When the Market is Crazy

The last couple of weeks have created heartburn for investors, especially for those who have been heavily invested in the top ten investments in the stock market. When the market corrects or becomes bearish, the pain can be dramatic and disheartening. It pays to keep things in perspective.

There are a couple of ways to do this. First of all, focus on things that really matter. This includes taking care of and spending time with family. It also can include enjoying the blessings that God has given, including good food and the wonder of God’s magnificent creation. If you wondered where I have been, the answer includes Big Sky Montana, Rapid City South Dakota, Yellowstone National Park, and Mount Rushmore.

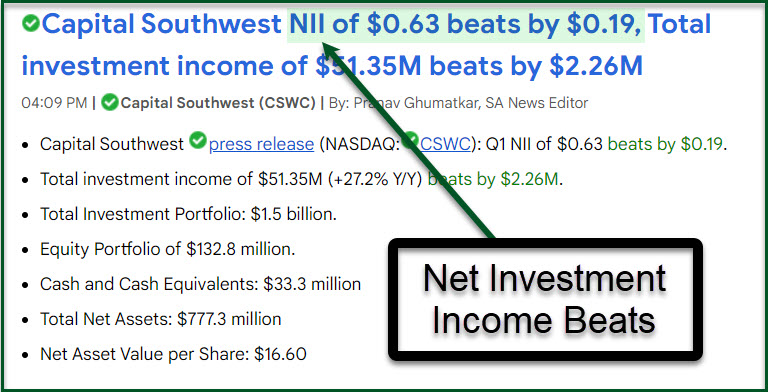

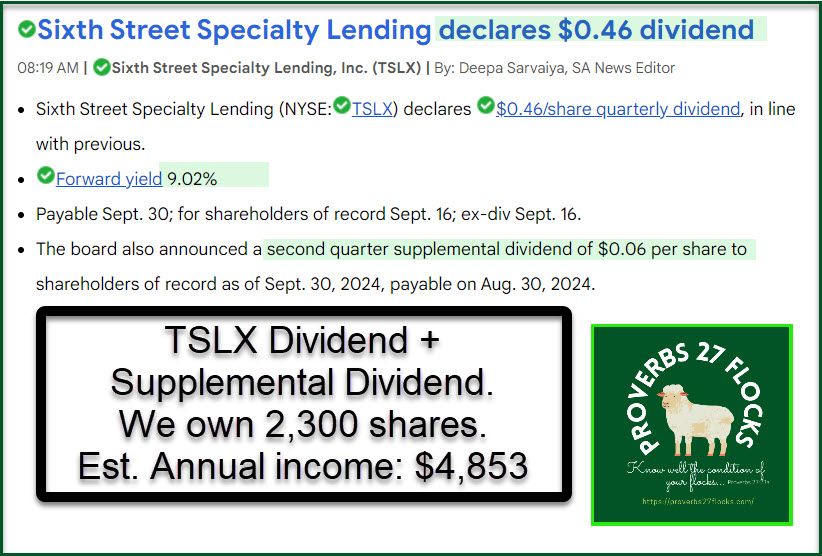

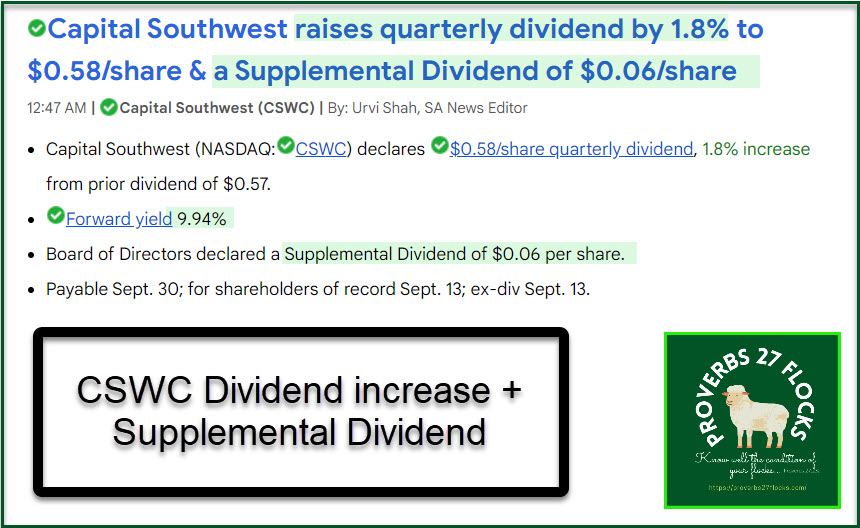

The other thing wise dividend growth investors can do when the market is petulant is focus on incoming dividends. The current price of our shares of CSWC, PNNT, MAIN, TSLX, and CGBD are of less importance to me than the dividend income. In the case of the recent announcements for these financial investments, the news is good. It included a dividend increase, several supplemental dividends, and the reminder of monthly dividends from MAIN and PNNT.

