Investing Income Streams

The FPLP is an addition to our existing income streams. In addition to Social Security, Cindie and I receive dividends from stocks and ETFs. We also receive interest from CDs. Of course, I trade covered call options and cash covered put options as well. YTD options income has now reached $50,048. YTD interest from CDs has exceeded $1,000, which is quite remarkable given how long cash earned nothing. $102,393 has come in from dividends. So far there is no income from lending stocks, but it is starting to accumulate.

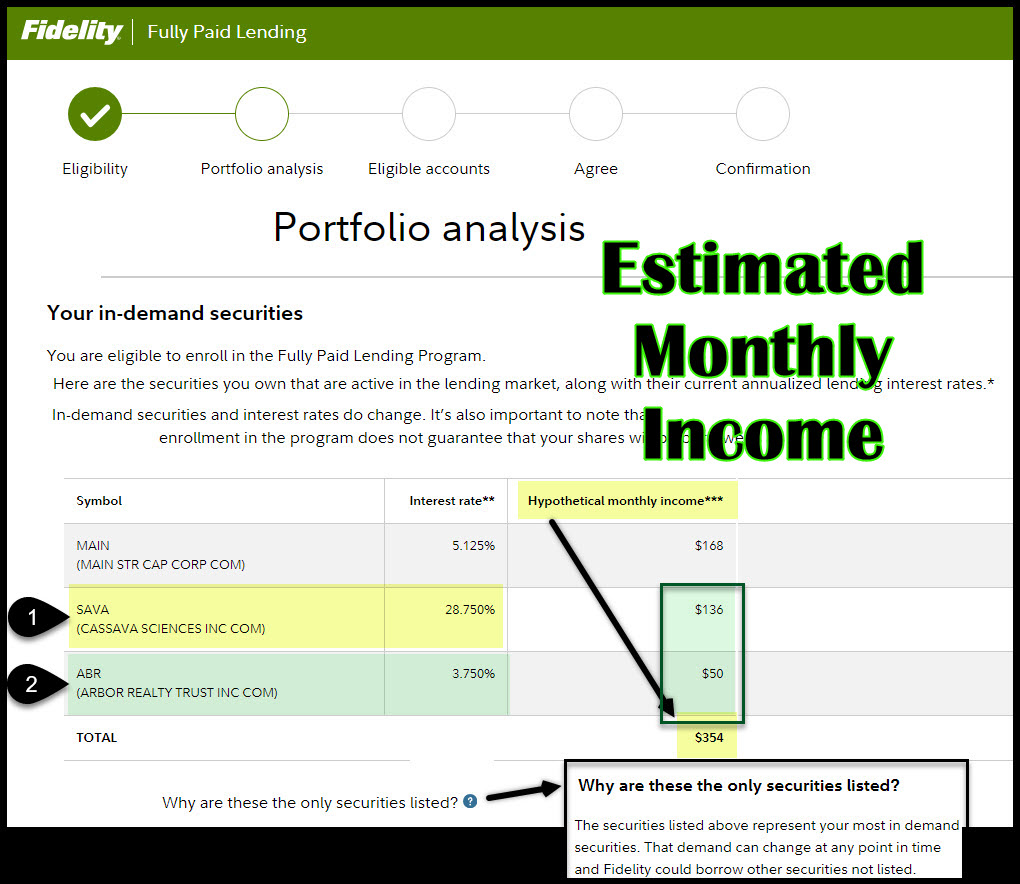

What Stocks Are Now Earning Additional Interest?

