Focusing on the Traditional IRA and Checking Account

I spend about ten minutes each month reviewing our consolidated Fidelity Investments statement. October’s statement was 92 pages long. I don’t read the whole thing, but I look for some high-level information. In my last post along this vein, I talked about the origins of my ROTH IRA including ROTH conversions. This time I will focus on my traditional IRA and our Fidelity checking account.

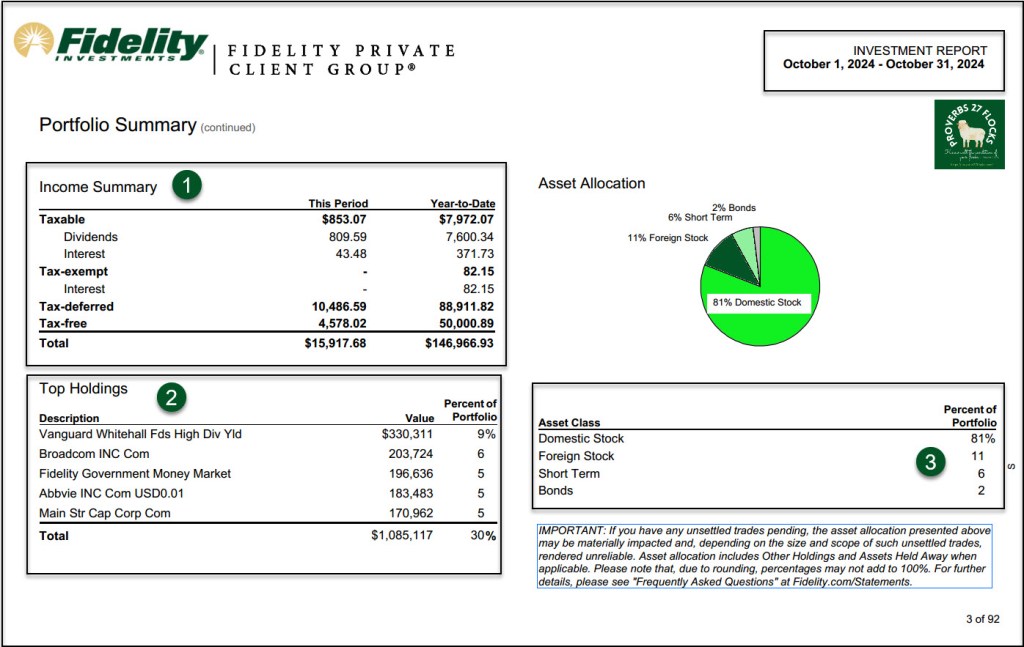

Before I do that, a quick look at the summary page for all of our accounts makes sense. The first box shows our YTD income of about $147K. This does not include options income. The next box is a reminder of the top five holdings across all of the accounts. The goal is to watch for any stock that exceeds five percent of the total portfolio. The third box is a reminder that my focus is on stocks (92%). The two percent “bonds” is really only short-term CDs.

The Traditional IRA

There are two things I look at each month. The first is the Account Summary Page. A quick look helps me see how my holdings are allocated at a high level. In the case of my traditional IRA, I have 70% in “Stocks” but that does not include some other stock-like investments. The summary also tells me my cash available ($153K) and that I am holding significant positions in AVGO, VYM, and STX. However, don’t be alarmed by the percentages. I look at our holdings across all accounts, so AVGO is not 10% of our total invested capital.

The other piece that I want to see is the “Income Summary.” YTD income is $82,445.54. The reason this is significant is that my expected RMD for 2025 will be less than that amount. In fact, the EAI for this account will exceed $85K for the next twelve months. This can be seen by adding up the values on the following page from the statement. The column to be excluded is “Bond & CD Principal.”

