The Right Alerts Can Help

We have lives full of alerts. In Wisconsin we want to be alerted if there is a tornado warning or sighting. I like alerts on the dash and mirrors of our Ford Escape so that I know about vehicles I might miss in my blind spots. The SimpliSafe system gives us verbal alerts when we activate the system and the system beeps anytime any door opens. SimpliSafe will also alert the fire department or the police department if our home is compromised by fire or breaking into our home.

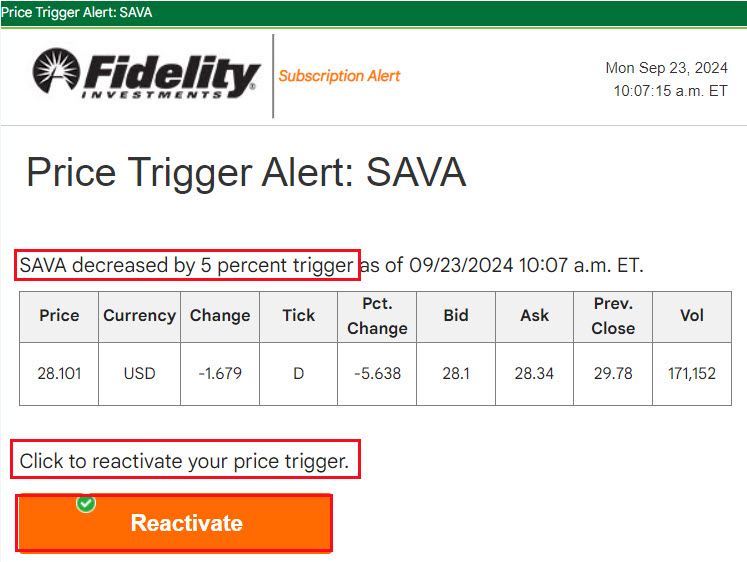

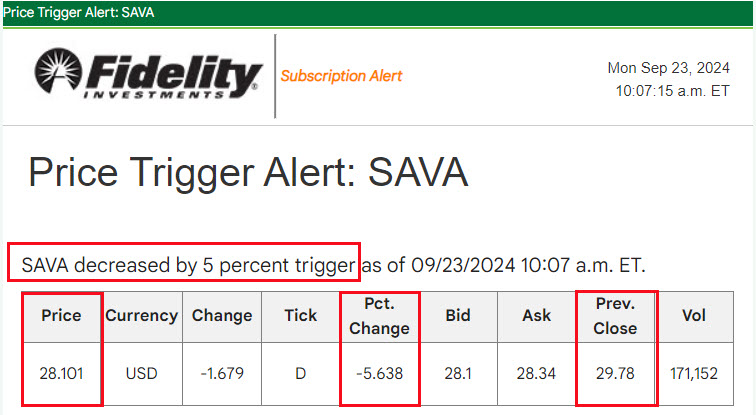

While stock and ETF alerts are not a matter of life and death, they provide me with information via a quick text message or email or both. These alerts make me aware of potential buying and selling opportunities or to help me know if I should roll a covered call option contract or a cash covered put option contract.

The Request from Jerry

In a recent blog post I said, “By setting alerts on positions I can get a text message or email from Fidelity Investments that provides a hitting (when at bat in baseball) opportunity. I don’t always have to be standing in the batter’s box waiting for the next pitch.” Tell us about your criteria for alerts, what are the parameters? Thanks. — Jerry

