A Friend’s Question and My Ownership of MMM

Sometimes I get a text message asking about a specific investment. Yesterday a friend sent me a question via text. Jeremy wanted to know, “What are your thoughts on MMM?” This is a ticker symbol that is easy to remember, as it has three M’s, or it identifies the company as 3M.

I’ve owned MMM in the past, and I watch it via Seeking Alpha. My first 100 shares were in my traditional IRA. My records show that I purchased the shares sometime before 2016 (Can’t easily determine history before 2016) as I see that I received dividends in 2016, 2017, and 2018. I sold 50 shares in 2018 for $235.38.

I continued to received dividends on MMM for the remaining 50 shares until I sold those shares in April 2019 for $194.55. In other words, I should have sold all 100 shares in 2018.

In January 2020 I purchased 12 shares of MMM in my ROTH IRA for a total cost of $1,995.20. One year later I sold my 12 shares for $1,992.91 after receiving $70.56 in dividends. If it weren’t for the dividends, I would have had a loss of $2.29 after one year.

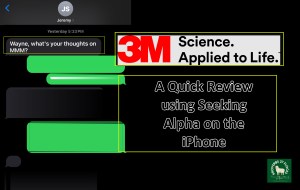

Seeking Alpha on the iPhone

One of the quickest ways to analyze an investment is by using Seeking Alpha on my iPhone or on my laptop computer. I started by looking at MMM on my iPhone. I did not care for what I saw. Growth is not likely and the shares are very pricey (Valuation.)

