Rolling a Covered Call Option

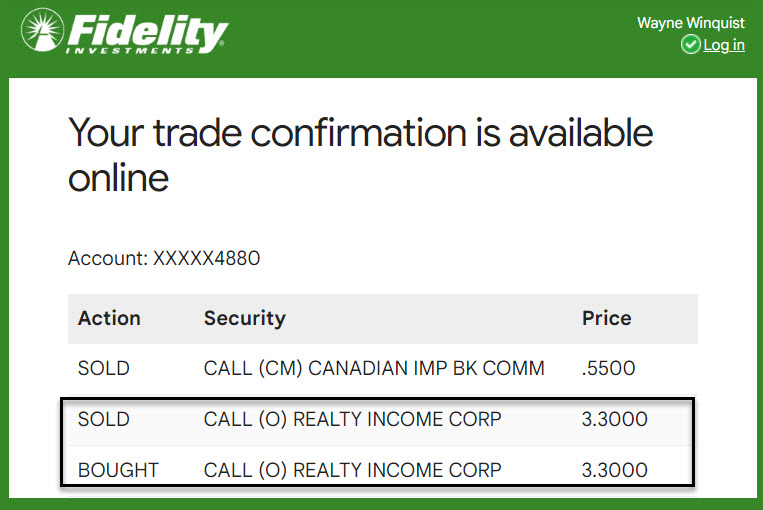

Sometimes the share price increase can surprise you after you sell a covered call options contract. When this happens, don’t despair. More often than not, it is possible to buy back your contract and sell a replacement at a higher contracted share price with a more distant expiration date. On August 7 I sold a covered call for a Canadian bank and rolled a covered call for Realty Income.

Example: Realty Income (Ticker: O)

I recently decided it would be acceptable to sell some of our Realty Income shares. We currently own 1,200 shares across six Fidelity accounts. I sold a covered call options contract on the 500 shares in my traditional IRA with a price of $57.50 to expire on August 16, 2024. Since that time, the shares have bounced up to over $60 per share. It seemed highly likely that my shares would be called away.

For a Few Dollars I can Roll Up to $60

The cost to roll my Realty Income shares up to a higher contract price was $6.81. This was a small price to pay for this pair of options trades. When you roll an option contract, you are buying a closing transaction to remove your obligation for the covered call option you created by selling a covered call. My five covered call contracts for “O” shares were set at a price of $57.50 to expire on August 16, 2024 (-O240816C57.5).

To close the contract I had to pay -$1,653.38. This seems painful, but if you know that the share price of O is over $60.00, there was a strong possibility that my shares would be called away in a couple of weeks. I would receive $57.50 x 500 shares or $28,750 for my shares if they were called away. But there is a feature in Fidelity’s Active Trader Pro to “ROLL” an option. This can be used for CALLS or PUTS. This issues both a buy call order and a sell call order that, if executed, happen simultaneously.

The Roll Was Completed

Because I rolled the contract to a new one that expires December 20, 2024, a couple of things happened. First, I received $1,646.57 (slightly less than what my close of the $57.50 contract cost) for the new contract with a higher contract price of $60 per share (-O241220C60.) If my shares are called away in December, I will receive $30,000 instead of the $28,750. In addition, because O pays a monthly dividend, I will continue to receive dividends through the end of November.

Note: -O241220C60 is interpreted as follows: “O” is the ticker symbol for Realty income; 241220 is the YYMMDD contract expiration date; C is “CALL” and “60” is $60.00.

Realty Income Dividends – It Pays to Wait

The monthly dividend is $0.26, so each month I receive $130 in dividends from my 500 shares. So the total cost of $6.81 is a small price to pay to extend my covered call option contract from August to December.

The Ex-Dividend date for O is 08/01/2024. O’s Ex-Dividend date is usually at the end of the month or early in the new month. This means that I will receive at least four more dividend payments from my 500 shares.

Why Sell a “Good” Investment?

You may be asking, “Why sell your shares at $60 per share? One reason is that the 52-week share price is between $45.04 and $61.60. There is a strong possibility that the price of the O shares will drop. So even though the Seeking Alpha QUANT rating for O shares is currently 4.05 (BUY), that can change from month-to-month.

There is another thing to remember. Let’s say that as December approaches the price of O shares rises to $62 per share. At that point I could do a similar roll trade to buy out the $60 contract and replace it with a contract for $62.50 that expires some future date in 2025.

Additional Easy Income from Canadian Imperial Bank

I have done repeated covered call contracts for my shares of CM (Canadian Imperial Bank of Commerce.) The shares closed yesterday at $49.61. The contract I entered was a covered call to sell my 1,000 shares (10 contracts) for $52.50 per share. The ticker symbol for my trade was -CM240920C52.5. If the share price is $52.50 or greater on September 20, 2024, my shares will be called away. I received $543.21 for the ten contracts, or about $54 per contract.

Bear in mind that I can also evaluate a roll of my covered call for the CM shares when the contract date approaches. I do this evaluation every time an option contract is coming due if the price per share at the time I do the evaluation is greater than the original covered call contract price.

If the share price remains below the contract price, I just let the contract expire. Then, if I want to, I can enter a new covered call option trade.

Easy Income Comes in Two Flavors: Vanilla and Chocolate

Easy income is really a vanilla and chocolate dessert. The easiest, vanilla way to generate income is by investing in dividend growth ETFs and stocks. The second way is chocolate: it is not difficult to master. is to sell covered call options for immediate income.