Report Cards Tell a Story

When I was in school, my parents always wanted to see my report card. They wanted to make certain that I was at least trying to do my best. The report card was one way to see if I was applying myself towards the goals of getting an education and moving forward with my knowledge of math, science, English, German, history, and specialty classes like drafting, electricity, and physical education. If I was not doing as well as I should, they helped me focus and made homework a priority.

The same is true of all areas of life, including investing. If you have a goal to graduate from high school, you have to meet the basic requirements. If you have a goal to “retire” at some point in the future, you need to set a goal and then do your own report card.

What About the Dividends Goal?

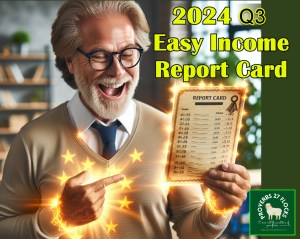

The goal each year is to increase our dividend income with as little work as possible. It appears likely that we will achieve this goal in 2024. This is possible because my easy income strategy focuses on dividend growth investments.

The first image shows our monthly dividend income. If you look at the final month of each quarter you will see growth. The April 2024 total is probably higher than what can normally be expected due to special one-time dividends.

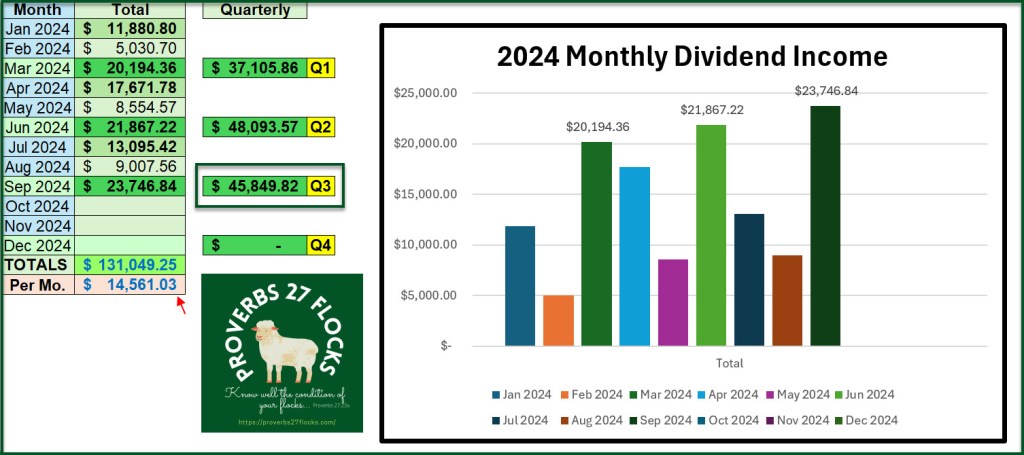

The next image shows the top ten contributors to our estimated annual income. The top four are all BDCs: ARCC, CSWC, MAIN, and OBDC. VYM, an ETF, comes in fifth place and ABR, F, PFE, ABBV, and TSLX round out the top ten. I’m willing to assume the additional risk by investing in BDCs to drive extra income for charitable giving.

