Do You Have Healthy Investments?

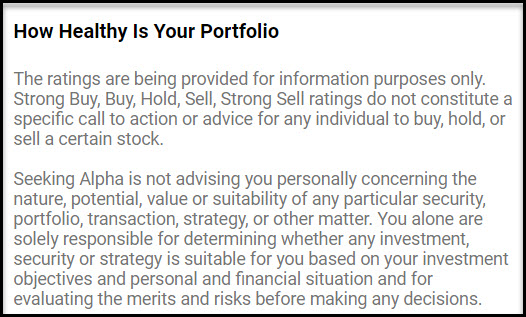

One of the first things I do when I help evaluate someone’s investment portfolio is to look at the quality of their investment portfolio. The best way to do this is to upload the ticker symbols to Seeking Alpha as a new portfolio. Then, by selecting that portfolio, it is possible to click on the “Health Score.” In general, I want to see the arrow pointing to the green and I want to examine any investments that are coded as “Sell” or “Strong Sell.”

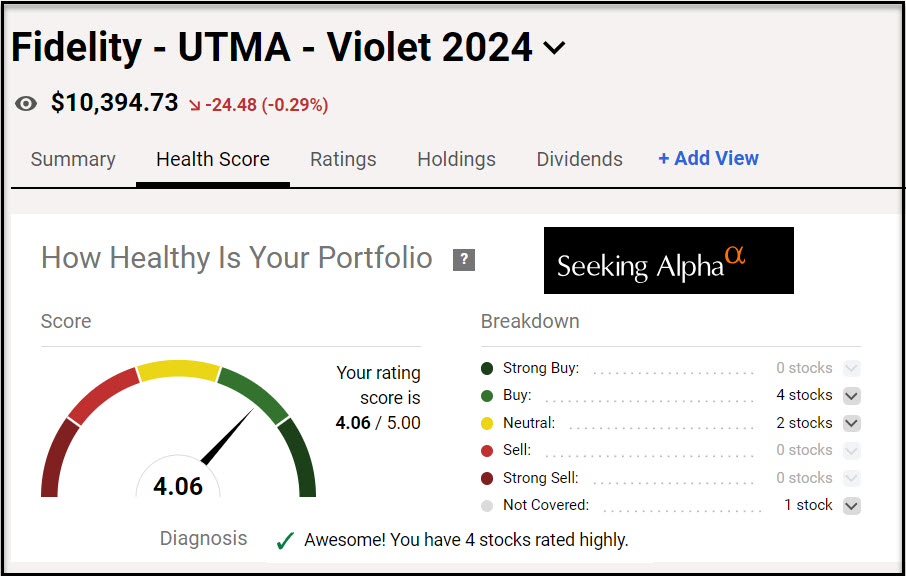

UTMA Accounts

I hope it isn’t surprising that I care about the health of our grandchildren. But I also care about the quality of the investments I have purchased for them in the UTMA accounts. (UTMA is Uniform Transfer to Minors Act) Here is a sample of just one of the six.