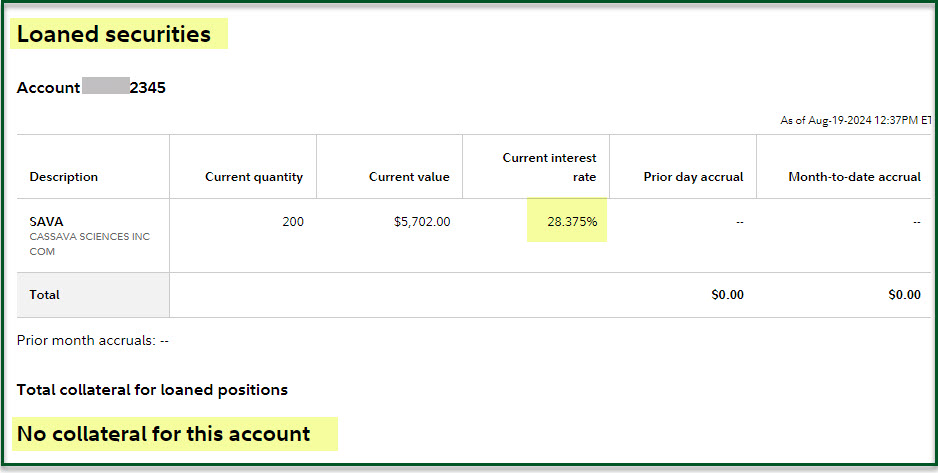

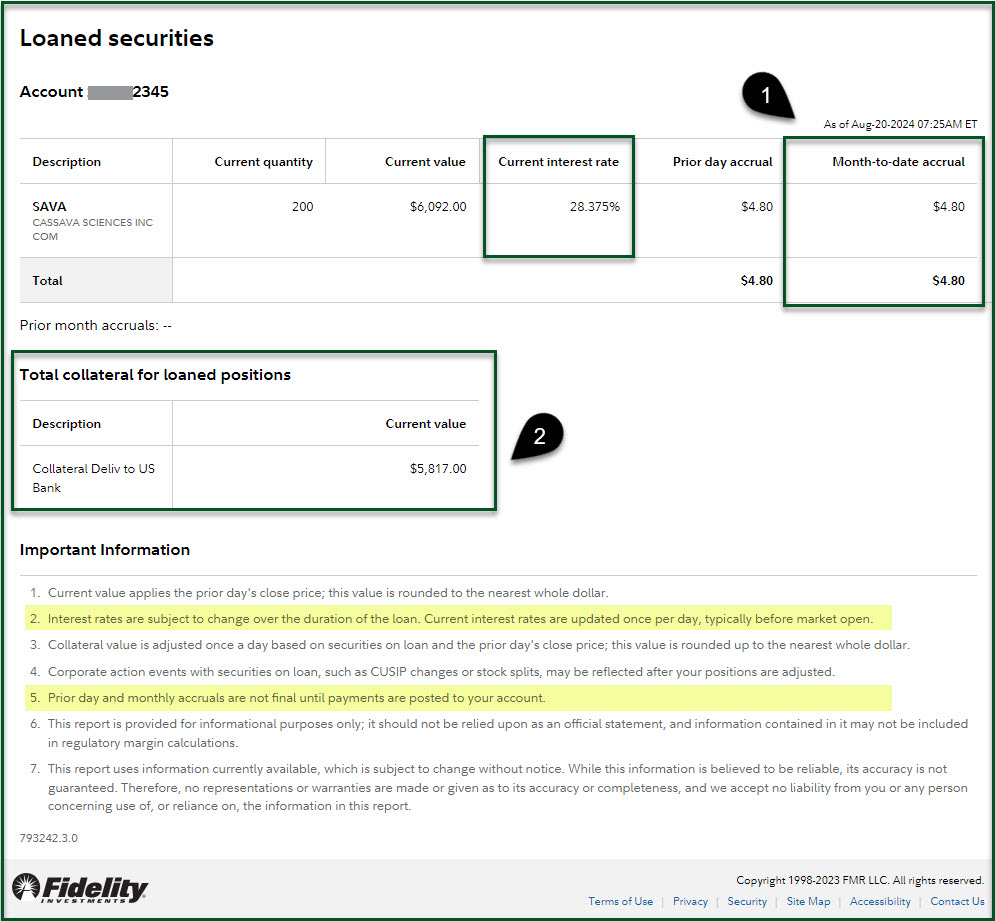

I mentioned that SAVA was activated, so it is now earning interest. I was pleased to see that in one day Cindie earned $4.80 on her 200 SAVA shares. There are borrowers who think it is worth 28.375% to borrow Cindie’s shares. It is likely that they are “short” SAVA. That means they think SAVA will drop in price. Investopedia has this to say, “When a trader wishes to take a short position, they borrow the shares from a broker without knowing where the shares come from or to whom they belong. The borrowed shares may be coming out of another trader’s margin account, out of the shares held in the broker’s inventory, or even from another brokerage firm. It is important to note that when the transaction has been placed, the broker is the party doing the lending, not the individual investor. So, any benefit received (along with any risk) belongs to the broker.” – INVESTOPEDIA LINK