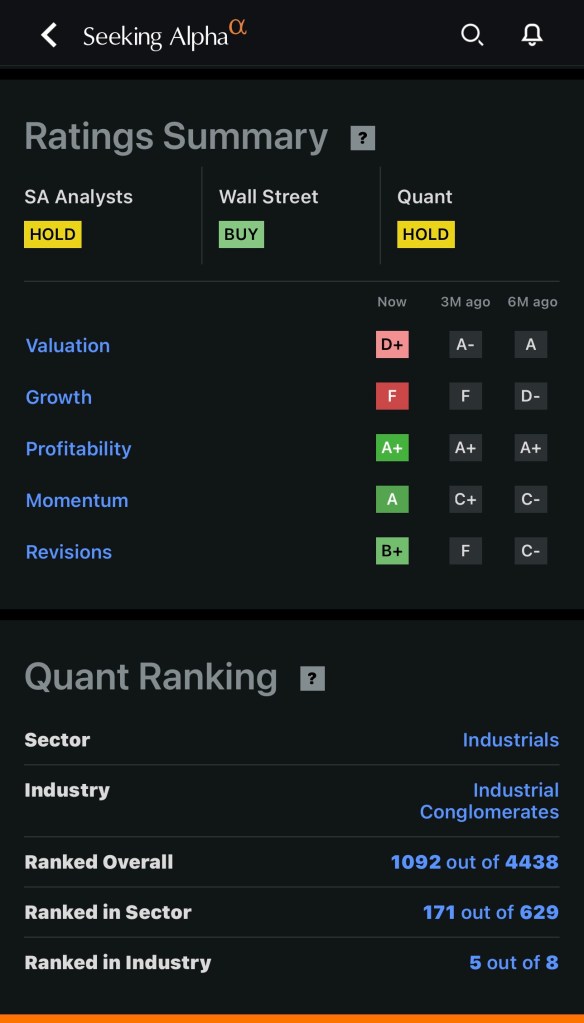

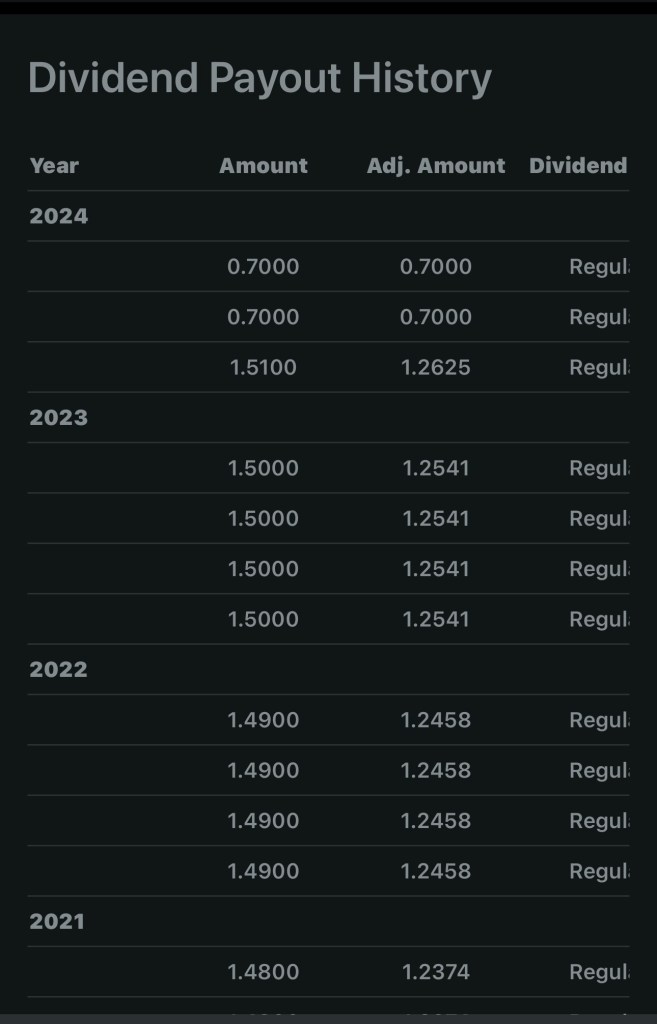

Dividends and Dividend Growth

MMM had been paying a growing dividend until the second quarter of 2024. The dividend dropped from $1.51 per share to $0.70 per share. Prior to that the dividend increase had been one penny per share. That is not acceptable dividend growth. Furthermore, a cut in a dividend is a sign of trouble most of the time. Over ninety percent of the time when a company I own has a dividend cut I sell my shares. There are exceptions, like Ford. But most of the time I don’t want to sit on an investment that paid dividends and then cuts or suspends their dividend.

