Why I Don’t Load Up on Energy

In a recent post I talked about our current investments in BDCs and REITs. Anyone who has read my posts for some time probably notices that I don’t invest many dollars in energy, utilities, communication services, airlines, or precious metals. At one time I did own shares of energy companies VLO, MPC, OXY, and PSX. But I prefer to avoid individual energy or energy-related companies with a few exceptions.

One reader, Matt M., asked the following question on my post about BDCs and REITs: “There are also good yields to be had in energy- I’m relatively new to the blog so I don’t know if you’ve addressed this before, but why are you not so high on that sector?”

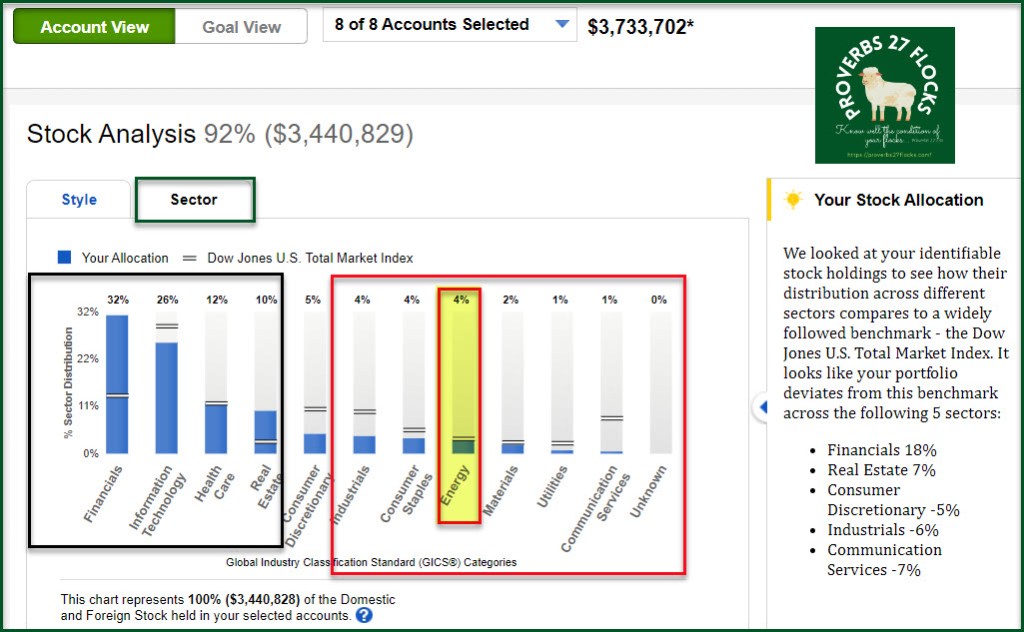

First, let me say that my exposure to the energy sector is like the total market index allocation of energy: about four percent. This is due primarily to the holdings in the ETFs we own: DGRO, SCHD, and VYM. Chevron and Exxon Mobil appear in DGRO and VYM’s top ten. I also own shares of EOG (EOG Resources, Inc.) which is in the Oil and Gas Exploration and Production industry subsector.

