GLOBAL SELF STORAGE INC

On Monday I sold 3,200 shares of SELF (GLOBAL SELF STORAGE INC) before the Ex-Dividend date. This means I won’t receive the most recently announced dividend. The dividend is insignificant in our total portfolio, and I can put the $17,299 from the sale of the shares to better use in other cash covered put options trades or to buy shares of a different REIT.

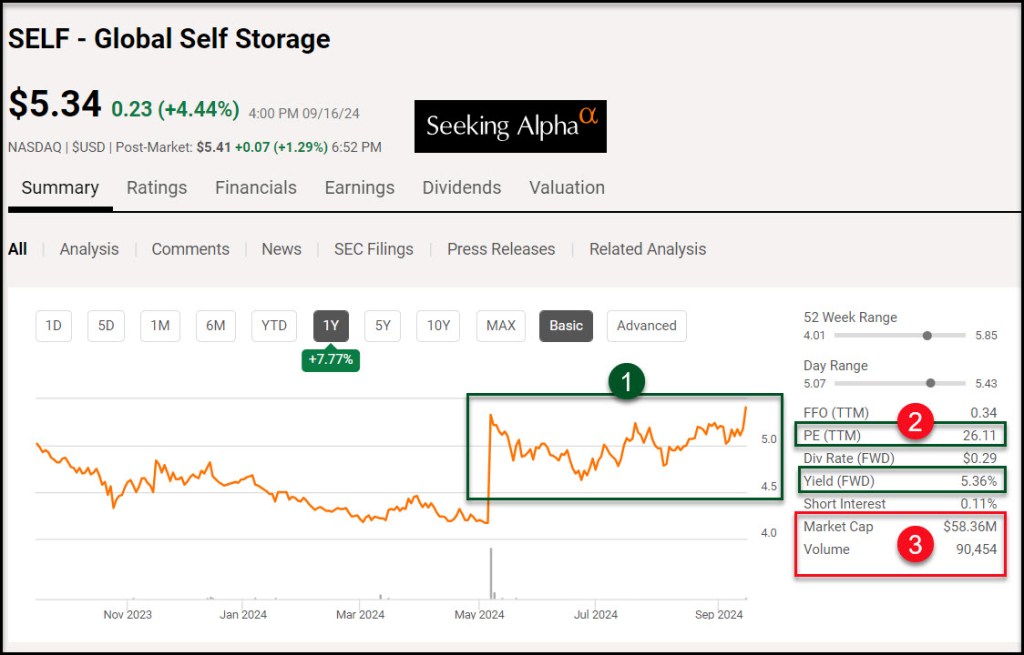

Seeking Alpha Summary Information

Although SELF is positive for the year, the P/E ratio is a bit rich at 26.11. The market cap is very small at $58M, and the volume, as you can see, is less than 100,000 shares per day most of the time.

