Some Tools and Reminders

Don’t get overly excited about share or stock splits unless they are reverse splits. If a company splits, for example, 1-for-10, it is likely because an exchange like the NASDAQ will delist the stock because the price per share dropped below $1. That isn’t usually a good sign. However, when a stock or ETF spits in a way that you have “more” shares, like 3-for-1, you are getting three shares for each share you own.

Our SCHD Holdings and Covered Call Options Trading

Cindie and I own 960 shares of SCHD, so when the split happens we will own 2,880 shares of SCHD. This doesn’t increase or decrease the value of the holdings, but it does change some market dynamics. For example, if I want to trade covered call options on my SCHD shares in my ROTH IRA, because I own 700 shares, I can trade seven contracts (100 shares per contract) on my shares. After the split, I will own 2,100 shares, which gives me the ability to trade 21 covered call contracts.

This does NOT change the income I might earn from options. For example, I recently sold seven contracts on my SCHD shares for $0.18/share on September 27th for a total immediate income of $347. The contract expires October 18. The share split happens before that. Therefore, my seven contracts will morph automatically into 21 contracts.

My current contract price is $87.00 per share. Because I will have more shares, I need to divide that by three. Therefore, if the share price is greater than or equal to $29 on October 18, my shares will be called away. I am not concerned. I can roll the contracts up to a higher price before that date if it looks like that might happen.

When Will It Happen?

From Schwab’s website: “The ETF share splits will apply to shareholders of record as of the close of US markets on October 9, 2024, payable after the close of the markets on October 10, 2024. Shares will begin trading at their post-split price on October 11, 2024.”

SCHD and StockRover

Here is a helpful reminder as to why I like SCHD as an investment.

