Patience Over Time

My ROTH IRA does not have the advantage of a long history of deposits simply because most of my working years I only had a traditional 401(k). However, I use the same dividend growth approach for my ROTH as I do for my traditional IRA. The largest holding in my ROTH IRA is ABBV. I have 900 shares that are currently worth about $176,000.

ABBV pays an annual dividend of $6.20 per share, which produces $5,580 in dividend income. However, I also gain covered call option income from this investment. My 2024 YTD options income for this position is $1,571.

ROTH Withdrawals

I rarely withdraw cash from the ROTH. It would be counterproductive to do so. The best approach for long-term tax consequences for both my wife and I and for our heirs is to maximize the tax-free benefits of the ROTH and reduce the taxable burdens of the traditional IRA.

Quality and Dividend Growth

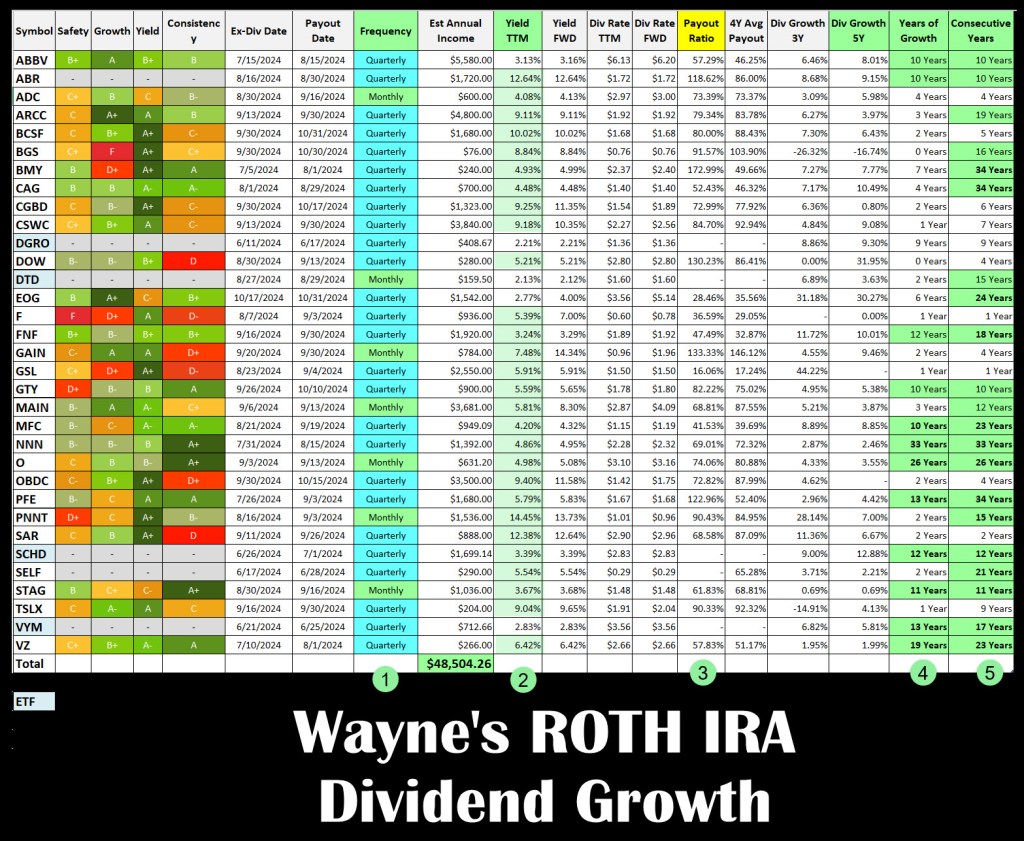

The quality of an investment is my primary focus. Therefore, I monitor my holdings using Seeking Alpha’s portfolio tool. As with the image I provided for the recent review of my traditional IRA holdings, I look at the dividend yield, payout ratio, 5-year dividend growth rate, the years of dividend growth, and the years of consecutive dividends.

If you compare the yields of many of the investments in this IRA, you will see they far exceed what I can get for funds in a Money Market Fund or in CDs. Therefore, sitting on excess cash in this account does not make sense. I do have $10,000 in short-term CDs in my ROTH, and my cash balance is under $10K. The estimated income in this account for 2024 should be well over $40,000 due to the assets I moved from the traditional IRA. It has already reached almost $26K in dividends.

ROTH Conversions 2023-2024 YTD

My most successful ROTH conversion has been my ABBV shares. However, in the last 20 months I have converted shares of the following from my traditional IRA: ARCC, BSCF, CCAP, CTRE, GSL, PNNT, ABBV, and VYM. I no longer own shares of CTRE. In hindsight, I should have kept them. The ARCC and VYM conversions have also been very beneficial.

What about TIPS as an Investment?

One of my readers asked a question that I plan to address in my next post. Here is what he asked: “Wayne, is there any place in your thinking and strategy for Treasury Inflation Protected Securities (TIPS)? For whom or in what circumstance, might they be a reasonable investment?”

I will explain why I don’t have any TIPS in any of our accounts. The “Inflation Protection” sounds like a good idea, but I believe there are some harmful effects from owning this type of investment.