The Dip is My Friend

My general rule for investing is to buy when everyone seems to want to sell. When everyone sells due to some news item, and the share price drops 10 percent or more, I get interested. Today ABBV was trading considerably lower due to a news flash: Here are some sound bites from Seeking Alpha:

“Emraclidine’s failure in phase 2 trials is a significant setback for AbbVie’s neuroscience pipeline. This was a very surprising outcome after very strong phase 1b results and the success of competitor Cobenfy in clinical trials in schizophrenia patients. Emraclidine was the main reason AbbVie acquired Cerevel for $8.7 billion, and I expect a substantial impairment charge on this deal.” SEEKING ALPHA

AbbVie had a response as well: “In addition to emraclidine, through the Cerevel acquisition AbbVie gained a neuroscience pipeline of multiple clinical-stage and preclinical candidates that are complementary to the company’s existing neuroscience portfolio with leading on-market brands in psychiatry, migraine, and Parkinson’s disease.” In other words, all of the biotech eggs are not in one basket.

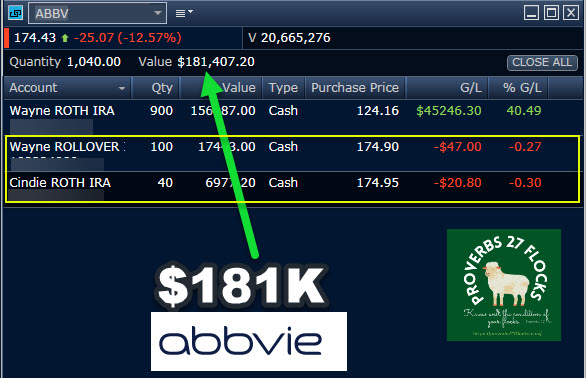

The Buy Orders and Covered Call Options

I placed an order to buy 40 shares of ABBV for Cindie’s ROTH IRA. The buy limit price was $174.95. It took a bit of time, but the shares were purchased.

Then I placed an order for 100 shares in my traditional IRA. My buy limit price was $174.90. The share price at close was just under that amount: $174.43, but in after-hours trading the last trade I see is for $174.96. Clearly the after-hours traders are interested.

I already own 900 shares of ABBV in my ROTH IRA, so I did a covered call option trade for nine contracts on those shares. That earned me about $190. The contract expires on Friday at a price of $185, so it is very unlikely that my ABBV shares will be called away.

I also entered a covered call contract for the 100 shares I added to my IRA. The contract price is $180, because my cost basis is lower. That contract also ends on Friday, and I made about $93 on that trade.

Dividend History

Yes, the shares could trade at a lower price in the days and weeks ahead. However, I am not focused on the short-term, and I did not want to buy shares gradually. The dividend flow from this investment more than meets my dividend growth expectations, so I don’t have to wait.

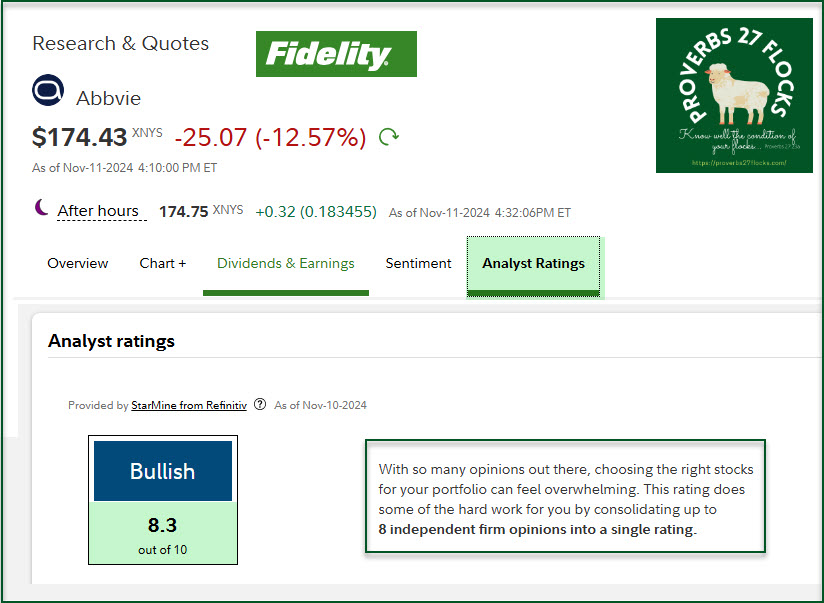

Fidelity’s Equity Summary Score

This may change based on today’s news, but that won’t discourage me. I still look at the long-term prospects, not the recent news.

Seeking Alpha Summary

If you are interested, here is the summary page. I always look at the “Profitability” factor when buying an investment. Profits lead to dividends.

Recommendation

If you are looking to trade options and can afford to spend $175 per share to buy 100 shares, then ABBV is another way to do covered call options trades. However, it is probably still best for new options traders to focus on lower-cost stocks like Ford.

Having said that, if you are an investor with a long-term mentality, slowly buying ABBV shares is a good strategy.