the graph above, they far exceed $20K assuming the news is good.

History 2019-2024

It is wise to measure your success over time. For that reason, I always compare my progress over the years. It is another reminder that it pays to have a strategy and stick to it for the long-term.