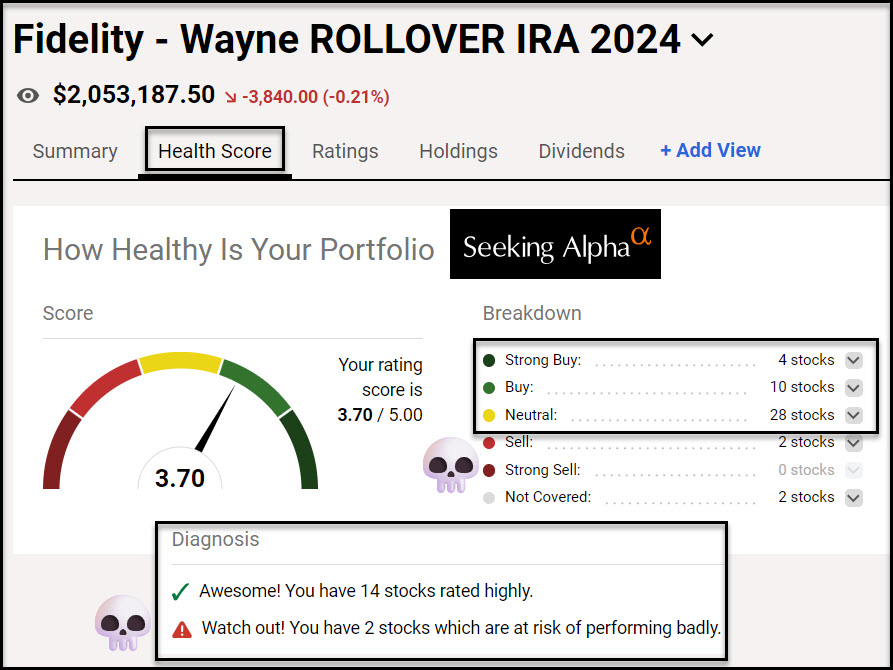

Our Portfolio Health Samples

The largest account we own at Fidelity is my traditional IRA account. The health of this account is also important to me. I can quickly spot two investments which are probably questionable, even though they seemed likely to perform when I purchased them: MPW and CLF. However, the vast majority of my holdings are in great shape.

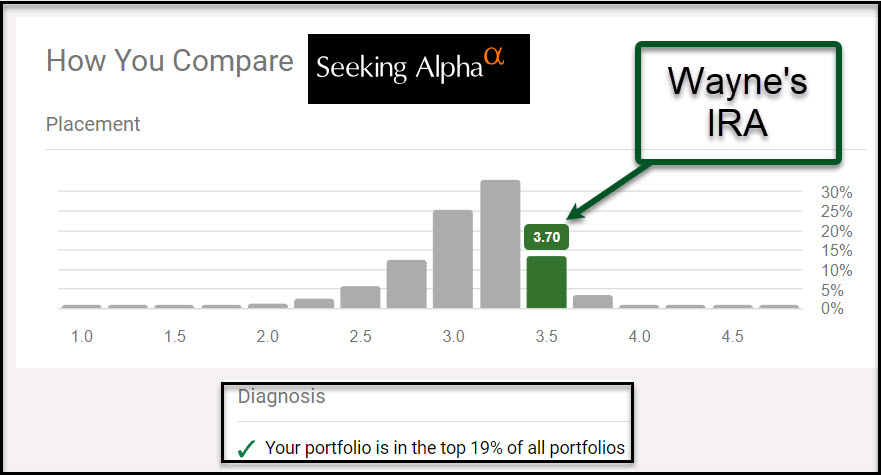

How Do I Compare With Other Seeking Alpha Users?

My traditional IRA is not in the top ten, but that is OK. I have a slightly different set of goals from other investors, including less of a focus on growth at age 73 and more of a desire for income.

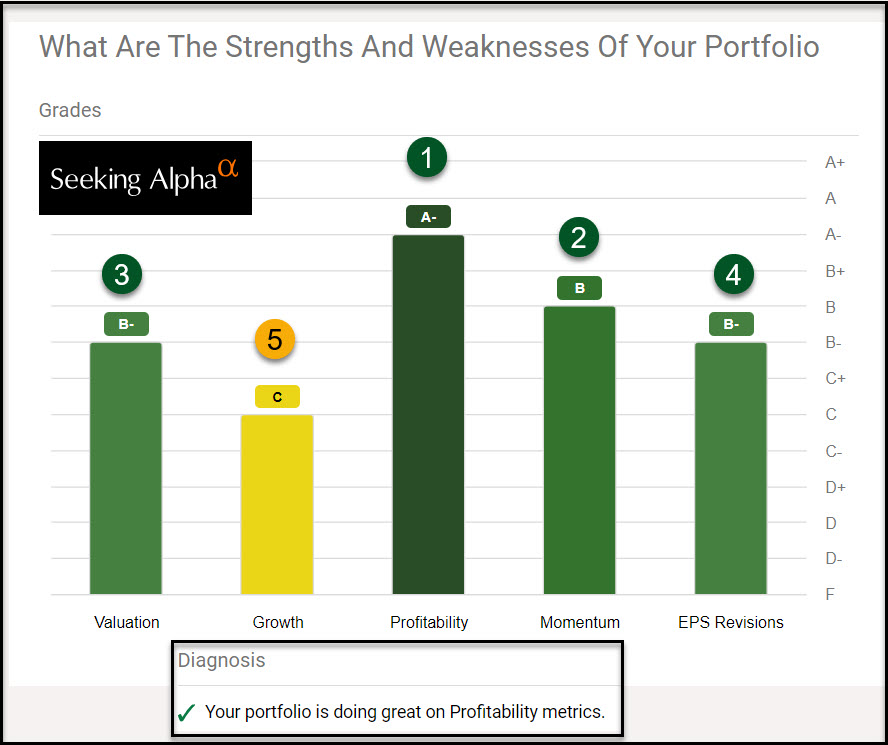

Where Am I Strong?

