Cindie’s Mom

In my previous post I started to answer Rickard’s question. He asked me to discuss something I mentioned in a previous blog post. His request was, “I am curious to know more about revocable trusts you mentioned in the newsletter: benefits, administrative burden, costs, tax implications, and other considerations.”

When Cindie’s mom Charlotte heard that we had a trust, she thought she should have one too. She asked us to take her to her attorney so that she could update her will and get a trust setup. Most of the time we were not in the room when the attorney was helping her with her needs and with the changes to her last will and testament. However, when it came to the trust, the attorney explained to us that Cindie’s mom did not need a trust because her estate was fairly small, and the larger portions were already set up with beneficiaries.

He suggested a few things to simplify life for Charlotte, including having her home title changed. As it turned out, even that would be unnecessary, as we helped Charlotte sell her home in Milwaukee and moved her to Fitchburg so that Cindie could help her more easily.

Therefore, it is possible that you don’t really need a revocable trust. However, there are benefits of the trust agreement that cover more than just the actual assets.

Why I Like the Revocable Trust

The short answer is four-fold. First, it removes most of our assets from the probate process and keeps the courts out of our pockets. Secondly, it makes it possible for our daughter or our son to manage the ownership and care of our assets if we are unable to do so. Thirdly, it provides for ongoing management of our assets by our trustee after we are deceased. Finally, it should make life easier for our son and daughter when we get old or when we die.

Details That Matter

A trust is a legal agreement that allows the grantor, to control how their assets are managed and distributed during their lifetime and after their death. The “grantor” is a person who transfers property to another person or a trust. The property moves from being in the name of the person to the name of the trust.

The trust document includes a specified trustee. The trustee is responsible for managing assets in the trust according to what’s best for its beneficiaries. Living trusts also provide specific directions for how assets should be distributed once the grantor dies.

You can include Real estate, financial accounts (taxable brokerage accounts, checking and savings accounts), money market accounts and CDs in a trust. You can title your vehicles in the trust. Other valuables like jewelry, artwork and even business interests can be assigned to a living trust. However, retirement accounts, such as 401(k)s or IRAs, should not be assigned to a living trust. If you do that you’re changing the ownership of the retirement plan. This is viewed as an early retirement withdrawal in the eyes of the IRS. That would cause a huge tax and perhaps even a penalty to be charged.

