Some Progress in Buying, Selling, Giving, and Taxes

As we approach the end of 2024, there are four things I consider. I see if there are some investments I should sell or buy, I consider my final ROTH IRA conversions, I review our current taxes, and I check the progress on our giving using the QCD approach. Last week was profitable in this regard.

2024 Income and Property Taxes

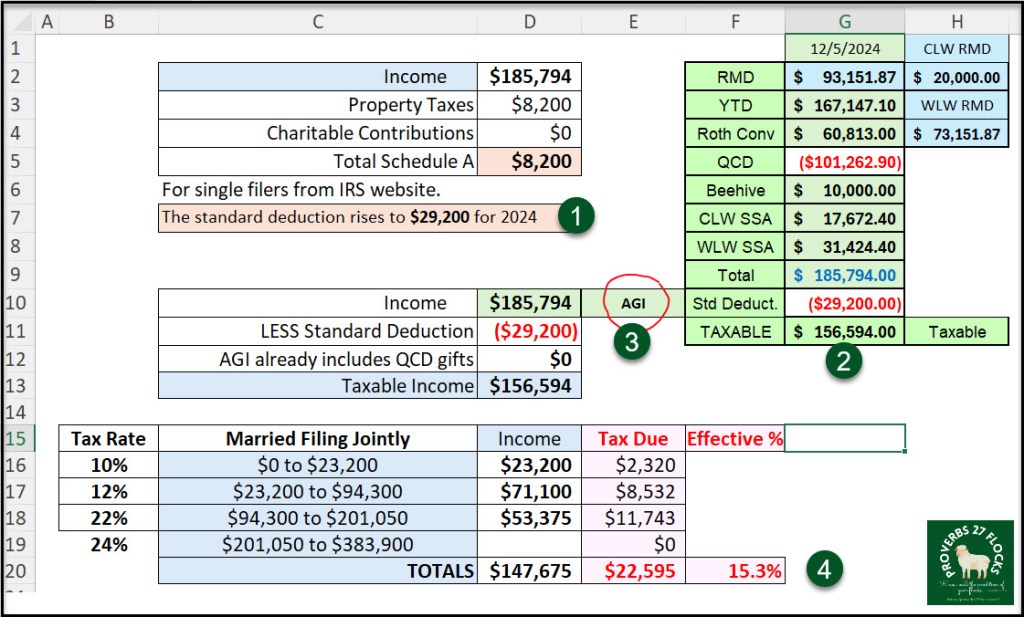

Rather than wait until January for the final 2024 income tax estimated payments, I pay them in December. This year I plan to sell one position in our taxable brokerage account at a profit and use that to pay our property taxes. I could wait to pay the property tax, as our Schedule A for itemized deductions will be less than the standard deduction for a married couple. However, because I took advantage of the QCD (Qualified Charitable Distribution) option in giving donations directly from my traditional IRA, I reduced our AGI (Adjusted Gross Income) by $101,262.90.

Our AGI is the total of our traditional IRA withdrawals (including the required amounts – RMDs), my earlier ROTH conversions of stocks I moved from my IRA to my ROTH, our social security income, and Cindie’s income from her part-time job as a baker at Beehive Homes. That would be a YTD income of $287K and would present a terrible income tax situation for two reasons. One is the income tax due for 2024 and the other would be the extra Medicare Premium we would have to pay in 2026.

Because of the QCD, which is calculated before the AGI on the income tax form, our current AGI is $185,794. This significantly reduces our income taxes for 2024. Then, there is the standard deduction of $29,200, reducing our taxable income to $156,594. If we have any capital losses, which will be small, this number will drop a bit.

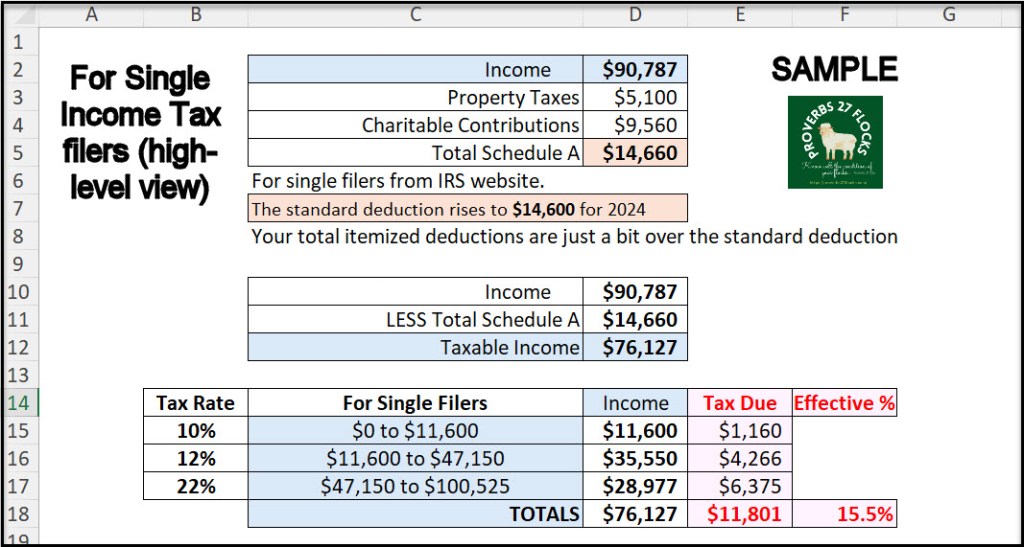

How did I come up with these numbers? Thanks to a friend’s request. I was asked to do some high-level tax calculations for a friend. She sent me her total income, her Schedule A deductions, and asked what she would owe for her Federal income taxes. I took the spreadsheet I created to do the calculations and created one for Cindie and me. This helped me see the big picture in a single spreadsheet.

