Expiring Options Create Opportunities

When you aren’t greedy, and set your options contract price high enough, while paying attention to a stock’s Ex-Dividend Date and Earnings Date, the best outcome is that your stocks are not called away. That happened on Friday, August 23, 2024, for five contracts: EOG (2), IBM, MPW, and SWKS. In addition, two cash covered puts expired. I did not get the shares, but that is the goal for most of my put options. Today I was able to start trading including a new covered call option for MPW and two option contract rolls to higher prices for ABBV and UAL.

Reviewing Options By Expiration Date

When you use Fidelity’s Active Trader Pro (ATP) it is easy to see when all of your options expire. The following two screen images show the options I had open on Friday for my ROTH IRA and my traditional IRA. One of the reasons I use this screen on Thursday and Friday is to determine if I should roll an option up to a higher price with a more distant option contract date. I do that frequently for two reasons.

The first reason is that I am usually trying to avoid the call of my stock. If the price of the EOG shares was heading above $135 (the contract price per share for the option), I might roll the contract to August 30 or to the first or second Friday in September. If I roll it up to $140, then my shares won’t be called at $135.

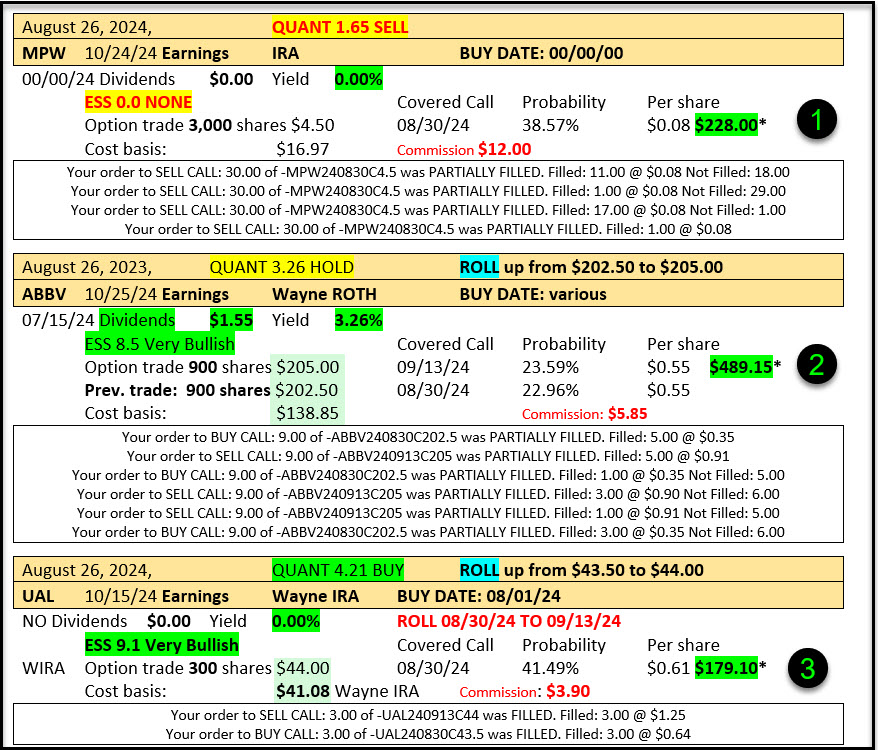

The other reason is that I earn income each time I do a roll up, or at least I attempt to break even. This morning, for example, I rolled the covered call contracts for my UAL shares from $43.50 to $44.00. For that simple trade I received about $179 in income. I also rolled my nine ABBV covered call contracts up from $202.50 to $205.00, earning about $489.

Monday Morning Review

On Monday I typically go to the Activity tab on Fidelity.com to see which options expired. Here is a screenshot of the expired trades. This becomes the working list for the new week of trades. I probably won’t enter any puts this morning, but I might do some on Tuesday or Wednesday. I’m certainly not limited to trading the stocks that have expired contracts, but it is often the first place I look for opportunities.

Taking and Keeping Options Trading Notes

Although taking notes is not a requirement for successful options trading, I have found that keeping notes about each transaction spares me having to dig into the trade details to see what my previous trades earned and if I was increasing or decreasing the probability that my shares would be called away.

Here is an example of the notes I kept in Word for the three trades I did this morning. Because I am proficient in Word, and copy/paste from previous transactions in the document, my typing and formatting efforts are minimal. The total income for about one hour of work today was almost $900.

Easy Income Trading Options

Not only is trading a covered call option easy, but it also takes very little time each week. I would estimate that my results YTD 2024 is at about $500 per hour. However, even if you are just starting out, you can easily beat the minimum wage for one hour of work with a small option trade on a lower priced stock. That is how I started. I started with small trades until I became proficient in the mechanics of options trading and until I had “perfected” my process.

One tip: Look for stocks that trade weekly options. When you do that you can try again the next week if your previous week’s option expired.