The Problem with Energy

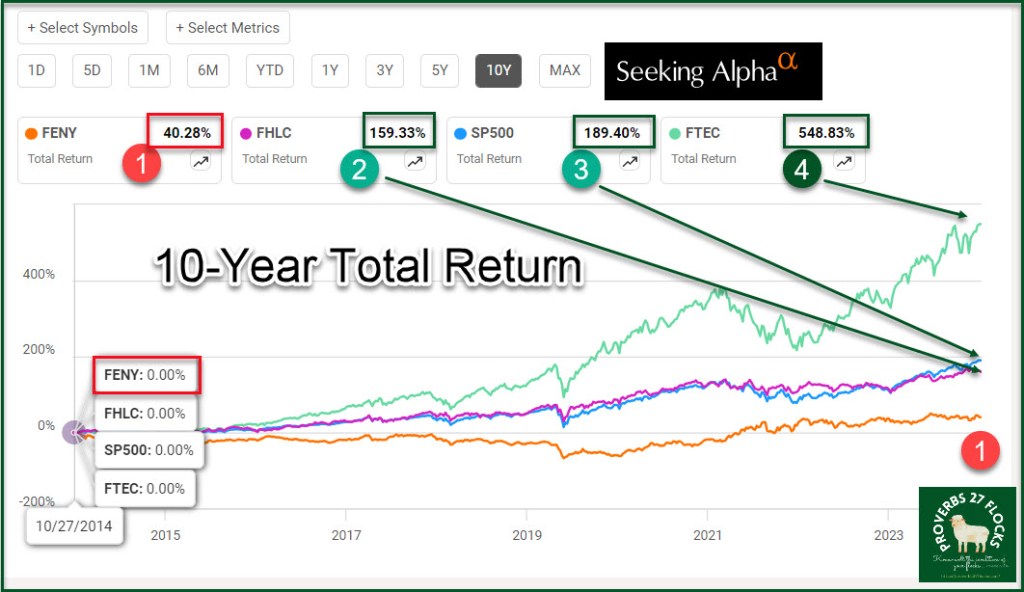

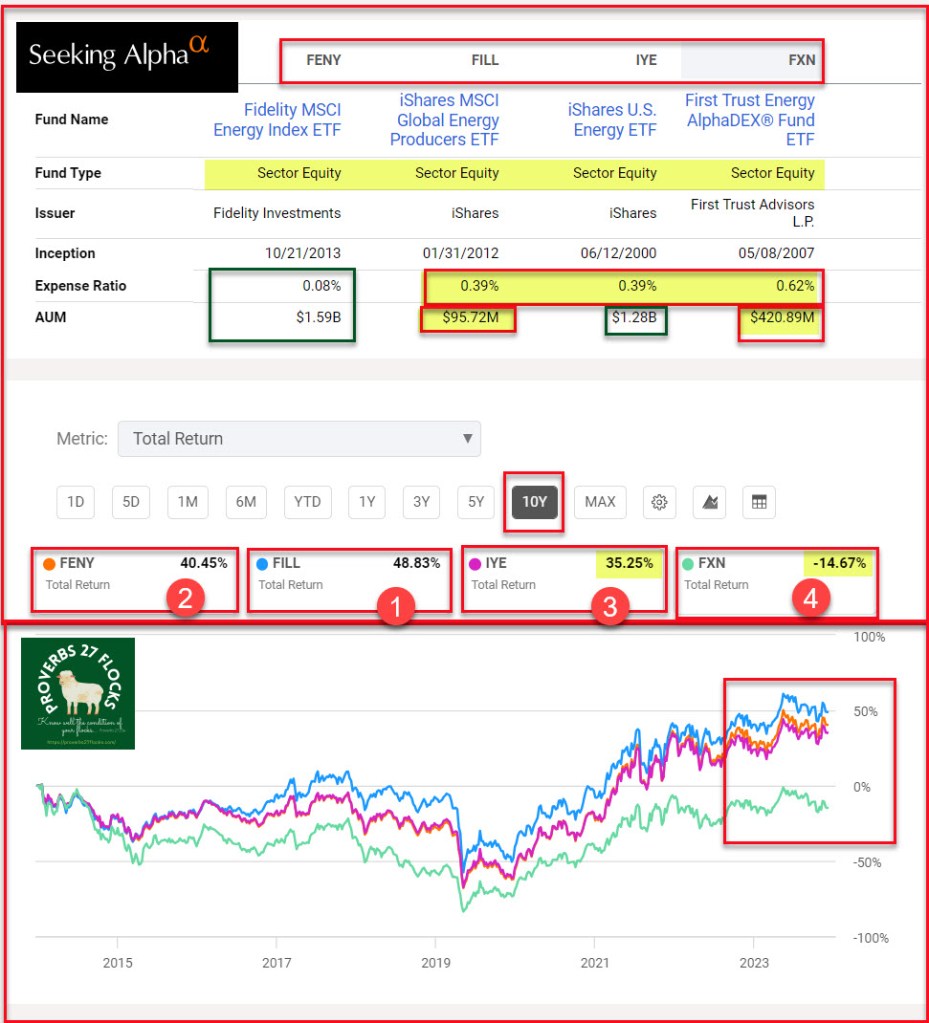

The problem with most energy stocks is that they don’t really have good long-term returns. If you compare some popular energy ETFs (FENY, FILL, IYE, and FXN), you will quickly see that the ten year total returns are just awful. In reality only FENY and IYE are worthy of any consideration due to assets managed.

