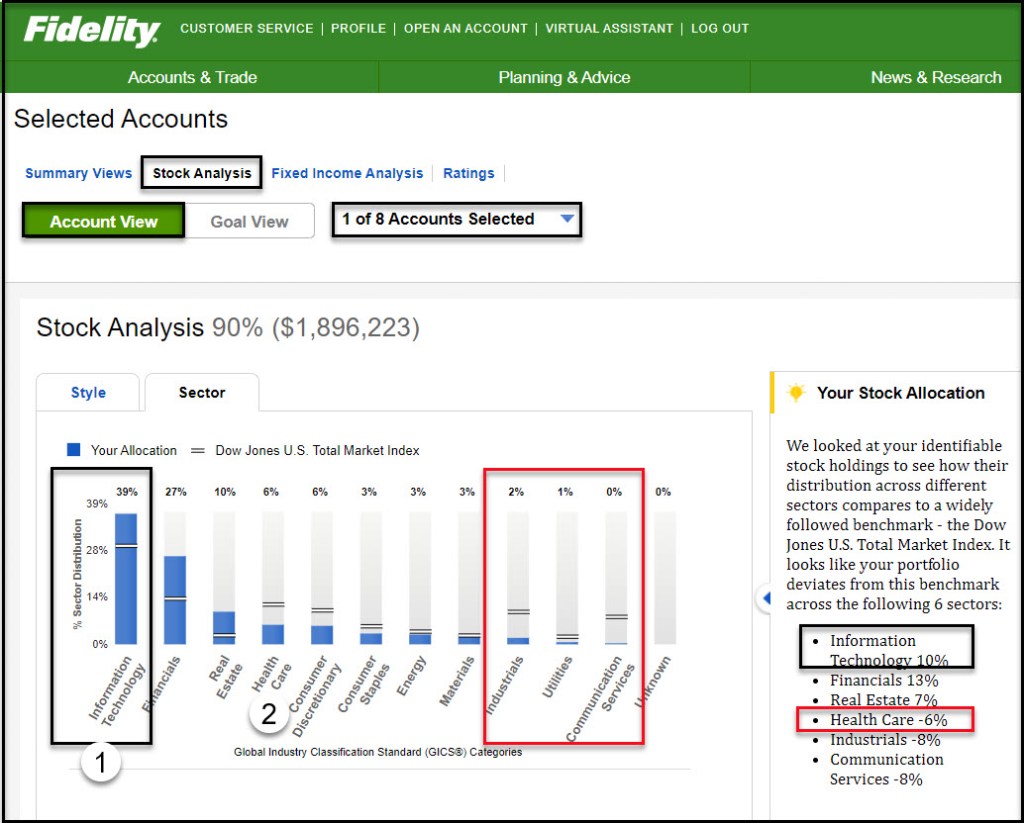

Sector Weightings Over Eight Accounts

Cindie and I have a total of eight accounts at Fidelity Investments. If you look at the sector weightings of the combined total, the Financials make up 32% of our total investments. This includes banks, insurance companies, BDCs, and other similar money-centric businesses. Number two is technology at 25%, and three is health care at 13%. The image below is a focus on only my traditional IRA (one of eight accounts).

