Feathering Your Nest

I enjoy watching the birds. I also love to see a feather that is beautiful, unless it is the result of a cat tearing a bird to pieces. However, a feather from a bluejay or from a peacock or pheasant is a special find. Then I like watching the birds build their nests. We even have an idiom that says, “He is feathering his own nest.” Sadly, this idiom generally means you are trying to make yourself rich, especially in a way that is unfair or dishonest. However, if you invest wisely, that is not dishonest.

Feathers are Amazing Structures

Companies molt. That is a good thing. It isn’t quite like a bird’s molt, but there is a way to see it that is positive. According to “All About Birds,” – “A feather is a “dead” structure, analogous to hair or nails in humans and made of the same basic ingredient, the protein keratin. This means that when they get damaged, feathers can’t heal themselves—they have to be completely replaced. This replacement of all or some of the feathers is called molt. In addition to providing a new set of healthy feathers, molts often provide a new look to the bird’s plumage—new colors or patterns that can indicate the bird’s age, sex, or the season of the year.” – SOURCE

When a company “molts” or distributes a dividend, the value of the company decreases by the dividend amount multiplied by the number of shares held by stockholders. So, for example, if a company declares a $0.50 per share dividend with an ex-dividend date of November 30, and assuming there are one million shares, the value of the dividend is $500,000. That means the company’s value will decrease by half-a-million dollars on November 30. However, you collect the feathers to feather your own nest.