Most of the time I just look at FENY, as it has 109 holdings and a dividend yield of about three percent. The top ten holdings are Exxon Mobil Corp, Chevron Corp, ConocoPhillips, EOG Resources Inc, Williams Companies Inc, Schlumberger Ltd, Marathon Petroleum Corp, Phillips 66, ONEOK Inc, and Kinder Morgan Inc Class P.

IYE is very similar but has a dividend yield of 2.75% and an expense ratio of 0.39%. FENY’s expense ratio is better at 0.08%. So if you must own energy stocks, then FENY would be the way to go. A far better way is to buy shares of VYM and DGRO.

Dividend Growth Analysis

XOM has a 25-year history of growing dividends. The 5-year growth rate is 2.37%. MPC has a five-year dividend growth rate of 9.99% according to Seeking Alpha. EOG, by way of contrast, has a 29.1% five-year dividend growth rate with growing dividends for seven years.

Where Do You Get Gas?

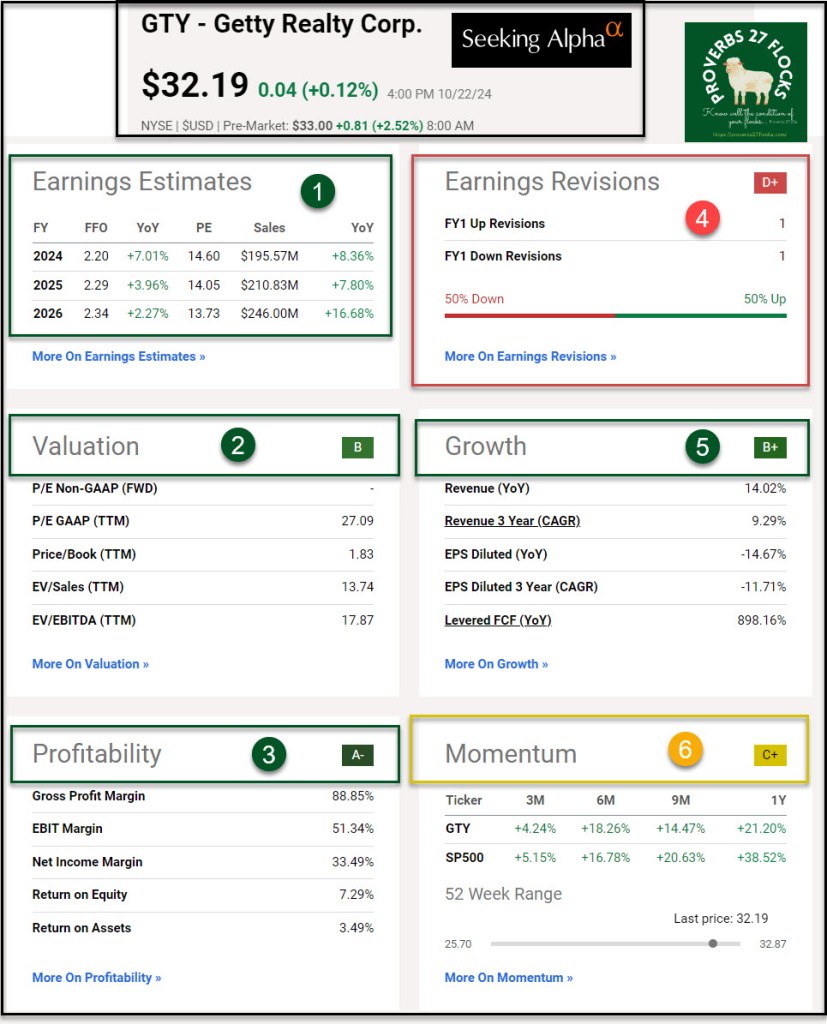

There is one REIT investment that is energy related. GTY (Getty Realty) owns 685 convenience and gas store properties, 127 car wash locations, 100 auto service locations, and 18 QSR properties. QSR is Quick Serve drive-thru Restaurants. The Company’s portfolio includes 1,093 freestanding properties located in 40 states across the United States and Washington, D.C. according to Seeking Alpha’s Company Profile.

Price Returns and Total Returns

When evaluating any company, it pays to look at more than just the price returns, or the growth in the price of the shares. It is far better to examine total returns. Total returns are the combination of the increase (or decrease) of the price of the shares and the dividends you receive over the life of the investment.

