Another Reader’s Request

Once again one of my readers, Rickard, asked me to discuss something I mentioned in a previous blog post. His request was, “Thanks for writing about the topic I suggested. I am curious to know more about revocable trusts you mentioned in the newsletter: benefits, administrative burden, costs, tax implications, and other considerations. Maybe a good topic for another newsletter. If not, I will read up on it online.”

When the Journey Started

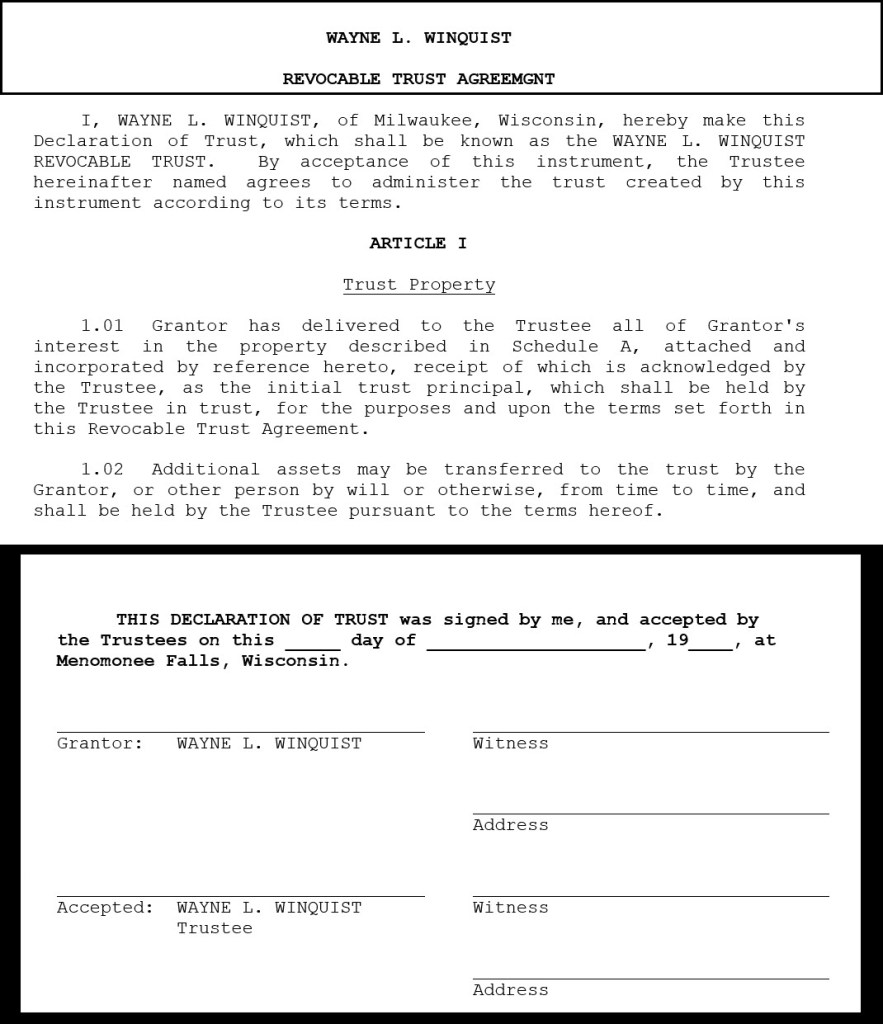

1988 original trust created by our attorney (a Christian man) in Menomonee Falls, Wisconsin when we lived in Milwaukee. At that time, for reasons I don’t recall, Cindie had a trust called the “Cynthia L. Winquist Revocable Living Trust” and I had one called the “Wayne L. Winquist Revocable Living Trust.” The attorney also created wills for both of us.

The language in this trust stated,

“If both my spouse and I are unwilling or unable to act, then I appoint the President, of GRAND RAPIDS BAPTIST COLLEGE & SEMINARY of Grand Rapids, Michigan, to act as Alternate Trustee under this instrument.” This was necessary at that time because our children were minors and could not serve as trustees. We wanted to make certain that our assets were handled by someone we trusted, not just by the legal system in Wisconsin. While I think our courts are necessary, keeping them out of our personal lives as much as possible is wise.

In hindsight, having the president of a college might not have been the best choice, but it was “free” and we did not want our bank or some other financial institution handling our financial affairs. We did not even know the president of the college, but we did make them aware of our desires.

