Agree Realty Corporation

There are reasons I like ADC, but I sold half of our ADC shares yesterday. We went from 600 shares to 300 shares. The shares I sold were in Cindie’s IRA and my ROTH IRA. The shares I kept are in our largest account, my traditional IRA.

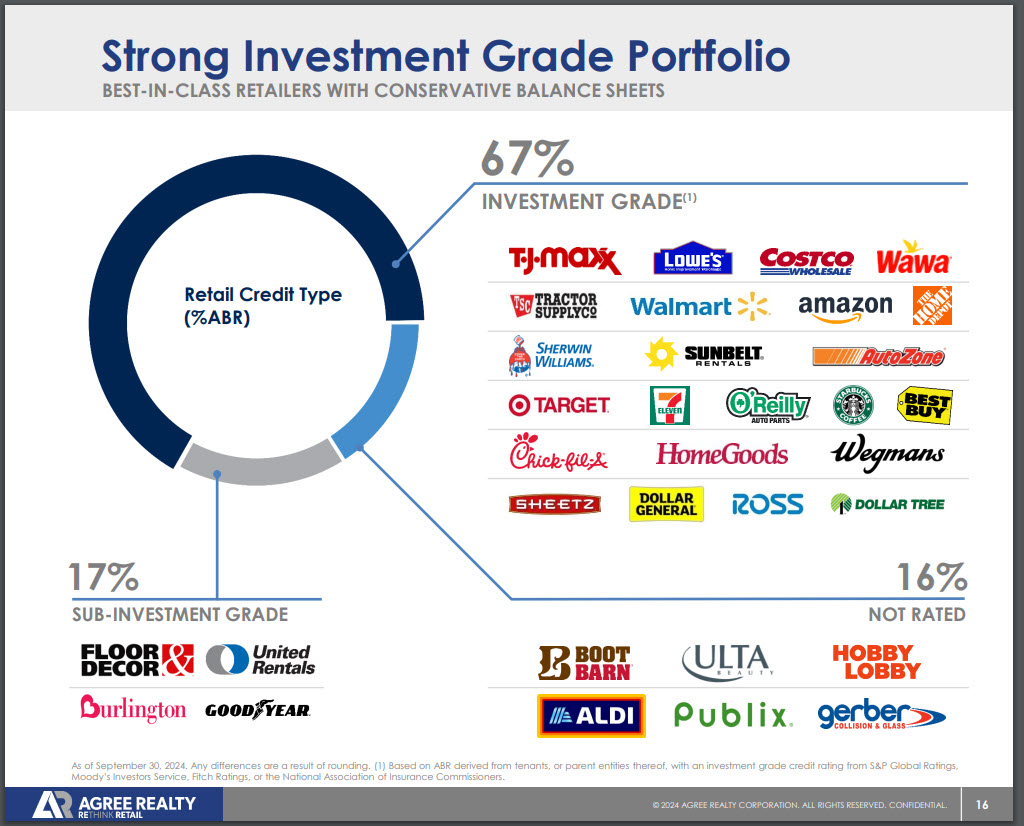

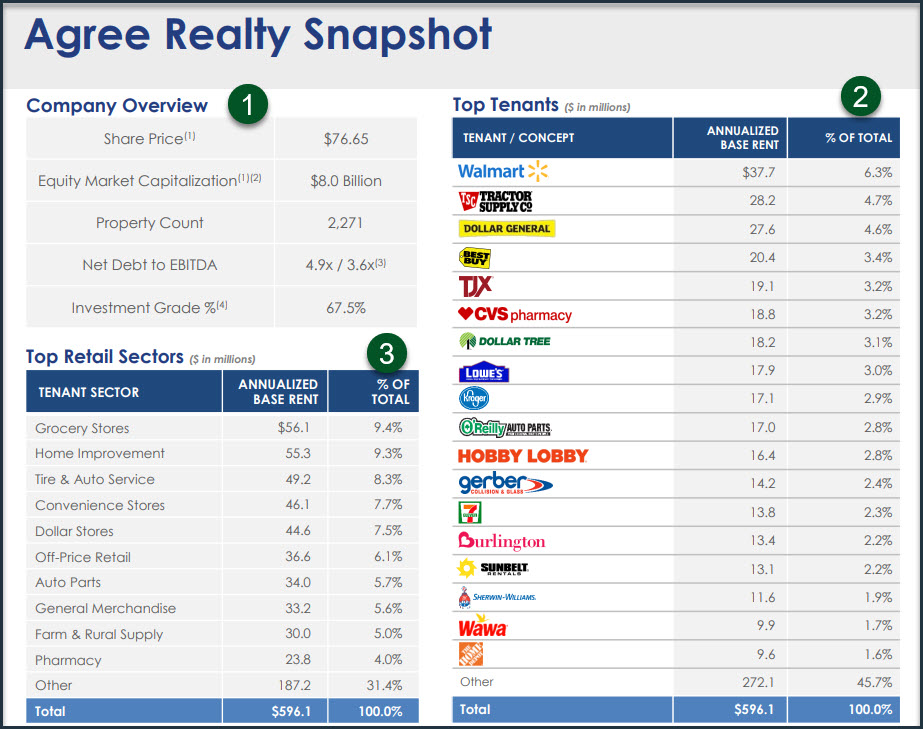

There are things I like about ADC, including the monthly dividend. In addition, ADC has an impressive portfolio of companies leasing from ADC, including Walmart, Home Depot, Costco, Amazon, Target, Aldi, and Chick-fil-A. The yield is also somewhat attractive at just over 4%. If interest rates continue to climb, this might be appealing to other value-focused income investors.

