Three BDCs – All with Supplemental Dividends

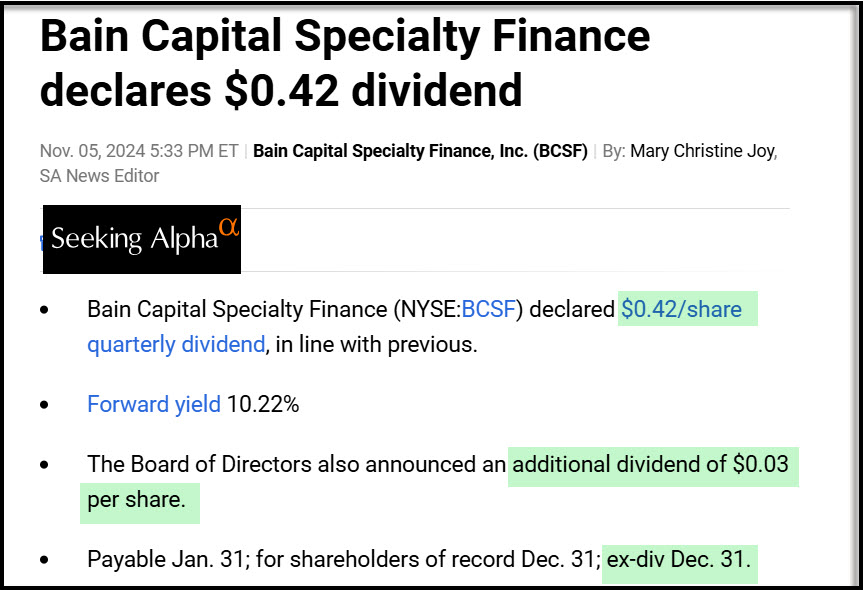

Rarely do I see a trio of email messages that announce both a quarterly dividend and a supplemental dividend. Three business development companies did just that on November 5. The three are TSLX, CGBD, and BCSF. The email messages all tell me about the next quarterly dividend and the supplemental, along with the Ex-Dividend Dates for each dividend.

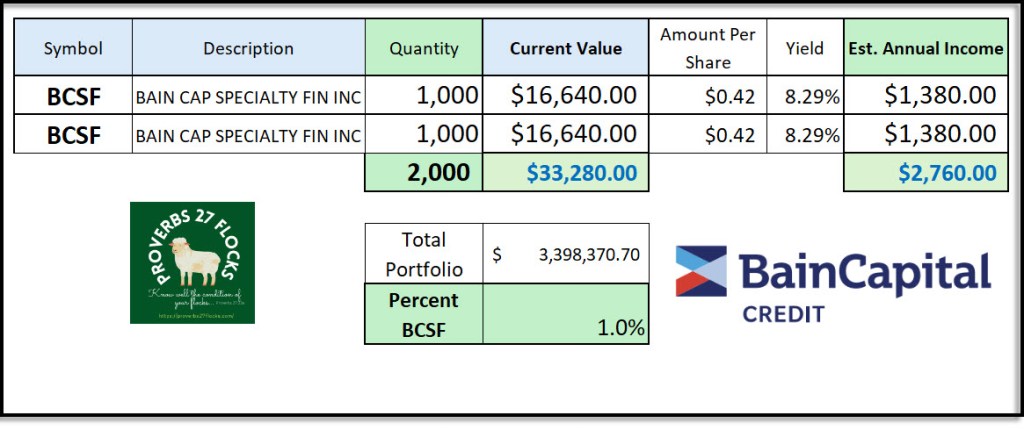

Here are our holdings for these three BDCs. Notice that the total dollars invested is relatively small compared to our portfolio total. Nevertheless, the income derived from these three BDCs is very helpful in our total dividend picture. The three combined provide an estimated annual income of $10,775, excluding the supplemental dividends.

