Current Interest Rates Are Meaningful

When interest rates are high, it makes sense to convert your emergency fund from a checking or savings account to short-term CDs. During 2024 I increased our Certificate of Deposit holdings so that we now have $125,000 invested in short-term CDs. I generally think long-term CDs are a bad idea, but I have one $10K CD that is paying 4.8% until 2026. The majority of the CDs are for 1-3 month durations.

Fidelity Investments Fixed Income Analysis

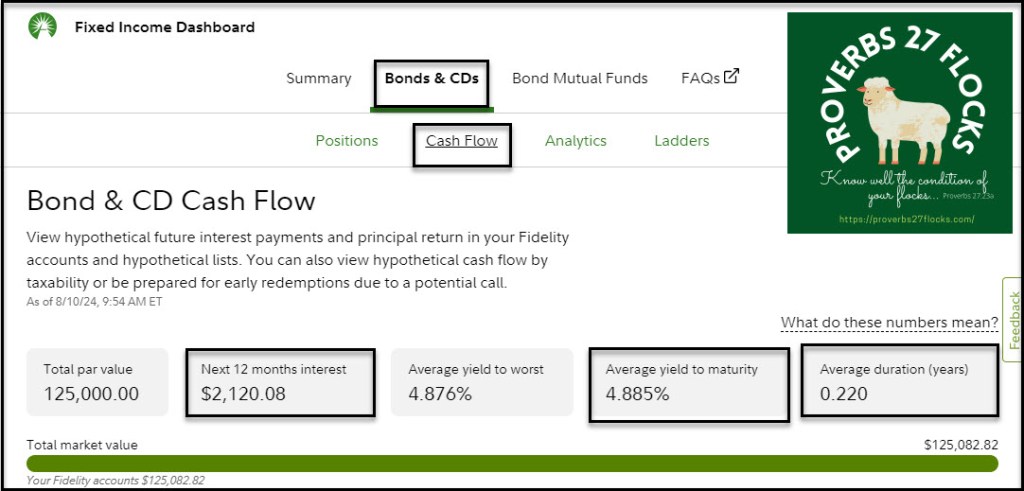

Fidelity has a tool that makes it easier to see the nature of your CD and bond holdings. In this series of images, you can see the types of information you can get from using this tool. Wise investors want to know when they will be receiving interest and when they can expect to have their principal returned.

Cash Flow

It is helpful to see cash flow from a chart perspective and a big-picture numbers perspective. These two images from Fidelity’s tool help me do that. As you can see from the chart, the majority of our CDs mature in 2024, so over $75K of the principal deposit to the money market account before the end of the year. A little over $25K will mature in early 2025, and the remaining $10K matures in 2026.

The table shows the numbers. I can expect $2,120 in CD interest in the next twelve months. The average yield of these investments is slightly less than 4.9% and the average duration is .22 years, or in normal language, a couple of months. Notice that the current market value of the CDs is greater than $125K, but not enough to sell the CDs.

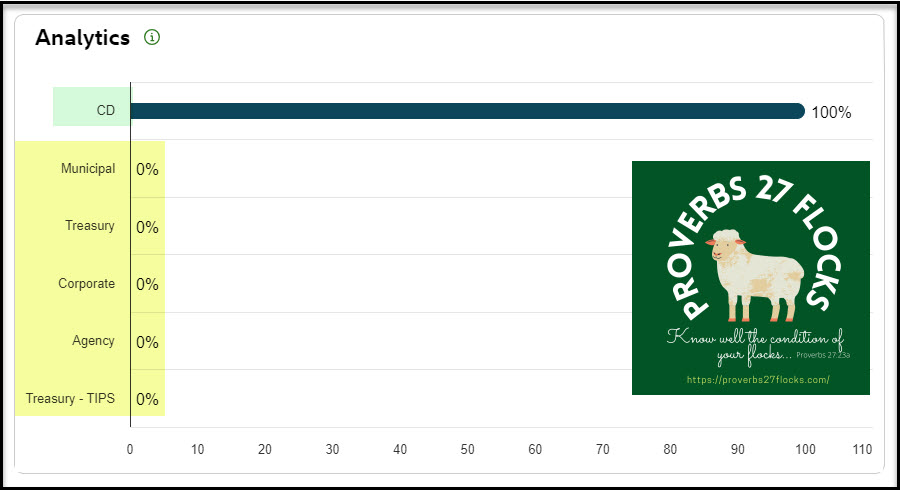

Fixed Income Analytics

I am a bond skeptic. By that I mean that I don’t see much value in holding bonds in a long-term portfolio. Inflation eats away at bonds and recent history has proven bonds to be less safe than they have been in the past. Therefore, the Fidelity Fixed Income Tool shows that I do not own Municipal bonds, Treasury bonds, Corporate Bonds or Agency Bonds.