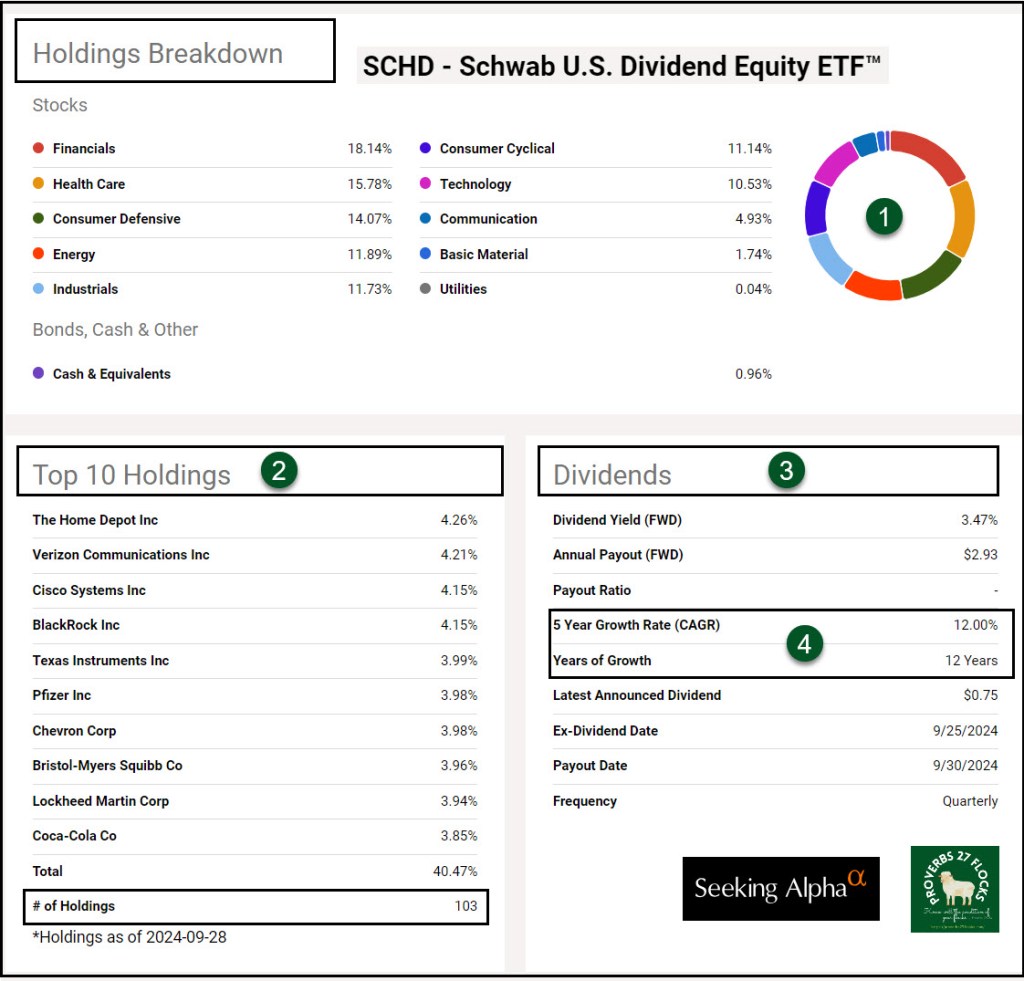

SCHD and Seeking Alpha Top Ten Positions and Sectors

This image from Seeking Alpha helps a dividend investor know what they are buying at a high level.

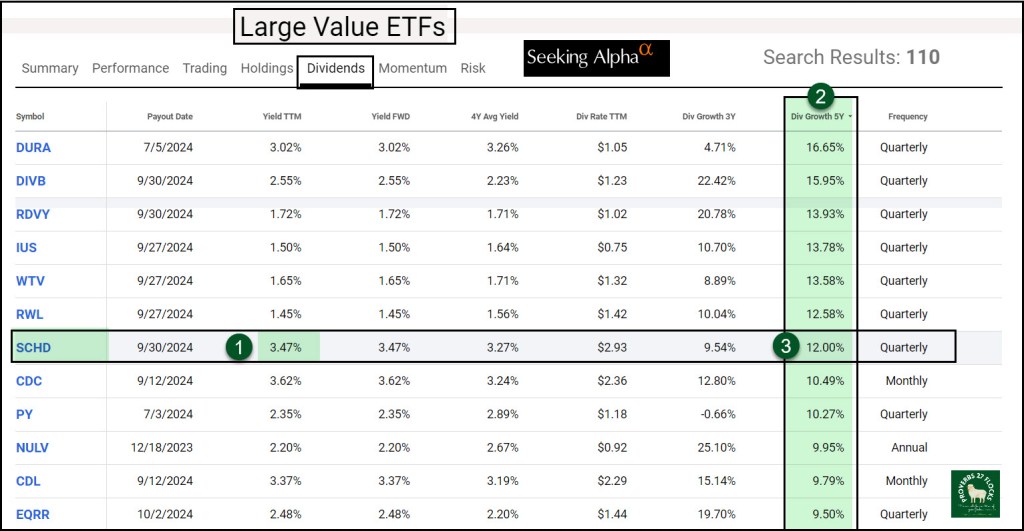

Comparing Large Value ETFs

Although SCHD is not currently a buy according to the QUANT rating, there are two attributes I find very attractive. First of all, of the 110 Large Value ETFs, SCHD falls within the top ten for the 5-year dividend growth rate. Furthermore, it offers a good yield of 3.47%. This doesn’t change when there is a stock split. The reason is simple: you still get the same dollar amount, even if the dividend per share is smaller. For example, the most recent quarterly dividend was $0.75, so for 100 shares you would receive a dividend of $75. After the split, the same dividend would be $0.25 per share, but you have 300 shares, so you still get $75.

