It Probably Is Not 2.5%

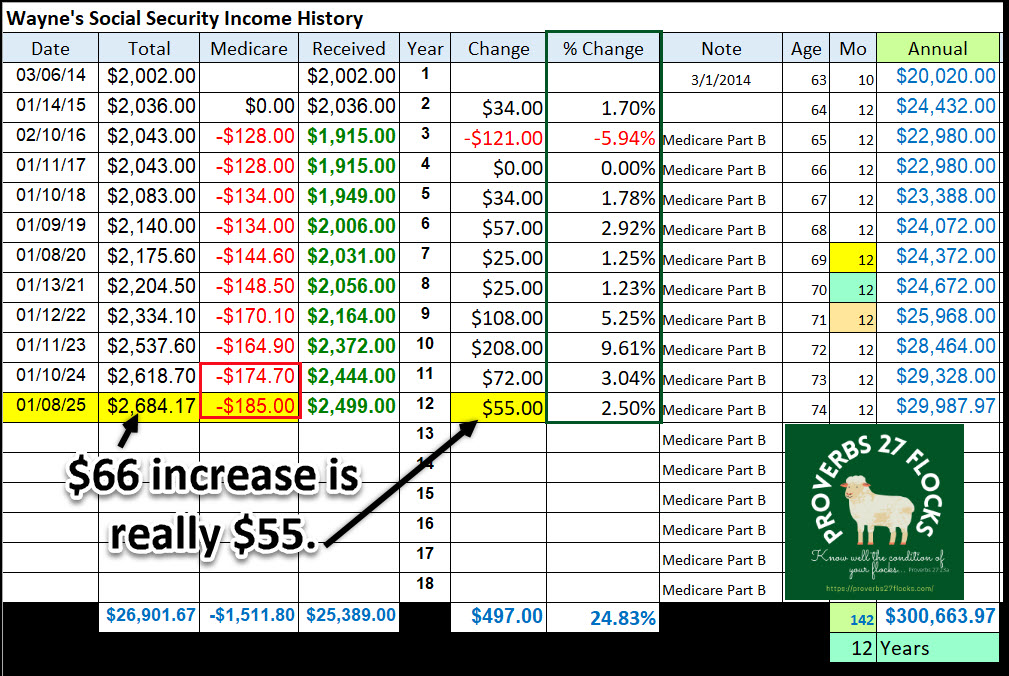

Every year the government announces if there will be a Social Security increase and what the percentage will be. This year’s increase is less than the last three years, but still more than what we received in 2020 and 2021. I have estimated that my “income” from Social Security will increase from $2,618.70 per month to $2,684.17 per month. However, that is the gross amount, not the net after the Medicare premium.

The Social Security 2025 Increase is 2.5% (Sorta, kind of)

What they say is “true” in that if you are currently receiving, let’s say, $2,000 per month in 2024, you should receive $2,050 on paper in 2025. However, most Social Security recipients will be on Medicare starting at age 65. As such, they also have a Medicare monthly premium that is deducted from their Social Security benefit before they even see it in their checking account. This also doesn’t account for any Federal and State income taxes that will have to be paid on the income.

Medicare’s 2025 Base Premium is Increasing Too

Assuming you fall in the right income bracket your premium is increasing by about $10 in 2025. That means your real income increase per month in 2025 will be $40 per month. That means you will receive less than ten dollars more per week. Remember that when you go to buy groceries or fill up your SUV’s fuel tank.

The Way Inflation is Calculated

There is another problem with the 2.5% inflation “cost of living adjustment.” The adjustment is based on what the government calls inflation and what they choose to exclude from their calculations. The costs of someone in retirement are typically different from those who are still in their working years. Of course, I believe the government chooses the numbers they like best, not the ones that match the reality of retirees.

A Word to the Wise

As I often repeat, Social Security is a nice annuity. However, it is certainly rarely enough to cover the real costs of living in retirement. I believe it is wise to save around 10% of your income during your working years so that you can live off of your investment income when you are no longer working full-time for yourself or an employer.

From the Wall Street Journal

Social Security Is Giving Retirees a 2.5% Increase, the Smallest Raise in Years – By Anne Tergesen October 10, 2024. Anne Tergesen does a nice job painting the reality. Here are some of the things she wrote…

“Next year, the standard premium for Part B, which covers expenses including doctor visits, is slated to rise to $185 a month from $174.70, according to estimates Medicare’s Trustees released in May. That would consume about 21% of the COLA raise.”

“Retirees’ Social Security benefits will rise 2.5% in 2025, the smallest cost-of-living adjustment in four years.”

“It doesn’t necessarily reflect financial reality, retirees say. Prices may not be rising as quickly, but retirees still feel the sting of paying more for everything from groceries to insurance. Inflation has made it harder for people to stick to a budget, causing many to draw down their savings faster than expected.”