Understand Before Investing

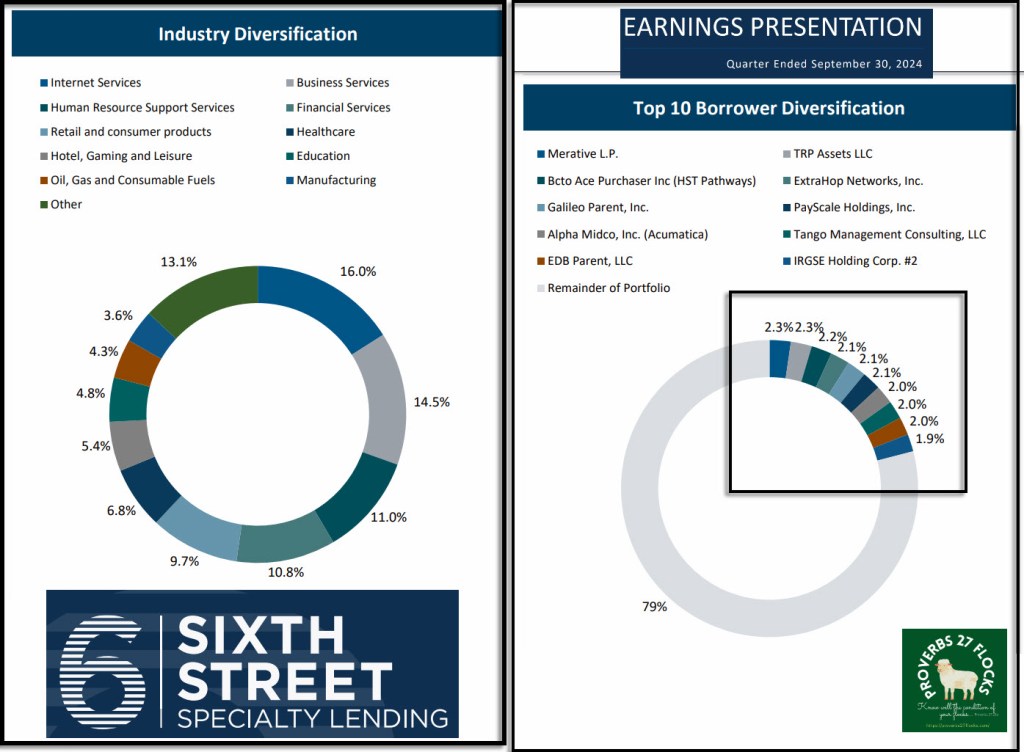

Don’t buy these if you don’t understand BDCs and if you don’t like volatility. To help you understand BDCs, look at the following images about TSLX (from their investor presentation.) A BDC is a financial business that loans money to other businesses. As a result, the BDC can be diversified in the sense that it has invested in many different businesses in different sectors. Of course, these businesses must be successful in order for the BDC to be successful.

It is also noteworthy that TSLX has most of their assets in these companies are “first lien loans.” This is important. “Not all senior debt holders are created equal, however. First lien debt holders are paid back before all other debt holders, including other senior debt holders. A lien is the legal right of a creditor to seize property from a borrower that has failed to repay the creditor. The creditor may exercise the lien by selling the property if the loan is not paid back.” – Yieldstreet

The first lien has risks, but the risks are something like the risk the bank takes when they loan you money for a home. If you don’t pay the bank, they take your home.

We Own Many BDCs

TSLX is a business similar to some of our other holdings. For example, MAIN, ARCC, SAR, HRZN, OBDC, and GAIN are all BDCs in the Asset Management and Custody Banks industry.

