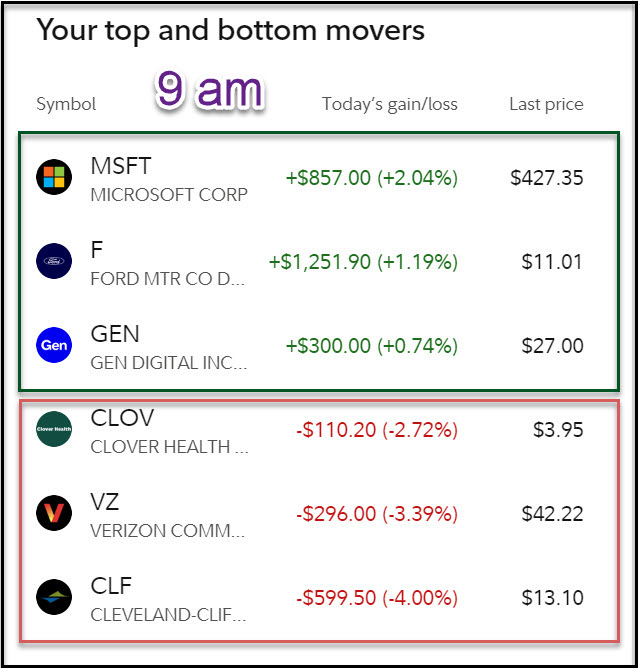

Top and Bottom Movers

In Part 1 I talked about looking at “Activity & Orders” for your incoming cash. It is also a good idea to look at what is moving up or down in your holdings.

On any given day when you have two minutes when the stock market is open, sign on to your Fidelity Investments account to see your “Top and Bottom Movers.” I do this from time to time to look for buying opportunities.

What is Going Up?

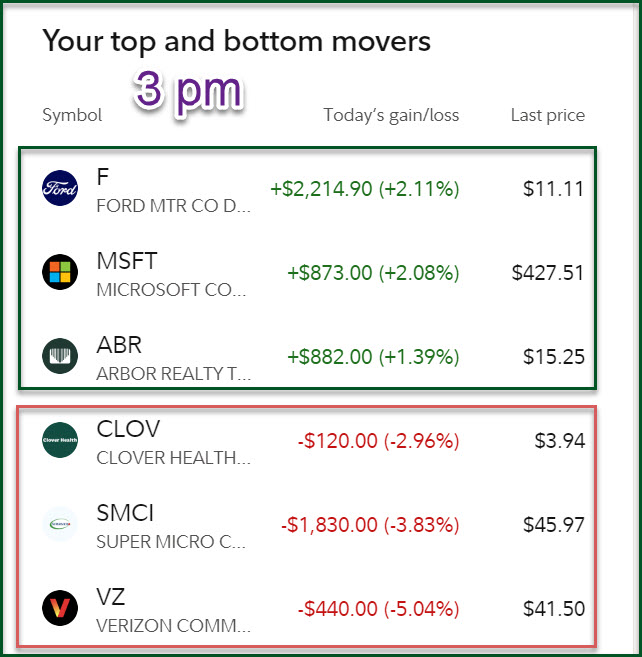

In this illustration MSFT, F, and GEN are up at the time I was looking at it. In general, I won’t be buying more of an investment that is up considerably on any day. The reason is simple: every investment goes up and down and buying on a down day or during a down part of the day is the best time to buy. Later in the day MSFT was still in the top three, as was F, but GEN was out and ABR was in. VZ continued to go down.

What is Going Down? Verizon Was.

If something is going down, I want to ask “Why?” If the entire sector is headed south, then that is not alarming. The news for Verizon (VZ) for example is “Verizon was the biggest decliner on the blue-chip Dow after the telecom giant missed estimates for third-quarter revenue with a 4.9% loss.” One thing about such a large decrease is that it means the dividend yield increases. There is an inverse relationship between the price and the dividend yield. If the price of a dividend paying stock decreases, then the dividend yield increases. If the price increases, then the dividend yield decreases. I prefer to buy dividend stocks when the yield is high if the business is fundamentally sound.

Dollar Cost Averaging Going Up or Going Down

If I wanted more shares of VZ, I might put in a buy limit order to buy 50 shares. My cost basis for my current ROTH holding of VZ is $40.19. This could be a good time to add shares. The shares were trading as low as $40.82 when I grabbed this image. Now they are up to $42.05. Had I wanted to buy shares shortly after the market opened, I would have entered a buy limit order for 50 shares at $41.00. Then if the price continued downward, I would have entered a second buy limit order for 25 shares at $40.75. The average cost of my shares would be higher than $40.19.

