What Do You Want?

There are three reasonable questions to ask about your insurance company. The questions include, 1) Are they profitable, 2) Are they solvent, and 3) are they reasonable and rational with the policy premiums and the increases in policy premiums. Of course, you also want them to be fair when you file a legitimate claim.

You want the company to be profitable. They have to pay employees, grow their business, enable technology, and be able to afford to pay for claims.

You want them to be solvent. In other words, it is highly desirable that they do not go out of business and that they manage their resources with reasonable prudence.

If you want them to be successful, it is likely that they will have to increase their policy premiums over time due to inflation and the nature of the claims they must pay.

Switching from Safeco (Liberty Mutual) to Rural Insurance

Over the years we have had policies with Farmers Insurance, American Family Insurance, AAA, State Auto, and Safeco. Safeco acquired State Auto, and Safeco was acquired by Liberty Mutual. Not surprisingly, we started to see some startling increases in the cost of auto, homeowners, and umbrella policy premiums. The recent increase announcement caused me to sit up and take notice. The increase was irrational. As a result, I explored alternatives.

One of the alternatives was American Family Insurance. They were expensive. I also considered Geico and Progressive. Then a friend recommended Rural Insurance. I had never heard of Rural, but I reached out to them and their agent sent me some very helpful information and rate quotes that were significantly less than those from Safeco.

Is Rural Solvent and Profitable?

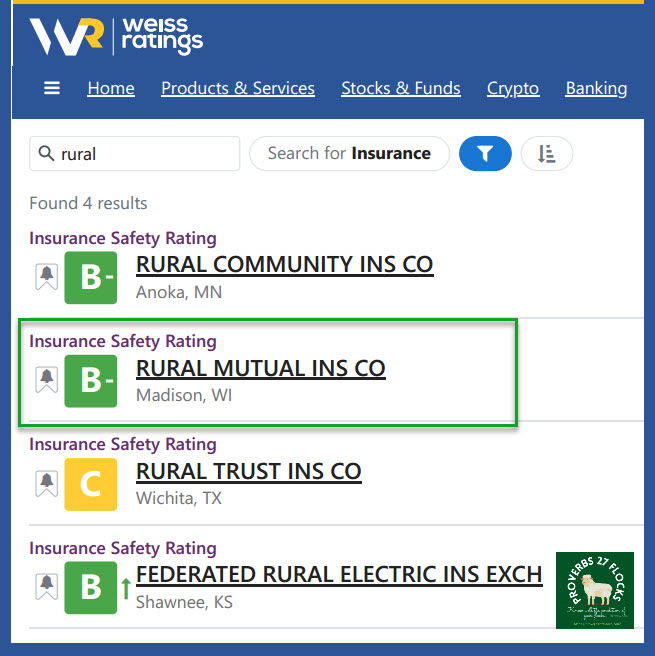

I used to explore Weiss Ratings all the time for stock and ETF ratings. Lately I prefer what I can get from Seeking Alpha (QUANT rating), StockRover, and the Fidelity ESS (Equity Summary Score.) However Weiss also offers insurance company ratings and bank ratings. So I did a comparison of Rural with Safeco (Liberty Mutual.)

Regarding Rural Insurance

Major Rating Factors: Fair overall results on stability tests (4.2 on a scale of 0 to 10) including potential drain of affiliation with Wisconsin Farm Bureau Federation and weak results on operational trends. Good liquidity (6.8) with sufficient resources (cash flows and marketable investments) to handle a spike in claims.

Other Rating Factors: Strong long-term capitalization index (10.0) based on excellent current risk adjusted capital (severe and moderate loss scenarios). Moreover, capital levels have been consistent in recent years. Ample reserve history (8.3) that helps to protect the company against sharp claims increases. Excellent profitability (8.9) with operating gains in each of the last five years.

Stability Factors: R – Concerns about the financial strength of its reinsurers. T – Significant trends in critical asset, liability, income or expense items.

Principal Lines of Business: Farmowners (31.0%), personal/comm auto (26.0%), comm multi (16.3%), work comp (14.5%), homeowners (9.1%), other (3.2%)

Licensed in: IL, MN, WI

Principal Investments: Investment grade bonds (86.9%), common stock (9.2%), non investment grade bonds (1.4%), cash (1.0%), preferred stock (0.2%), other (1.2%).

The following images are from Weiss to show the ratings.

Rural Data for a Careful Review

Ratios

Premium to Surplus 53.60%, Reserve to Surplus 32.50%, 1-Year Reserve Development -4.10%, 2-Year Reserve Development -6.30%, Expense Ratio 25.00%, Combined Ratio 92.20%, Cash From Underwriting 106.10%, Net Premium Growth 9.30%

Corporate Info: Group Affiliation Wisconsin Farm Bureau Federation

Company Address 1241 John Q Hammons Drive Suit MADISON, WI 53717

Phone Number (414) 369-5033

Rural’s Website