More Real Income Without the Sucking Sound

The “sucking sound” I hear when I consider investing comes from fund expenses and income taxes. Any time I can reduce or eliminate expenses or reduce or eliminate income taxes, I free up additional dollars for investing and for charitable giving.

The traditional IRA is a wonderful tool. However, when you reach my age, the required minimum distribution (RMD) forces you to start making withdrawals even if you don’t need the cash. To help mitigate that problem, I want to keep my IRA balance as low as possible before the end of the year. There are only four ways to do this: 1) Buy terrible or undesirable investments that drop in value; 2) Use the QCD approach for charitable giving (if you are old enough to use this approach); 3) withdraw cash for the RMD and additional cash for other purposes; and 4) perform a ROTH conversion.

Obviously the first one is just a silly idea and the fourth one is a great idea if you keep your overall current tax liability in mind. You have to pay the income tax on a ROTH conversion, and the ROTH conversion must be done after you complete your RMD for the year.

The 2024 RMD for My IRA

My 2024 RMD is $73,151.87. Therefore, before converting any assets from my IRA to my ROTH, I had to withdraw that amount. One way to accomplish this is by charitable giving. YTD giving is approaching $70K, so that leaves about $3K. YTD cash withdrawals are around $45K. Therefore, we have reached our RMD requirement because the total withdrawals exceed the RMD.