It would be even better if I could buy more shares at $39.50 per share. Therefore, if I want 100 shares, I buy smaller lots like 50 or 25 shares looking for a potential opportunity to add even more at a lower price.

Options traders can be creative. As an alternative, I could sell a cash covered put option to buy the shares if they drop to $39.50 per share. There is an upside and a downside to this approach. If the shares drop to $39.00, I still have to pay $39.50 per share to satisfy the put option. However, if they don’t I get the premium from the option trade and don’t have to buy the shares. The other consideration is that each option is 100 shares. Using this approach I cannot buy 50 shares now and 25 shares later.

Some Buy Limit Rules (When and How Much?)

As a result of my previous post about looking at your activity for dividend income, Bill said, “I know you are now on your weekly investment plan, but I have a particular query as it relates to how you set your new buying.”

He went on to say, “As mentioned in your article, you look to see what pending orders have been executed. In particular I am interested in your thinking on buy order limits. How in the world do you set your orders?” He then went on to describe how he tracks investments on his potential buy list. His conundrum is also one that every investor faces. It is, “But in every case, my buying of investments come down to irrational thinking (in my mind). What price should I buy this at? Market? Pull back? The price minus some percent? The next, if I think I should own it and not worry about it, I may tend to jump in especially if it looks like the market is going up. Yet, after all this, one often thinks, there has to be some logical better way of determining a price.”

Now the list of potential buys is not arbitrary. Rather, he says, “The fact that I want to invest it means it meets my threshold for wanting to own. Otherwise, research and fundamentals.” The homework is essentially complete, but the real questions remain: “Should I buy now and if so, at what price?” How do we set a price that is rooted in, as Bill says, “logic?”

Are You Voting or Weighing?

Voters tend to vote for the short-term. They like their candidate today, but often they realize that they regret their vote. Next time they will vote for the opposition (unless they are just going to always vote for their party.)

In contrast, if you are weighing a valuable metal, it tends to retain the weight. Sixteen ounces of gold today is still sixteen ounces ten years from now. The primary difference is the likely value placed on sixteen ounces of gold ten years from now. (I’m not an investor in gold, so don’t read too much into this contrast example.)

So I weigh instead of seeing the investment just purely as a vote. I remind myself of something each time I place a buy order: I’m buying for the long-term not for a short-term enthusiasm. There are times when a particular investment looks like a mistake after I buy, and I can easily think that I bought at the wrong time and at the wrong price. However, I have seen time and again that the current price is a voting machine, not a weighing machine. Sometimes the voters are terribly wrong. I would rather weigh (value determination) an investment and take joy in a price decline that offers even more opportunities when the voters are short-sighted.

In a previous post, “The Market is Just a Voting Machine” (02/10/23) I said the Stock Market has a split and erratic personality. We should not be motivated or deterred by or fall for his emotional highs and lows. The market is bipolar. Mr. Market is really just other buyers and sellers in the stock market. Some days there are more buyers than sellers. When that happens, prices will tend to go up. Some days there are more sellers than buyers. The reverse happens on those days. The phrase, “In the short-run, the market Is a voting machine, but in the long-run, the market Is a weighing machine” is widely attributed to Warren Buffett. Warren is saying don’t follow the herd but leverage the behavior of the herd.

How to Buy? Here is My Short Answer Using Hypothetical XYZ

I like the XYZ stock, and I want some shares. I would start buying XYZ now considering the price range for the last 5-10 days. If you want to build an investment in a specific stock, don’t expect to get a bargain. If the current XYZ price is $40 per share it is ridiculous to think a buy limit order of $35 will fill. However, a price of one percent lower might trigger. So if I think it is a good investment at $40, then buying shares at $36.75 may be a rational choice. Also look at the normal daily trading range for XYZ. If it varies by fifty cents, enter a buy limit order for $36.50.

Here is a More Complete Answer

Look at the next earnings date. It often pays to buy before the earnings date and then buy more if the rest of the world is selling because of some short-term disappointment. Look at the next ex-dividend date. Don’t wait until the day before the ex-dividend date to buy shares. I like getting started with a position knowing I will be rewarded soon with more cash.

Look at the trading range for the stock. Is it basically moving up? Then now may be the best opportunity to buy. Is it gradually moving down? If you want 100 shares, don’t feel compelled to buy all 100 shares in one purchase. If the XYZ stock is trading at $40 per share, and it drops to $39.75 I would buy 25 shares. Then, if it drops to $39.50, I will buy another 25. I’d continue to take that approach, knowing my average cost will be lower for the total investment.

Suggestion

Be realistic. No one knows what any price will be one day from now, much less than one year from now. Remember, you did your analysis and weighed the investment potential. That is a long-term perspective. It is foolish to think that what the voters are paying is the right price or right valuation.