What Has Risk?

This is the fifth in my series of posts about Howard Marks’ book THE MOST IMPORTANT THING. Today the topic is “risk.” Risk has a number of characteristics. First of all, there is risk in all of life. Risk, when it comes to investing often is viewed as volatility. Volatility is the insane behavior of the price of an asset. It is like a psychotic “I’m happy and confident now” followed quickly by “I’m sad and fearful now.”

When I drive somewhere I am facing a risk. The risk includes my own poor judgment, weather conditions, and the behaviors of other drivers. Today I saw at least one driver using their smart phone while driving. I call that high risk.

So it is with investing. There are other investors who can create a mess on any given day in the stock market. When it comes to investing, it is important to understand risk.

Chapter 5: Understanding Risk

“Risk means more things can happen than will happen.” Elroy Dimson, p.31 I like this quote because it is a reminder that we tend to worry about too many things. The list of risks a company faces is usually in their company documents. They include many unlikely issues or events. However, the point is that there are many risks every business faces.

Marks says there are three powerful reasons to examine risk. The first is that risk is a bad thing. Common sense tells us that most people are risk-averse. Financial advisors know this, so they tend to make recommendations to reduce the risk. So we should understand risk when buying an investment.

The second element is one of risk/reward. If I am willing to take on more risk, then there better be the potential for more reward. Today, for example, I purchased 500 shares of Immutep Limited (Ticker IMMP.) I paid $2.06 per share. IMMP is a health care biotechnology company located in Australia. They engage in developing novel immunotherapies for cancer and autoimmune diseases. Sounds good on the surface, but they have not yet made a profit. However, their current QUANT rating puts them in position 45 out of a total of 495 biotech stocks.

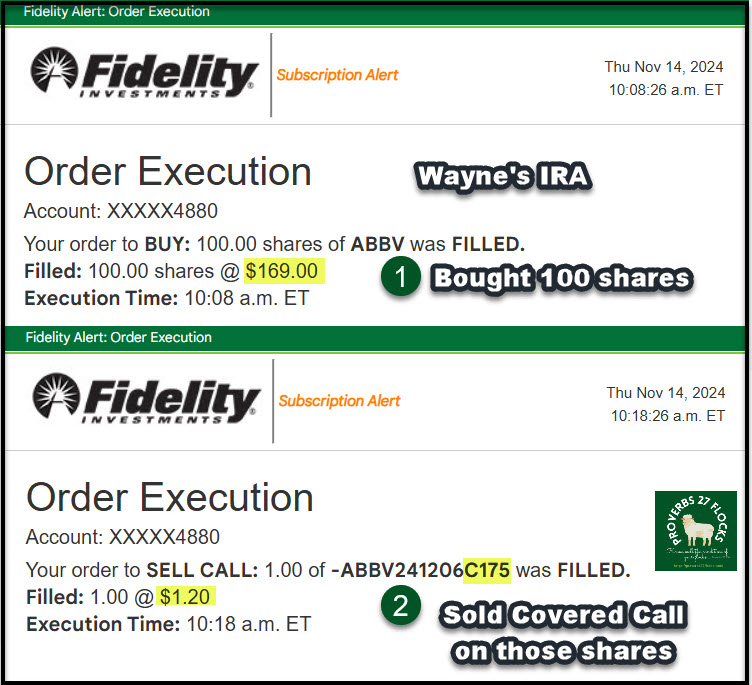

Bear in mind, however, that my total capital at risk is only $1,030. If the share price goes to zero, I lose that amount. In contrast, I also purchased 100 more shares of ABBV today. I paid $169 per share for 100 shares for a total investment of $16,900. If those shares drop to $12,000 in value, that is a larger loss.

Furthermore, our total ownership in ABBV is now 1,140 shares and they are currently worth just over $193K. You might conclude that I have more risk with my ABBV investment. However, that is a short-term perspective. ABBV is not only profitable, but they pay a growing dividend. The five-year dividend growth rate is 7.69%. However, their current QUANT rating puts them in position 89 out of a total of 495 biotech stocks.

Which is higher risk? I believe IMMP is. However, I view both as potentially offering greater rewards over many of the 495 biotech stocks. One other noteworthy data point: In the top 100 biotech stocks, only two offer a dividend: GILD and ABBV.

The third element is the reality of the risk/return. If your broker shows that your account balance increased during the year, did it rise in accordance with the overall risk of the investments they selected? Furthermore, some risk isn’t really known until you sell. You may think you have made a pile of money, but it is only in terms of the current value of your holdings. There is risk in waiting. The question every investor must ask is “when will I or should I sell an investment?” Every day you are facing the risk that your $100 investment will become worth $50 or $0. I speak from experience!

It is wrong to conclude that riskier investments provide higher returns. If that were true, everyone would be buying the riskiest investments. One way to spot risk is in the P/E ratio. A lower P/E can be a flag that says, “this investment has more risk that other similar investments.” Another way is to look at the dividend yield. If the yield is over five percent (excluding REITs and BDCs) then the market concludes that there is a lot of risk. IMMP, by the way, has neither. There is no P/E ratio because the earnings are negative. There is no dividend, so there is no yield.