In the case of GTY, the 10-year total returns are 196%. Compare that to the SP 500 index which has a 10-year return of 189%. In other words, our investment in GTY does not sacrifice total returns for income. While it is true that ETFs VOO, and IVV have better ten year total returns than GTY, those gains are price returns. I want the income so that I can buy other investments or have income to satisfy our annual IRA RMD and to support QCD giving.

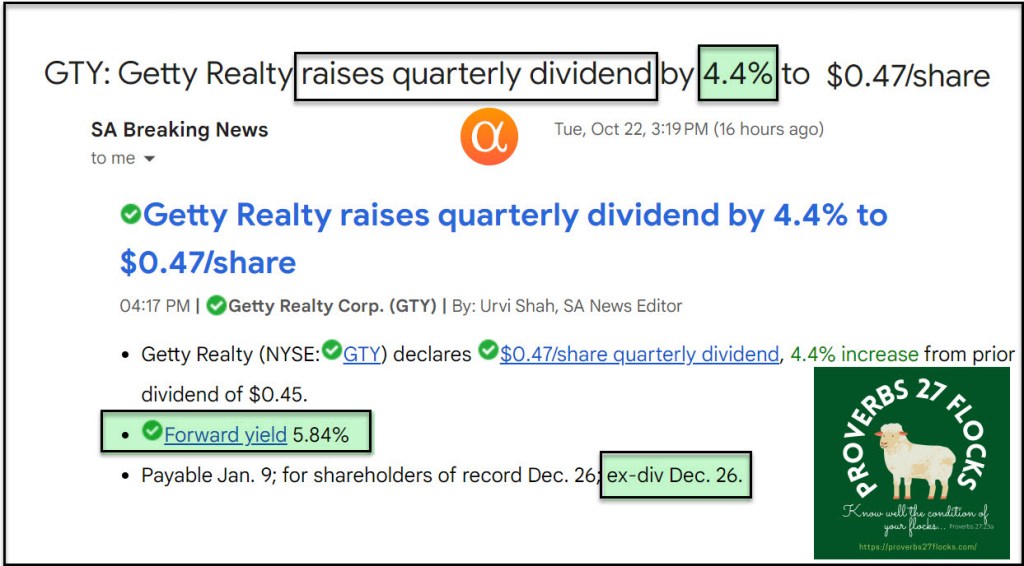

GTY Dividend Increase

GTY just announced an increase of 4.4% for their quarterly dividend. They raised the dividend from $0.45 per share to $0.47 per share. Because Cindie and I own a combined total of 1,900 shares, the extra two cents per share is the same as an additional $38 of income. That is $152 more annualized.

Even more encouraging is the total dividend income from GTY. It increased from $3,420 per year to $3,572 per year. So far this year, including trips to Big Sky Montana, Louisiana, and Florida, we have put $986 of fuel in our 2020 Ford Escape. In other words, GTY gives us enough cash to cover all of our gasoline and convenience store purchases with money leftover for oil changes and any other maintenance we need to have done on the Escape.

Summary

Don’t just look at “ratings” when you buy an investment. Also, don’t make the mistake of just looking at price returns when you evaluate a stock or an ETF. Total returns are a much better way to look at the history of an investment’s contribution to your portfolio.

