Five Days of Reminder Email Messages

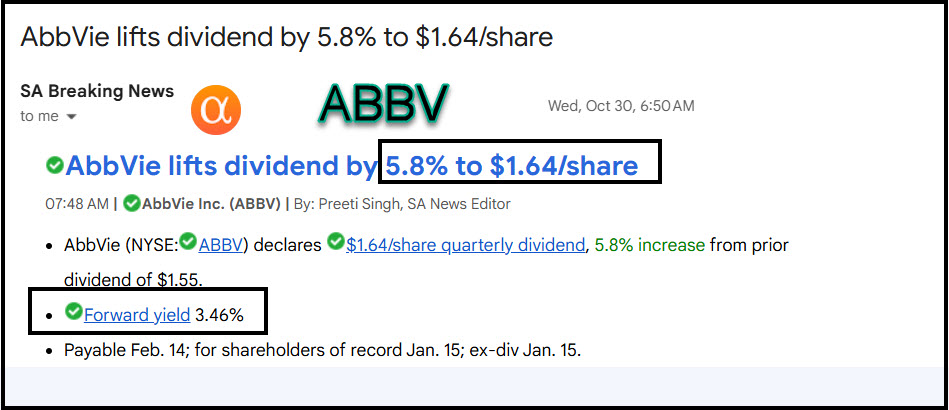

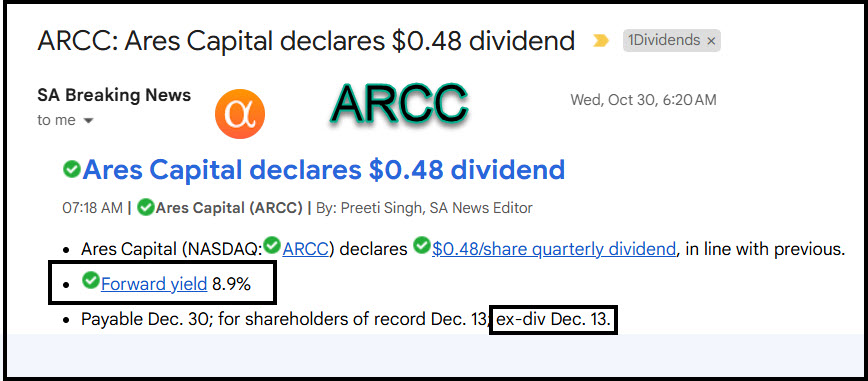

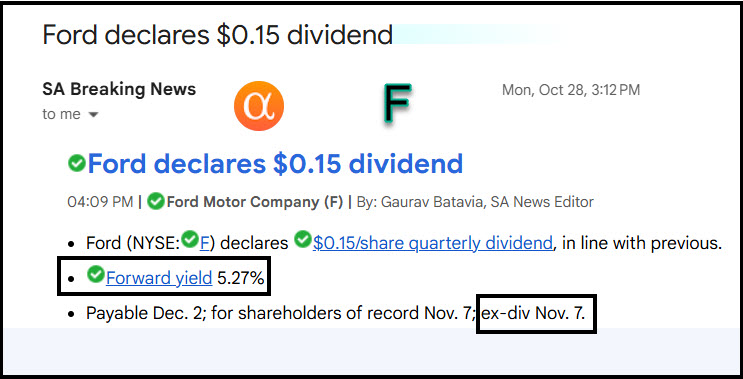

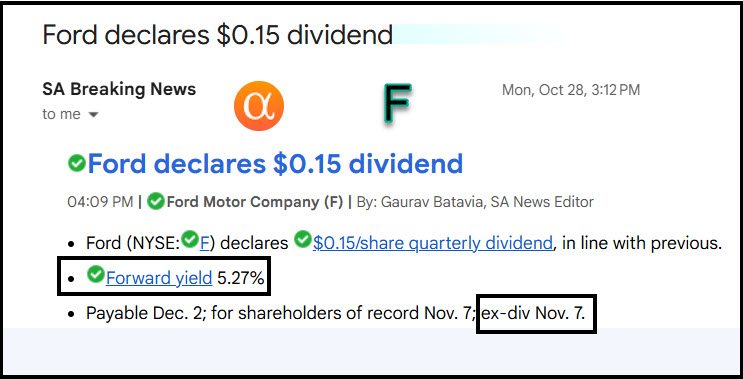

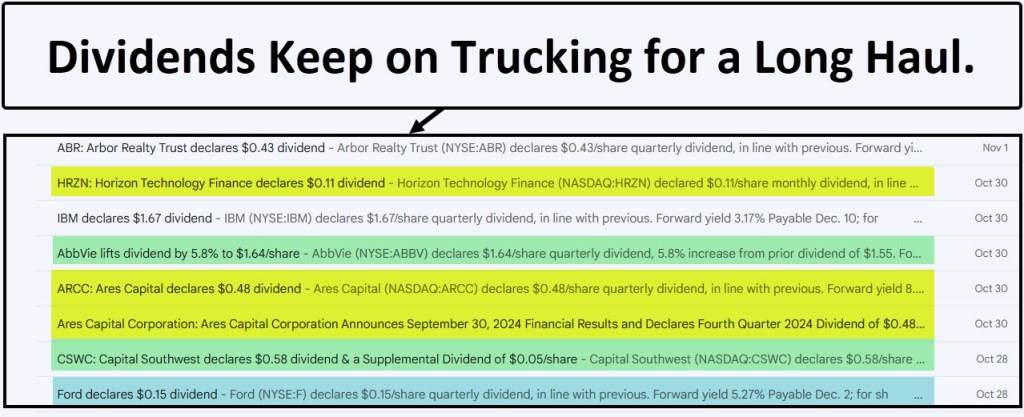

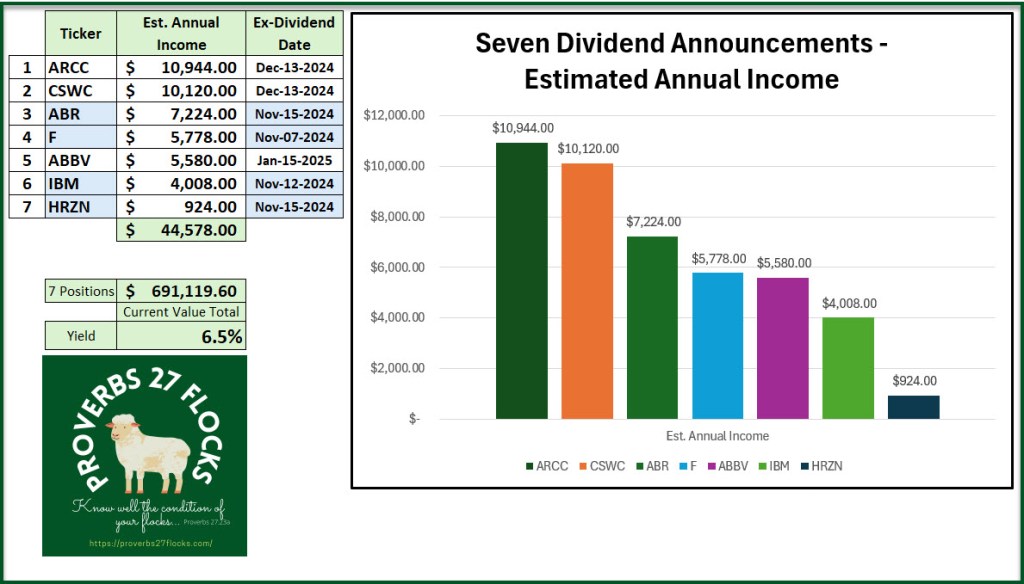

From October 28 through November 1 I was reminded that our easy income continues to provide a helpful income stream. The companies that announced dividends included ABR, HRZN, IBM, ABBV, ARCC, CSWC, and F. ABR is a REIT, HRZN, ARCC, and CSWC are all BDC’s (Financial sector), IBM is in technology, ABBV is a healthcare Biotechnology powerhouse, and F is a Consumer Discretionary Automobile Manufacturer. The seven emails I received are shown below.