When I buy investments, my primary concern is profitability. Momentum is a good thing, but the market can be fickle. I do want “Earnings Per Share Revisions” to be positive. This means that the future is likely to be bright for these investments. As far as growth is concerned, I don’t rate very highly. However, dividend stocks and dividend growth ETFs are not designed to be high growth investments. If you want high growth, then you probably want to buy the top ten investments in the S&P 500. That introduces considerably more risk to your portfolio.

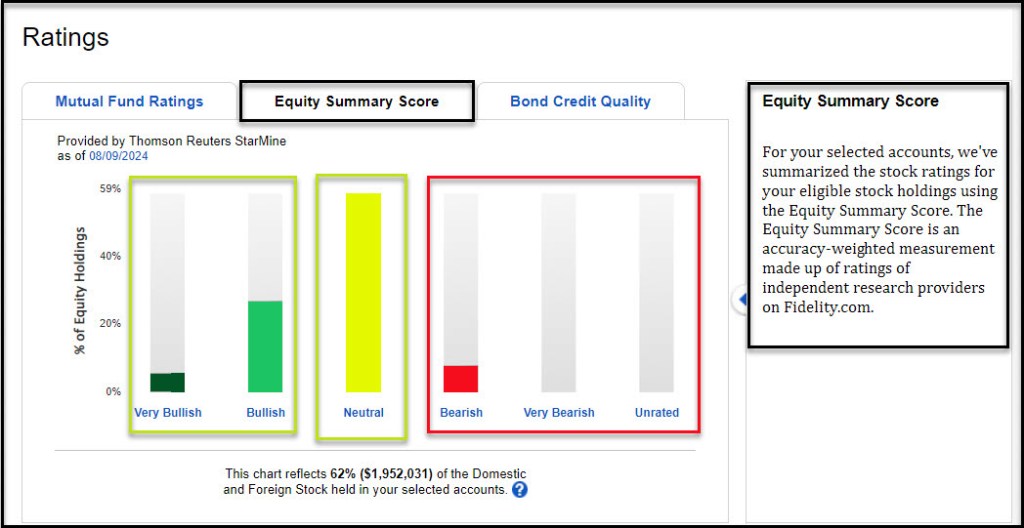

Fidelity Equity Summary Score View

Fidelity has a similar tool, but it is no where near as robust. I color-coded the screen capture to show what it looks like for my traditional IRA.