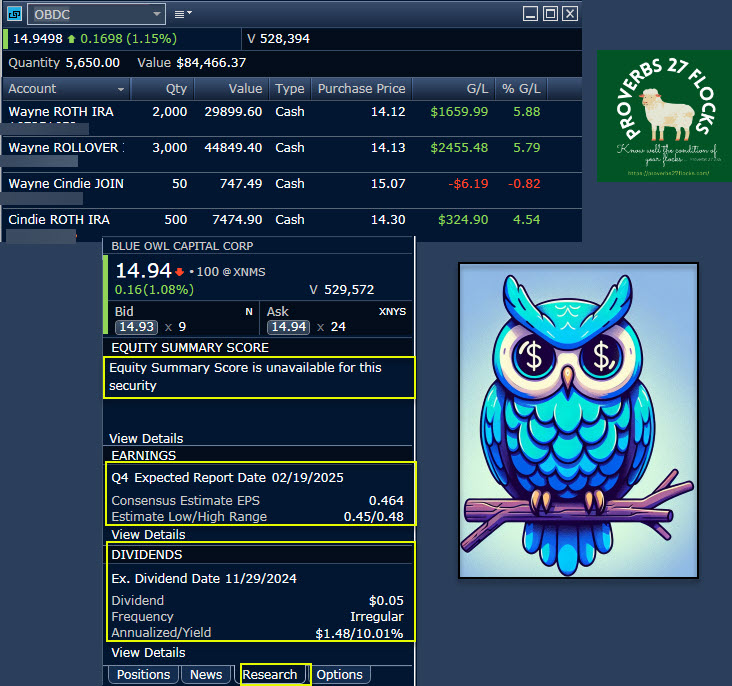

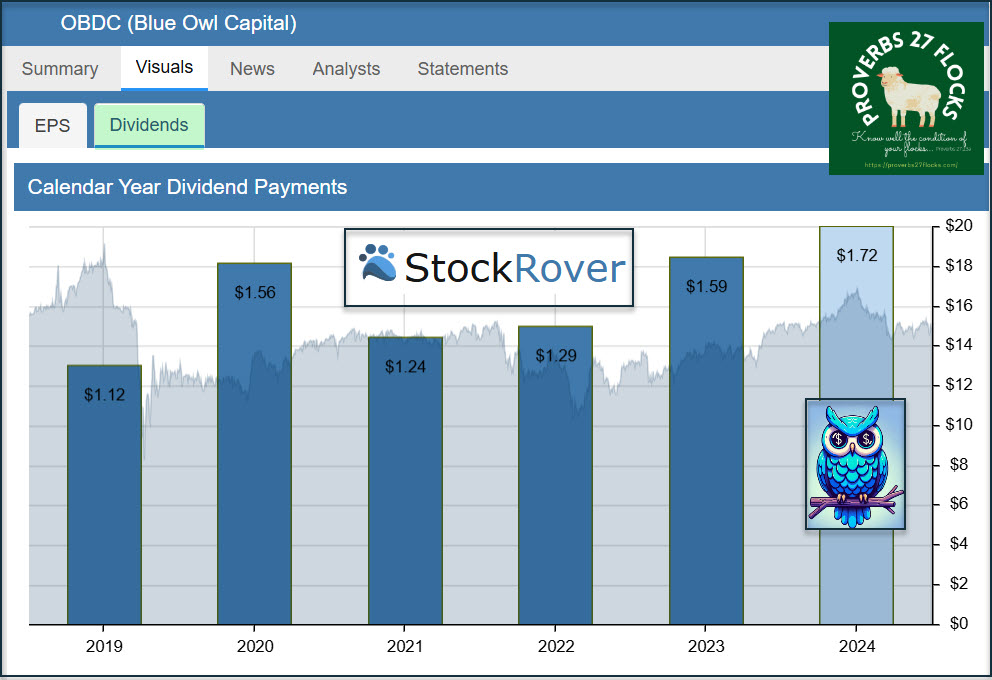

Blue Owl Capital’s Molt Dividends

Blue Owl Capital declared a $0.37 dividend and a $0.05 supplemental dividend on November 6. The quarterly dividend is payable Jan. 15, 2025, for shareholders of record Dec. 31, 2024; ex-div Dec. 31. The special dividend, however, is payable on December 13, 2024, for shareholders of record Nov. 29; ex-div Nov. 29. The yield is 9.79%. Both the Seeking Alpha Analysts (4.00) and Wall Street (3.80) rate OBDC as a buy, but the QUANT rating is currently HOLD (3.05).

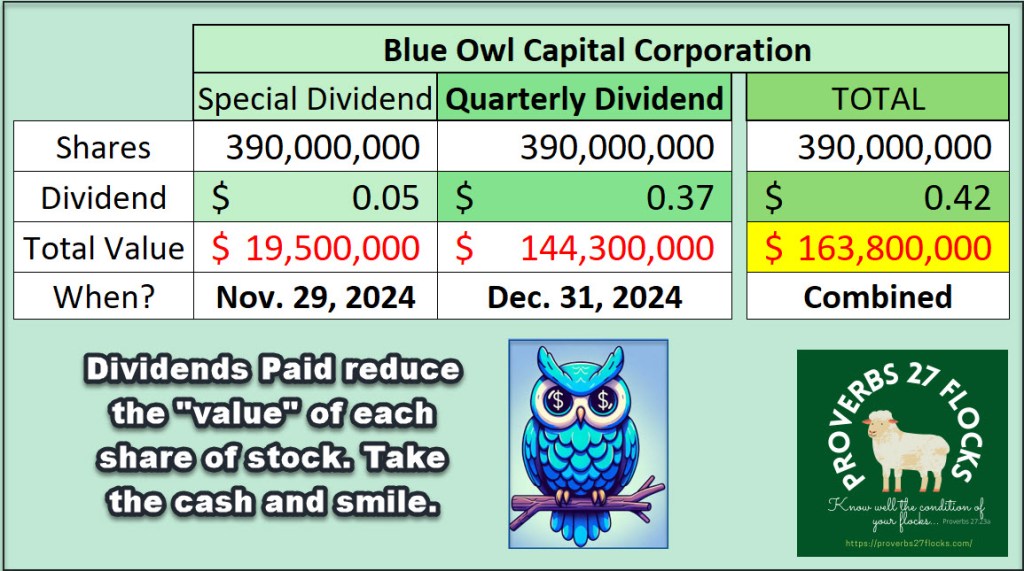

An Illustration of the Impact of Paid Dividends

OBDC currently has about 390 million shares outstanding. If you take the $0.05 supplemental dividend and multiply it by the share count, OBDC’s “value” will shrink by a total of $0.42 per share – as shown in the following illustration. The same is true for the quarterly dividend. However, you are the recipient of the “loss” of the total value of the shares, so you have more feathers for your nest. The only other way to raise cash with OBDC is to buy shares at a low price and sell them at a higher price. That is too much work for my easy income strategy.