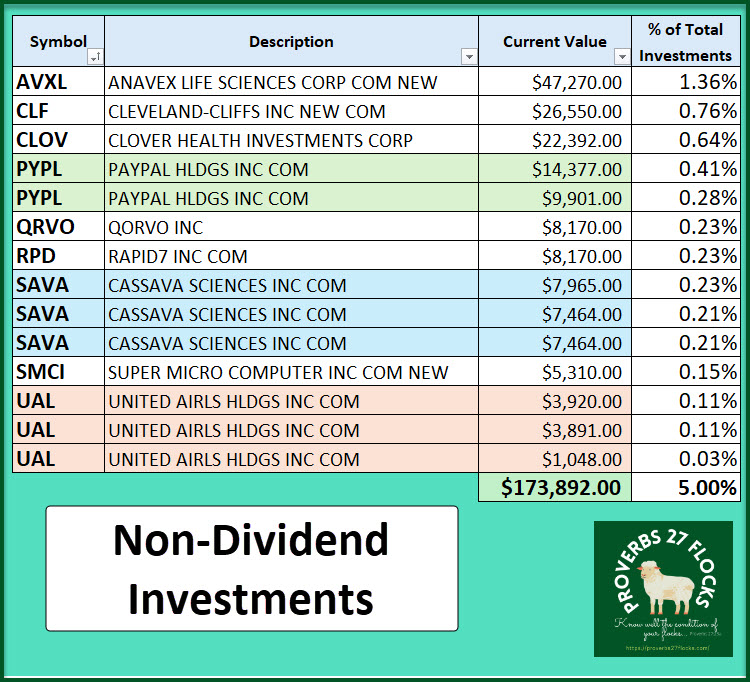

Non-Dividend Investments

In addition to dividend-paying investments, we also hold investments that do not pay a dividend. These include AVXL, CLF, PYPL, QRVO, RPD, SAVA, SMCI, and UAL. Why these investments? Each of them has either the potential for significant capital gains (or losses!) and each of them can be used to gain covered call options income.

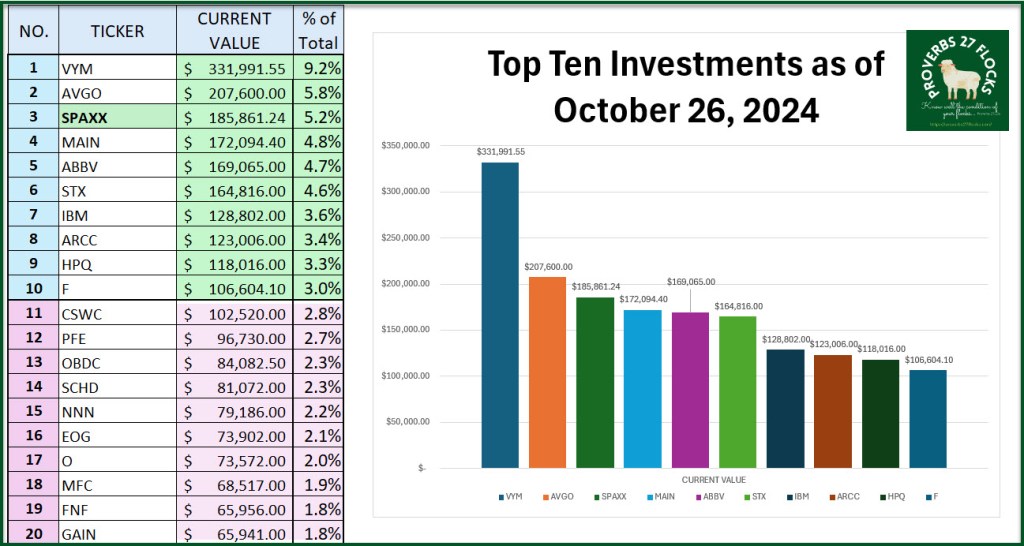

Top Ten Investments

We have about sixty different investments. Because I manage eight accounts for my wife and myself, it is helpful to see them consolidated. VYM, AVGO, SPAXX, MAIN, and ABBV are the big five and STX, IBM, ARCC, HPQ, and F round out the top ten. Note that I have heavy allocations to technology and health care. Most of these investments also contribute significant options income using covered call trades.

