Easy Income is Patiently Waiting

My easy income strategy only works if you don’t sell your investments. If you are constantly second-guessing your investments and your investment strategy, it will be harder to have easy income that grows at a rate that at least keeps up with inflation. This week I added another 50 shares of SCHD to my ROTH IRA. Cindie and I now own a total of 960 shares of SCHD that are worth about $99,000. Even though I also like VYM, our largest investment, it is time to accumulate SCHD shares instead.

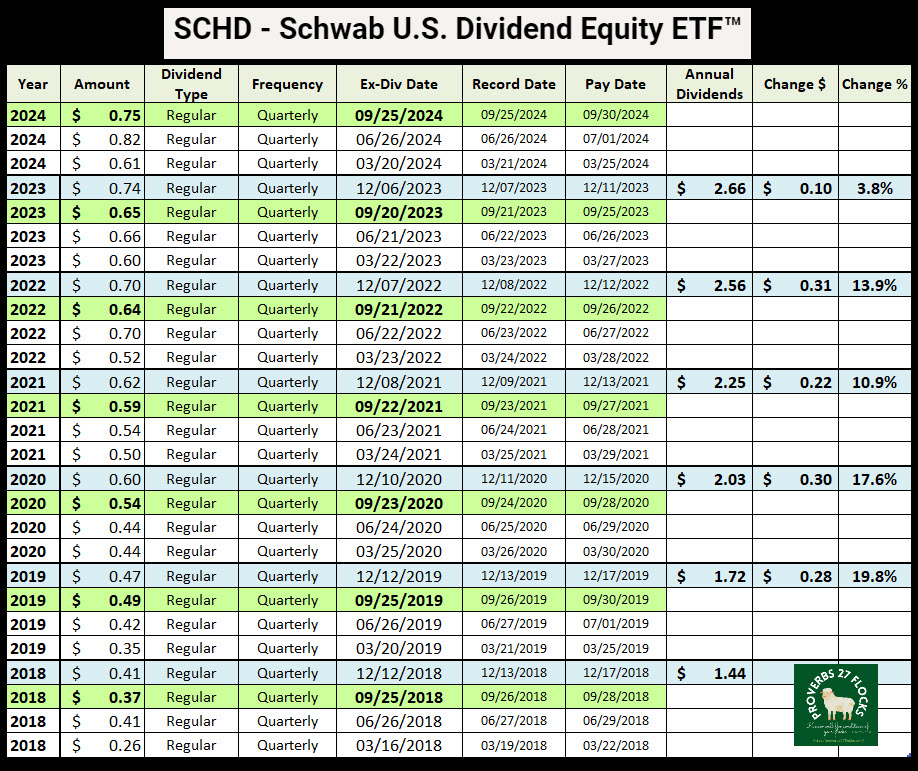

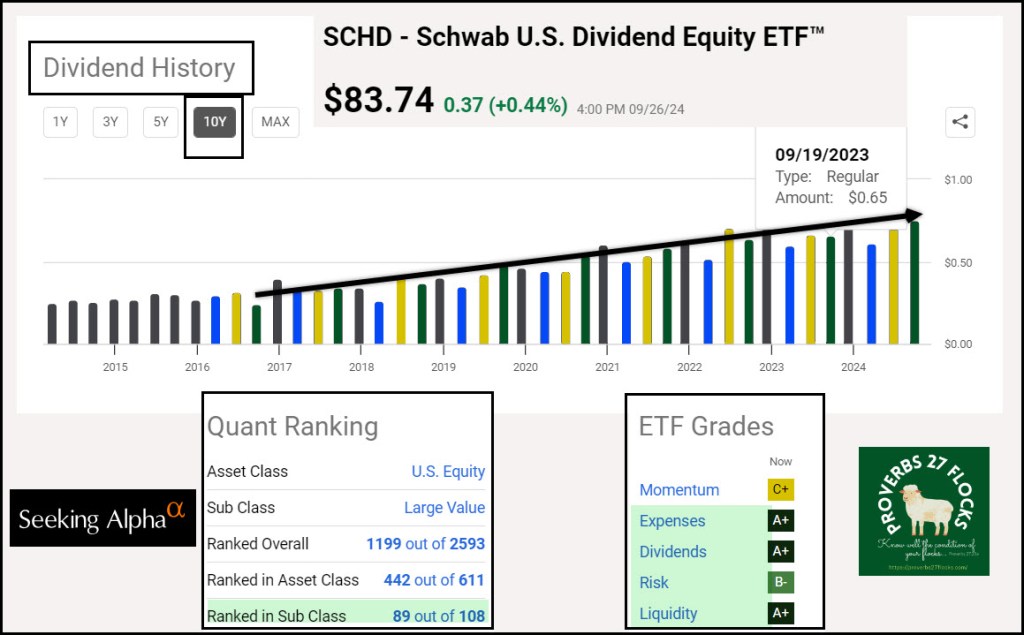

SCHD’s Dividend Growth Analysis

As I have said before, you have to be careful not to view the bouncing nature of an ETF’s dividend too quickly. It is generally best to compare similar quarters. In the following image, using data downloaded from Seeking Alpha, it is easy to see the third quarter results over time. The September 2024 dividend was ten cents more than the dividend in 2023. That may not seem like a lot, but because we own 960 shares now, those ten cents are worth $96 in dividends for this quarter. $96 is enough to more than cover our US Cellular charge for September.

