It Is Working!

In my previous post on this topic I provided an overview of the stock lending program offered by Fidelity Investments. In this post, using images, I will show the steps necessary to get enrolled in this program. Today I saw that one of Cindie’s positions, SAVA, was accepted into the FPLP program. Therefore, it looks like the time I spent researching this and setting it up might bear fruit.

Step One: Portfolio Analysis

There are some steps I am not showing that determine your eligibility. The steps are easy to understand and include responding to questions about your investing skill level and some high level information about your assets. After you get that done, you are presented with a screen that shows the analysis of your portfolio. Cindie’s “in demand” stocks are MAIN, SAVA, and ABR. Notice the loan interest rate for SAVA: 28.75%. The potential monthly income from this load of Cindie’s shares is $136. Because SAVA does not pay dividends, this is very attractive.

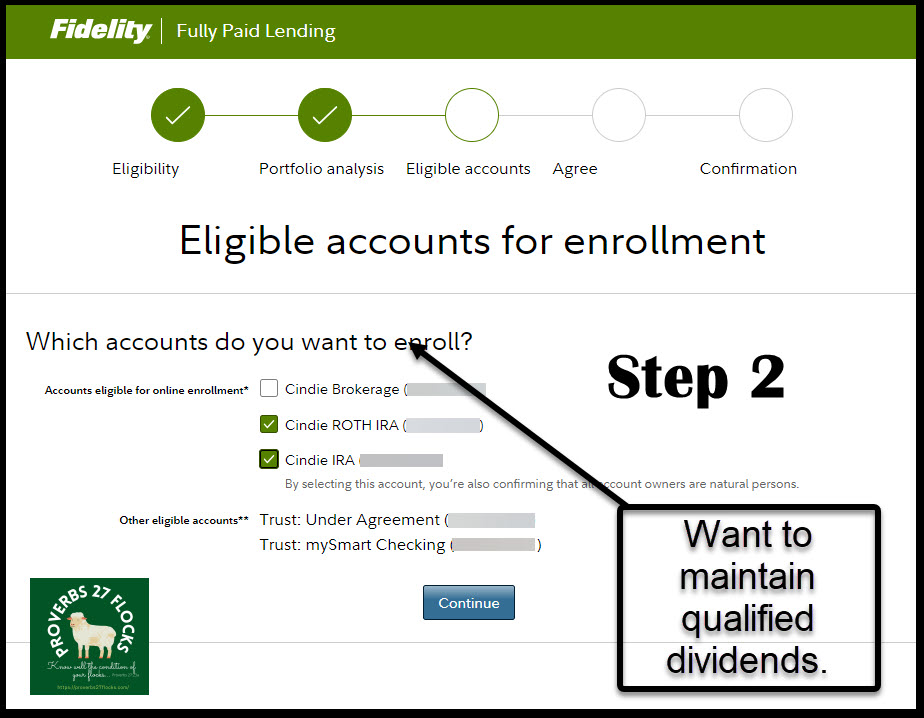

Step Two: Eligible Accounts for Enrollment

The second step focuses on the accounts eligible for this program. In Cindie’s case, there are three accounts: her brokerage account, her ROTH IRA, and her traditional IRA. I only selected the IRA accounts, as I don’t want problems with dividends/income taxes that might come as a result of lending securities in a taxable account.

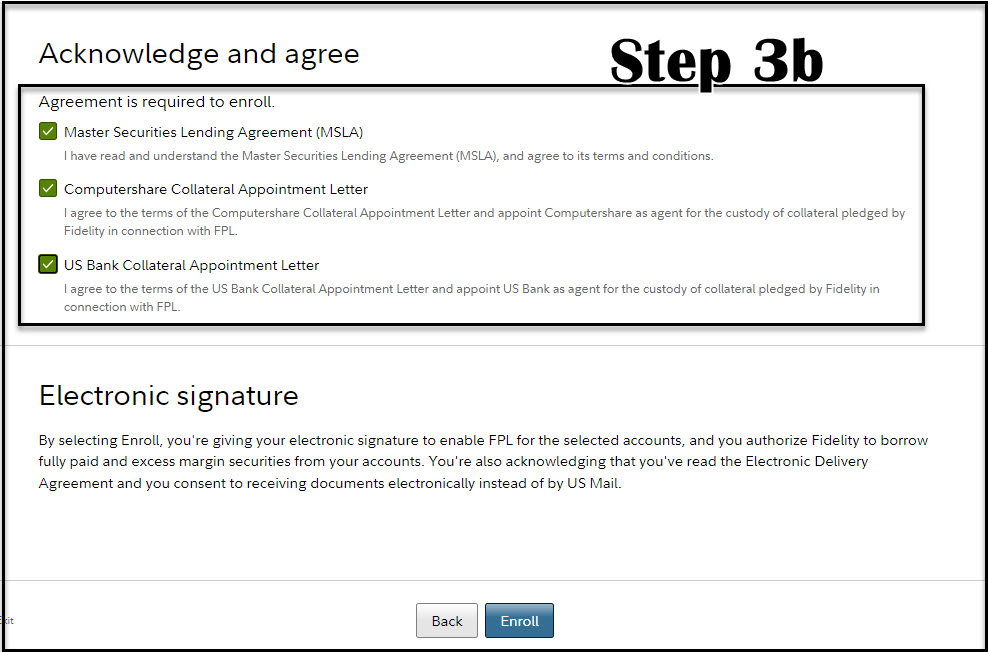

Step Three: Agreement to Terms and Conditions

This is likely the most daunting step. There are four PDFs to download and reading them would take quite a bit of time. I’ve learned over the years that this is usually a waste of time. I skimmed them and decided they were written by a lawyer who is nervous. Therefore, I clicked to select all of the agreements and clicked ENROLL. (This reminds me of the endless chatter for software licenses. I know it is necessary, but I never read those either.)

Step Four: Confirmation

This screen told me that “You are All Set!” It showed which accounts were included. Note you can contact Fidelity to exclude some holdings from the loan program, if you so desire. Here is the text from this image if you want something that is easier to read:

What to expect next

- Please notify Fidelity (fullypaidlending@fmr.com) if there are any particular holdings (e.g., your company stock) that are not eligible for lending or you would otherwise like to exclude from lending.

- View shares on loan, current rates, market values, and collateral from your Positions page. A trade confirm will be sent to you whenever there’s any lending activity on your account.

- On a monthly basis, your lending income will be credited to your account on the evening of the third business day of the following month. You’ll receive a separate fully paid lending statement, which is also available under Account Records.

- All eligible securities in your account (now or in the future) will be considered for borrowing based on demand in the lending market. Enrollment in the program does not guarantee that any securities will be borrowed.

Cindie’s Positions

Cindie has positions in two accounts that are eligible for the FPLP program. These screen images show those positions.

Next FPLP Post

As I mentioned at the beginning of this update, SAVA shares were loaned. In the next post in this series I will share some screen images that show what this looks like in the Positions Page on Fidelity.