How? Using the Fully Paid Lending Program FPLP

For about a year, or perhaps more, I have seen a message on the positions page about their “Fully Paid Lending Program.” When I first explored it, I decided it was too complicated, so I ignored it. Recently I decided to stretch my wings a bit to see if there was an opportunity I was missing. This is the first post of a couple I plan to write about this topic. Some of what I am quoting comes from the PDF you can download from this LINK. Any text that is in italics is a quote from the PDF.

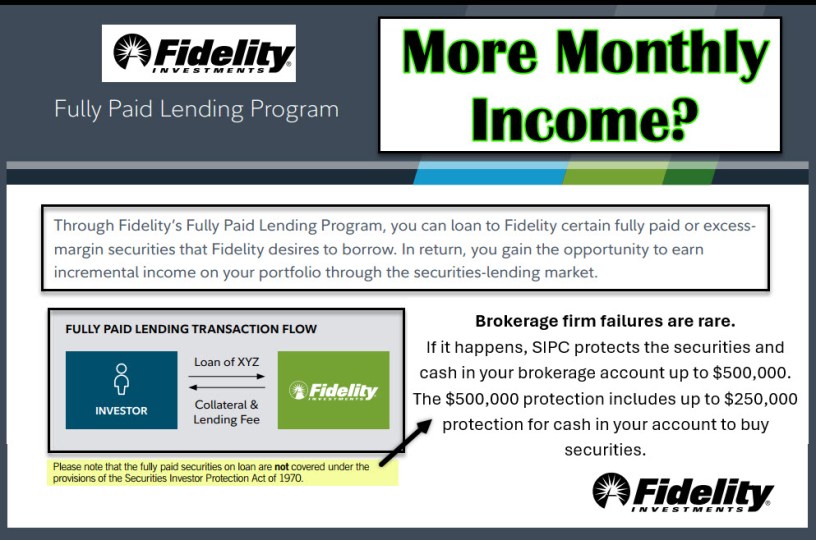

“Through Fidelity’s Fully Paid Lending Program, you can loan to Fidelity certain fully paid or excess-margin securities that Fidelity desires to borrow. In return, you gain the opportunity to earn incremental income on your portfolio through the securities-lending market.” – Fidelity

The lending of your shares carries some risk, but after reading the risk factors, I believe they are of minimal consequence. However, all investors should understand the risk before they participate.

The FPLP has Basic Guidelines

First of all, not everyone can participate. Furthermore, even if you are eligible and complete the enrollment process, there is no guarantee that you will get income from the program. However, once it is set up, it seems like an easy way to get some income on autopilot.

• You must execute a Master Securities Lending Agreement (MSLA) with Fidelity. The MSLA governs all loan transactions and gives Fidelity the right to borrow fully paid and excess-margin securities from your account. It is a separate agreement from any previously executed margin agreement, and the borrowing of securities under the MSLA is a separate process from rehypothecation within a margin account.

• Only securities that have been fully paid for or that are in excess of any margin debit are eligible.

• Certain eligibility requirements may apply. Please contact an investment representative for more information.

• You maintain full economic ownership of the securities on loan and may sell the securities or recall the loan at any time.

• In the event of a default by Fidelity, you will have the right to withdraw the collateral from the custodial bank in the manner described in the agreements.

• Fidelity is not obligated to borrow securities at any time and enrollment in the program does not guarantee that your securities will be borrowed. – Fidelity

What Are The Risks with the FPLP?

If Fidelity were to fail, you have collateral provided by Fidelity at a custodian bank. This can be a pain in the neck, so you might want to be selective about the stocks you include in the lending program.

• The principal risk in any securities-lending transaction is counterparty default. Fidelity is your counterparty on all fully paid lending transactions. If Fidelity were to default on its obligations as defined in the MSLA, you would have the right to withdraw the collateral from the custodian bank in the manner described in the Collateral Administration Agreements.

• Please note that the collateral delivered to you may be your only source of satisfaction in the event that Fidelity fails to return the securities to you. In the event that you make a withdrawal request, the bank will transfer an amount equal to your current collateral amount (or such lesser amount as you may have requested) to your specified delivery instructions. If you were to choose to use the collateral proceeds to repurchase securities, this would be considered a new purchase and, potentially, a taxable event.

• Additionally, fully paid securities on loan are not covered under the provisions of the Securities Investor Protection Act of 1970. (See this LINK.)

• Similar to your remedies against Fidelity in the event of default, Fidelity maintains the right to liquidate a securities lending transaction as a result of certain credit and or default scenarios specified under FINRA Regulation. – Fidelity

Do I Get My Dividends?

Yes, you will still get dividends for securities on loan. However, there is reason to be cautious. In the case of my trial run, there are only three holdings that qualify in Cindie’s ROTH IRA and traditional IRA accounts. They are MAIN, ABR, and SAVA. This means, of course, that ETFs like VYM, DGRO, SCHD and DTD are not candidates. SAVA doesn’t pay a dividend, but MAIN and ABR do.

The problem some might face has to do with income taxes. The best way to avoid that problem is to only select IRA and ROTH IRA accounts during the setup process. Therefore, Cindie’s brokerage account was not selected.

Here is Fidelity’s statement: “Cash distributions paid on securities borrowed by Fidelity pursuant to the Fully Paid Lending Program will be credited to your Fidelity Account in the form of a “cash-in-lieu” payment if shares are borrowed over a dividend record date. Receipt of cash-in-lieu payments may have different taxable consequences than receipt of the actual dividends from the issuer.” – Fidelity

Do Other Brokers Do This?

Yes, they do. If you are interested in learning more, then visit the Schwab, Vanguard, and eTrade links here.

Next FPLP Post

You may be wondering how long it took to get Cindie set up with the FPLP program. I did it methodically after reviewing the risks. The actual mechanics of the enrollment were completed in about 30 minutes. I will show the steps in my next post on this topic.