Focusing on the ROTH IRA

I’ve noticed that one of my popular articles was “How AND Why I Read My Monthly 80-Page Fidelity Statement – Only Four Pages Capture My Attention.” That post was written in December 2023. Since that time I have increased my options trades and am now participating in the Fidelity Fully Paid Lending Program. Because of this, my wife and I have a combined statement that is 102 pages long for September. I don’t read all of the pages.

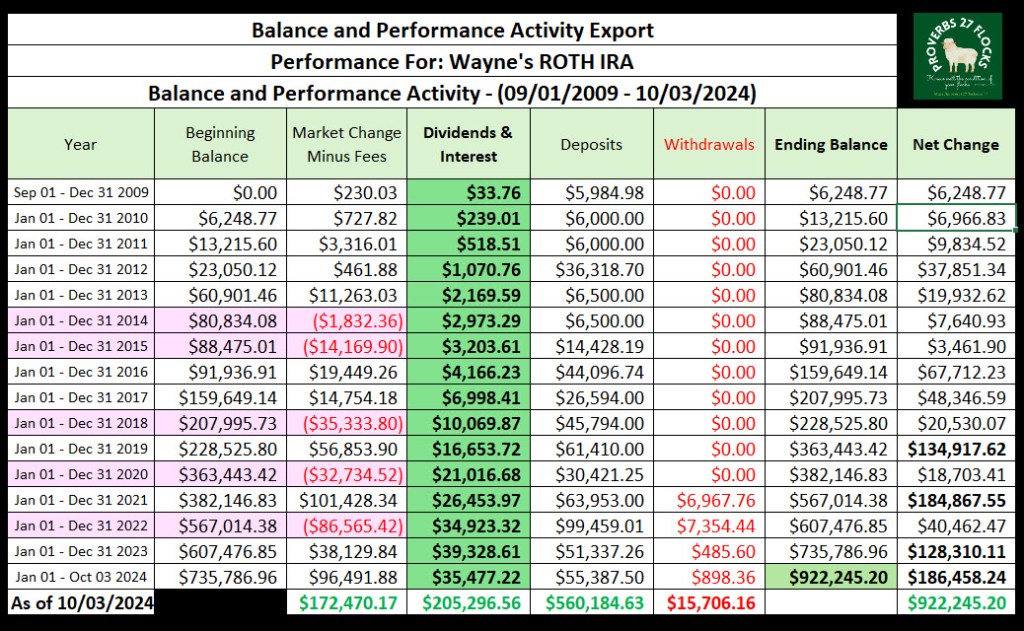

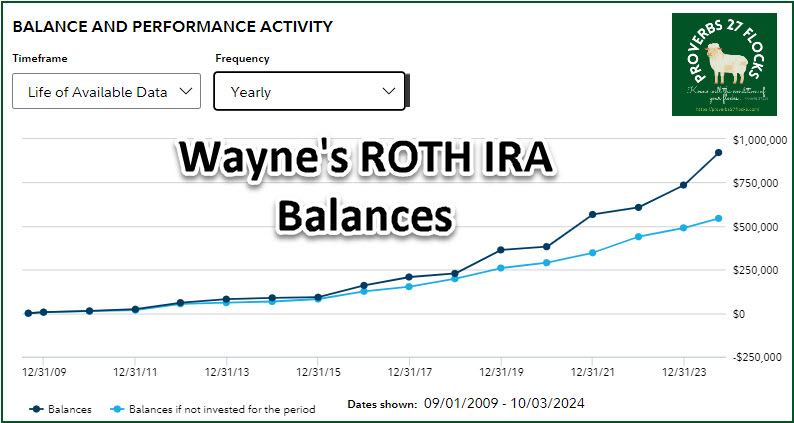

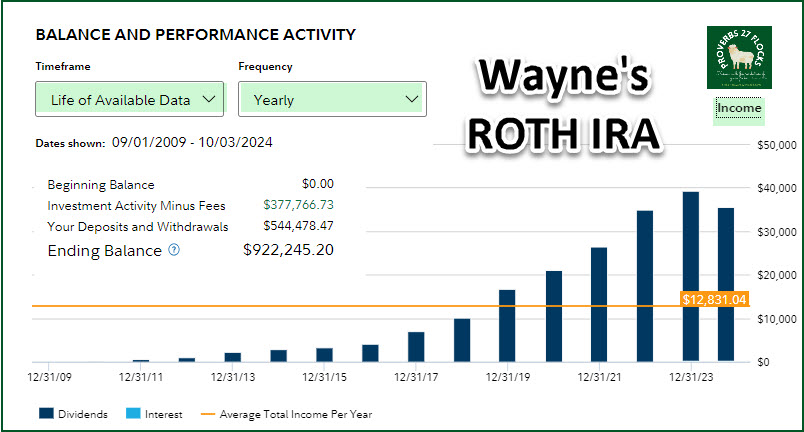

Today I want to share my quick review of my ROTH IRA. There are a couple of things that stand out when you look at what has happened with my ROTH since 2009.

A Long Time Ago

When I worked for Universal Foods Corporation (UFC), there was no ROTH IRA. According to Investopedia, “Roth individual retirement accounts (Roth IRAs) were created by the Taxpayer Relief Act of 1997 and went into effect in 1998.” UFC only offered a traditional 401(k) because that was the only choice. When I left Universal Foods in 1999, I rolled my 401(k) balance to my own traditional IRA. I had worked at UFC from 1976-1999, and I believe my 401(k) balance was about $300K.