Seventeen Years Later

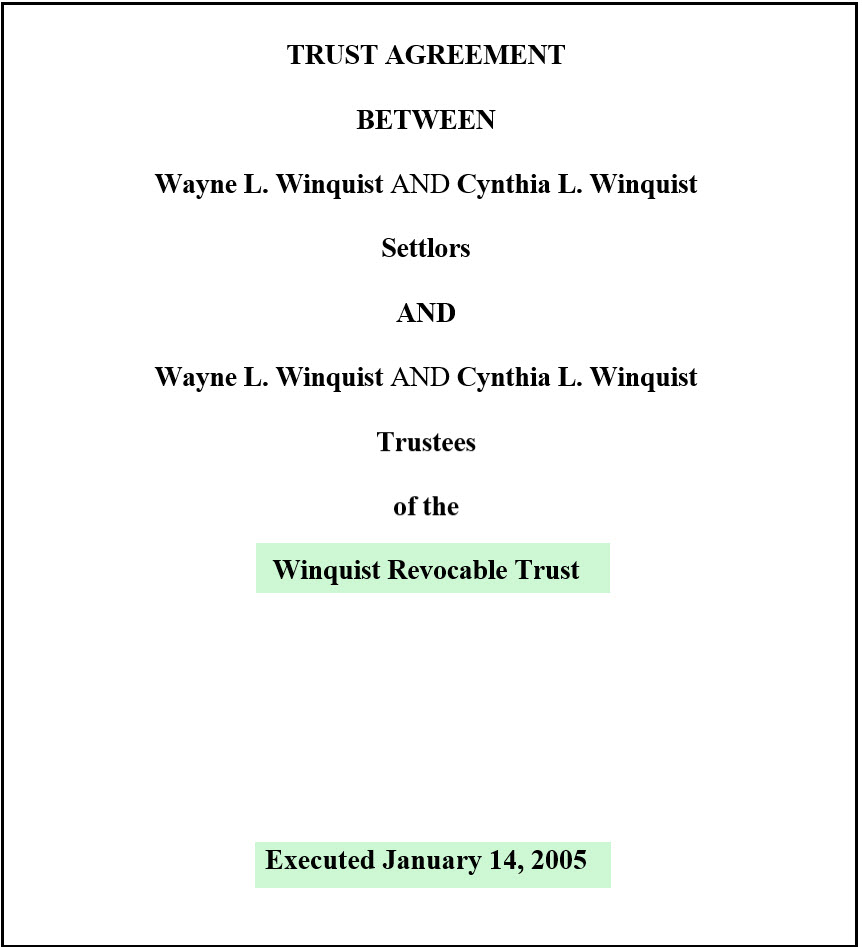

In 2005 enough had changed in our lives (our children were adults by this time) that it was time to revisit an attorney, but now we had moved to the Madison, Wi area. We found a local Christian attorney who created a combined trust agreement called the “Winquist Revocable Trust.” Cindie and I continued as the trustees of the trust, meaning we still controlled all of the assets we put into the trust. However, our children (who are very responsible, honest, trustworthy, and intelligent) now played a part.

The revised trust included the following: “Upon the resignation or incapacity of one Settlor, the other Settlor shall serve as sole Trustee. If both of the Settlors resign or become incapacitated, then Elisabeth L. Schultz shall serve. If Elisabeth L. Schultz is also unable or unwilling to serve as Trustee hereunder, Matthew L. Winquist shall be Trustee of said Trust.” In other words, if either Cindie or I could not or would not serve as a trustee one of us would still be the trustee. However, if both of us were unable to function, then our daughter would become the trustee, and our son would be the backup.

Changes in 2005

I also took some notes as reminders. This was one of them: “The formal name of the trust is “Wayne L. Winquist AND Cynthia L. Winquist Trustees of the Winquist Revocable Trust Dated January 14, 2005. The short name is “Winquist Revocable Trust.”

There were other changes to the trust but suffice it to say they had to do with how we wanted the trustees to distribute our assets. Our former church in the Milwaukee area was replaced by the church we were members of in Verona Wi. At that time our total assets were our home (with a mortgage), two vehicles, and bank checking and savings accounts. Our investments were not in the trust because they were either in 401(k) plans or in a traditional IRA. Those assets don’t need to be in the trust because they were set up with beneficiaries.