The Fidelity Checking Account

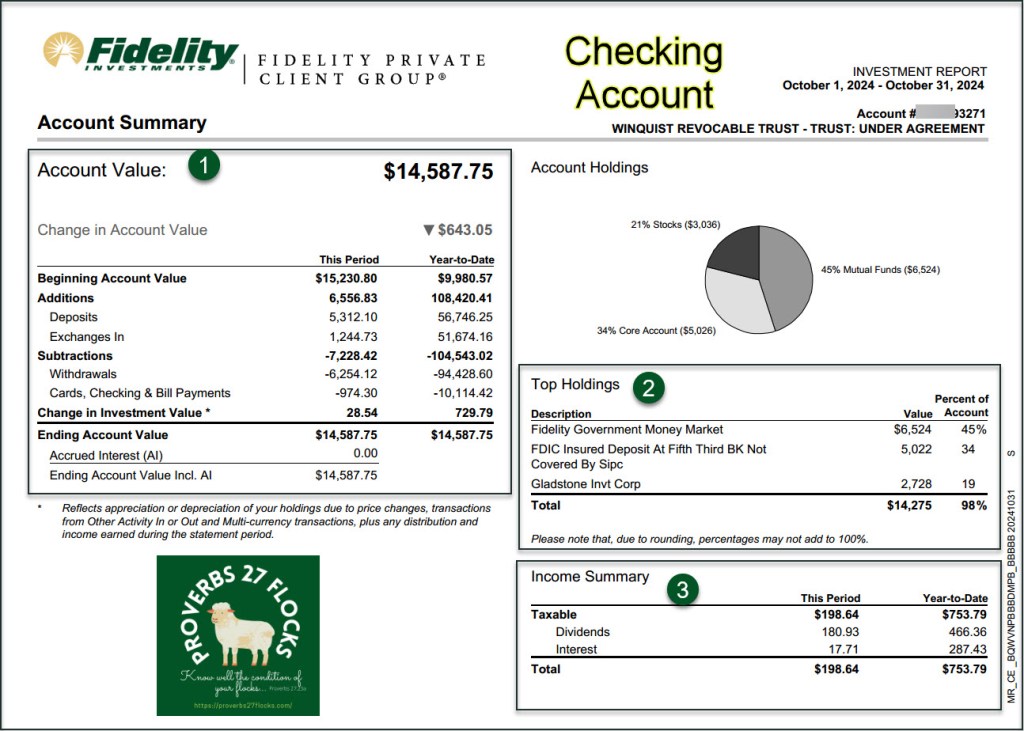

The account we use for “checking” is far more flexible than any checking account our former banks can provide. Our normal account balance in checking is usually around $15K. In a traditional checking account we would earn little or nothing in interest. YTD we have received $287 in interest (box 3) and $466 in dividends. What many do not realize is that you can own stocks and ETFs in your checking account at Fidelity. That is another way to gain income on cash that is sitting idle.

