Getting Started By Starting Small

The first time I thought about the purchase of a drone in September 2020, I went to a store that specializes in drones. The salesperson saw I was looking at $2,000 drones and asked me about my flying experience. I told him I had never flown a drone. He wisely suggested that I buy an inexpensive drone first to gain experience from multiple crashes before spending a couple thousand dollars on a better drone.

I went to Amazon’s website and found this product: “SANROCK X105W Big Drones for Kids and Adults with 720P HD Camera, Wi-Fi Video Feed, App Control. Long Flying Time 17 Mins, Altitude Hold, Gravity Sensor, Route Made, One Button Return.” The total cost before a gift card was just under $50. It was difficult to fly, especially since it was very lightweight, and it could only fly for about 15 minutes. But I learned how to fly. I also learned that I enjoyed it.

A year later I went back to the store where I received good advice and purchased a $2,000 drone. It can fly longer, higher, and faster. It takes incredible pictures and videos. I took the maiden flight One year later on September 16, 2021. Here is an image from that first video.

The same approach applies to investing. Start small and learn from small trades. You don’t want to crash a $10,000 trade. You want to do something less expensive. That is what I did when I started trading options in April 2020. My first trade was a covered call for 100 shares of AMD stock: “CALL (AMD) ADVANCED MICRO MAY 08 20 $59 (100 SHS)” and I received $294.30 for that trade. The call expired and I kept the cash and my 100 shares of AMD. Several of my options trades earned me less than $5 per trade, but I gained experience flying options.

Starting Small with Put Options

Most new options traders don’t want to risk losing a lot of money trading options. They also don’t have a lot of cash to use for options trading because they focus on buying and holding good investments. I prefer to buy and hold dividend growth investments because that is easy and growing income. It is possible and easy to earn additional income by buying and selling option contracts. Covered call options are the best way for most investors to start. But selling puts on low-cost stocks is another way to do this.

What is a Cash-Covered Put Option?

“A cash-secured put—also known as a cash-covered put—involves having enough money in your account to cover the cost of potentially buying an underlying stock that you sell a put on.” SOURCE: Fidelity Smart Money

Fidelity goes on to say: “This is a strategy to consider when you have a neutral-to-bullish outlook on a stock.” In other words, you sell a put option when you think the share price will stay steady, go down very little or go up before the contract expires. A put is really just a way of saying that I will buy the shares if the price of the shares drops to the contract price. It also means I am willing to pay the contract price amount, even if the shares plummet in value.

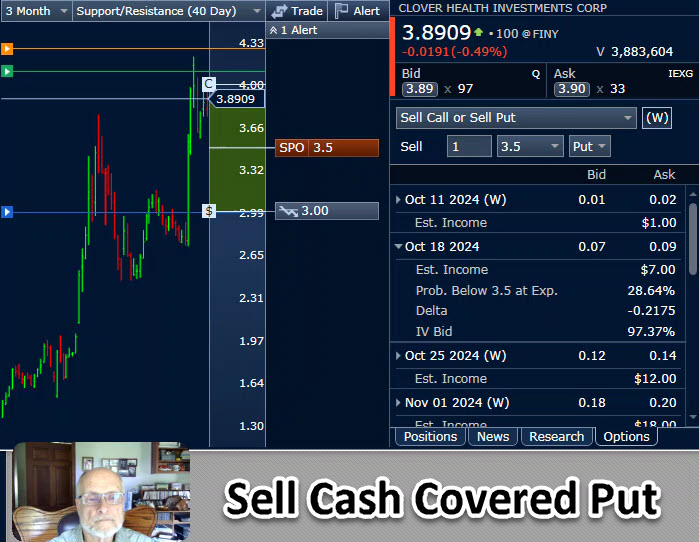

Using Clover Health Investments as a Low-Risk Example

For example, if the shares of CLOV (Clover Health Investments, Corp.) are trading under $4 per share, I could just buy the shares for about $3.95. But what if I would like to buy them if they dropped to $3.50 per share? I could enter a buy limit order and may or may not get the shares. If I don’t get them, I lose nothing, but I also don’t earn anything.

Alternatively, I could sell a put option contract to buy the shares at $3.50/share and receive some income just for my willingness to buy the shares on the contract expiration date if they fall to or below $3.50 per share. I need $350 ($3.50 x 100) in cash in my account for this type of option contract. If the shares stay above $3.50, I keep the premium I have already received and don’t have to by the CLOV shares. So you see, I made income on an investment that I don’t own.

The income isn’t much, but that is OK, I’m only “risking” $350 and then only if the shares drop in price. I become the owner of the shares if the shares drop to $3.25/share, so the buyer of the PUT option is happy because I have to give them $350. They were saved from taking an even greater loss. But the story doesn’t have to end there. I can now sell a covered call option on my 100 shares of CLOV with a contract price of $3.50 per share. That will also earn me income. Therefore, the risk can be reduced with a prudent PUT/CALL approach to options investing.

Video Training: Put Option for CLOV

In my ROTH IRA I own 1,000 shares of CLOV. I also sold ten covered call options contracts on my shares. Using this approach, and rolling out my ten contracts, I have received $119.38 in income since September 10th. In other words, my September CLOV income thus far is almost $120. In August I made $101.62 from these same shares. Bear in mind that CLOV doesn’t pay a dividend, but I still received income in August and September!

My cost basis for 1,000 shares is $3 per share. If my $4 option contract reaches $4 per share on November 18, my shares will be sold and I will make $1,000 in profit, plus the $221 I already received from the options trades. My investment is $3,000, but my potential total profit could be $1,221.

The video I created talks about the current covered call option contract and then goes on to show, step-by-step, how to trade a cash covered put option on CLOV shares with a contract price of $3.50.

Here is a link to the YouTube Video: LINK

Two Reminders

If you want to trade options on Fidelity’s options trading platform, I highly recommend that you start using the Fidelity Active Trader Pro software. It is free to download, install and use.

Furthermore, you cannot just start trading options. You have to apply for options trading. You can do that online at the Fidelity website.