Dividend Dates

You can be relatively certain that the last dividend of 2024 will be announced in early December. Therefore, any SCHD shares you purchase before December 5th are likely to qualify for a dividend. By looking at the previous image, pay attention to the Ex-Dividend dates for the December dividends. It is too late to receive the September dividend if you did not purchase shares by the Ex-dividend date of September 25. My extra 50 shares qualify because I purchased them before the 25th.

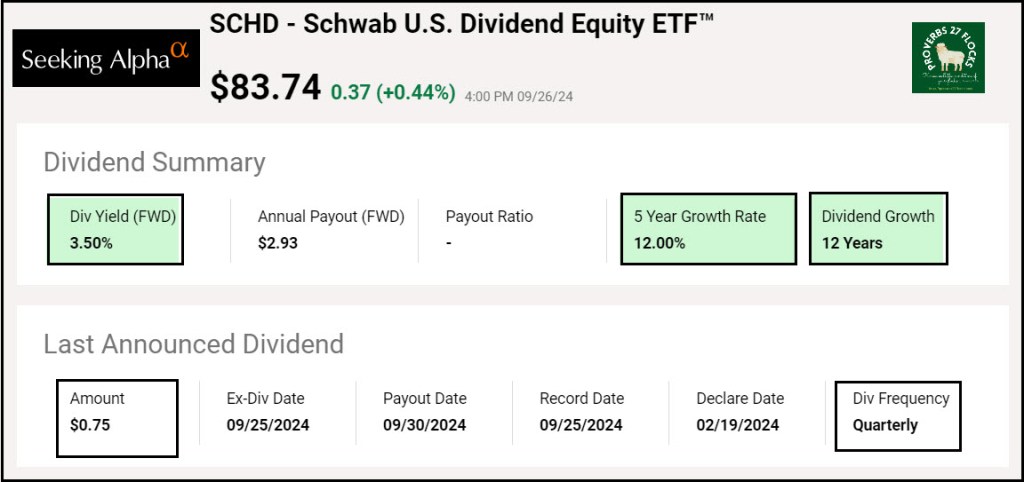

Dividend Growth Rate

The dividend grows at a different pace every year. However, according to Seeking Alpha the 5-year dividend growth rate has been 12%, and SCHD has been growing their dividend for twelve years.

Top Ten Holdings (out of 103)

The top ten holdings in SCHD are well-known large cap companies. The top ten currently are The Home Depot Inc, Verizon Communications Inc, BlackRock Inc, Cisco Systems Inc, Pfizer Inc, Chevron Corp, Bristol-Myers Squibb Co, Lockheed Martin Corp, Texas Instruments Inc, and Amgen Inc.

The focus in the top ten are energy, financials, healthcare, technology, communications services and consumer discretionary. When you buy one share of SCHD you are really investing in over 100 companies. Diversification is made easy by buying ETF investments like SCHD.

SCHD’s Top Five Sectors

I tend to favor investments in the financials, health care and technology sectors. SCHD has this weighting in the top five sectors: Financials (18.12%), Health Care (15.91%), Consumer Defensive (14.03%), Energy (12.15%), and Industrials (11.57%).

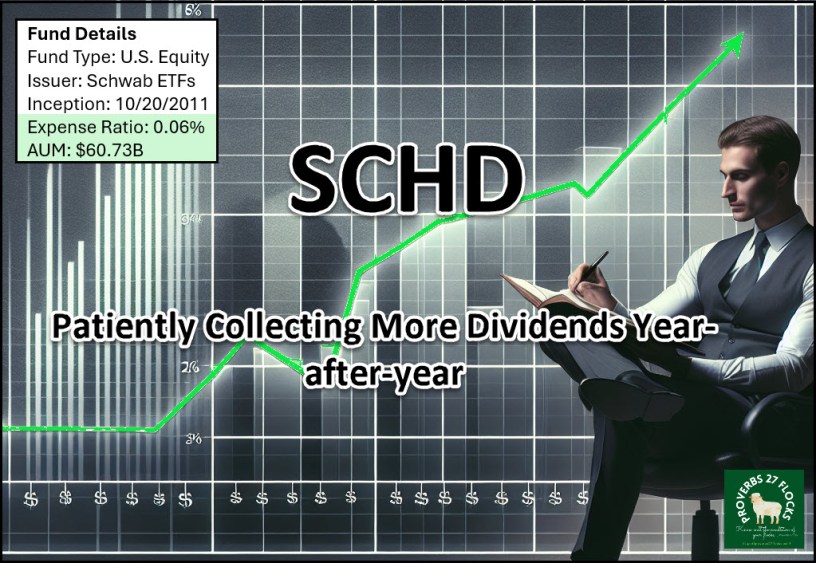

SCHD’s Fund Attributes

This ETF focuses on U.S. Equity and it is a part of the family of Schwab ETFs. I tend to like Vanguard, Schwab, and Blackrock (iShares) ETFs. SCHD was started in 2011, so it has some history. It also has a rational expense ratio of 0.06%. Finally, it has assets under management of $60.73B. The other thing to watch is the TOTAL RETURN. StockRover helps illustrate this part of the SCHD investment.

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF is an exchange traded fund launched and managed by Charles Schwab Investment Management, Inc. It invests in public equity markets of the United States. It invests in stocks of companies operating across energy, materials, industrials, consumer discretionary, consumer staples, health care, financials, information technology, communication services, utilities sectors. It invests in growth and value stocks of companies across diversified market capitalization. It invests in dividend paying stocks of companies. It seeks to track the performance of the Dow Jones U.S. Dividend 100 Index, by using full replication technique. Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF was formed on October 20, 2011 and is domiciled in the United States.