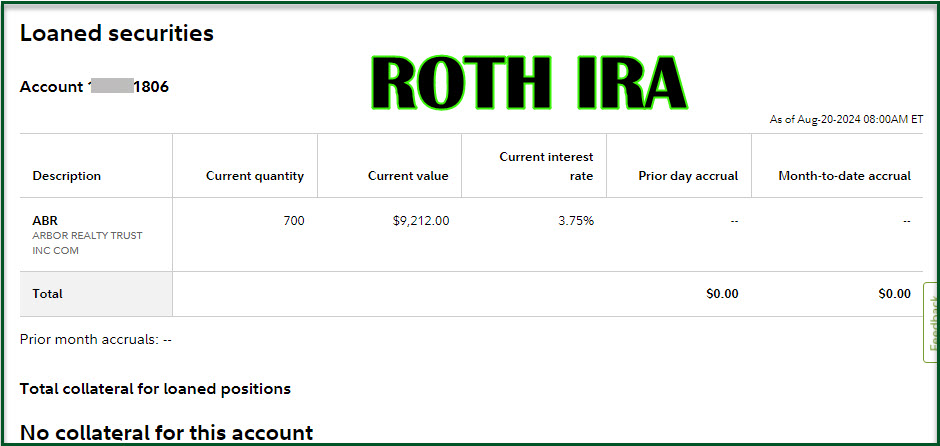

In addition to SAVA, her REIT investment ABR (Arbor Realty Trust, Inc.) is also activated for both her ROTH IRA and her traditional IRA. The interest rate isn’t quite as exciting at 3.75%, but when you add dividends from ABR, it is a nice addition. She has 700 shares of ABR in her ROTH and 500 shares in her traditional IRA.

The current QUANT rating on Seeking Alpha for SAVA is 3.84 (BUY) and ABR does not have a QUANT rating. However, the short interest for SAVA is quite high, at 39.66%. The short interest for ABR is 35.54%. That is one indication of the higher risk of both of these investments. Investors who short stocks believe they will fall significantly in price.

