Cash Creation in Two Ways

Some positions don’t pay any dividends, but I get “synthetic” dividends. Some stocks do pay a quarterly dividend, but I also can receive, with a bit more work, synthetic dividends. This is true of our investment in Seagate Technology Holdings.

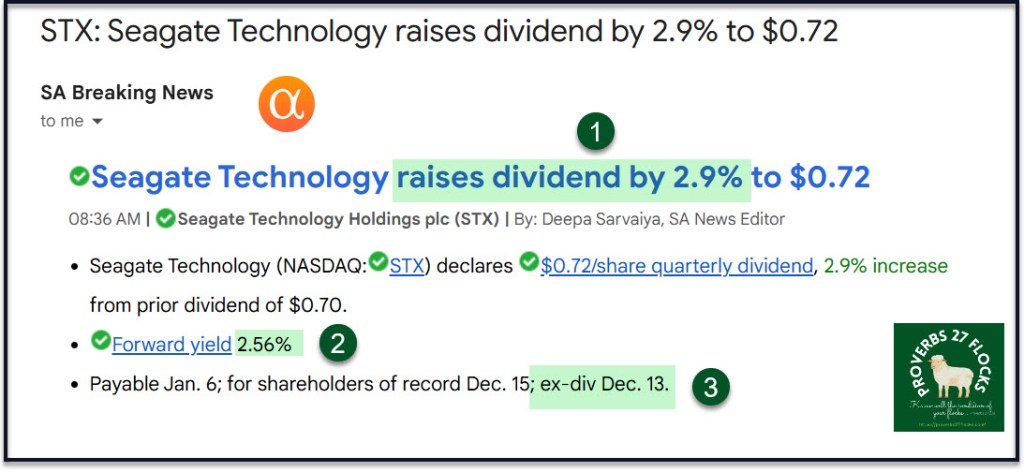

Seagate Dividend Increased

I was pleased to see that Seagate increased their dividend by 2.9% to $0.72 per share. I own 1,600 shares of STX, so I will receive $1,152 on January 6, 2025. That is a nice way to start the new calendar year.

What is a “Synthetic Dividend?”

Investopedia says it well: “A synthetic dividend is an investment strategy in which investors use various financial instruments to create a stream of income mimicking that provided by dividend-paying companies.” – Investopedia

“A common example of this strategy consists of selling covered call options against a portfolio of non-dividend-paying companies. In doing so, the investor would realize income from the premiums earned on the options they sell, thereby creating a “synthetic dividend” out of their portfolio.” – Investopedia

However, you can do this with any stock, including those that already pay a dividend.

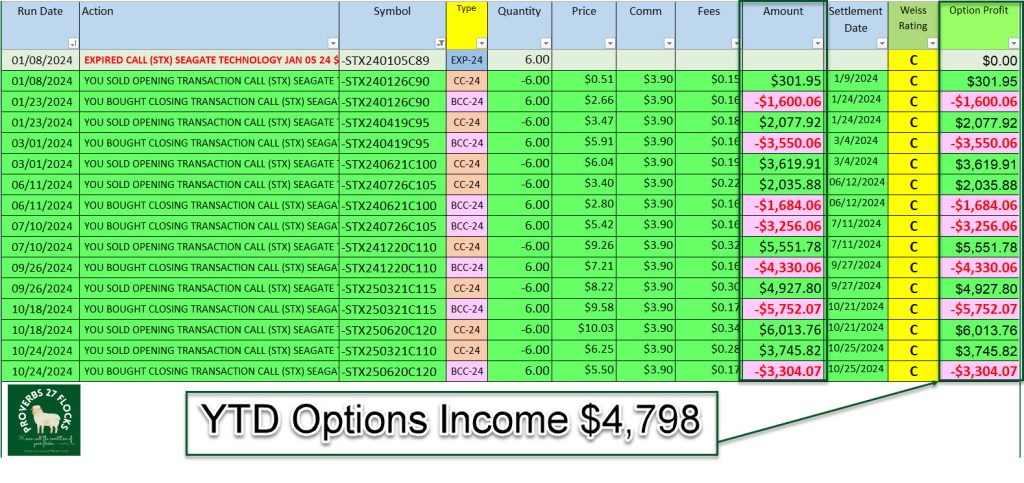

Seagate Options Income YTD 2024

My “quarterly” dividend annualized will now be $1,152 x 4 = $4,608. I have already generated a synthetic dividend from my STX shares of $4,798. What makes this even more incredible is that I have only traded covered call options on 600 of my 1,600 shares. I want to continue to hold STX shares, so I did not want to write options on all 1,600 shares.

In the following illustration I use some abbreviations for the types of options contracts I write. EXP-24 indicates an options contract that expired in 2024. I was writing options on my STX shares in 2023 for synthetic dividend income.

BCC-24 is my abbreviation to indicate that I bought a covered call option to close an open covered call option contract. This is part of an option contract “roll.”

CC-24 is my way of showing that I sold a covered call option. When you do an option roll, both a BCC and a CC are written automatically. It is a way to add income by taking advantage of the price increases and decreases of the stock. As a stock’s price increases, I roll the contract to a higher price at a date further into the future. As the price of the shares drops, I can also roll the contract to a lower price with an equal, less than or greater than contract end date.

Company Profile

Seagate Technology Holdings plc engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally. The company offers mass capacity storage products, including enterprise nearline hard disk drives (HDDs), enterprise nearline solid state drives (SSDs), enterprise nearline systems, video and image HDDs, and network-attached storage drives. It also offers legacy applications comprising Mission Critical HDDs and SSDs; external storage solutions under the Seagate Ultra Touch, One Touch, Expansion, and Basics product lines, as well as under the LaCie brand name; desktop drives for personal computers and workstation applications; notebook drives traditional notebooks, convertible systems, and external storage applications, DVR HDDs for video streaming applications, and gaming SSDs for gaming rigs. In addition, the company provides Lyve edge-to-cloud mass capacity platform, that includes modular hardware and software to support enterprises’ on-premise and cloud storage infrastructure needs. It sells its products primarily to original equipment manufacturers, distributors, and retailers. The company was founded in 1978 and is based in Singapore.