Dividends are for Dummies

A misconception is an idea, notion, opinion, or understanding that is incomplete or mistaken. It is really a misunderstanding. Many investors and financial advisors don’t really think through the power of buying and holding dividend-paying stocks and ETFs for the long-term. Even fewer seem to understand the power of dividend growth investing. There are a couple of reasons for the thinking that buying investments that pay dividends is really a dumb idea.

Reason Number One

If a company pays a dividend, then the “value” of that company has declined by the loss of the cash that could have been put to use in growing the business. If, for example, a company is worth $500M on the stock market, and they pay a 4% dividend, then the company loses $20M in value because an asset (cash) was given to the investors. On the surface this is true. However, there are many other factors that influence the price of a share of stock. A four percent reduction caused by paying a dividend can be inconsequential. Take ABBV for example.

ABBV has a dividend yield of 3.2%, a dividend payout ratio of 57%, a five-year dividend growth rate of 8%, and dividend growth for ten years. That hurt the price of the shares, right? Wrong. The shares are up about 230% in the last ten years.

Reason Number Two

Some investors, as a result of number one, think the individual investor is “missing out” on great growth opportunities. This forgets the power of reinvesting dividends. As dividends come into our accounts, they are not automatically reinvested. However, over time I have reinvested dividends by purchasing other investments or more shares of the same investments. This is a powerful way to create both income, growing income, and diversification of the overall portfolio.

For example, because ABBV pays $6.20 per share per year in dividends, my 900 shares of ABBV give me $5,580 in annual income in my ROTH IRA. As a result, I could buy more ABBV, or I could purchase shares of some other investment. I could also trade cash covered put options on investments like CLOV.

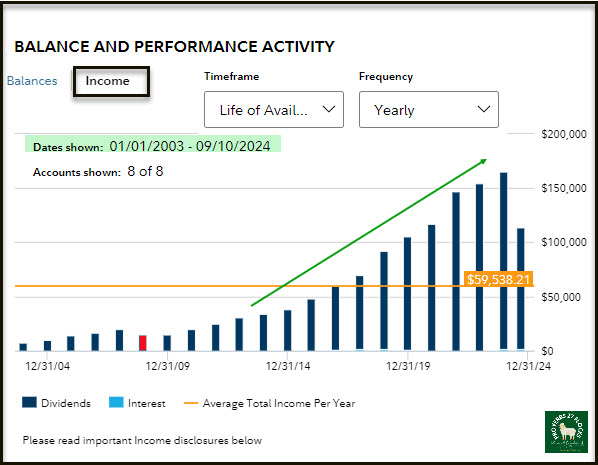

Dividends from 2003-2024

While dividends are nice, neglecting to look at dividend growth is another oversight of many investors and advisors. As I noted earlier, ABBV has a decent 5-year dividend growth rate. However, you can accomplish the same thing with ETFs like VYM, SCHD, and DGRO.

SCHD, for example, has a five-year dividend growth rate of 12.9%. Think about that. If the dividend is $1.00 this year, it is possible that it would be at least $1.10 next year. In a similar way, VYM has a growth rate of 5.81% and DGRO clocks in at 9.30%.

We own shares of VYM, SCHD, and DGRO, but VYM is our largest holding at the present time. The current value of our VYM shares is just over $320K.