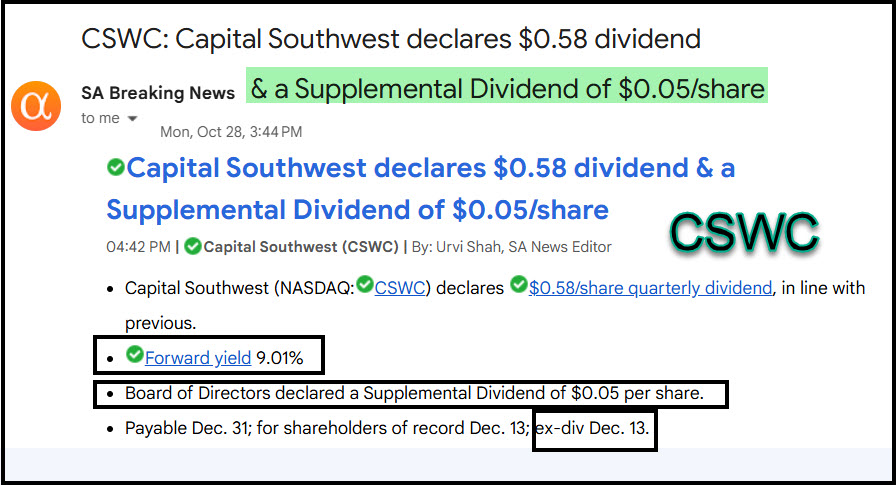

CSWC: What to Understand About This BDC

What stood out from these seven are CSWC, which announced the regular quarterly dividend of $0.58 per share and another special dividend of $0.05 per share. The previous five CSWC special dividends were $0.06 per share, so this was a slight drop. However, a special dividend is just extra income and should not be expected as normal. Another way to look at this is the next total dividend is $0.63 per share.

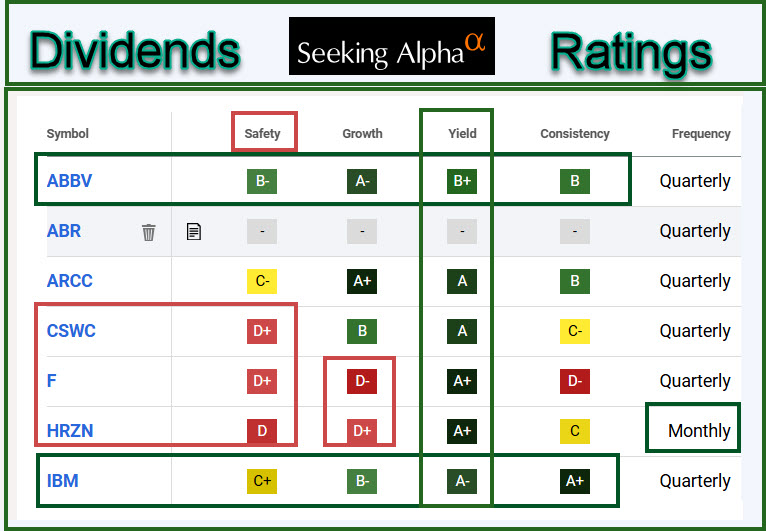

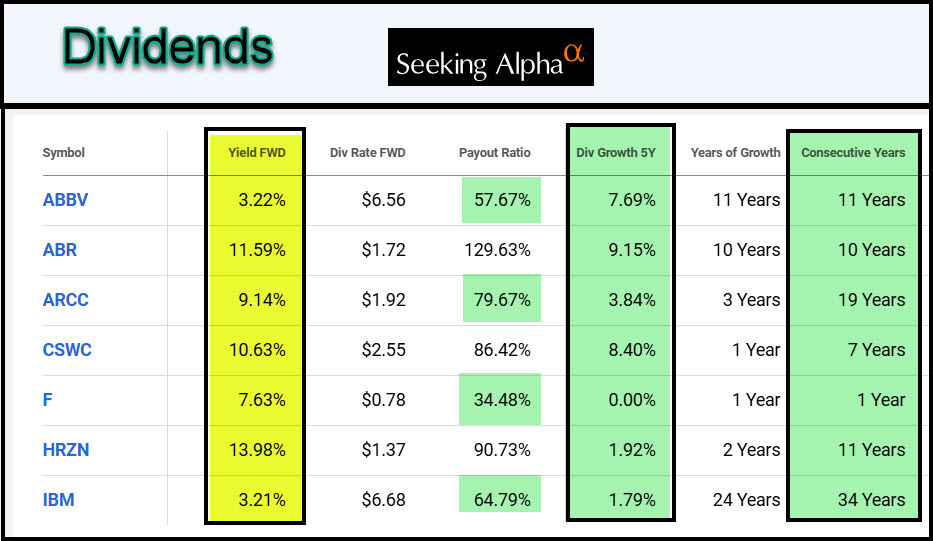

CSWC’s yield is 10.63%. The caution here is that CSWC can be highly volatile. However, using Seeking Alpha’s charting to see total ten-year returns, the price appreciation plus dividends provides a total return of 360%. Compare this to the S&P 500 return of 182% and you can see why I am willing to add risk to gain income. CSWC is a BDC. Most financial advisors avoid investments like this, but I think judicious and careful BDC selection can really enhance your total returns.