Types of Alerts I Use

There are three broad types of alert that I set up on Fidelity

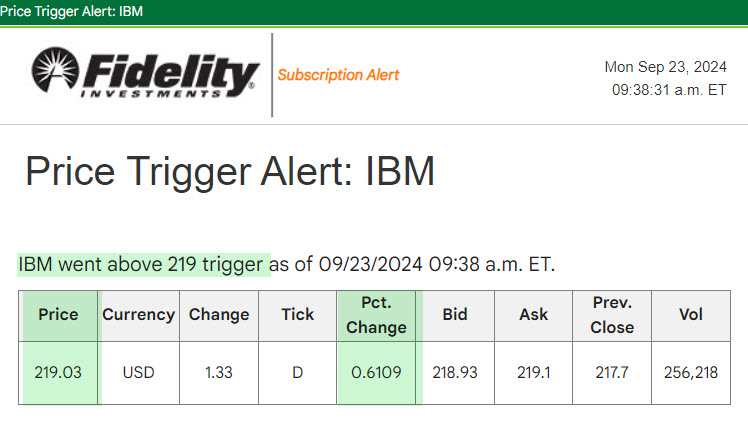

- Price alerts for a drop or increase in the stock/ETF price: what might be my buy price? Did the price of the shares drop significantly? If so, perhaps I want to buy more or perhaps I want to consider selling if there is really bad news. If the price is increasing, I might want to sell my shares or sell some of my shares.

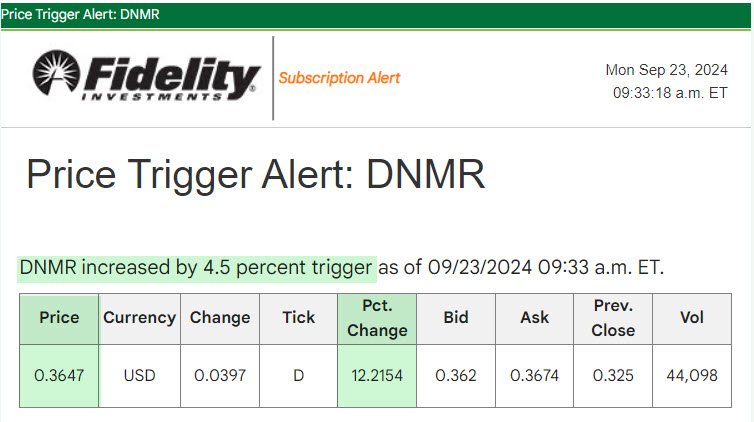

- Percentage change alert: Is there an opportunity due to mass hysteria that is producing huge upward or downward price movement far greater than the raw price alerts? I usually set these alerts for a drop of at least three percent so that I don’t get too many alerts. In a volatile market you don’t want to have every position telling you that the price of a share has dropped by one percent. For upward moving prices, I tend to set most of these alerts for three percent or more. However, different investments behave differently. Therefore, I might set an ETF like VYM at one percent and a stock like TSLA at five percent or more.

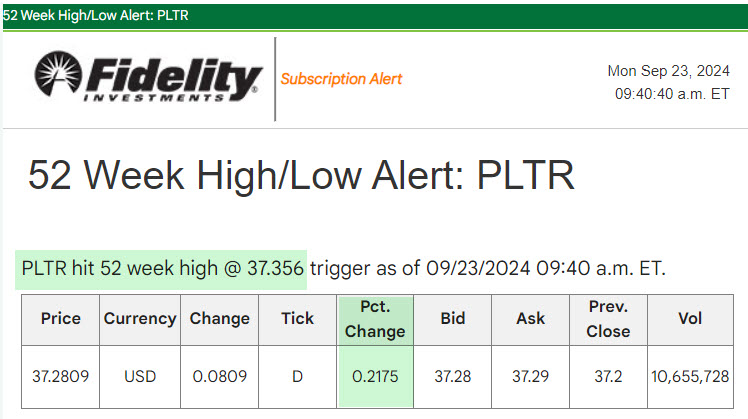

- Has this ticker hit a 52-week high/low? The higher something goes, the more it may go higher. However, at some point most investors have a limit as to what they will tolerate. When that happens, they start selling and the share price may drop. When something hits a 52-week low, that is usually a bad sign.