In the end, I can ignore any price declines on the ex-dividend date, as I know I will receive that equal amount of cash on the payable date.

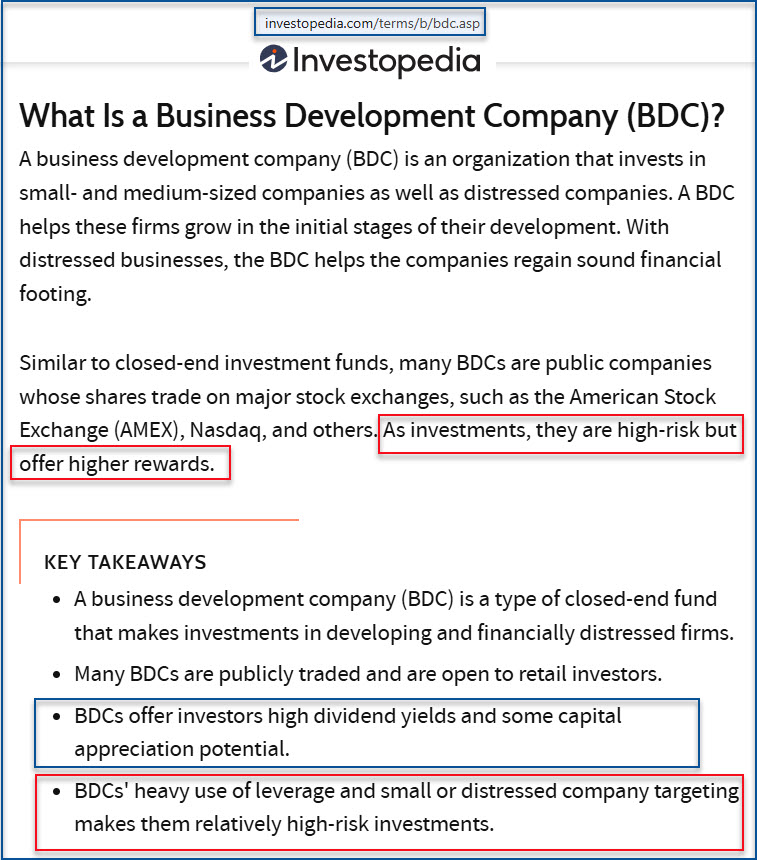

BDCs Are Small Cap Ways to Diversify

Business Development Company (BDC): Definition and How to Invest

“A business development company (BDC) is an organization that invests in small- and medium-sized companies as well as distressed companies. A BDC helps these firms grow in the initial stages of their development. With distressed businesses, the BDC helps the companies regain sound financial footing.” – Investopedia

“The BDC must invest at least 70% of its assets in private or public U.S. firms with market values of less than $250 million.” – Investopedia