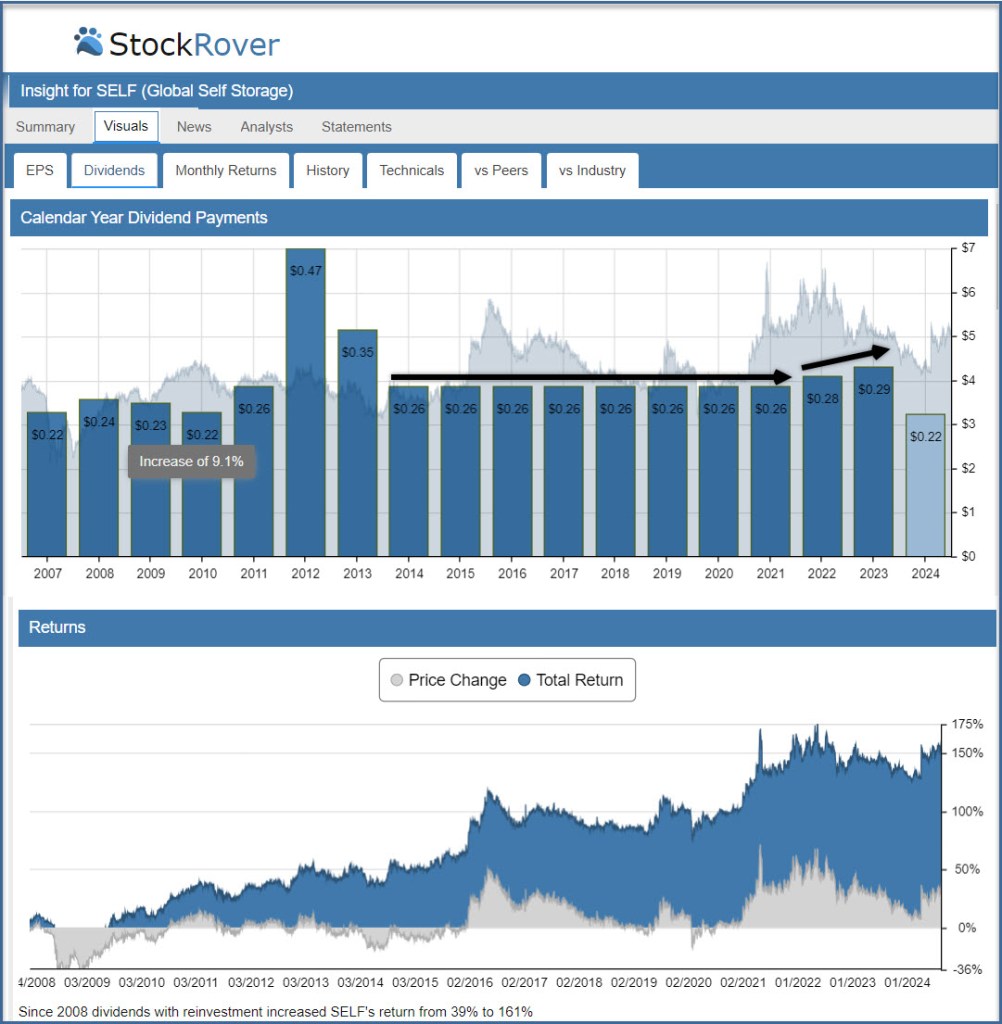

A Bit of History and My Reason for Selling

We have owned the SELF shares starting in June 2022 and collected about $1,500 in dividends since then. SELF does not, however, fit with my covered call options strategy and is thinly traded. When a stock is thinly traded, it means there isn’t a lot of demand for the shares.

In addition, this is a micro-cap stock. It seems unlikely that it will grow and there is little hope for dividend growth. The dividend yield was good, but not good enough to keep the shares.

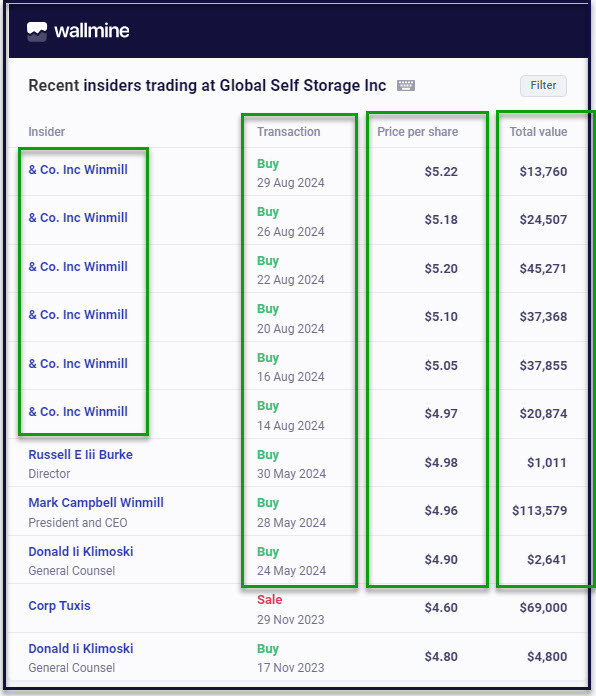

Insiders Update from Wallmine

I usually check to see what “insiders” are doing before I sell a position. Although they are buying, there isn’t enough activity to lead me to think that this is a positive for holding the shares.

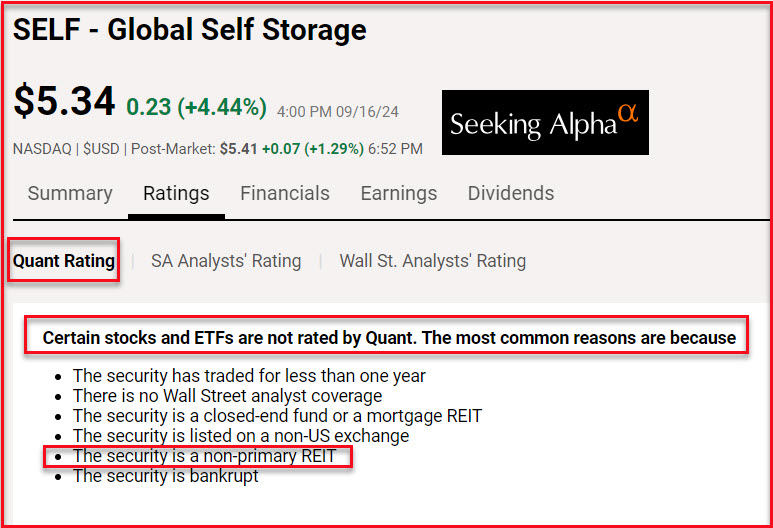

SELF’s Seeking Alpha QUANT Rating

SELF does not have a QUANT rating, so that makes me less enthusiastic about this investment. There is no Fidelity Equity Summary Score for this REIT as well.

About SELF

Global Self Storage is a self-administered and self-managed REIT that owns, operates, manages, acquires, and redevelops self-storage properties. The company’s self-storage properties are designed to offer affordable, easily accessible and secure storage space for residential and commercial customers. Through its wholly owned subsidiaries, the company owns and/or manages 13 self-storage properties in Connecticut, Illinois, Indiana, New York, Ohio, Pennsylvania, South Carolina, and Oklahoma.