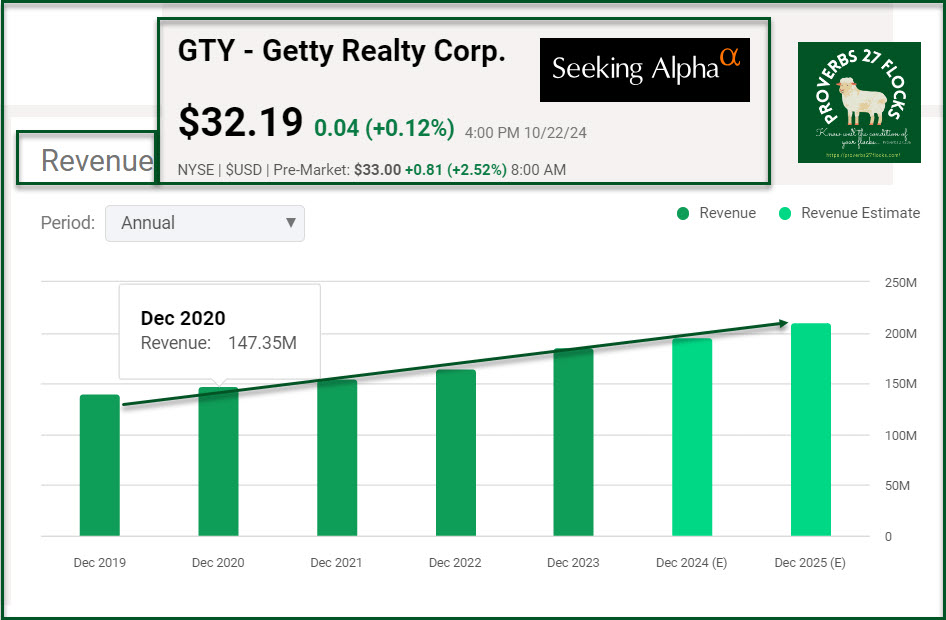

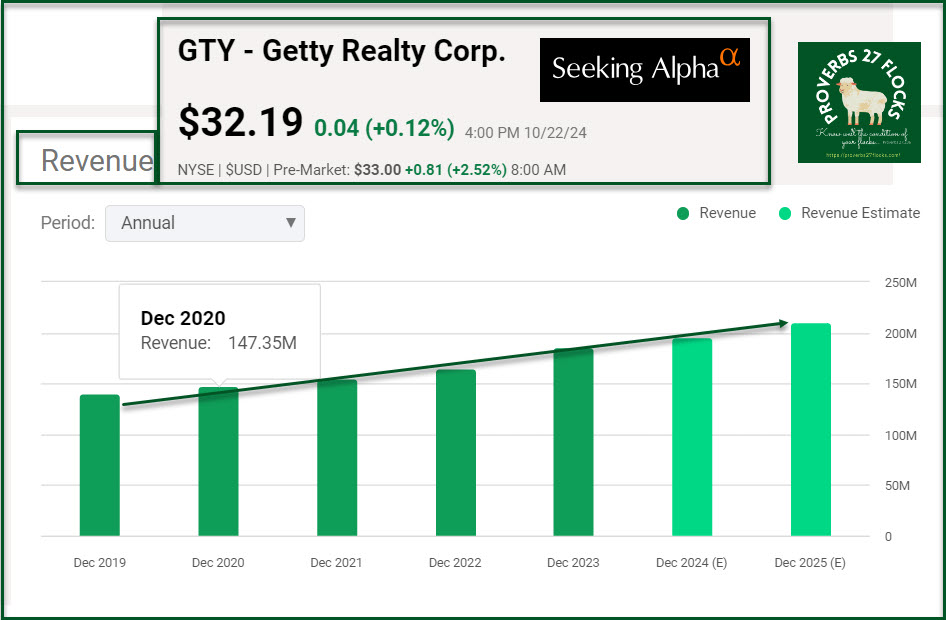

Also, don’t forget to look at the revenue trends for each individual stock. Finally, if you invest in a REIT, pay attention to the FFO (Funds from Operations.) The FFO is a good indicator of whether the dividend makes sense. The FFO annualized should be larger than the dividends paid annually. Here are two graphs for GTY. Both tell a positive story. Note that the quarterly FFO is greater than the new $0.47 dividend.

Thanks Wayne. I have a small position in GTY, might increase it. I don’t want to impose further on your time but I value your opinion- I’m looking at EPD, ET, DVN, KMI, and OKE. Do any of those sound like a good buy? Is there one you would avoid at all costs?

LikeLiked by 1 person

Do you like complicated income taxes? If so, investments like OKE and EPD issue K-1’s. Suggestion: Go to the websites for each of these to see if they issue a 1099-INT or a K-1. I would avoid all K-1’s in IRAs and ROTH IRAs. I have owned some Limited Partnership investments in the past and they create a mess at income tax time. As soon as Fidelity said they would start income tax considerations on LPs in IRAs and ROTH IRAs I sold my LP holdings.

OKE has excellent 10-year returns. I would avoid all of the other ones. Let’s face it, if the yield is higher, and your taxes are complicated (and filing is delayed) you have to consider the extra work and frustration of the Limited Partnership. However, if you already deal with K-1’s and don’t mind complicated tax returns, then perhaps OKE is worth a few dollars of your portfolio.

LikeLike

That’s a good point- I appreciate it!

LikeLiked by 1 person