Expiration Dates

Many things in life come with an expiration date. Term life insurance contracts expire unless you die before the expiration date. Food often has a “freshness date” that is essentially alerting the consumer for the safety of the food. Most medications I have seen have an expiration date, after which the prescription probably should not be used.

In the world of options, however, an expiration date can be a reminder that it is time to make more money from your shares. This week my covered call options for ABBV, BGS, QRVO, MPW, and GEN all expired. Although I could have rolled any of them, creating some additional income, I would prefer to revisit each position next week and see if it makes sense to try to sell covered call options on any or all of them.

Example is ABBV Income

On August 13 I sold nine contracts for the 900 shares in my ROTH IRA at a price of $0.65 per share. I earned $585 of instant income from that transaction, less the commission and fees of $6.11, leaving me with real income of $578.89. That income was earned with about ten minutes of work.

The contract specified that I wanted $195/share, and ABBV closed on Friday at $193.90. Because it was less than the contract share price, I get to keep my shares, and I keep the $578.89. Furthermore, because there are weekly options on ABBV shares, I can create a new contract next week for up to 900 shares.

Also, because the Ex-Dividend date for the ABBV shares is 07/15/2024, I received a total of $1,395 in dividends for my 900 shares. That makes my total August income from ABBV $1,973.89. If the trade makes sense next week, my August income from ABBV can easily exceed $2K.

How Did I Create My Contract in Ten Minutes?

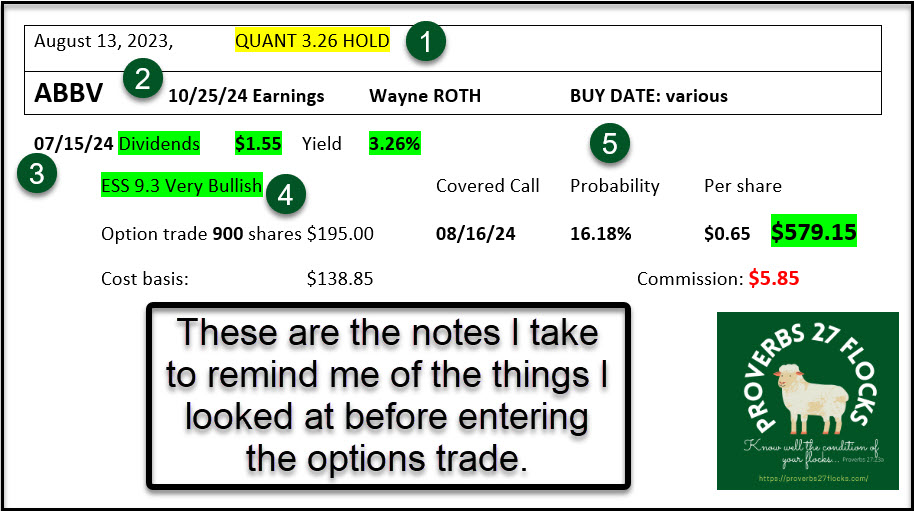

On August 13 I looked at five data points using Seeking Alpha and Fidelity’s Active Trader Pro. On Seeking Alpha I looked at the QUANT rating (1). It was 3.26 (HOLD). I then looked at the earnings date (2) (10/25/24) to make certain it was not within the timeframe the contract would be open.

I then looked at the Ex-Dividend Date (3) (07/15/24) to make certain it was not in the current week. Finally, I looked at the Equity Summary Score on Fidelity and it was 9.3 (4), which is very bullish.

The “hard” part is deciding on the contract price. I selected $195 because ATP told me that the probability of the contract price hitting $195 was 16.18% (5). It is best, based on my experience, to keep the probability below 20%. If it isn’t, it makes sense to pick a higher contract price, like $197.50 or $200.00 to get the probability of having my shares called away less likely.

Exploring a Third Way to Get Monthly Income Using “FPL”

Fidelity, like many brokers, offers the possibility of earning income by lending your stocks to get monthly income. This is called “Fully Paid Lending.” In a future post I hope to share my experience with FPL with three positions: SAVA, GAIN, and ABR. The downside is that not every stock is of value in FPL program and there is no guarantee of income.