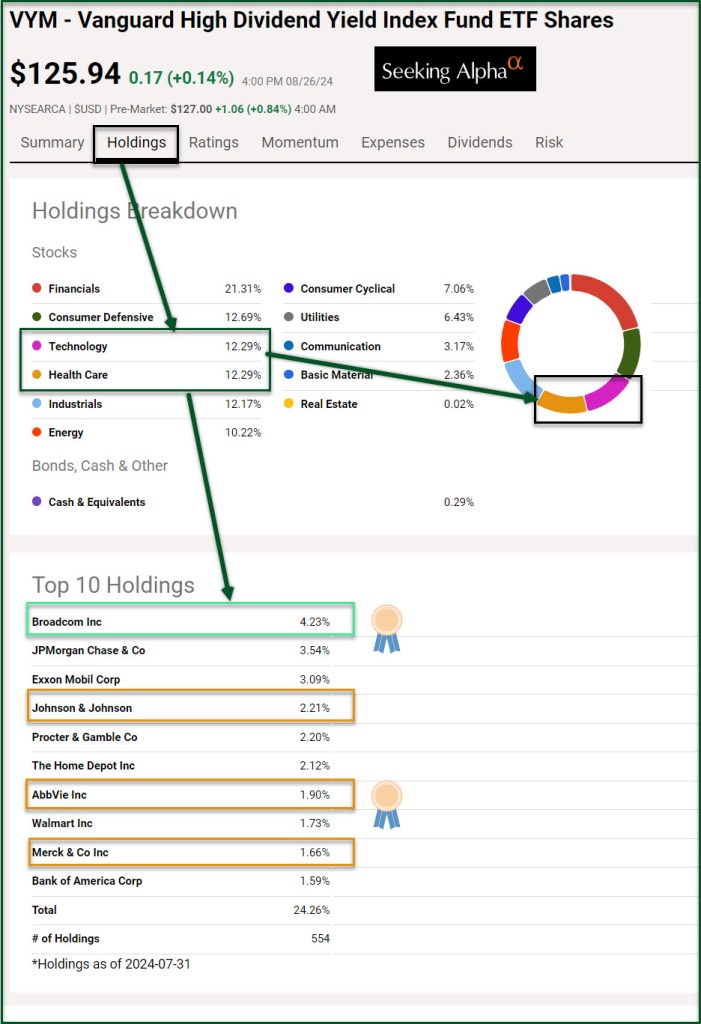

The sectors I typically avoid, with a couple of exceptions, are utilities and communication services. We do own some shares of Verizon (VZ), and there are shares of utilities and communication services in the ETFs we own like VYM.

The financials provide significant income for the retiree. As a result of my investment choices, my dividend yield on assets for my traditional IRA and ROTH IRA is currently at 4.60%. To put that in perspective, the yield on the S&P 500 set of companies is 1.28% (Using VOO “Vanguard S&P 500 ETF” as the proxy.) For a $1 million dollar portfolio, the difference in income is substantial. A portfolio with a 4.6% yield produces $46,000 in annual income. A portfolio with a 1.28% yield gives you $12,800 in income.

Why This Matters

As a retired value investor I want to avoid selling investments during bear markets or recessions. Therefore, the flow of cash into our accounts provides coverage for our normal expenses (that are not covered by Social Security), for charitable giving, for paying income taxes, and for the purchase of other investments. Other investors who focus on large-cap growth stocks like the “Magnificent Seven” can face some serious challenges when the market misbehaves.

