AVGO Shares Will Split

Broadcom (AVGO) has long been a holding in my traditional IRA. At one point I held 300 shares. Because this skewed the total value of this investment well above my 5% limit, I sold 200 shares and now only hold 100. I also have an open covered call option on the 100 shares, so it is highly likely that those shares will be called away on or before December 19, 2025.

However, AVGO has a 10-for-1 stock split that will expand Broadcom’s 2.9B shares to 29B shares. The split will happen June 12. The split will occur after the markets close on Friday, July 12. Therefore, I will have 1,000 shares of AVGO, post-split. That also means I will have ten covered call options contracts on those shares.

What I Did Yesterday

Knowledgeable investors know that a stock split does not increase or decrease the value of an investment. If you have AVGO shares worth $1,740 per share on June 12, your new ten shares will be worth $174 per share. The value has not changed. However, some investors get excited about splits, so it can make sense to buy a quality company pre-split. Therefore, yesterday I purchased ten more shares of AVGO for $1,759.97 per share, or a total investment of $17,599.70. On Monday, those shares will appear as 100 shares, each worth around $176 per share. I can, therefore, sell the shares if they rise in value, or I can sell a covered call option on the shares.

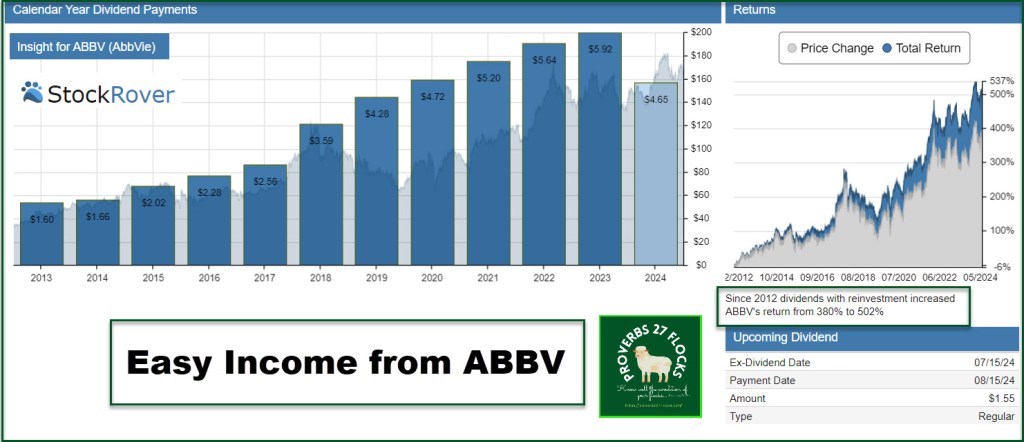

Another Purchase Yesterday: ABBV

I also purchased another 50 shares of AbbVie Inc. (ABBV) in my traditional IRA. I paid $166.60 per share for the addition, bringing my total IRA shares to 200. This makes it possible for me to sell two covered call options on the shares, as each 100 shares is required for an options contract.

I also hold 700 shares of ABBV in my ROTH IRA, and the reason is simple. The dividend yield is 3.69% and the five-year dividend growth rate is 8.34%. ABBV has been paying growing dividends for ten years. The next Ex-Dividend Date is Monday, 07/15/2024. Therefore, the $ 1.55 per share dividend will translate into $1,395 of cash for the 900 shares on August 15.

Covered Call Trades

Cindie and I will be traveling to Montana to spend some time in Big Sky and at Yellowstone Park. The cost for the luxury cabin might cause sticker shock for some. It was $3,805.98. However, we will save quite a bit by cooking our meals in the cabin. Furthermore, I was able to complete some covered call options trades on my QRVO, STX, and SWKS shares yesterday. The net income from those trades was $2,887.67. Therefore, all but about $900 of the cost of the Big Sky cabin is covered by income I earned in about 30 minutes of options trading activity.

CD Purchases

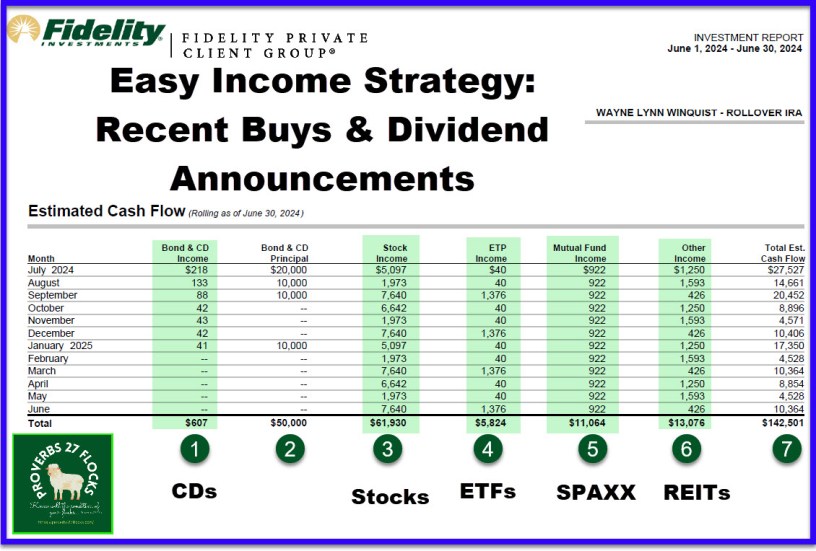

I continue to buy short-term CDs that have brought our total CD holdings to $103K. I expect the Federal Reserve to start lowering interest rates before the end of the year. None of the CDs I purchased yields less than 5%, so the annualized income for these is quite attractive. Most of them pay monthly interest.

Dividend Announcements

Two of our holdings announced their monthly dividends this week as well.

STAG Industrial declared a $0.1233 dividend that is paid monthly. STAG is a REIT that yields about 4%. There were three announcements: Payable Aug. 15; for shareholders of record July 31; ex-div July 31. Payable Sep. 16; for shareholders of record Aug 30; ex-div Aug 30. Payable Oct 15; for shareholders of record Sep 30; ex-div Sep 30. Cindie and I hold a total of 1,500 shares of STAG.

In addition, GAIN is one of the BDC investments we own. GAIN: Gladstone Investment declared an $0.08 dividend that is paid monthly. The yield on this investment is about 6.9%, and the three dividends are payable July 31; for shareholders of record July 22; ex-div July 22. Payable Aug 30; for shareholders of record Aug 21; ex-div Aug 21. Payable Sep 30; for shareholders of record Sep 20; ex-div Sep 20.

Other recent dividend announcements of our holdings include PFE and PNNT.

As a result, our total estimated annual income from our investments stands at $ 157,737.48. However, this does not include income from the $103K in CD interest, nor does it include income from my covered call options trades or from any dividend growth I can expect during the last half of the year. That is easy income.

Easy Income Strategy Reminder

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends. Sometimes good news comes in groups, but that is, admittedly, rare. It really depends on the makeup of your investment portfolio. The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market.

Recommendation

If you have less than $200K, I suggest that you focus on dividend growth ETFs like VYM, DGRO, and SCHD. However, adding some BDC and REIT exposure is a good strategy, even if you have less than $100K in your retirement portfolio. You can then add shares as you deposit more funds to your accounts. However, be careful about adding REITs to taxable accounts. It is better to own REITs in traditional or ROTH IRA accounts.