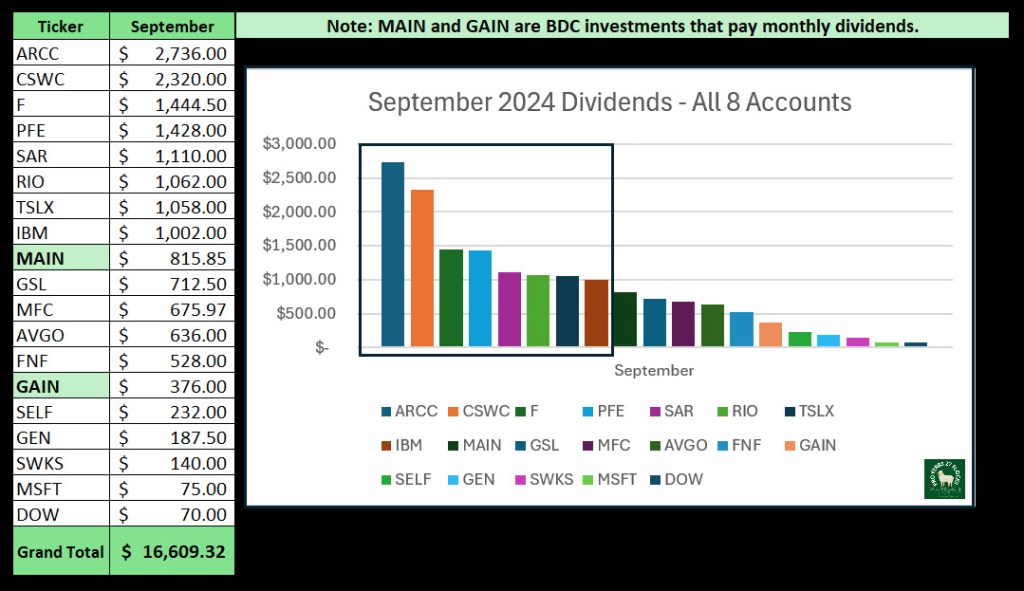

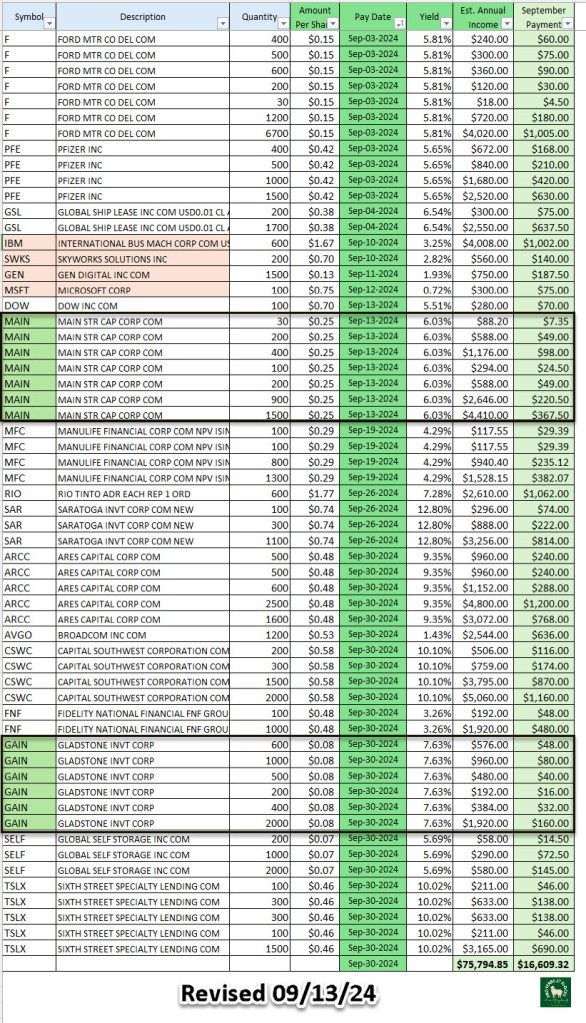

The Third Month of Each Quarter is Fun

Because of our mix of investments, our best months for dividends are March, June, September, and December. That isn’t to say the other eight months are dividend-poor. We receive substantial dividends in all of those months. However, the third month is always grand. As you can see from this image, it is certain that we will receive over $16,000 in dividends in September.

What can we do with $16K? Well, for some of it we will have to pay income taxes if we withdraw the dividends from my traditional IRA. But the ABBV dividends are tax-free because I hold the ABBV shares in my ROTH IRA. After income taxes, as noted earlier, I can reinvest the dividends, or we can give most of them away to various charities. We can do that because we manage our budget to keep our cost of living low.

Recommendation

If you work with an advisor, ask them what they think of dividend or dividend growth investments. Ask them which ones they recommend, and why they recommend them. Ask them to explain why they don’t educate you about the power of growing your portfolio by reinvesting growing dividends. In any case, be aware that your dividends may become your income someday. Be ready for that day.