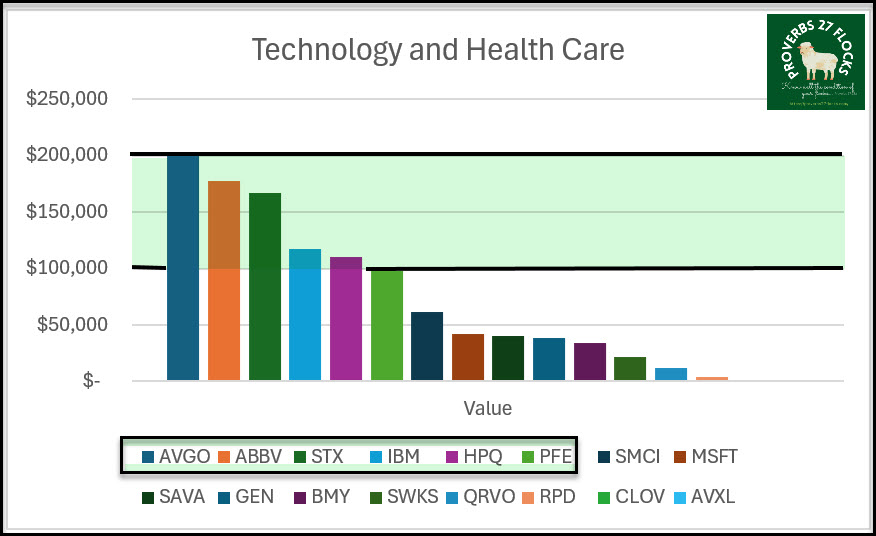

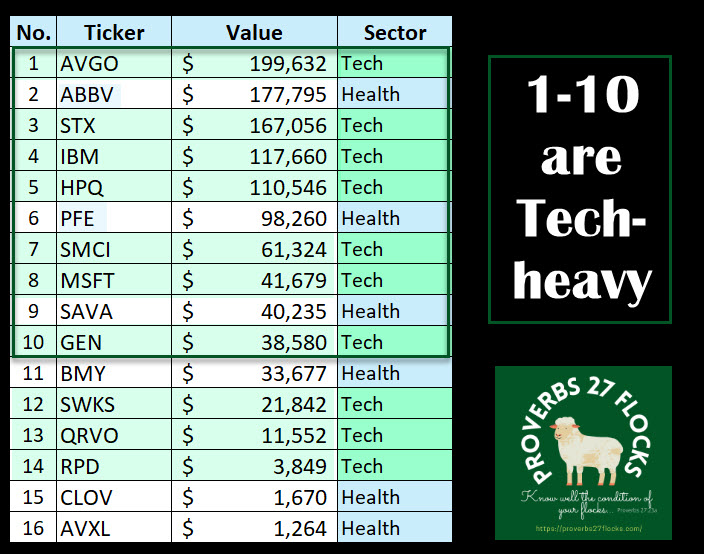

A Snapshot of Tech and Healthcare

It sometimes helps to look at your investment mix by sector. In our case, although the financials are number one, I want to see where our largest investments are focused across all accounts. I also want to confirm that the higher-risk investments are not increasing our overall risk. So, for example, I would not recommend stocks like RPD, CLOV, and AVXL to an investor with a small total investment portfolio. Even some in my “top ten” as shown here, like SMCI, have a higher risk factor. SMCI is not for a faint-hearted investor! However, if earnings continue to climb, it seems highly likely that this stock will prosper significantly. Just know that SMCI does not pay a dividend.

That is not a hinderance for an options trader. YTD income from SMCI options trades has been $26,282. That is a significant amount. Our total income from options trades YTD is $52,478. In other words, SMCI has contributed greatly to our 2024 income from options trades.

NOTE: Super Micro Computer (SMCI) slid 8% by the end of trading on Monday. The company remains on track for a 10-for-1 stock split on Oct. 1. That means I will have 1,000 shares instead of 100 shares after the split. I will also have ten covered call options contracts to replace the one I have now. This gives me more flexibility for selling a portion of the shares and still being able to trade options on any that remain. I also have an open cash covered put option which will become ten put options post-split.

But Why Technology?

There are a couple of reasons I like businesses like AVGO, STX, IBM, HPQ, SMCI, and MSFT. Most of these pay a dividend, some pay a growing dividend, and all of them provide opportunities for trading covered call options. For example, STX (Seagate Technology Holdings plc) has provided both dividends ($3,360) and options income ($3,497) in 2024. These are YTD numbers. Therefore, by doing very little, we have received $6,857 in combined YTD income from our STX shares.

My career was in the technology field. Every year we had to upgrade systems, pay software licenses, pay for system maintenance, add new hardware and software, and pay for consulting services. There is a lot of money changing hands. Technology went from the old IBM 360 mainframe to the Apple iPhone I use every day. The phone has more storage than the 360 ever had.

There are cautions, however. Stocks that tend to charge up at a dizzying pace can also fall at an equally dizzying pace. That has happened with Tesla this year, which is down 14.2% YTD. I know that TSLA is not a technology company, but the types of businesses within TSLA are heavily dependent on consumer discretionary spending, energy, and technology.

Why Healthcare?

Healthcare is another growth sector. Back in the early days of my first brokerage account, one of the first investments we purchased was PFE (Pfizer Inc). Although PFE has seen some downturn in their share price post-Covid, the total return of our PFE investment over the past several decades has been more than adequate. PFE is another investment that pays a handsome dividend, and it is also a stock that can be used for covered call options trading.

Summary

It is prudent, even when you focus on ETFs, to understand your exposure to the various sectors. Even more important is the need to ensure that you don’t have too many dollars focused in a single sector like technology. That can hurt from both an income perspective and during bear markets.