Investing Income Streams

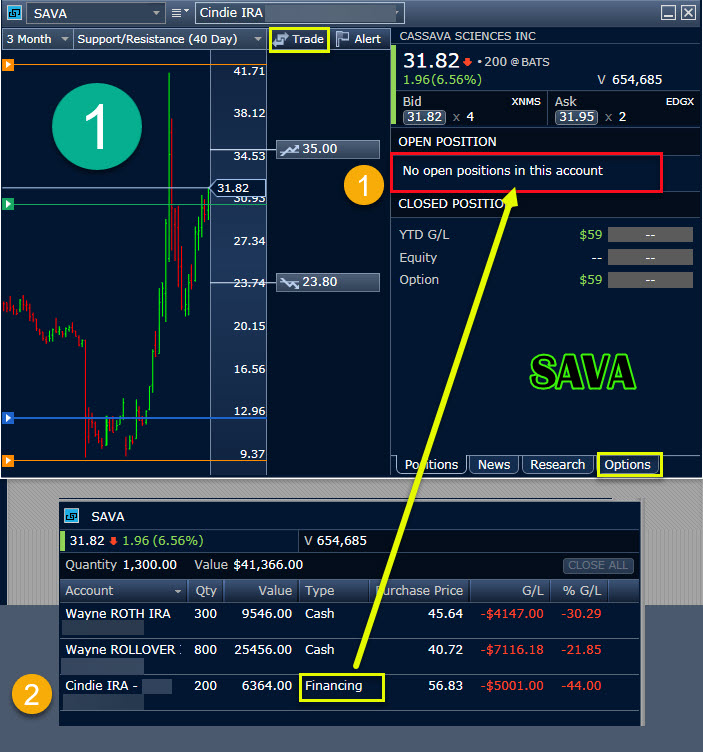

If you use ATP for your trading and options trading, then it helps to be aware of a slight “problem” with the Trade Armor feature. If you are looking at a position that has shares in the Fully Paid Lending Program (FPLP), those shares look like they are missing. The message you will see is “No open positions in this account.”

However, this does not hinder you from selling your shares or from trading a covered call option on your shares. I experimented with both, and the system seems to realize that you do have shares that can be traded, as Fidelity Investments promised.

No Open Positions Is Not True

When using Active Trader Pro (I highly recommend using ATP for your Fidelity trades), shares that are lent do not appear in the Trade Armor screen. However, I also keep open a window that shows all of the shares in all of the accounts I manage. If you use ATP with multiple windows you can link them so that all of them change whenever you change the ticker symbol in any of the linked windows. In the upper right corner of each window there is a small blue icon. I set that in one window, and then made all of the other windows blue.

Therefore, the top image in this screen shot is the window that shows Cindie’s SAVA holdings in her IRA account. The bottom image is a separate ATP window that shows we hold shares of SAVA in three accounts.

Trading Invisible Lent Shares

I attempted to enter an order to sell Cindie’s SAVA shares that are on loan. That feature works. In fact, it also alerts me that the loaned shares will be returned to the IRA account so that the sell trade can be settled.

Covered Call Option Trades for Lent Shares

Just as for a sell transaction, a covered call option trade can be executed in ATP. Therefore, even if the trader cannot see the shares using Trade Armor in ATP, the trade can be completed. However, if the shares are called, the shares will be returned to the IRA account and will cease earning interest.