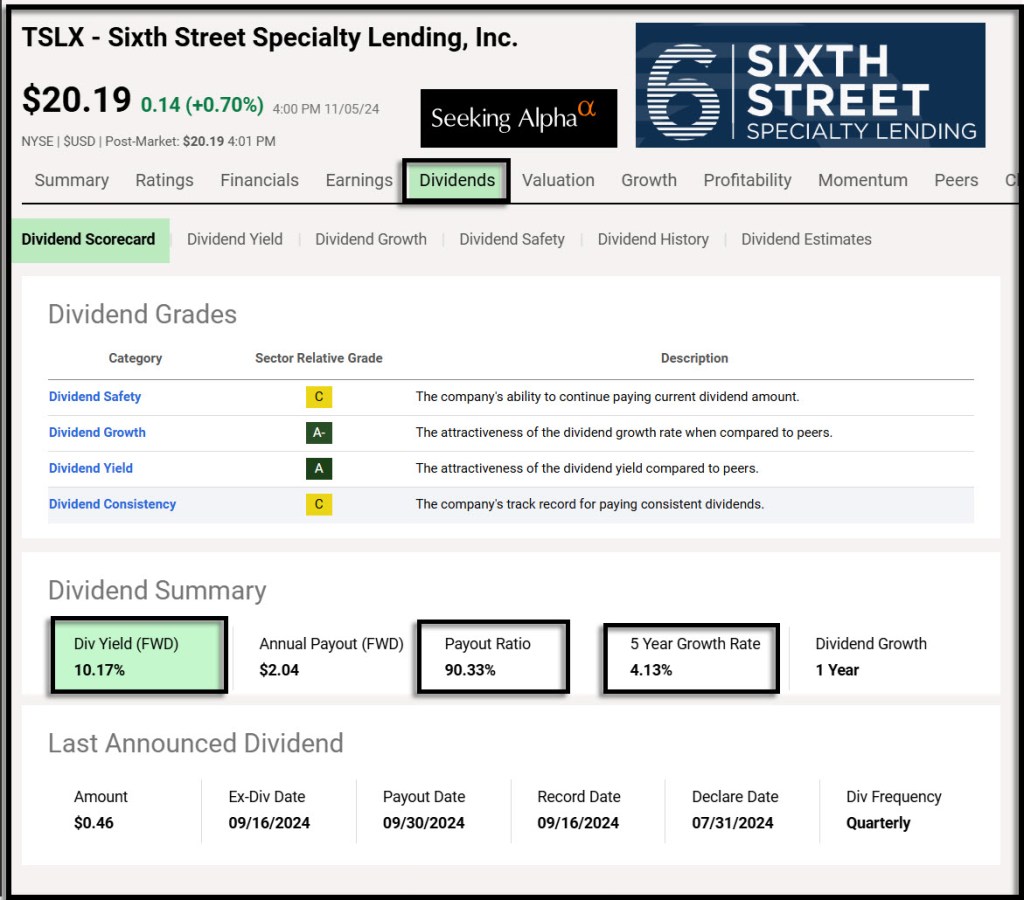

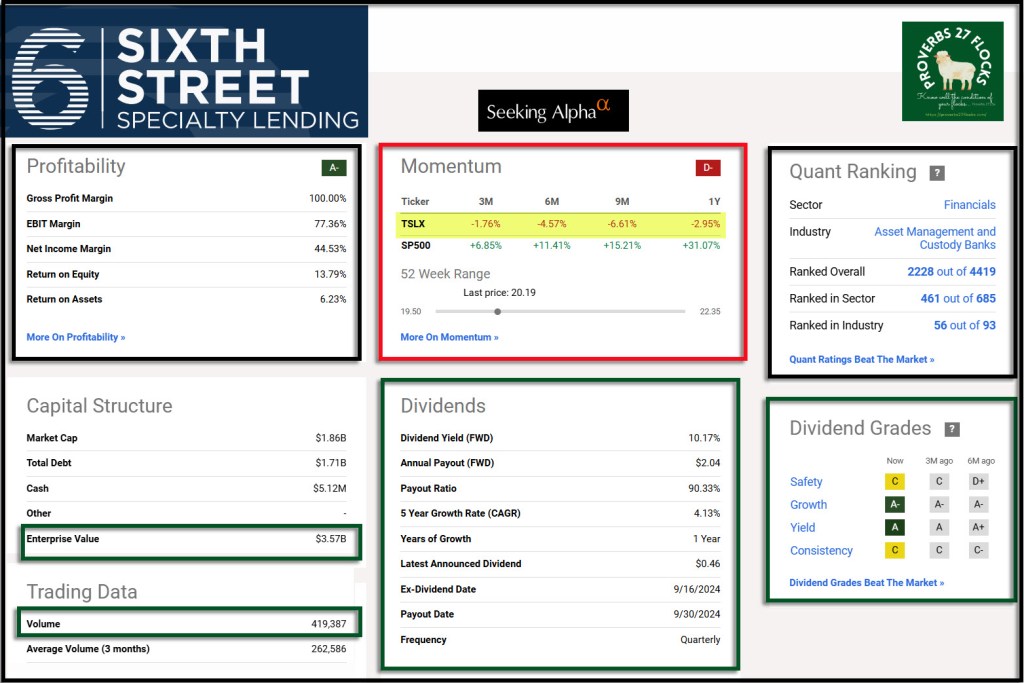

Reviewing TSLX Using Seeking Alpha

I captured some images using my Snagit software to help you understand what I look at when buying shares of a BDC. I want to know about the total returns, the dividend details, and the profitability of the BDC. The next two sections describe TSLX and CGBD. I could have done the sam with BCSF, but you get the idea from reading these two.