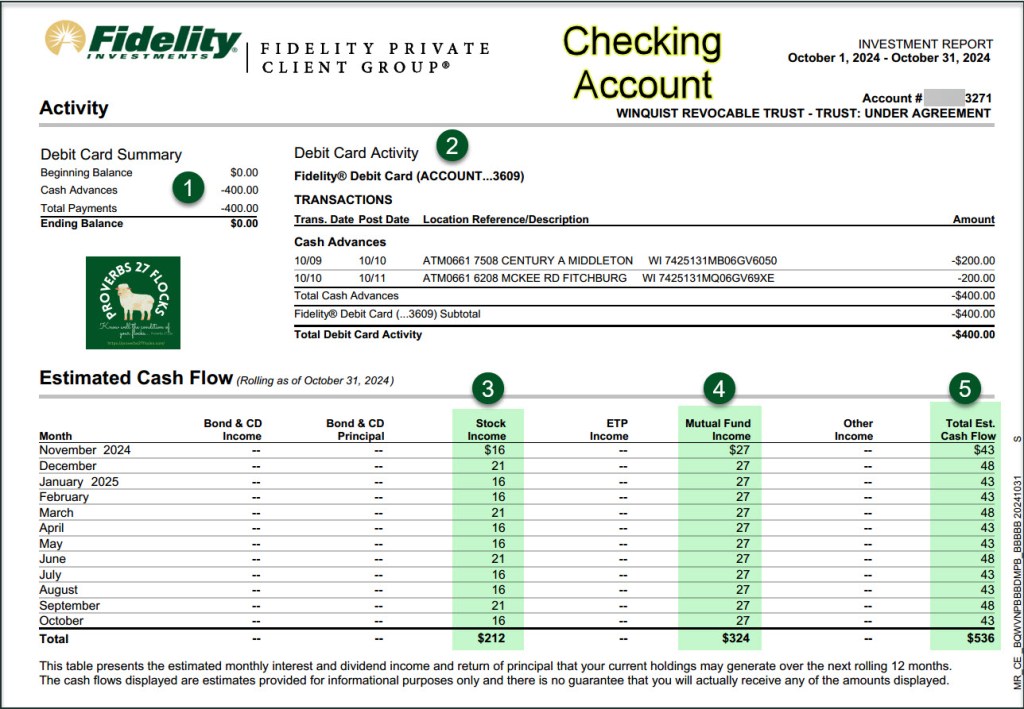

In the same way that Fidelity estimates the income in my IRA, they also estimate the income I can expect from our checking account. This image shows we can probably expect $536 over the next twelve rolling months. However, that number may shrink if the fed continues to lower interest rates.

ROTH IRA Income

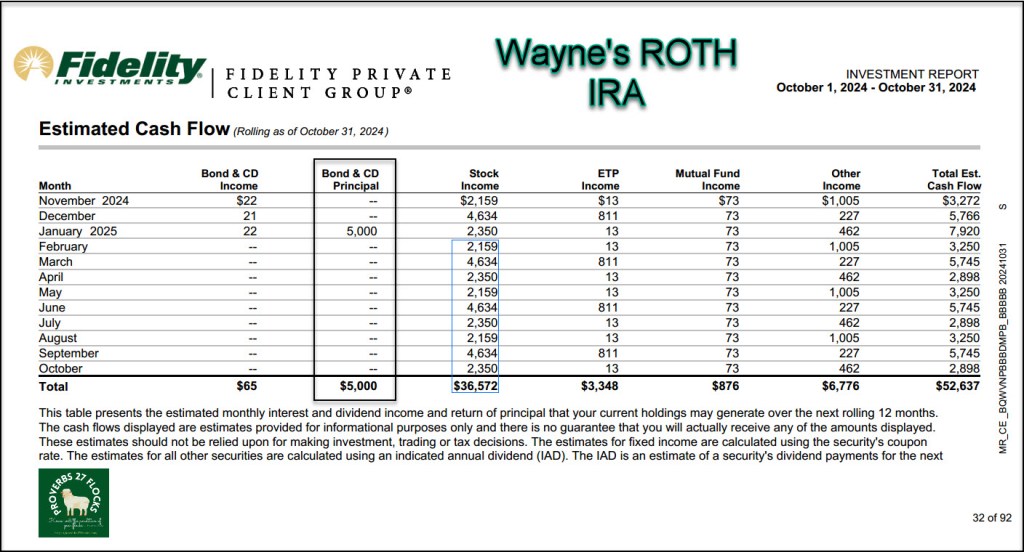

It takes only ten seconds to review the estimated annual income for the next twelve months for my ROTH account. I have one $5K CD that will come due in January. For planning purposes, excluding income from the Fully Paid Lending Program and options trades, I can expect to receive about $47.5K in tax free income in my ROTH account.

The YTD Income Big Picture

I use Excel to enter the monthly dividends for each account. The average monthly income for all accounts is approaching $15K. I was a bit surprised that October’s income was as good as it was. However, there has been some growth in dividends because I am a dividend growth investor.

Options Trades and Even More “Other” Income

Fidelity cannot forecast dividend growth, as they have to be conservative in their data presentation. No one knows what the actual dividend growth will be. They also cannot determine what I might or might not earn by trading options.

Goal: Think Long-Term

Far too many don’t read their statements. Some advisors say you shouldn’t do that because you may be discouraged when the market is volatile or when there is a bear market. I compare reviewing my statement to stepping on the bathroom scale. I want to make certain I don’t eat so much that my health will suffer over time. I want to be informed. I want to shoot for a goal weight.

The primary reason to read your statement each month is to be informed. Another good reason is to see if you are achieving your goals. Finally, you want to watch for any changes that might indicate it is time to sell or lighten up on a position. I will be doing that with AVGO.

If you moved from one employer to another and you have a 401(k) at the old employer, it would be wise to roll your 401(k) ROTH to your own ROTH IRA. If you have a traditional 401(k), do a ROLLOVER IRA account. That is what I did.