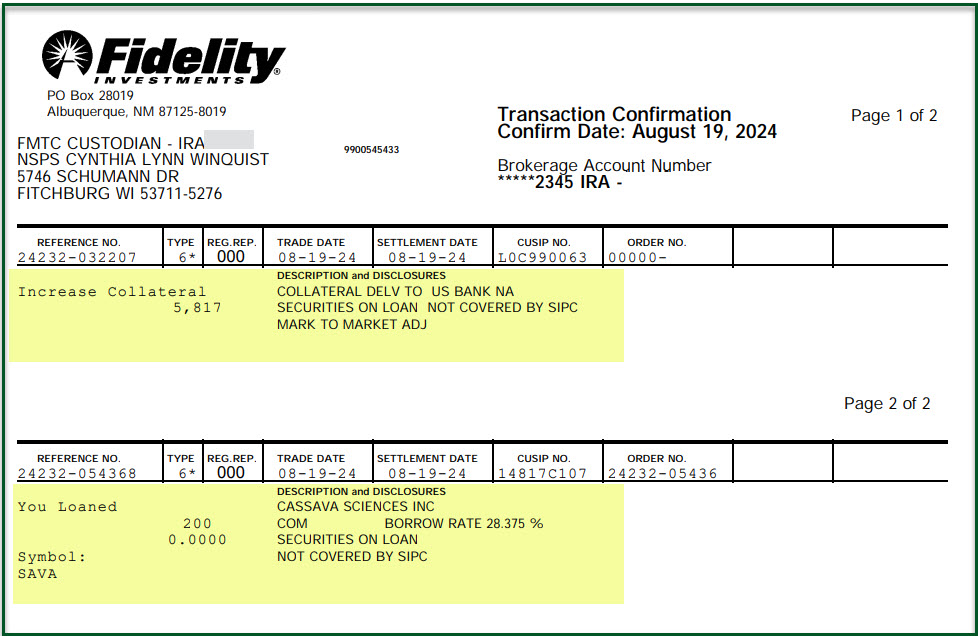

Trade Confirmations

As promised, Fidelity did provide a trade confirmation for the SAVA shares. It was a two-page confirmation. The first page showed that collateral was created at a bank to cover the value of the SAVA shares in the event that Fidelity was to fail for some reason. The second page shows the loan of the 200 shares along with the borrow rate of 28.375%.

Given the fact that ABR shares were loaned Tuesday, I expect to see a trade confirmation for the 700 shares in the ROTH and the 500 shares in the IRA this morning.

Shares in Active Trader Pro

Because the shares are on loan, they don’t appear in Fidelity’s Active Trader Pro “Trade Armor” window. This is just a minor inconvenience. I plan to ask Fidelity why this is so.

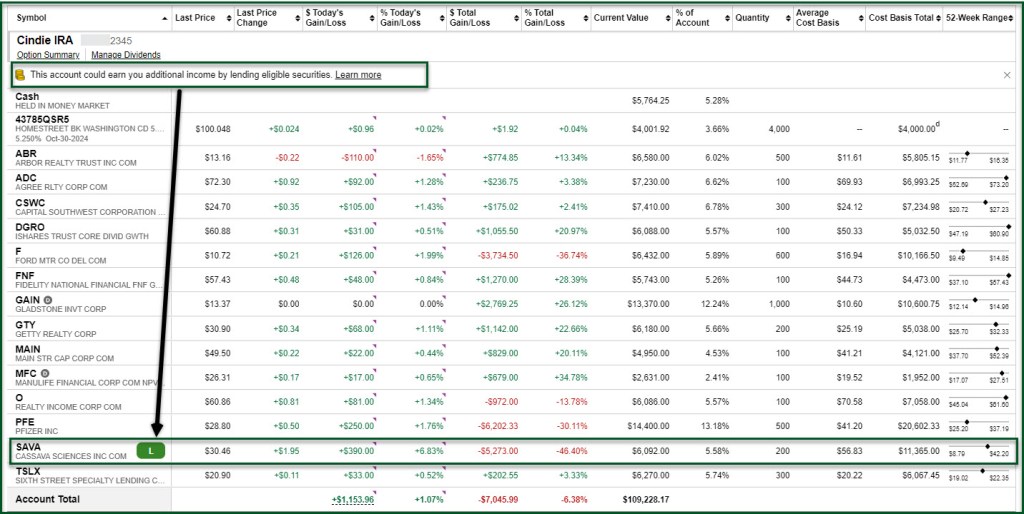

Positions Page on Fidelity’s Website

The good news is that Fidelity does a nice job showing the loaned shares on the Positions page. Here is an image of Cindie’s IRA that shows the shares are on loan. I also downloaded the positions to a csv file to see if they looked any different. The one thing that is different is the “TYPE” column. Instead of saying “CASH” or “MARGIN” (for margin trades), it shows “FINANCING.” This is helpful because I can either sort or filter the spreadsheet to see all positions that are on loan.

Next FPLP Post

It will be some time before my next post. When I receive the interest on the SAVA and ABR positions, I will share those results. The two screenshots show how the interest appears before the loan settled and after.

Thanks Wayne for this information. I have been wondering about it.

LikeLiked by 1 person