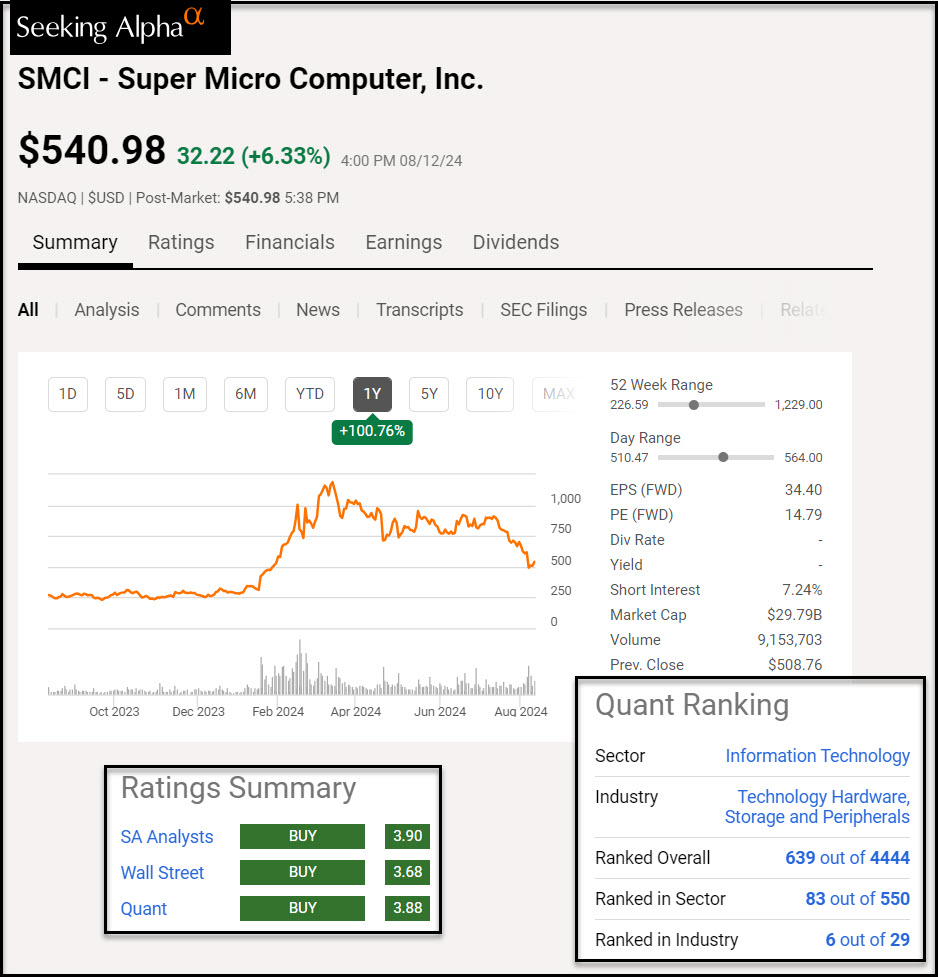

Comparing Fidelity with Seeking Alpha

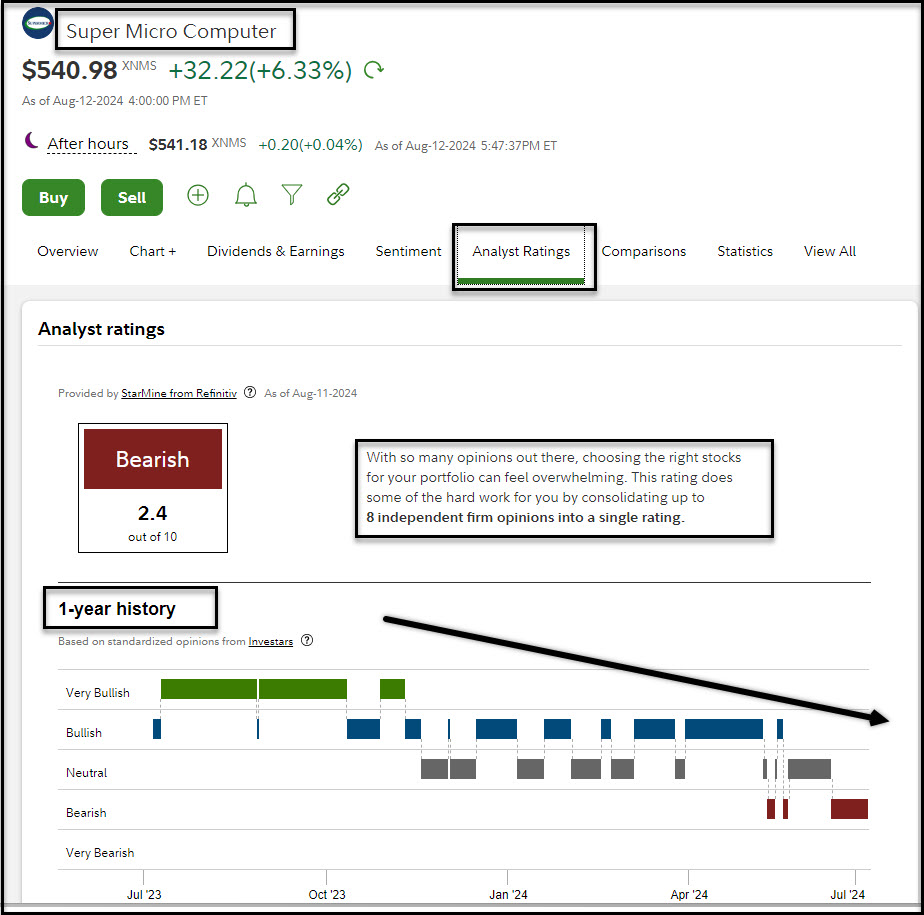

When I compare one of my holdings, SMCI, using both tools, I come away with a different story and a different perspective. I won’t go into the details, but I think Seeking Alpha’s story is the best one, but it does introduce some additional risk. I think Fidelity’s analysts have a much shorter timeframe in mind. That is behaving like a day trader.

Do You Need Help?

If you don’t know the health of your investments, I can help. The easiest way to do this is for you to send me your ticker symbols, separated by commas. If, for example, you have AAPL, VYM, SPX, DGRO, IBM, F, and MAIN in your portfolio, you would email me this string:

AAPL, VYM, SPX, DGRO, IBM, F, MAIN,

I will do my best to give you some screen shots and some comments from my perspective.