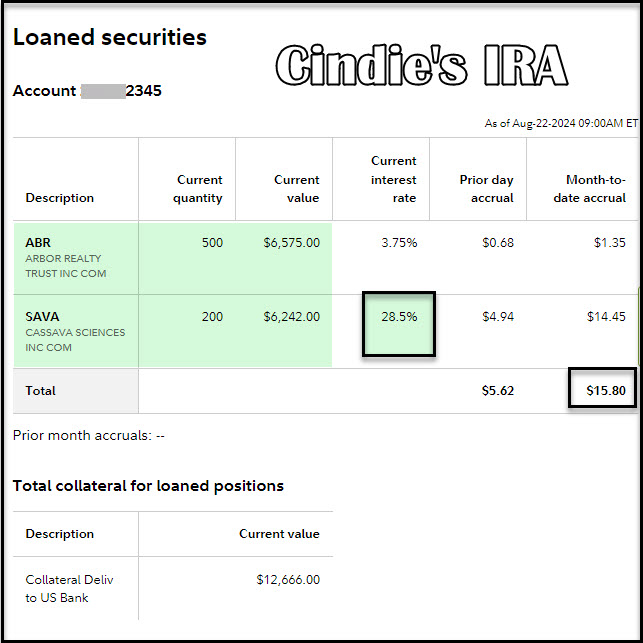

Adjustment Mark to Market Adj Collateral Delv to US BANK

One other thing I have noticed is daily activity adjusting the collateral on the shares lent. On August 21 the collateral was adjusted down by $453 for Cindie’s lent shares. On August 22, 2024 the collateral was adjusted up by $594. This doesn’t have any impact on the model, but it is encouraging to see that the investment is protected.

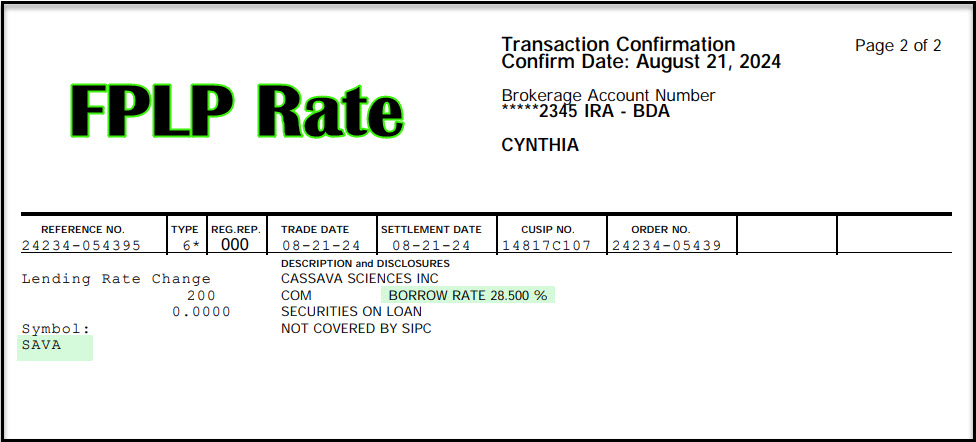

Interest Rate Increased

Another thing I noticed was a trade confirmation for SAVA that showed the interest rate on the loaned shares has increased from 28.375% to 28.50%. This is not a huge increase, but every move up is more income.

Next FPLP Post

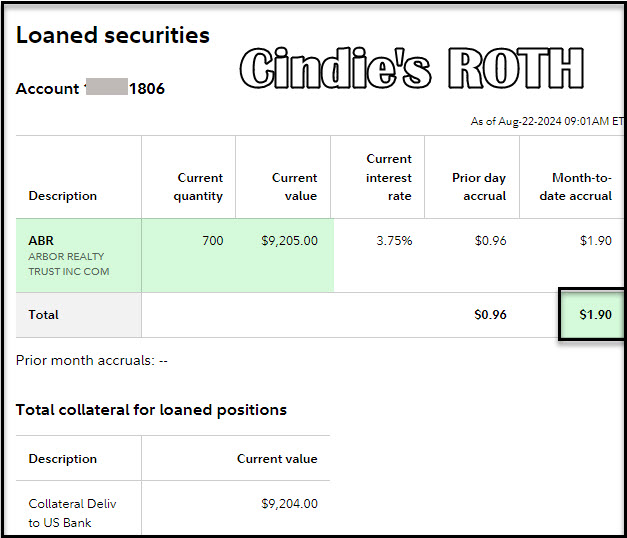

I think it will be some time before my next post on this topic. When I receive the interest on the SAVA and ABR positions, I will share those results. However, as I learn more I will discuss what I discover.