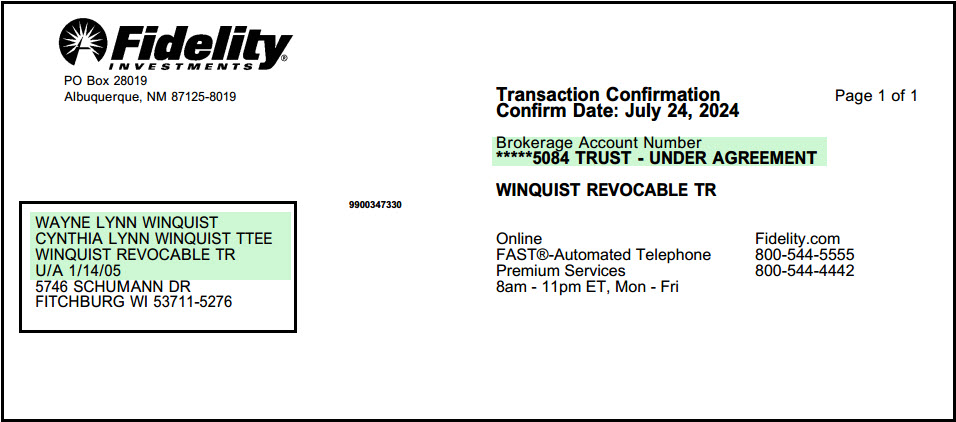

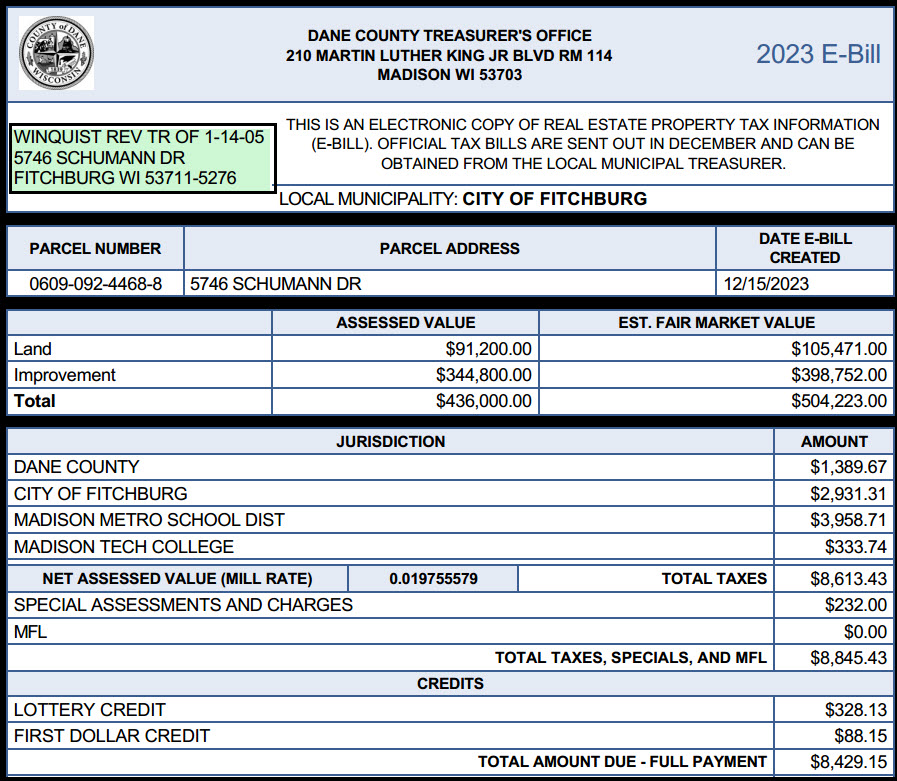

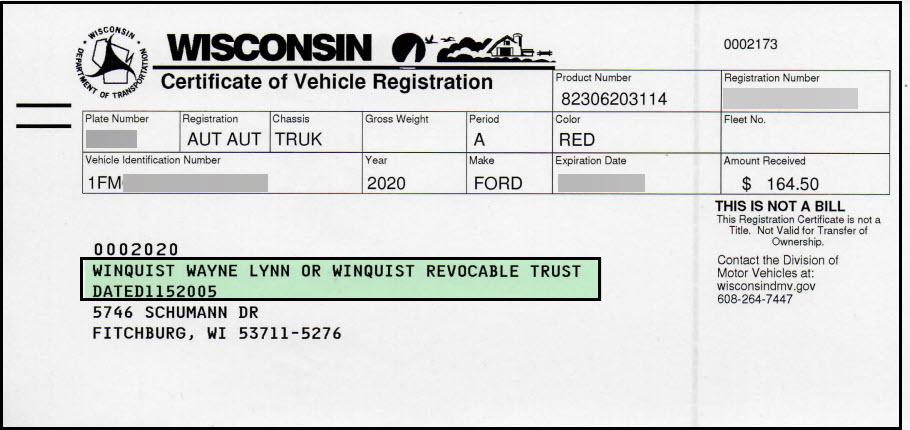

A revocable trust gives us the ability to maintain control over the assets in the trust because Cindie and I are the trustees. This gives us the power to change the trust’s terms, change beneficiaries, designate a new trustee, remove assets or terminate the agreement. When we sell a vehicle owned by the trust, we sign over the title as trustees. There is a bit more paperwork to title a vehicle in a trust, but only because the people doing the paperwork usually want to see the cover page and signature page of the trust agreement. Here are some images that show assets in our trust.

This type of trust is especially useful if we become unable to manage the assets. When this happens, the successor trustee (our son or our daughter) will make decisions on our behalf. These trusts generally become irrevocable once the grantor dies. In other words, if the I am no longer around, the trust is now the “owner,” and the successor trustee cannot make changes to the trust. However, they can still manage the assets.

There are pros and cons. This is true of everything in life. With a living trust, assets can be transferred to beneficiaries smoothly, quickly and without interference from the court. We also take comfort in knowing that our assets must be protected by our successor trustee. Of course, this means we must really TRUST the wisdom and honesty of our daughter and son.

Lets Avoid Probate and Costs!

Probate is the judicial process whereby a will is “proved” in a court of law and accepted as a valid public document that is the true last testament of the deceased. You still want to have a will, as there may be some assets that will have to go through probate.

Probate can be an expensive and time-consuming process. Fortunately, placing your assets in a revocable living trust means they aren’t subject to probate. Why is this true? It is because the trust remains intact after your death. It “lives” beyond your life as a separate entity. This allows you, the trust-maker, to choose who should receive your assets. You can specify this and any details of how assets should be distributed when you create or modify the trust.

Do You Like Privacy?

Most people don’t like others, perhaps even family, to know what they own and who gets what when you die. Far too many families have real issues accepting what their mom and dad decided about their assets and who should get them. Therefore, you should name a beneficiary for your investment accounts like an IRA and a ROTH IRA. When it comes to a trust, another benefit of avoiding probate is privacy protection. If your assets go through probate, all of the documents filed in court are public records, including your last will and testament and the assets it mentions. When you place your assets in a revocable living trust, they aren’t subject to probate. That means they won’t be made public record.

Do You Think You Might Get Old and Confused?

There are many things that can diminish your capabilities as you age. This can include physical things like eyesight and hearing. It can also include cognitive abilities and rational thinking. Old people can get very confused, frustrated, and fearful. Then there is the specter of Alzheimer’s disease or perhaps a stroke.

We all get old, or at least some of us do. It is possible that Cindie and/or I might become chronically ill or disabled, making it difficult for us to act on our own behalf. A revocable living trust gives us the ability to select a successor trustee who assumes control of our assets should we become incapacitated.

Summary

The words that come to mind are privacy, protection, management, and thinking wisely about the future. Even if you aren’t a millionaire, you might want to protect yourself and your family from a mess down the road by discussing a revocable trust with a reputable attorney.

Helpful Links