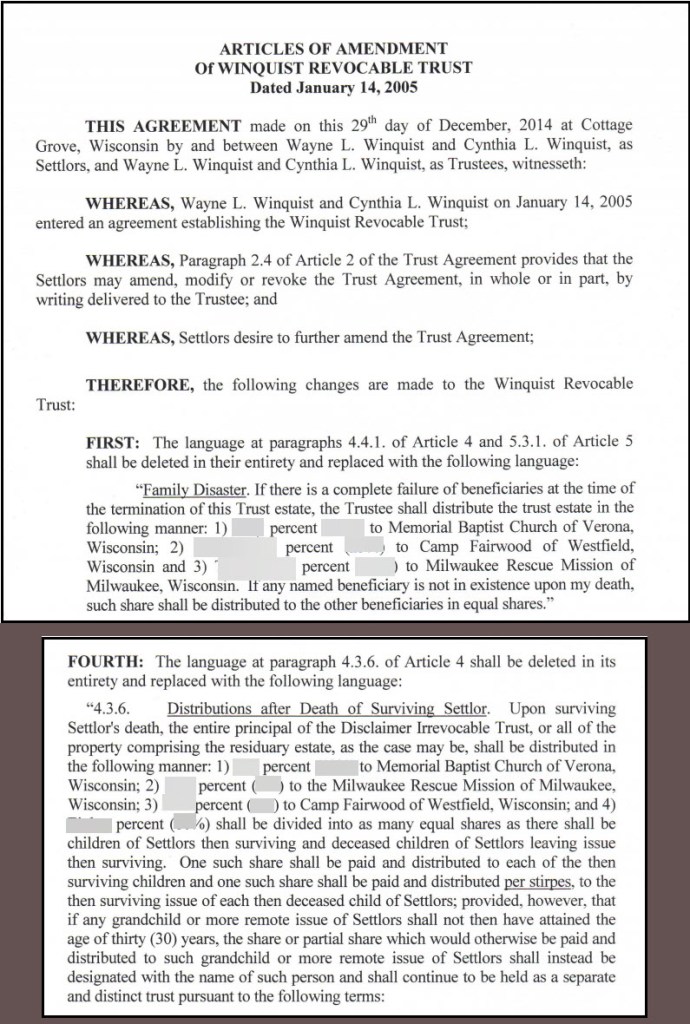

The 2005 Trust also described the “Distributions after the death of the surviving settlor.” In other words, after Cindie and I were both deceased, we wanted our assets divided between our new church home, a university, the Milwaukee Rescue Mission, Camp Fairwood, with the balance going to our children. These were stated in percentages. In addition, there was language that described how our grandchildren would receive assets if either our son or our daughter preceded us in death.

Changes in 2014 for IRA and RMD Distributions

In 2014 there was another visit to the attorney. We wanted to make some additional changes to the wording of some of the 2005 trust agreement. In addition, the attorney added language regarding our retirement accounts and RMD distributions. At the same time we updated our wills, as there are some assets that are not in the trust that we want to cover using our wills.

In my will I declare something important for my heirs to know. My “Statement of Faith” is the first section: “It is my desire that all who read this will would know that I received Jesus Christ as my Lord and Savior and desire to bring honor to Him after my death as I strived to do in life. The Heavenly Father has always been faithful to me, and although I was a sinner, it was through His mercy, love and grace that He saved me. I know that I could not do good works to merit favor in God’s sight, and I received God’s gift of eternal life made possible by the unique sacrifice, finished work and shed blood of His Son, Jesus Christ when I was nine years old. For by grace I was saved, through faith, it was not of myself, but it was the gift of God and not my works lest I should boast. One of my favorite verses has been Isaiah 40:31, which says, “But they that wait upon the Lord shall renew their strength, they shall mount up with wings as eagles, they shall run and not be weary, they shall walk and not faint.” I challenge all who read this to trust and obey God, for He is the only sure hope and salvation. He gives true peace, joy and purpose for life.”

Paper and Electronic Copies

In addition to paper copies of these documents, we have electronic versions. I stored these on my laptop in a folder called “D:\DOCUMENTS\A1 Current MASTER Files\WILLS_TRUST_POA 2014Updates.” They are also stored in Dropbox, and the folder is shared so that family members can access all of the wills and trusts.

Attorney Costs

I don’t remember what we paid for the work the attorney did in 1988. However, we were relatively poor back then, so I would guess it was less than $500. I also don’t recall the 2005 costs, but the attorney was careful to tell us what the revisions to our will and trust would cost. However, for the most recent update in 2014, the total amount we paid was $600. There are no ongoing costs for the trust.

Coming Up Next

This post was historical on purpose. In my next post in this series I will start to answer the question my reader asked. In addition, I will describe which assets are in the trust and which ones are not. I am not an attorney nor am I a tax advisor. Therefore, I won’t be able to give any individual advice about what you should do or tax advice about your particular situation. Seek wisdom from the right sources!