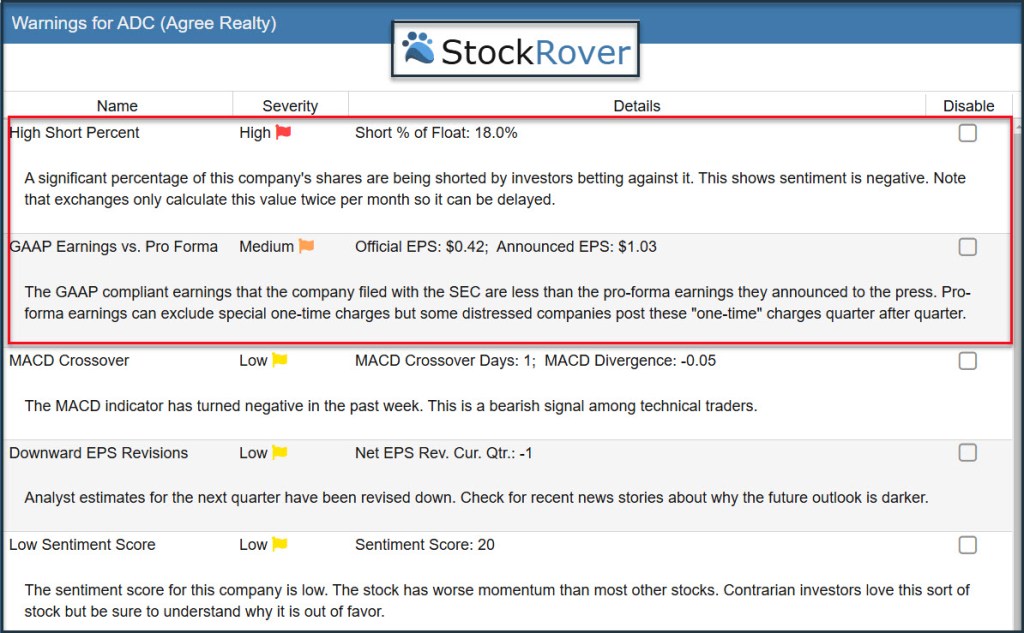

However, since September of this year the shares have been trading sideways in a range of about $73 to $76 per share. In addition, the short interest is a bit high at 13.92%. This is sometimes an indicator that there is a larger pool of investors who think the shares are too costly at the present time.

Why I Sold

In the case of Cindie’s IRA, I sold her 100 shares to raise cash and to book a profit on the shares. I purchased her shares in October 2021, and she has received $878.55 in dividends during the time she held the shares. The cash will be used in 2025 for Cindie’s RMD (Required Minimum Distribution). I prefer to hold a minimum of cash most of the time, but RMDs make it necessary to boost the cash holdings.

In the case of my ROTH IRA, I sold 200 shares and booked a profit. I started buying ADC shares in December 2019 and gradually added more in small lots of 5, 10, 25, and 40 shares per buy. My last buy was in November 2021. During the time I have owned these shares I have received $2,316.31 in dividends. Again, I sold these shares to raise some cash ($15,000) for other investments. This brings my ROTH IRA cash to $26,298.92. This dollar amount gives me a better balance for strategic buys.

Why I Kept 300 Shares

It is possible to trade covered call options on ADC shares. In September I sold three contracts (300 shares) and received $297.97 in contract income. The contract is set at $80 per share and it expires January 17. 2025. It is highly unlikely that the shares will be called, so I can keep them if that happens and do three more covered call option contracts. Of course I will continue to receive the monthly dividends as well.

Suggestions

If you hold ADC shares I don’t think you should sell them unless you have reasons similar to mine. If you don’t own shares, I would recommend waiting to see if the share price dropped. I might be willing to buy more in the $70-72 price range for my traditional IRA.

Company Profile

Agree Realty Corporation (the “Company”), a Maryland corporation, is a fully integrated real estate investment trust (“REIT”) primarily focused on the ownership, acquisition, development and management of retail properties net leased to industry leading tenants. The Company was founded in 1971 by its current Executive Chairman, Richard Agree, and its common stock was listed on the New York Stock Exchange in 1994. As of March 31, 2024, the Company owned 2,161 properties, with a total gross leasable area (“GLA”) of approximately 44.9 million square feet.