Little Companies

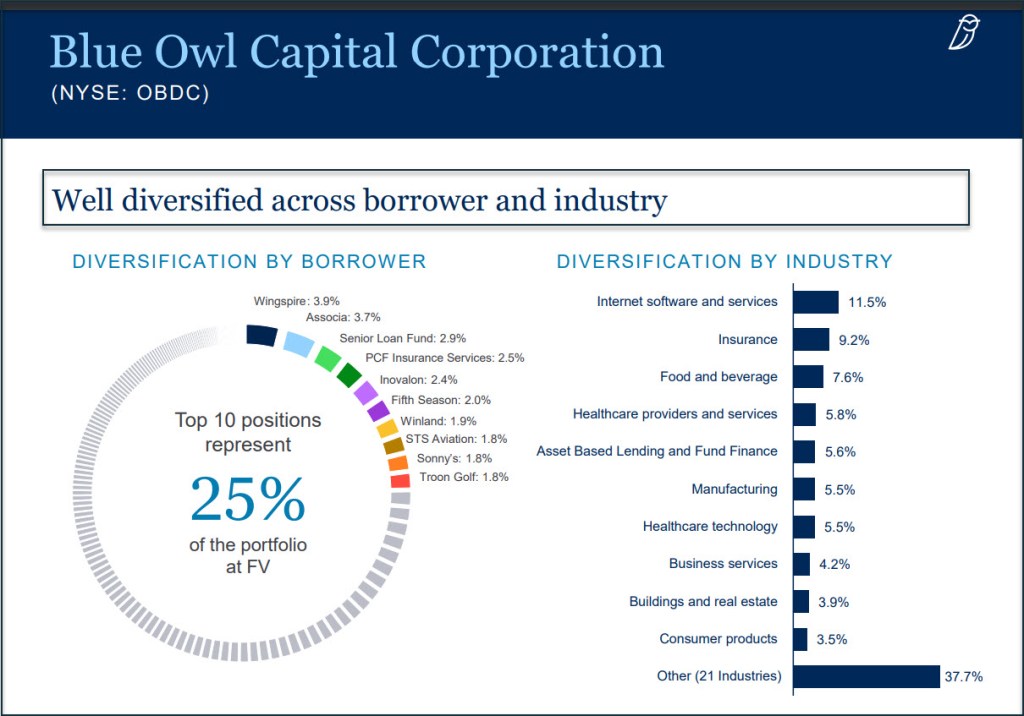

I prefer to invest in large companies, mid-cap companies, and small companies. When it comes to small companies there are too many choices. Therefore, it makes sense to buy a small-cap ETF to gain the advantage of the potential of the small companies. Another way to enter that arena is to invest in BDCs. By their very nature, they are loaning money and providing expertise to smaller companies. They are also (usually) wisely diversified.

Company Profile

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments. Within private equity, it seeks to invest in growth, acquisitions, market or product expansion, refinancings and recapitalizations. It seeks to invest in middle market and upper middle market companies based in the United States, with EBITDA between $10 million and $250 million annually and/or annual revenue of $50 million and $2.5 billion at the time of investment. It seeks to invest in investments with maturities typically between three and ten years. It seeks to make investments generally ranging in size between $20 million and $250 million.

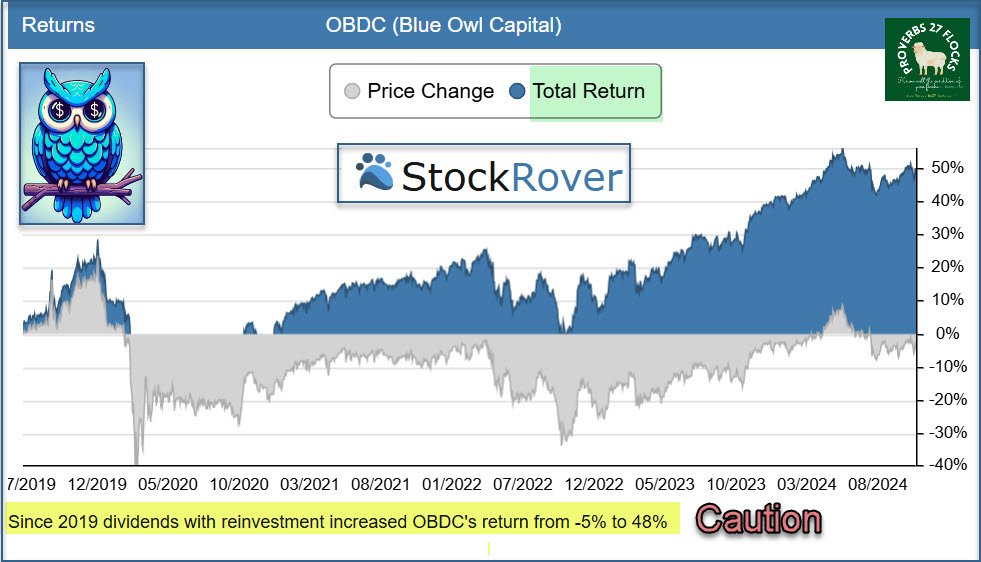

Recommendation

OBDC is not for the growth investor. It is a value-oriented income investment. Is it higher risk? Yes. In my opinion, however, it is a worthy risk as long as it isn’t the only BDC in your total portfolio.