Sometimes An Investment Tempts Me

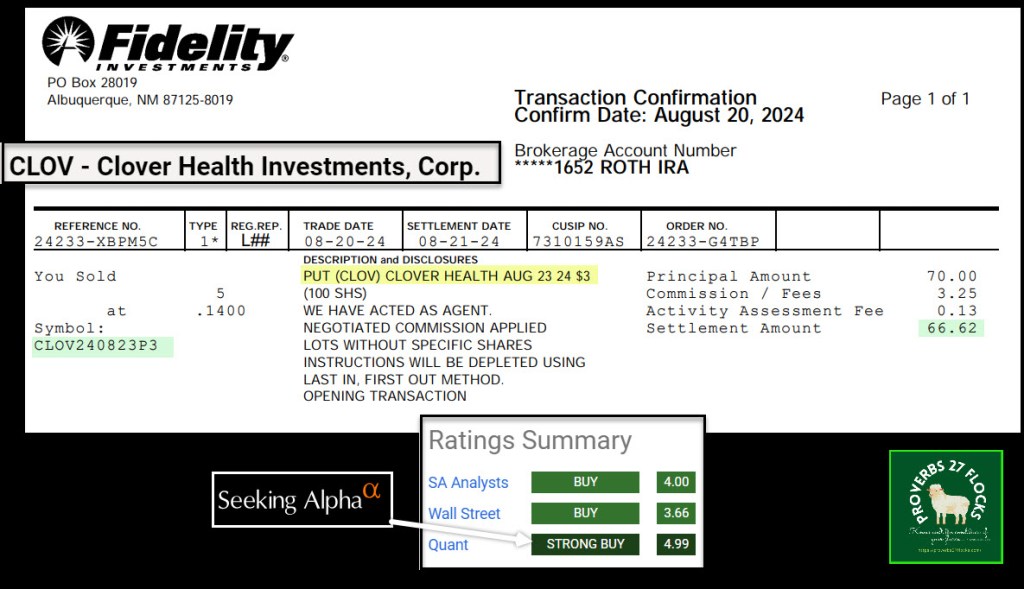

I don’t recall exactly how I came to learn about Clover Health, but it didn’t take much to convince me to enter a cash covered PUT OPTION for 500 shares. This type of option is a promise to buy shares if they fall below the contract price on the close of the Friday when the contract expires. In this case, the contract expires on Friday, August 23 and the contract price is $3. Therefore, $1,500 is on hold in my ROTH IRA for the potential buy.

What Were the Three Temptations?

There were three enticements. The first was the Seeking Alpha QUANT rating is a strong buy at 4.99. That doesn’t happen often with an investment. Clover is part of the Managed Health Care industry, so competitors include monsters like United Health Group Incorporated, Centene Corporation, and Humana. Clover is like a spider monkey while UNH, CNC, and HUM are gorillas. The market cap of CLOV is $1.54B and the other three range from $536B to $41B.

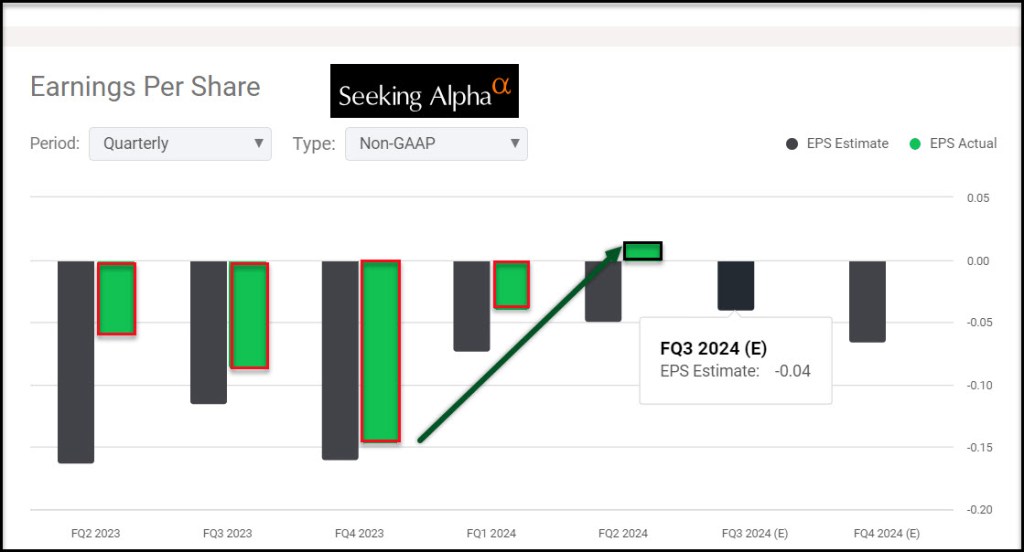

Dividends aren’t a temptation, because CLOV doesn’t pay a dividend but CLOV just recently had positive Non-GAAP earnings. That is the second temptation. Earnings have been growing.

The third temptation has to do with an insider buying one million more shares. The insider is both a co-founder and the CEO. He is not bashful. He now owns 61% of the company, so he is buying more even though he already is the majority shareholder. Also, the company has zero debt and it is buying back shares. All of those are positives from my perspective.

Potential Ownership but Certain Cash

I probably should have just purchased the shares for around $3.10/share. However, by trading an option contract (5 contracts for a total of 500 shares), I made $66.62 after paying Fidelity’s commission and fees. That is free income in a ROTH IRA. While it isn’t a bonanza, a little income here and a little income there and the dollars add up. If I do get the shares, I will start to trade covered call options on them for additional income. If I don’t I may enter another cash covered put for 500 shares next week.

Clover Health Investments

Clover Health Investments, Corp. provides medicare advantage plans in the United States. It operates through two segments: Insurance and Non-Insurance. It also offers Clover Assistant, a cloud-based software platform, that enables physicians to detect, identify, and manage chronic diseases earlier; and access to data-driven and personalized insights for the patients they treat. Clover Health Investments, Corp. was incorporated in 2014 and is based in Franklin, Tennessee.

“In terms of liquidity, Clover’s financial position increased in strength during Q2 with cash, equivalents, short-term investments, securities available for sale, and securities held to maturity worth more than $379 million, and has zero debt on its balance sheet. Moreover, the company has long-term securities available for sale and securities held to maturity worth nearly $103.8 million, which means that the company has total liquidity of $482.8 million. The company’s strong financial health has allowed it to buy back $1.77 million worth of stock in Q2 as part of its $20 million share repurchase program.” – SOURCE: Seeking Alpha