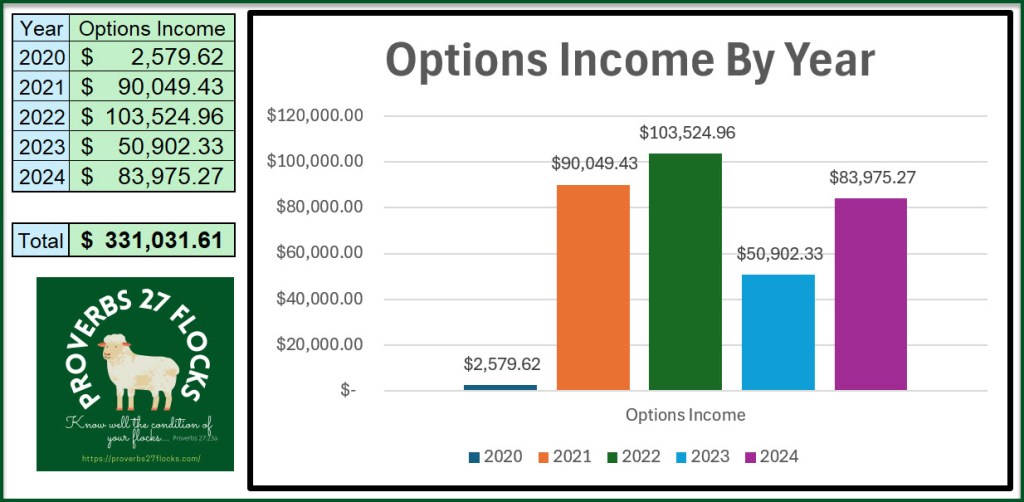

Options Income

Our YTD options income now exceeds $80K. The first image shows my options income for the first four years I traded options (2020-2023). The 2024 story remains to be seen, but it is encouraging to see that I have improved upon my 2023 results. I am optimistic that I can beat my 2022 results, or at least get close to $100K in options income this year.

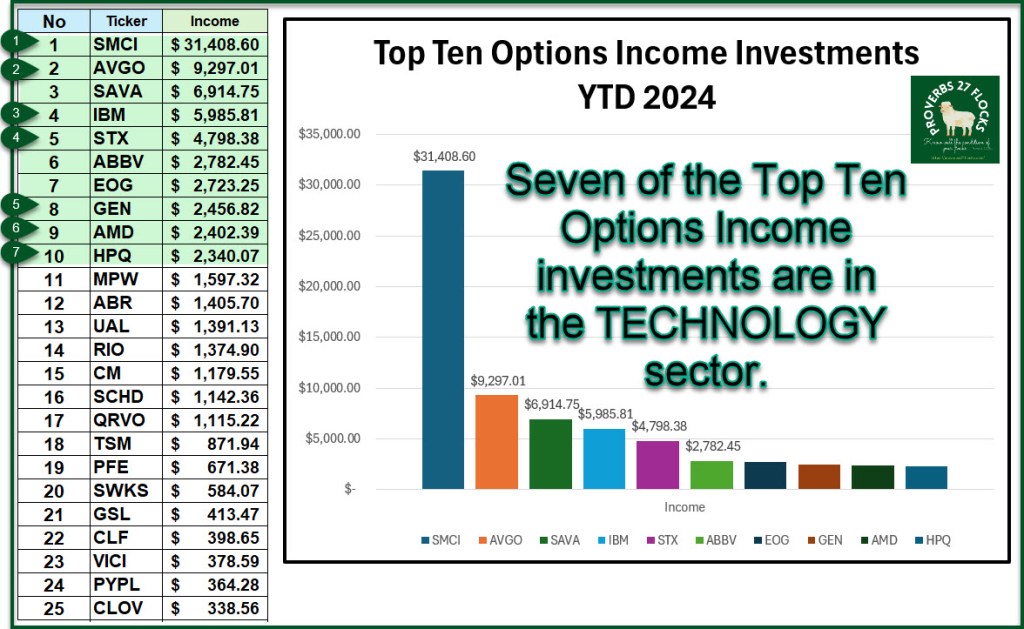

Of the top ten contributors to our option income, seven have a connection to technology. They are SMCI, AVGO, IBM, STX, GEN, AMD, and HPQ. I no longer have shares of AMD, but it was a good play earlier in 2024. Only three of my options trading stocks lost money trading options. They were GLYC, KO, and QCOM. The lesson here is that you should diversify your options trading or be less aggressive than I am when trading options. I have traded options on 47 different stocks and ETFs. ETFs are not as profitable from an option’s perspective, but you can be successful in learning how to trade options using an ETF like SCHD.

Charitable Giving

There are two paths we take when it comes to giving. The first are gifts we give to others that are not tax-deductible. It is a joy to share our resources with family and friends.

The second path is charitable giving. Because I am 73 years old, I am able to give from my traditional IRA using QCDs (Qualified Charitable Distributions.) We are on track to give over $100K this year to worthwhile ministries, including our local church. This is a part of our “report card” as well.

Summary

How did we get to this point? Discipline and consistent investing in quality companies and ETFs that pay increasing dividends. While our returns aren’t always like the S&P 500, it is satisfying to know that we can get at least a “B+” in asset growth and probably and “A” for dividend or income growth.

This isn’t hard to do. Start by setting a goal and then determine what needs to be done to achieve the goal. I think two standards are helpful here so that you have the right attitude and perspective. Give away at least 10% of what God places in your hands. Then, think like an ant and save another 10% in an investment account. You won’t regret those decisions.