The Next Two Employers

When we moved to the Madison area in 1999, my two main employers offered ROTH 401(k) plans. Because I know the government will always want more of our income, I opted to use the ROTH plans. Then, when I left each of those jobs, I rolled the ROTH 401(k) accounts into my own Fidelity ROTH IRA.

ROTH Conversions

Another discipline I established, and that I still do, is to selectively move my stock and ETF holdings from my traditional IRA to my ROTH IRA. This reduces my future RMD tax liability and increases our current and future tax-free income. In addition, because I like easy income, I hold dividend growth stocks and ETFs in my ROTH IRA, just like I do for the other accounts I manage.

Therefore, as a result of both dividend growth and converting assets from the traditional IRA to the ROTH IRA, our income from my ROTH IRA has grown to over $35K YTD. That is tax-free income. In the following chart you can see that I have been avoiding withdrawals from this account. It is far better to withdraw from the traditional IRA accounts and pay the income tax. This should improve the tax situation for our heirs.

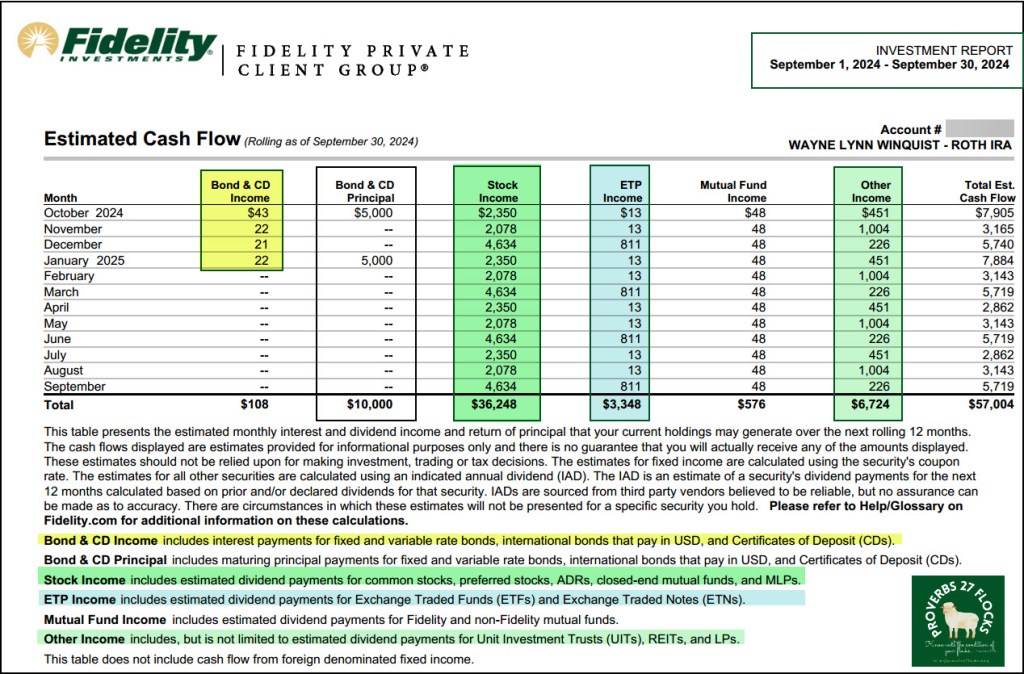

The Focal Point in Wayne’s ROTH Section

While it is certainly nice to see the increase in the value of our investments, you cannot live off of or give from a statement balance. Income is the only real money. If you don’t invest in stocks and ETFs that pay a dividend, then you probably have to sell some of your investments to generate cash. Therefore, of the 102 pages of my September statement, the following one is of most interest to me. It is a focus on the Estimated Cash Flow.

There are six contributing factors. The first is some fairly insignificant income from some short term CDs. The second is from individual stocks like ABBV, FNF, PFE, DOW, GSL, F, and HPQ.

The third category is “ETP Income.” This includes ETF investments like VYM, SCHD, DGRO, and DTD. The fourth is “Mutual Fund” income. This is primarily income from SPAXX, a government money market fund. Finally, there is a category called “Other Income.” Other income includes REITs and BDC investments. Some of the ticker symbols in this group are MAIN, GAIN, ADC, O, SAR, TSLX, CSWC, and PNNT.

Options Trades and Even More “Other” Income

What Fidelity cannot forecast are two other pieces of income. They also are unable to factor in dividend growth, as they have to be conservative in their data presentation. No one knows what the actual dividend growth will be.

One of the missing pieces is the interest from the Fidelity Fully Paid Lending Program. The other piece is the income I derive from trading options. For example, my YTD options income in my ROTH IRA is $5,173. That is another $575 per month. I view that as a conservative estimate.

Think Long-term and Learn Something New

If you are not yet retired, then be reminded that you don’t need spectacular income growth during your working years. What you need to do is apply a long-term vision to your investing habits. It also doesn’t hurt to learn something new, at least once each month. Finally, if your employer offers a ROTH 401(k), and you can afford to contribute to it, especially if your employer does matching of at least some of your savings, take the free money!