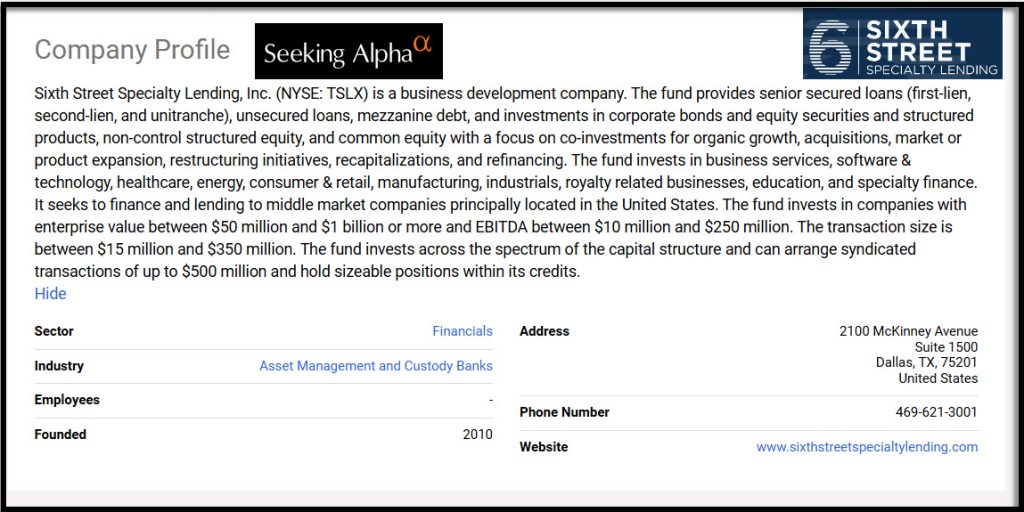

Company Profile TSLX

Sixth Street Specialty Lending, Inc. (NYSE: TSLX) is a business development company. The fund provides senior secured loans (first-lien, second-lien, and unitranche), unsecured loans, mezzanine debt, and investments in corporate bonds and equity securities and structured products, non-control structured equity, and common equity with a focus on co-investments for organic growth, acquisitions, market or product expansion, restructuring initiatives, recapitalizations, and refinancing. The fund invests in business services, software & technology, healthcare, energy, consumer & retail, manufacturing, industrials, royalty related businesses, education, and specialty finance. It seeks to finance and lending to middle market companies principally located in the United States. The fund invests in companies with enterprise value between $50 million and $1 billion or more and EBITDA between $10 million and $250 million. The transaction size is between $15 million and $350 million. The fund invests across the spectrum of the capital structure and can arrange syndicated transactions of up to $500 million and hold sizeable positions within its credits.

Company Profile CGBD

Carlyle Secured Lending, Inc. is business development company specializing in first lien debt, senior secured loans, second lien senior secured loan unsecured debt, mezzanine debt and investments in equities. It specializes in directly investing. It specializes in middle market. It targets healthcare and pharmaceutical, aerospace and defense, high tech industries, business services, software, beverage food and tobacco, hotel gamming and leisure, banking finance insurance and in real estate sector. The fund seeks to invest across United States of America, Luxembourg, Cayman Islands, Cyprus, and United Kingdom. It invests in companies with EBITDA between $25 million and $100 million.

Easy Income Strategy Reminder

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends (or be surprised by supplemental dividends.) Don’t build your spending projections on supplemental dividends, but enjoy them when they come. The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market.

Recommendations and Cautions

Don’t rush to buy shares of BDCs like TSLX, CGBD, or BCSF. There is certainly risk associated with the business model. If there is a recession, investors get nervous, and smaller companies can suffer.

If you have less than $200K, I suggest that you focus on dividend growth ETFs like VYM, DGRO, and SCHD. However, adding some BDC and REIT exposure is a good strategy, even if you have less than $100K in your retirement portfolio. You can then add shares as you deposit more funds to your accounts. However, be careful about adding REITs to taxable accounts. It is better to own REITs in traditional or ROTH IRA accounts.