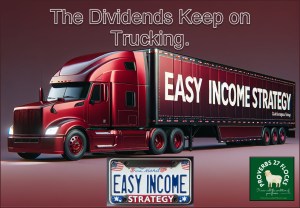

ABBV Continues to Deliver

I hold 900 shares of ABBV in my ROTH IRA. Therefore, based on the current stock price, my shares are worth $183,195.00. To put this in perspective, ABBV is 5.4% of our total investment assets. That means it is in my top five investments. VYM is number one, and AVGO is number two.

The most recent dividend announced is a 5.8% increase bringing the dividend per share to $1.64. AbbVie lifted their outlook again on immunology demand, which is a good sign. As one Seeking Alpha author rightly observed, “It is no surprise investors have responded positively to AbbVie’s latest results considering revenue growth, earnings outlook upgrade, and dividend increase.” – Manika Premsingh

Of the Top Biotechnology stocks ranked by Quant Rating, ABBV is number 81 out of 493. Why don’t I own shares of the top ten Biotechnology stocks? None of them pay a dividend, much less a growing dividend. In fact, none of the top 80 Quant-rated stocks in this sector/industry pay a dividend. While they may be good growth stocks, they don’t provide a reliable income stream.

Covered Call Trades

When it comes to trading covered call options, ABBV, IBM, and F are all candidates. I currently have open options contracts for ABBV and IBM. While I could trade options on Ford, it isn’t as profitable to do so at the present time. However, Ford is an excellent stock for a beginner to consider for covered calls or cash covered put options.

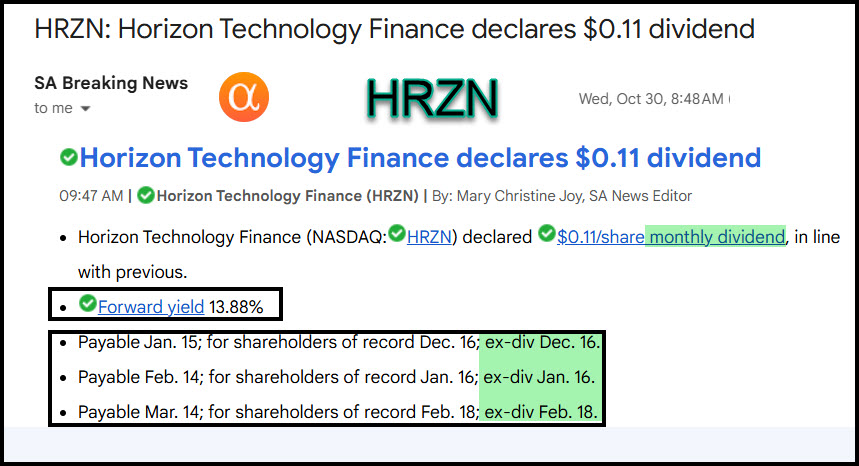

QUANT Ratings and HRZN

Before you rush out and buy shares of these seven, press the pause button. For example, HRZN has a current yield of 13.98%. That may not be sustainable. If you look at HRZN’s current Quant rating, you will see that it is 2.12. In Seeking Alpha land, that means I should sell my shares. However, HRZN has a good profitability score, so I will continue to hold my shares. Furthermore, HRZN provides monthly income of $0.11 per share and they have been paying this amount since December 2022.

Easy Income Strategy Reminder

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends. Sometimes good news comes in groups, but that is, admittedly, rare. It really depends on the makeup of your investment portfolio. The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market.

This shows what the estimated annual income from these seven holdings will be for the next twelve months. You can see that the average yield on these seven is 6.5%. That is better than any CD you can purchase. However, CDs are certainly “safer” investments for short-term purposes.

Recommendations and Cautions

Don’t rush to buy shares of BDCs like HRZN. It is a higher risk investment. Why is it higher risk? The business description clearly says, “Horizon Technology Finance Corporation is a business development company specializing in lending and investing in development-stage investments. It focuses on making secured debt and venture lending investments to venture capital-backed companies in the technology, life science, healthcare information and services, cleantech and sustainability industries. It seeks to invest in companies in the United States.” – Seeking Alpha

If you have less than $200K, I suggest that you focus on dividend growth ETFs like VYM, DGRO, and SCHD. However, adding some BDC and REIT exposure is a good strategy, even if you have less than $100K in your retirement portfolio. You can then add shares as you deposit more funds to your accounts. However, be careful about adding REITs to taxable accounts. It is better to own REITs in traditional or ROTH IRA accounts.