Which ETFs Do You Own?

One of the ways I learn from ETF fund managers is to analyze their top ten investments. This works well because most fund managers don’t want any of their top ten investments to drag down their results.

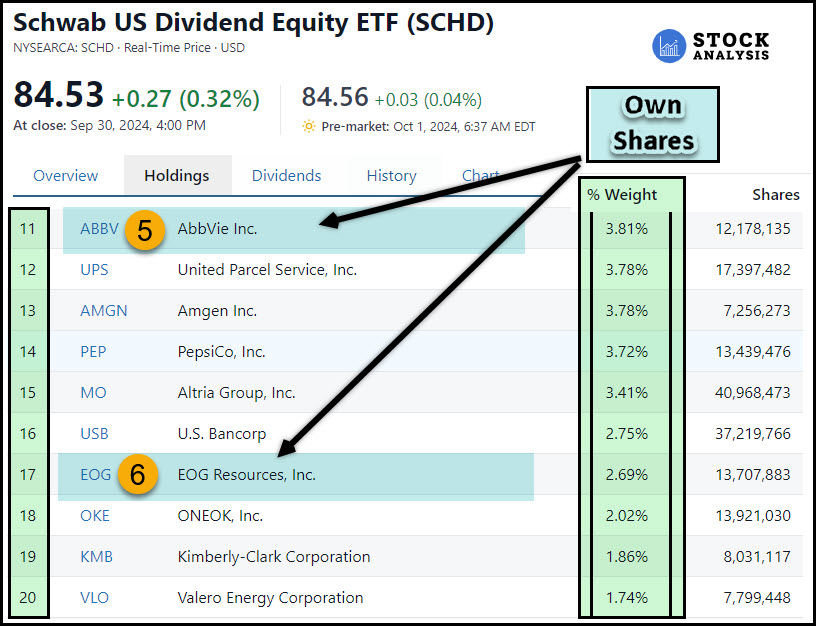

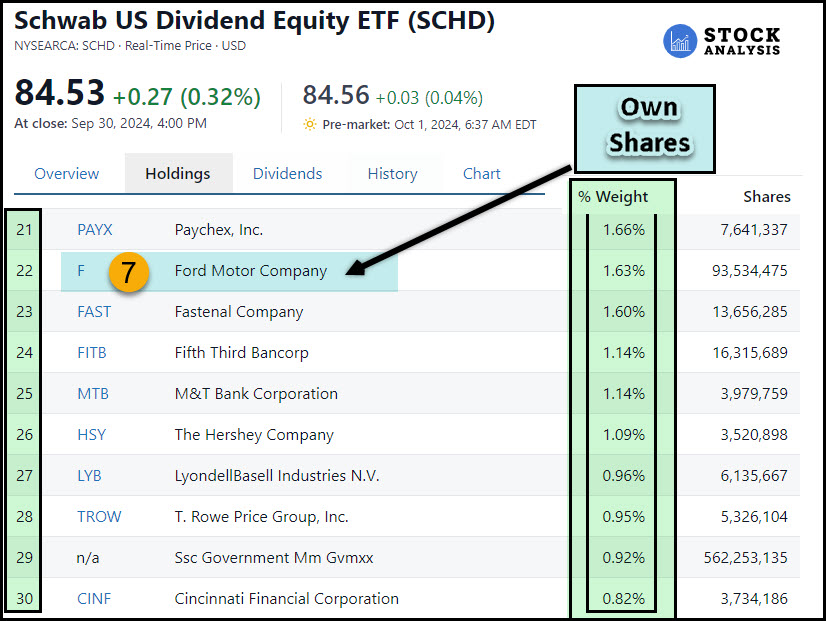

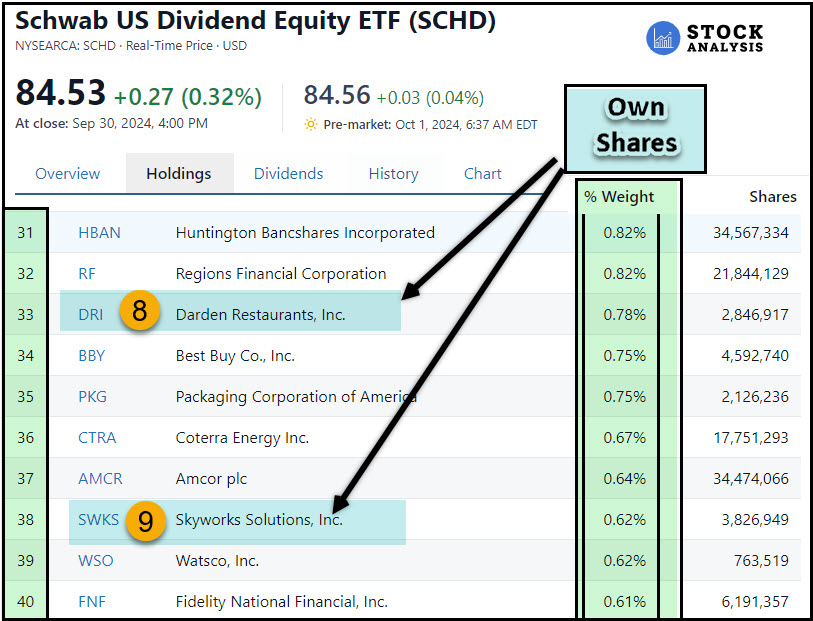

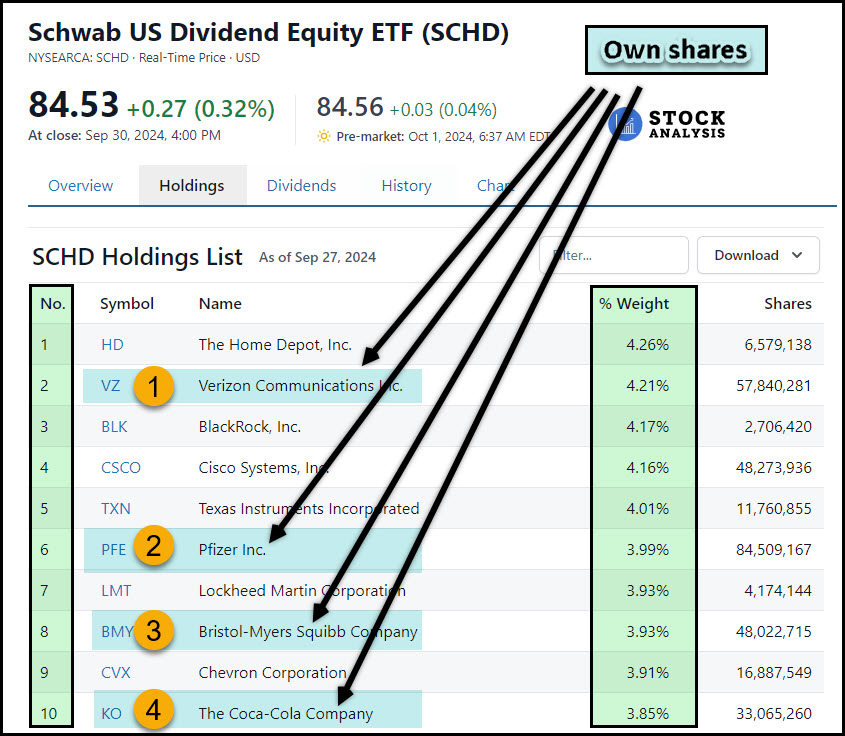

Example: SCHD Top Ten

If we look at ETF SCHD using Seeking Alpha, for example, we can quickly determine the top ten investments, and the percentage of the ETF dollars devoted to the top ten. For SCHD the top ten are: The Home Depot Inc (4.26%), Verizon Communications Inc (4.21%), Cisco Systems Inc (4.15%), BlackRock Inc (4.15%), Texas Instruments Inc (3.99%), Pfizer Inc (3.98%), Chevron Corp (3.98%), Bristol-Myers Squibb Co (3.96%), Lockheed Martin Corp (3.94%), and Coca-Cola Co (3.85%).

Concentration of the Investment Dollars

This means that just over 40% of SCHD’s investments make up one-tenth of the total companies. This is significant. It is also possible to see all of the holdings of SCHD using a tool like “STOCK ANALYSIS.”

Create a New “Portfolio”

Using Seeking Alpha I can quickly create a temporary portfolio to give me a high-level view of the ten stocks. I’m interested in the profitability of the companies, the QUANT ratings, the 5-year dividend growth, the years of dividend growth, and the consecutive years a dividend has been paid.

It is quickly apparent that the top ten all have remarkable dividend payment histories. This is not surprising, as SCHD is a US Dividend Equity ETF. SCHD has a five-year dividend growth rate of 12.0% and a good 12-year history of dividend growth. Furthermore, the yield is a respectable 3.47%. Why is this possible? Because Charles Schwab Investment Management, Inc. isn’t making stupid decisions.

A Thought to Consider

Therefore, it might make sense to build your own ETF. How is this possible? Well, one way to do this is to allocate $50K to five different stocks that are in the top ten holdings of your favorite ETF. That way you avoid the expense ratio, and you can add shares when the market drops for any or all of your personal ETF companies.

Obviously, you aren’t really creating an ETF. However, I view the companies I own as my own private ETF. You can’t trade the Winquist ETF, but you can observe which stocks I purchase, and you will find most of them have excellent dividend growth attributes.