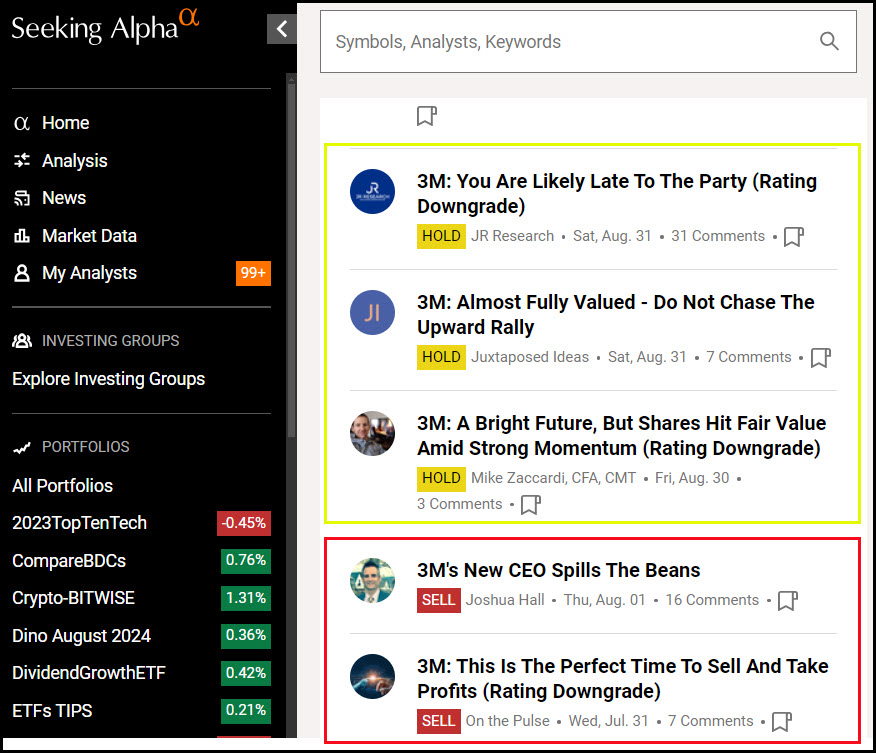

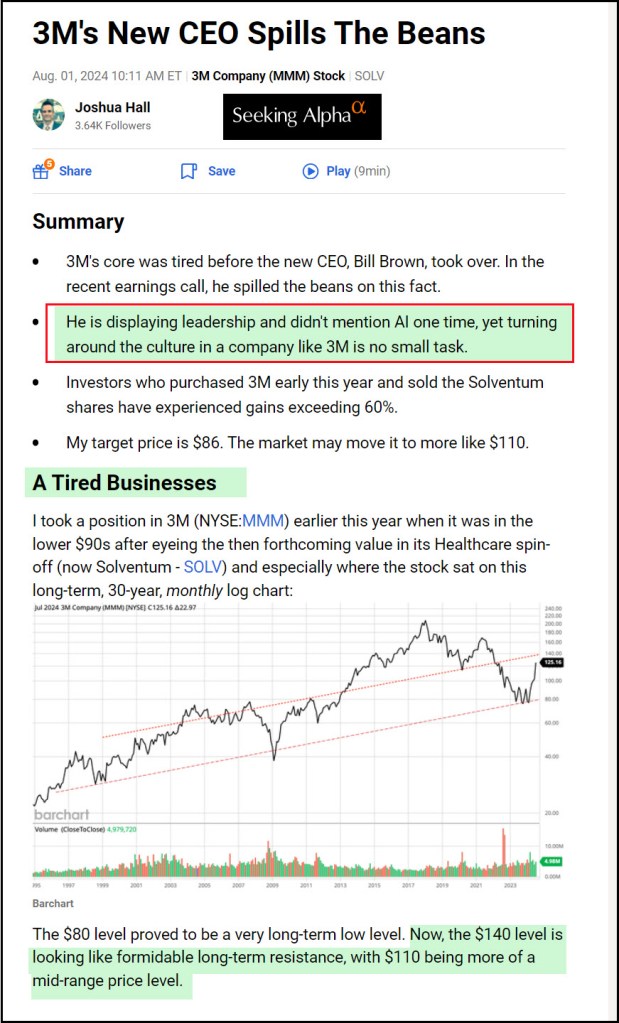

Recent Seeking Alpha Author Ratings

Let’s just say there aren’t a lot of fans of the stock in the Seeking Alpha cohort at the present time. These images are from my laptop.

Ten-Year Share Price Growth

Let’s be honest. It stinks. The shares are priced at 137.30. Notice above what I got per share back in 2018. I’m glad I sold. If you purchased MMM ten years ago you would not be very happy. You may as well buy bonds in 2014 instead of MMM. I can’t believe I just said that!

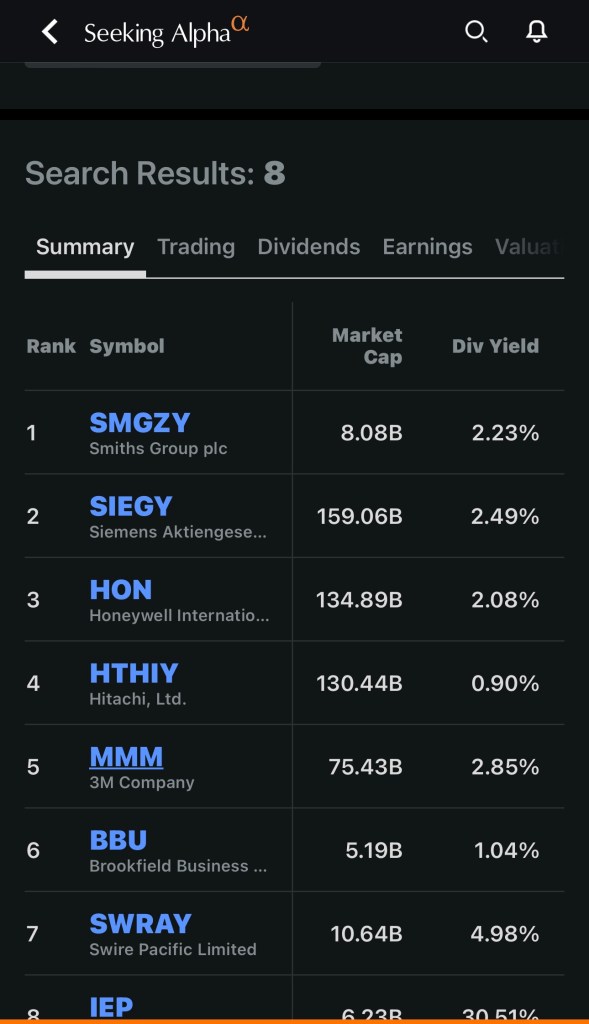

Competitors in Industrial Conglomerates

When you look at other opportunities on Seeking Alpha, sorted by QUANT rating, the ones that are in the top three of the eight are SMGZY (Smiths Group plc), SIEGY (Siemens Aktiengesellschaft) and HON (Honeywell International Inc.). I’m not tempted by SMGZY or SIEGY. However, I would certainly buy HON well before I bought any shares of MMM.

Conclusion

MMM is not a dividend growth stock and it certainly isn’t EASY INCOME. MMM has some serious problems. They won’t be growing quickly based on anything I can see. They will stay in business, but that isn’t a good reason to buy the shares. If I owned shares, I would sell them.

Note: I cannot analyze every company for every person. The goal of this post is to help you do your own research. However, I have promised Jeremy that I will always answer his questions! I will try to answer every reader’s question that is posted as a comment on my blog. However, the answer might be “Don’t buy the investment!”