The Problem is Multiplied

There is much to be said for putting your eggs in different baskets. If one basket has a bad handle, and the basket falls while you are carrying it, many of the eggs will probably break. If you have more baskets, the chance for failure may seem to be less. There are exceptions. For example, having multiple homes doesn’t necessarily decrease your problems. Having multiple brokerage relationships may seem prudent, but there are reasons to avoid that if possible.

I know of some investors in the Fidelity Community who may have an account with Fidelity and also with Schwab or Vanguard. Even I have had multiple brokers at times and currently have two relationships: Fidelity Investments and Robinhood. I don’t recommend Robinhood, but it is an interesting weak platform used by many in the younger generation. According to one source, the Robinhood Average Account Size (Aug 2023) is $3,826. My Robinhood account has a balance of $276. It has not done well.

Former Employer 401(k) Accounts

A surprising number of people don’t move their 401(k) account from a previous employer to their own self-directed IRA or ROTH. I won’t repeat what I have said in previous posts, but this is rarely a good idea.

The problem is compounded if you have that account, a 401(k) with a new employer, and your own brokerage account. It becomes difficult and sometimes impossible to really know what you own. You cannot easily answer questions about the total costs of your investments, the dividend growth, the sector weightings, or the performance of your total portfolio of investments. Some brokers charge crazy prices for their services and may sell you things you don’t need because it enhances their income stream at the expense of yours.

Which brokers are worthy of consideration? In all of my years of looking at different providers, Fidelity Investments, Charles Schwab, and Vanguard appear to be the best. I think any one of them is fine for the average investor, but I believe Fidelity offers unique advantages. Therefore, all of our accounts, except the tiny one at Robinhood are at Fidelity.

What Do I Gain From This Approach?

While it would probably make some people nervous, the advantages of having all of our investing eggs in one basket far outweigh the risk of investing this way. Here are six images to help illustrate why I want a focus. This is just the tip of the iceberg. There are many small advantages as well.

One: A Better View of Asset Allocation

It is far easier to see how much of our portfolio is in stocks, bonds, and short-term investments like CDs. You don’t need a spreadsheet to see this. Fidelity provides that view. This also provides a quick look for stocks that might be 5% or more of the total portfolio across all eight accounts.

Two: A Better View of the Stock Style

Are you a large-cap growth investor, or a mid-cap value investor? This may not matter much unless you want to have a better chance at growth in your overall portfolio. There are, generally speaking, more growth opportunities in the mid-cap and small-cap areas of the market.

Three: A Clear View of Sector Allocations

If you have accounts at multiple companies/brokerages, do you know how your asset mix compares to the Dow Jones U.S. Total Market Index? I think there is value in knowing if you have put too many of your eggs in the utilities or communications sectors of the stock market. It also helps to be aware of your weightings of important sectors like the financials, health care, technology, and real estate.

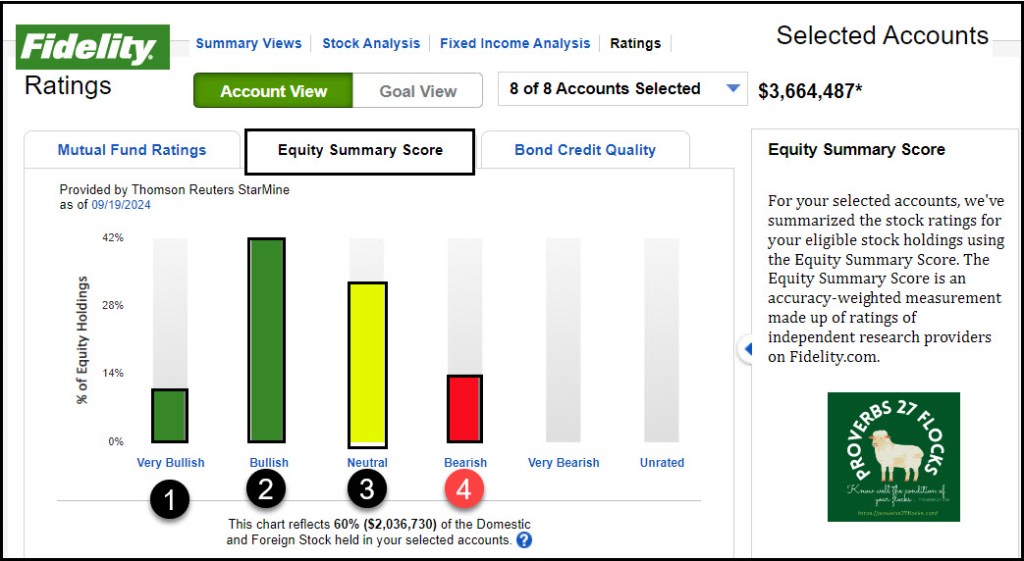

Four: Risk Factors

Do you have a high-level view of the nature of your investments? While I am not a huge fan of the Fidelity Investments Equity Summary Score, it does help illustrate the relative risk weightings of our investments. I want the majority of our investments to be “very bullish” and “bullish.” I don’t want to be in the “very bearish” portion of the overall market.

Five: Balance Growth

It is most helpful to be able to see the growth of your overall investment portfolio over time. It also helps to be able to see withdrawals in the mix so that you can balance your view including the gains on your portfolio against the impact of withdrawals. Someday, if you live long enough, you have to take RMDs from traditional IRA or 401(k) accounts.

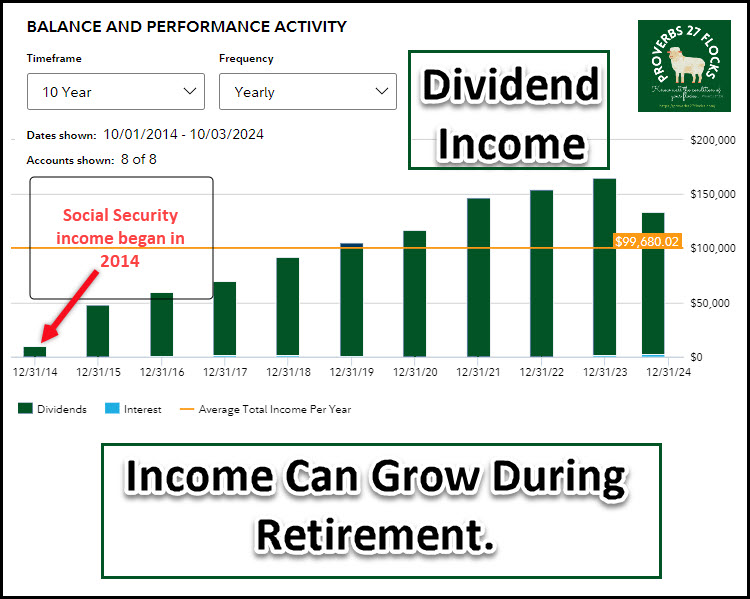

Six: Income Growth

An Easy Income Dividend Growth approach should result in growing income. If it doesn’t, just remember inflation will grow. I started taking Social Security in 2014. That “income” has grown, but not very well. The government is not going to give me the same income growth that I can get from our investment portfolio. By implementing a dividend growth approach we have had more than sufficient income from our investments.

Summary

In the end, it is probable that you will have multiple brokerage relationships over your working years. If that is the case, think about how you can consolidate your bank savings account(s), checking account, brokerage accounts, and old 401(k) accounts, to gain a view of your accounts that is not possible when they are spread all over the investing horizon. Reduce the clutter, the multiple statements, and the higher costs associated with a disjointed approach.