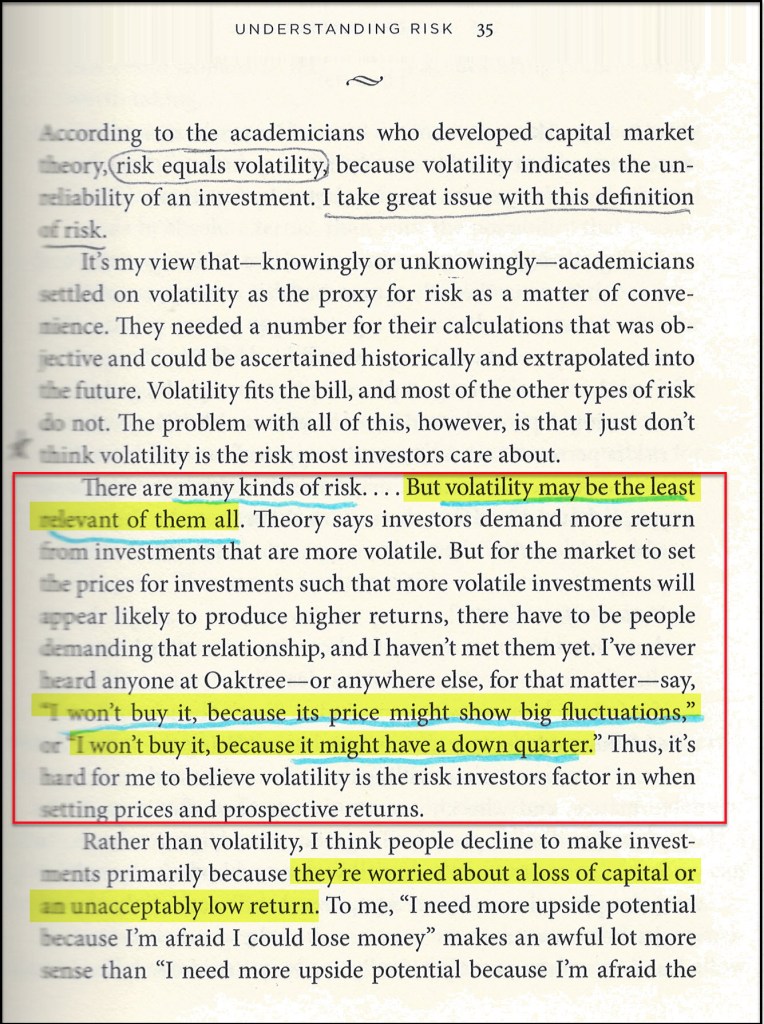

Volatility May Be the Least Relevant of All Risk Factors

On page 35, Marks says something that I often tell investors. “There are many kinds of risk…But volatility may be the least relevant of them all.” It is not prudent, in my opinion, to avoid an investment due to volatility. Big price fluctuations happen for many reasons.

Other Factors

On pages 36-37 Marks talks about how some investments might be risky for some investors and not so risky for others. My investment in IMMP is lower risk for me in light of the total dollars invested. However, if your total portfolio is $50,000 and you buy $10,000 of IMMP, you are exposing yourself to irrational risk.

He also talks about “falling short of one’s goal,” “underperformance,” and career risk (does your advisor take on too much risk or too little risk because they are afraid their clients will rebel if their choices result in a huge loss). “Unconventionality,” is avoiding all investments that may not fit what is viewed as normal. For example, most advisors will not allocate many dollars to BDCs because they are “unconventional.” One other risk is “illiquidity.” An investment is illiquid if you cannot easily sell it at a rational price. That usually happens with stocks that don’t have a lot of buying and selling activity. That is one of the reasons I only buy the larger, more liquid ETFs like VYM, SCHD, and DGRO.

How Is This Knowledge Useful?

If you have a choice between five hundred investments all focused on healthcare biotech, you can pick from 495 companies (Seeking Alpha QUANT ratings). ABBV is QUANT-ranked 89 out of the 495 in that industry category. So why didn’t I pick any of the stocks listed from rankings 1-106? The reasons are simple. ABBV is the only one that pays a dividend, and that dividend is increasing.

But IMMP is in the top fifty, and I saw a news item about the company that encouraged me to take on a bit of risk. However, there are other stocks in the 495 that have a QUANT rating of 1.0. That is a strong sell. That is full throttle risk. Here are the bottom four with a 1.0 QUANT rating:

492 NTBLQ Notable Labs, Ltd.

493 APTO Aptose Biosciences Inc.

494 COEP Coeptis Therapeutics Holdings, Inc.

495 SLXN Silexion Therapeutics Corp

There is Risk in Generosity

Did you know that generosity is risky? Some think it is risky because they want to keep everything for themselves and build bigger barns. They don’t want to become poor and so they are worse than frugal, they are miserly. Some think charitable giving is risky because the recipients might waste the gift. While that is true, God expects us to be generous and wise in our giving. He will hold the other party accountable if they waste or misuse your gifts.

Ecclesiastes 11:1-2 “Cast your bread upon the waters, for you will find it after many days. Give a portion to seven, or even to eight, for you know not what disaster may happen on earth.”

There are many ways that this statement has been interpreted. I like this one: “Ecclesiastes 11:1–6 can reasonably mean, ‘Sow seeds of goodness every day, even when it doesn’t make sense to do so. In due season you will reap a reward. Be diligent about sowing goodness, and accept no excuses! Then goodness will become a part of who you are, not just a thing that you do, and the world will be a better place because of it.’” – SOURCE: GOTQUESTIONS.ORG

Take that risk. It is more than worth it. Remember, you cannot take it with you.

The Next Post

I did not finish chapter five, so if I write another book review post, I will pick up from where I left off on page 38.

All scripture passages are from the English Standard Version except as otherwise noted.