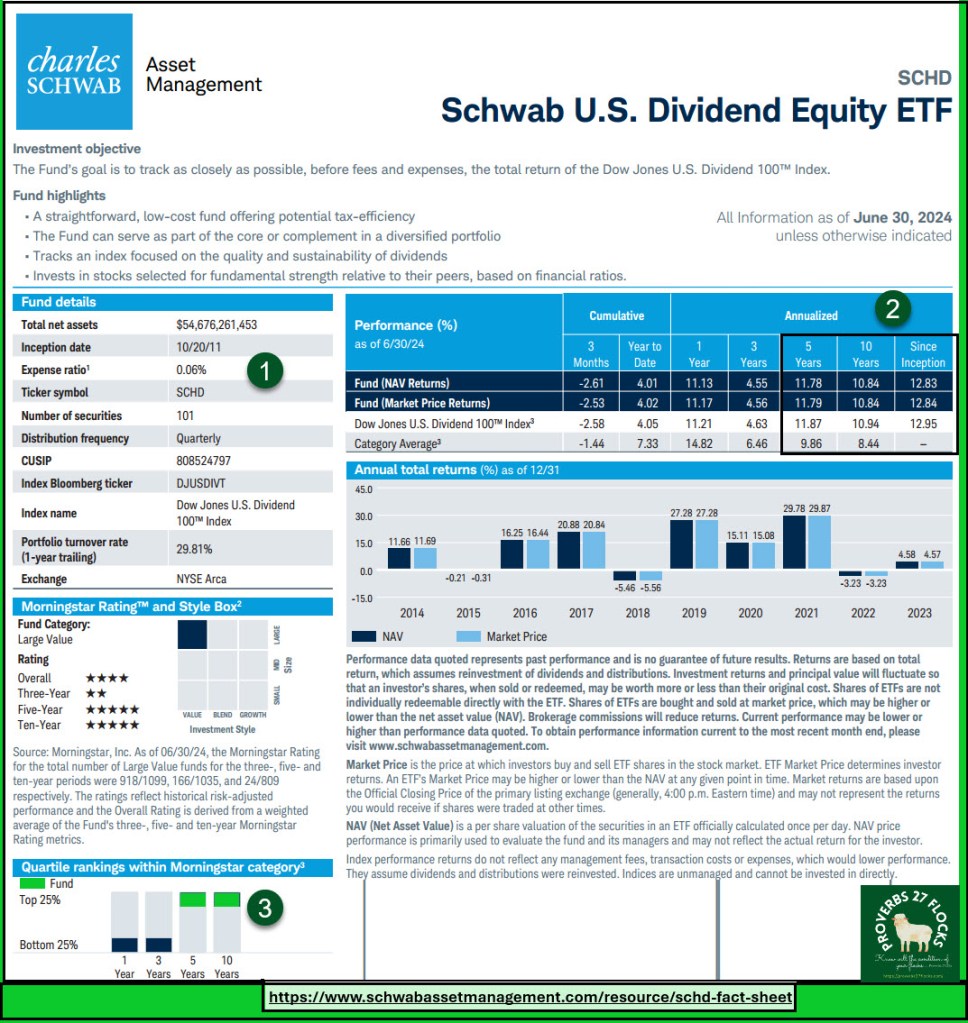

SCHD Fact Sheet

All mutual fund companies and ETFs have Fact Sheets. At least every one I have ever explored offers these nice summaries. It never hurts to look at a fund’s fact sheet. Here is a sample, and a link to the entire fact sheet is provided below in the “Tools and Links” section of this post.

Three Reminders

1. A share split is an administrative update. There is no direct impact to the value of the ETF. The ETF in total is still valued at the same price.

2. In the case of SCHD, they announced a 3-1 stock split. Why did they do this? Most trading platforms offer fractional shares. Instead of buying a whole share you can buy a portion of a share. Fractional shares are more popular these days, so “why is Schwab doing this?” Schwab’s platform does not, offer fractional trading on ETFs. This split makes it easier for Schwab clients to purchase shares regardless of their investable cash.

3. SCHD remains a long-term wealth compounder. This ETF benefits from a diversified sector exposure and strong dividend growth. I will be buying more shares over time.

Do You Want to be a Better Investor?

If you want to be a better investor, then you should be an educated investor. I suggest that you take ten minutes to quickly review the information on the following links.

Tools and Links

- Schwab Spit Announcement

- Schwab SCHD Fact Sheet PDF

- Stock Analysis Dot Com

- Seeking Alpha SCHD Split Article

Fund Profile

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF is an exchange traded fund launched and managed by Charles Schwab Investment Management, Inc. It invests in public equity markets of the United States. It invests in stocks of companies operating across energy, materials, industrials, consumer discretionary, consumer staples, health care, financials, information technology, communication services, utilities sectors. It invests in growth and value stocks of companies across diversified market capitalization. It invests in dividend paying stocks of companies. It seeks to track the performance of the Dow Jones U.S. Dividend 100 Index, by using full replication technique. Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF was formed on October 20, 2011 and is domiciled in the United States.