Buying Investments: CAG

Last week I added 200 more shares of CAG to my ROTH IRA. That brings my total to 700 shares in my ROTH plus 1,500 shares in my traditional IRA. The total investment is now worth about $60K. CAG is Conagra Brands, Inc. Before you rush out and buy shares of CAG, understand it is not a great investment from a ten-year return’s perspective. I have owned shares of CAG off and on since March 2016, buying low and selling high. All of the shares I currently own have been purchased this year.

CAG has an EPS (FWD) of $2.58, a PE (FWD) or 10.55 and a dividend rate (FWD) of $1.40. This is a good value stock that currently yields 5.14%. CAG has a Payout Ratio of 55.12% (excellent) and a 5-Year Growth Rate of 10.49% – also excellent.

What does CAG do? It is a food company. Conagra Brands, Inc., together with its subsidiaries, operates as a consumer-packaged goods food company primarily in the United States. The company operates through four segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice. The Grocery & Snacks segment primarily offers shelf stable food products through various retail channels. The Refrigerated & Frozen segment provides temperature-controlled food products through various retail channels. The International segment offers food products in various temperature states through retail and foodservice channels outside of the United States. The Foodservice segment offers branded and customized food products, including meals, entrees, sauces, and various custom-manufactured culinary products packaged for restaurants and other foodservice establishments. The company sells its products under the Birds Eye, Marie Callender’s, Duncan Hines, Healthy Choice, Slim Jim, Reddi-wip, Angie’s, BOOMCHICKAPOP brands. The company was incorporated in 1919 and is headquartered in Chicago, Illinois.

Buying Investments: SCHD

Last week I also bought more shares of SCHD (SCHWAB US DIVIDEND EQUITY ETF) for our grandchildren’s UTMA accounts. This is a good dividend growth ETF. At this point each UTMA account holds 20 shares of SCHD.

Buying Investments: ABBV

Cindie’s ROTH gained another five shares of ABBV last week, bringing her total investment in ABBV to fifty shares. We now hold 1,150 shares of ABBV that are currently valued at $202,618.50. This is one of my top ten investments. ABBV has a ten-year total return of 308% and currently has a dividend yield of 3.72%. However, the dividend Payout Ratio is a very good 57.67% and the 5-Year Growth Rate is an acceptable 7.69%.

Sold PNNT (a BDC)

Last week I also sold 3,800 shares of PNNT. I also sold shares of PNNT for a friend. PennantPark Investment Corporation is a business development company is a private equity fund specializes in direct and mezzanine investments in middle market companies. There is a problem brewing. Although PNNT has a ten-year total return of 135.69%, there are warning signals.

The problem is that the EPS (FWD) is $0.84, but the Dividend Rate (FWD) is $0.96. This means they don’t have enough earnings to support the dividend. This is also why the Yield (FWD) has risen to 13.99%. This is not sustainable.

Sold 1,500 shares of SAVA

Cassava Sciences, Inc., a clinical stage biotechnology company, develops drugs for neurodegenerative diseases. Its lead therapeutic product candidate is simufilam, a small molecule drug, which is completed Phase 2 clinical trial; and investigational diagnostic product candidate is SavaDx, a blood-based biomarker/diagnostic to detect Alzheimer’s disease. The company was formerly known as Pain Therapeutics, Inc. and changed its name to Cassava Sciences, Inc. in March 2019. Cassava Sciences, Inc. was incorporated in 1998 and is based in Austin, Texas.

Sadly, their Alzheimer’s drug failed and the shares plummeted. I knew this was a possibility, so it was time to sell at a loss.

There is a silver lining. During the time we owned shares of SAVA I made $33,420 in options income trading covered call options. So, although our gross loss on this investment was $55K, the real loss was only $22K. That, of course, doesn’t consider the opportunity cost, but sometimes a bit more risk can have a marvelous payout. The thing to remember is keep your total high-risk investments to a minimum. Better yet, don’t buy something that could be worth nothing tomorrow.

CD Called

Finally, I had one $5K CD in my traditional IRA that was paying 4.75% that had a end date of 2/9/2026. The bank decided to call the CD, so I received the interest and the $5K back into the money market account.

Are You Planning and Acting?

Don’t be surprised by your 2024 income tax liability. A little preparation today will save you some surprises in April 2025.