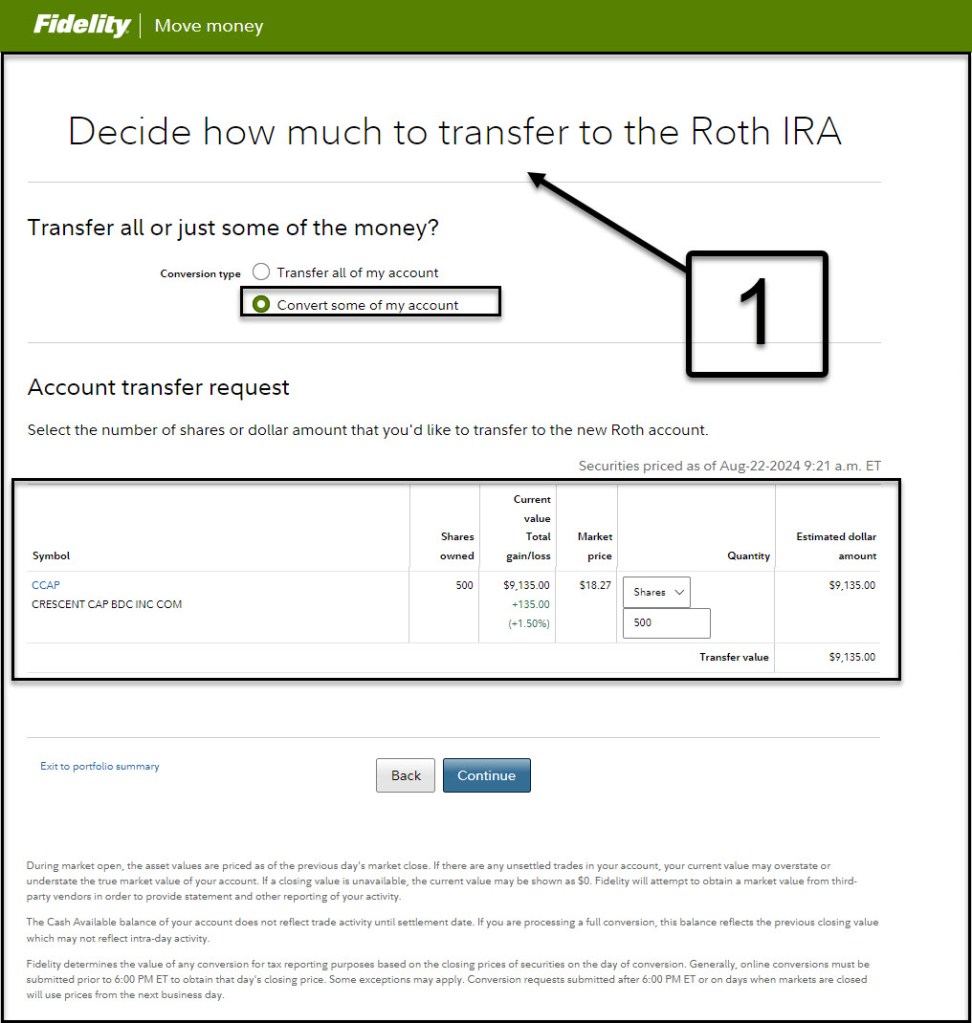

ROTH Conversion of CCAP

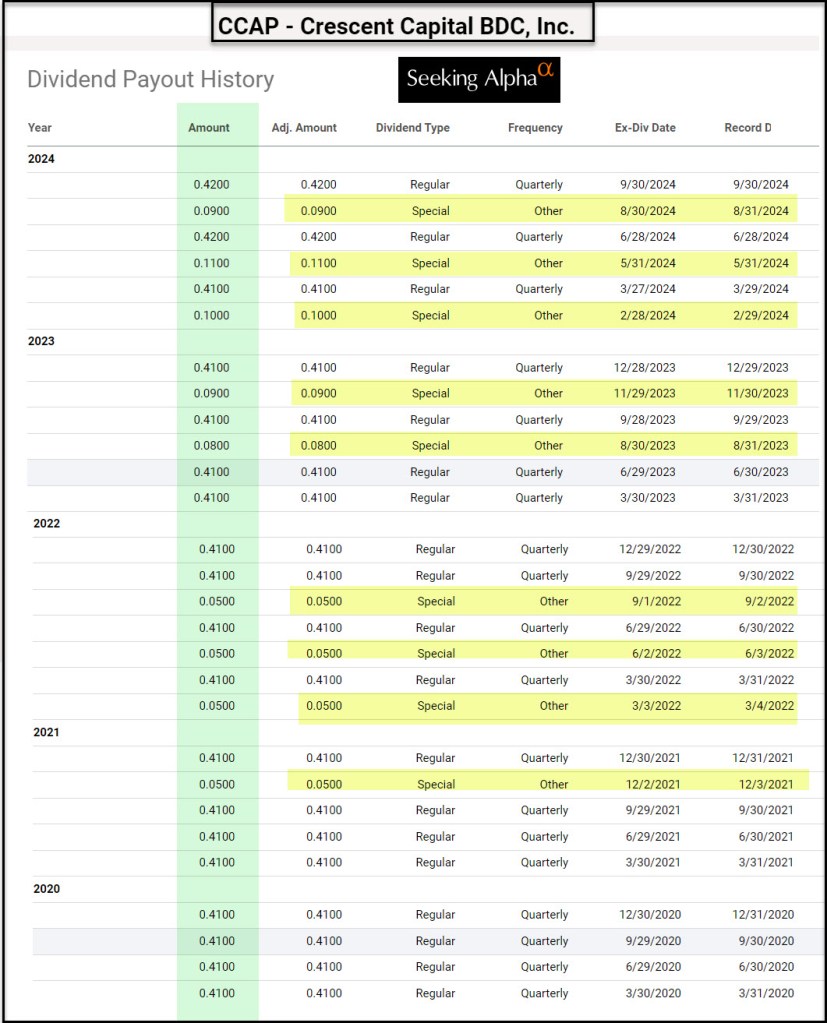

This week I moved my 500 shares of CCAP to my ROTH IRA. This means I will owe income taxes on about $9,000 of income. If history repeats itself, the tax burden will be about $1,800. The annualized dividend from CCAP is $840, excluding special dividends. Therefore, after paying the taxes, it is likely we will receive $840 per year or more in dividends we can withdraw without income tax liability. However, this is even better because any future RMDs will not be increased by the value of the CCAP shares. Each year the RMD increases as you age. Keeping this in check makes it easier to do additional ROTH conversions in future years after the RMD obligation is satisfied.

Fidelity’s website calculates the estimated annual income from CCAP as $1,020. This is due to the special dividends that CCAP has been paying for the last five quarters. While these are not guaranteed, they would shorten the payback time. The current yield on CCAP is 9.68% and the dividend is easily covered by expected earnings.

ROTH IRA Estimated Annual Income

As of today, the estimated annual income from my ROTH investments is $47,464.74. Again, this is very easy to see on the positions page on the Fidelity website. If you are a Fidelity client, go to your Positions and then click on “Dividend View.”

Cindie’s ROTH IRA generates $13,061.02 in estimated annual income. Therefore, our tax-free annual income now stands at about $60K.

Company Profile

Crescent Capital BDC, Inc. is as a business development company private equity / buyouts and loan fund. It specializes in directly investing. It specializes in middle market. The fund seeks to invest in United States.

Full Disclosure

I own 500 shares of CCAP as a long-term investment.