Three Different Alert Setup Platforms

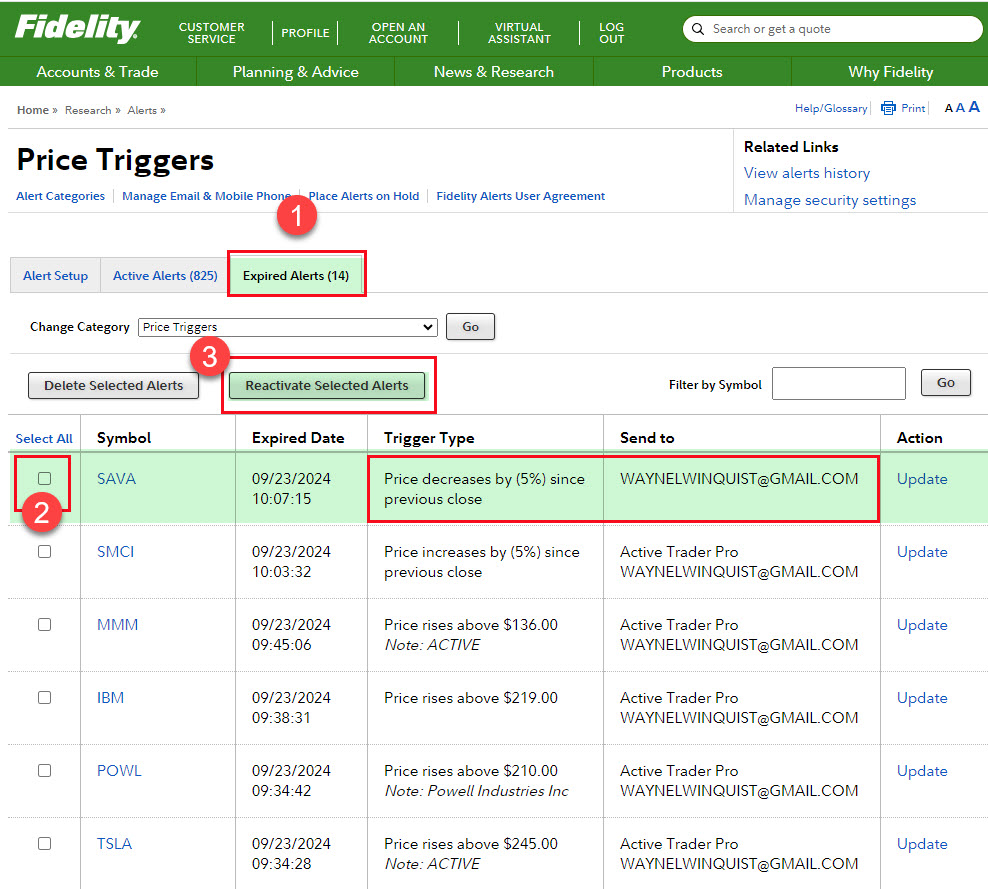

Unfortunately Fidelity’s Active Trader Pro (ATP) does not have great functionality for alerts. Price alerts are the only choice. I understand the Fidelity Mobile app provides more flexibility, but I don’t really like using my iPhone to access Fidelity resources. The screen is just too small for my vision.

However, the Fidelity Investments website offers far more flexibility and makes it easy to set multiple alerts on the same ticker and to reactivate an expired alert. Reactivation is especially useful if you use “Decreases by (%) since previous close” or “Increases by (%) since previous close” or “Reaches a new 52-week high/low.” It isn’t as helpful for price amounts like “Drops below (USD) or “Rises above (USD.”

Even More Alerts: EMA

There are more alerts available than what I use. For example, “If you like using technical analysis, knowing when an investment crosses the 20-, 50-, or 200-day exponential moving average (EMA) can be useful. An EMA is the average of a set of closing prices over a specific period, with recent data given more weight. Setting alerts to be triggered when an investment or an index crosses above or below its moving average could give you some insight into trends of that investment or index relative to past prices, as well as provide potential buy or sell signals.” – SOURCE: Fidelity Investments

Examples of My Recent Alerts

I have over 800 alerts set. That is far more than what the average investor needs. If you have twenty-five positions, you might have one or two alerts on each position. You might also set alerts on one-to-five positions you are considering as buys if the price is right. In a typical day I receive about forty alerts. I could reduce that by reducing the number of price alerts and just stick with percentage alerts as the primary alert mechanism.

Alerts Make Me Aware

As a “retired” investor, I don’t want to spend my retirement looking at the monitor to try to spot the opportunities. I’d rather be creating lessons or sermons. I’d like to go out into the yard and help with the gardens or mow the lawn. I want to take trips to visit family and friends. The nice thing about alerts is that I can choose to do nothing. However, that becomes a choice. At least I know there might be an opportunity.