FDIC Concentration

If you have large CD holdings, you want to be careful to spread them out over several banks. The reason is simple: the FDIC insurance doesn’t cover all savings, so you need to be thoughtful about this if you decide to convert all of your assets to CDs.

According to the FDIC, “The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. When calculating an individual’s coverage amount, the FDIC adds together all of the deposit accounts you hold in the same ownership category at the same bank regardless of the deposit type (e.g., Certificates of Deposit (CDs), checking, savings, or money market deposit accounts (MMDAs)).” Source: FDIC

Our CD investments certainly fall far below the $250K limit, and I doubt I would ever have more than $150K in CDs at one time in any event.

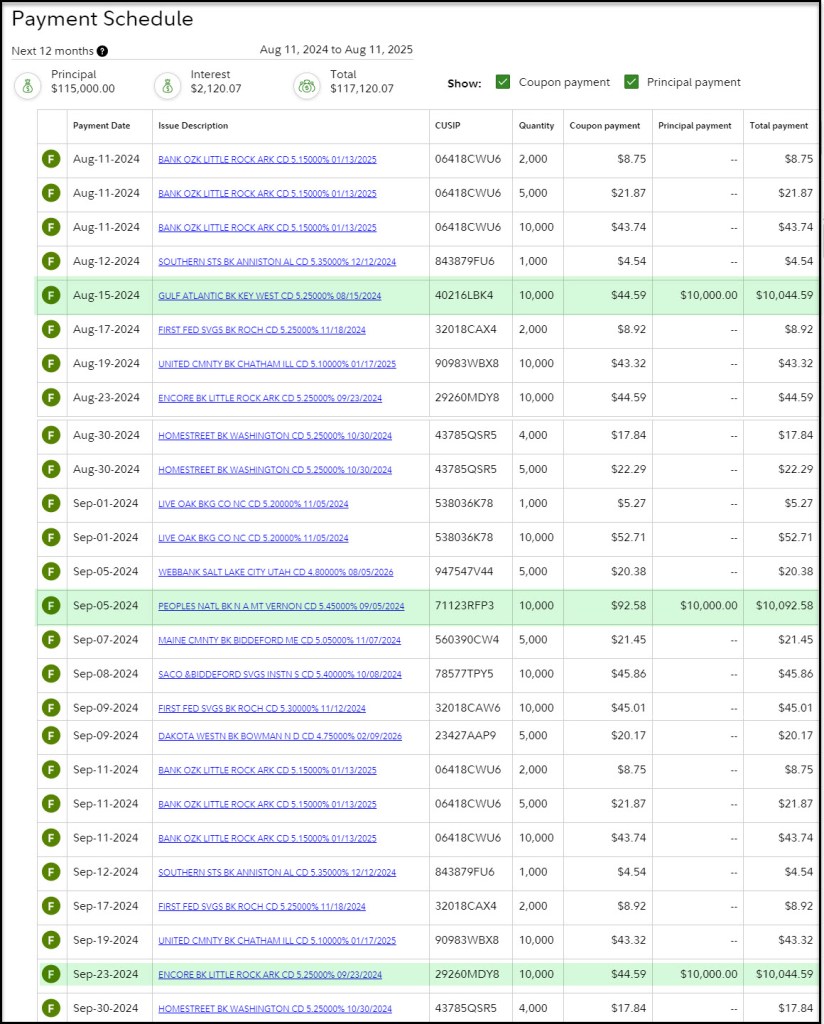

Payment Schedule – Show me the Money

Most of the CDs I purchase pay monthly interest. While it is certainly OK to buy CDs that pay at the CD maturity, I like to see the income flowing into our accounts each month. This image shows when both the interest and the return of principal will occur through the end of September. This shows me that $30K will be returning to our SPAXX Money Market holdings in August and September. I can then decide if I want to purchase replacement CDs, buy other investments, or just hold the cash for RMDs or charitable giving.

Where to Find This Information

On the “All Accounts” page, select the “More” tab and then select “Analysis.” Within the “Analysis” section, click on “Fixed Income Analysis” and from the drop down menu select “Fixed Income Analysis Tool.”

You should then see a page that says, “Welcome to your Fixed Income Dashboard.” “This tool can help you manage your cash flow, create consistent streams of income, and get insight on the composition of your holdings.”

Proverbs 27:23-24 says, “Know well the condition of your flocks, and give attention to your herds, for riches do not last forever; and does a crown endure to all generations?” CDs are part of the overall herds and flocks in our investment portfolio. I know the condition of those sheep and cattle.

All scripture passages are from the English Standard Version except as otherwise noted.