Montana and South Dakota and Options Trading

During our time in Big Sky Montana, we enjoyed a luxurious cabin with three bedrooms, a fireplace, a hot tub, and a relaxing living area. We also drove to Yellowstone to see Old Faithful and eat ice cream. Ribeye steaks were cooked on the cabin’s grill, and Cindie made some wonderful desserts with help from her grandnieces. I can tell you I did add some pounds to my tummy. Cindie and I also stopped in Rapid City SD on our way home and visited Mount Rushmore. There was ice cream there too!

Options Training and Trading

In addition to spending time with our nephews and their daughters, I was able to help one of our nephews get started with trading covered call options and cash covered put options. It was fun to see him learn and then to hear that he is applying what he learned on his own.

Although I usually don’t try to do much investing while traveling, because I was helping our nephew I did enter some options trades. The total income from those trades was about $1,425. Entering those trades took me less than an hour of time. During the time I was with our nephew, I showed him how to use Fidelity’s Active Trader Pro to research the options for holdings in his account and how to enter options trades.

Options trading, believe it or not, is very easy income. YTD, I have earned $46,384 in options trades. To put that in perspective, through the end of July our total dividend income stands at $98,295. That is certainly easier than options trading, but no where near as hard as most people think.

Easy Income Dividends for CSWC, PNNT, MAIN, TSLX, and CGBD

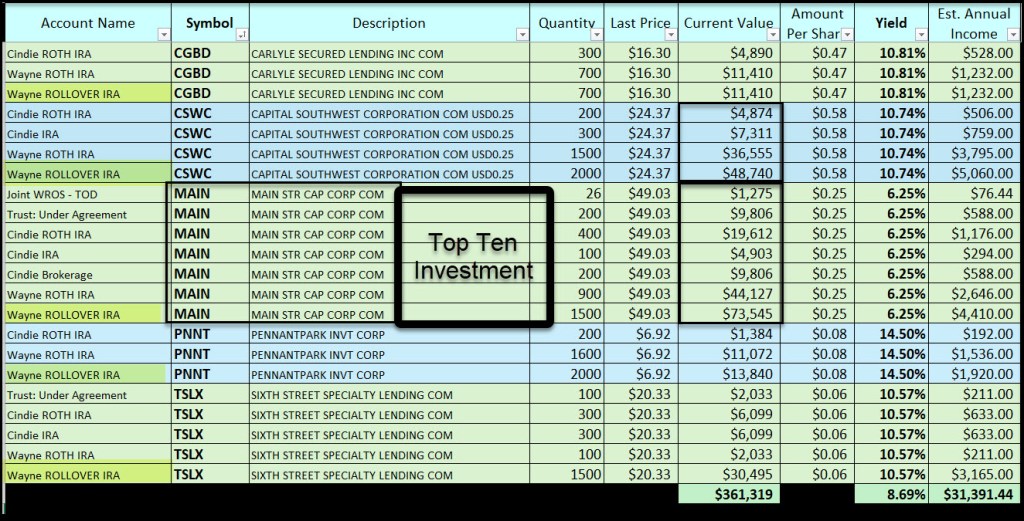

MAIN continues to be one of our top ten positions, with a current total value of about $163K. CSWC is also a large holding, with about $97K in total assets. The interesting thing about the five that announced dividends this week is that they are on track to provide $32K in dividends in 2024. Those dollars require zero effort as they come automatically every month or every quarter. $12,455 of that income is tax-free, because it is dividend income within our ROTH IRAs.

These five financial stocks have an average yield of 8.69% based on the current prices of the shares. There may be more safety in CD’s, but holding financial stocks, including BDC’s, is a good way to gain additional income in retirement. This gallery helps tell the story.

Full Disclosure

The following image shows all of our positions of these five holdings across all of our accounts.