Number Four of Twenty

This is the fourth in my series of posts about Howard Marks’ book THE MOST IMPORTANT THING. Today the topic is “value” with an added dimension. Value is what is probably the true worth of an investment while the price of the investment may be more or less (or the same as) the value.

The prudent investor does not want to pay a price for an investment that is greater than the current or potential future value of the investment. This is the “buy low sell high” component. But this can be difficult to determine, as an investment that is a luxury ocean liner today might become the Titanic tomorrow. But even if it isn’t a Titanic, it can flounder. In a moment I will provide an example of a popular company’s stock. Lasting value does matter.

The Bible Talks About Lasting Value

Wise investors, I believe, think long-term. This means that day-trading and chasing meme stocks is a really bad idea. Jesus also talked about putting stock in things of limited value for a short period of time. Far too many people invest their lives in rust and moth-eaten treasures. The price is high, and the value is low. That is not a good plan.

“Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also.” Matthew 6:19-21

Chapter 4: The Relationship Between Price and Value

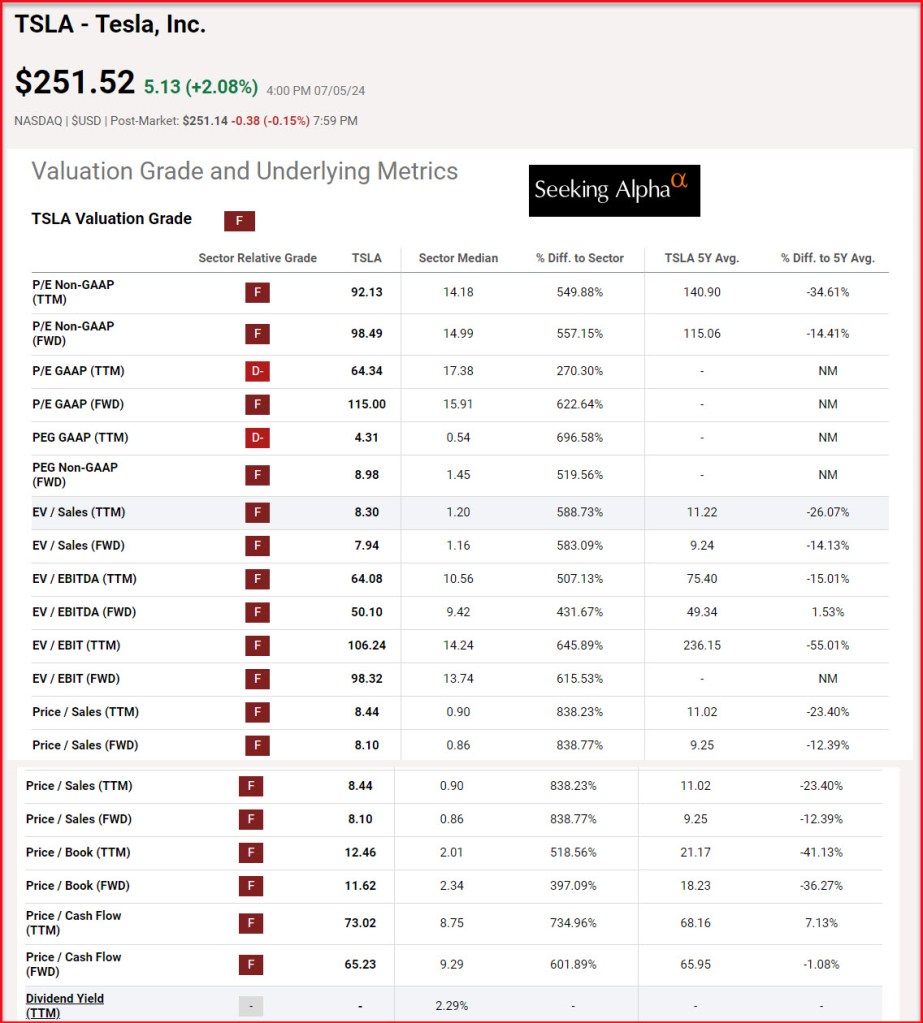

“Investment success doesn’t come from ‘buying good things,’ but rather from ‘buying things well.’” Howard Marks, p.24 This is a wise perspective. Let’s use Tesla as an example.

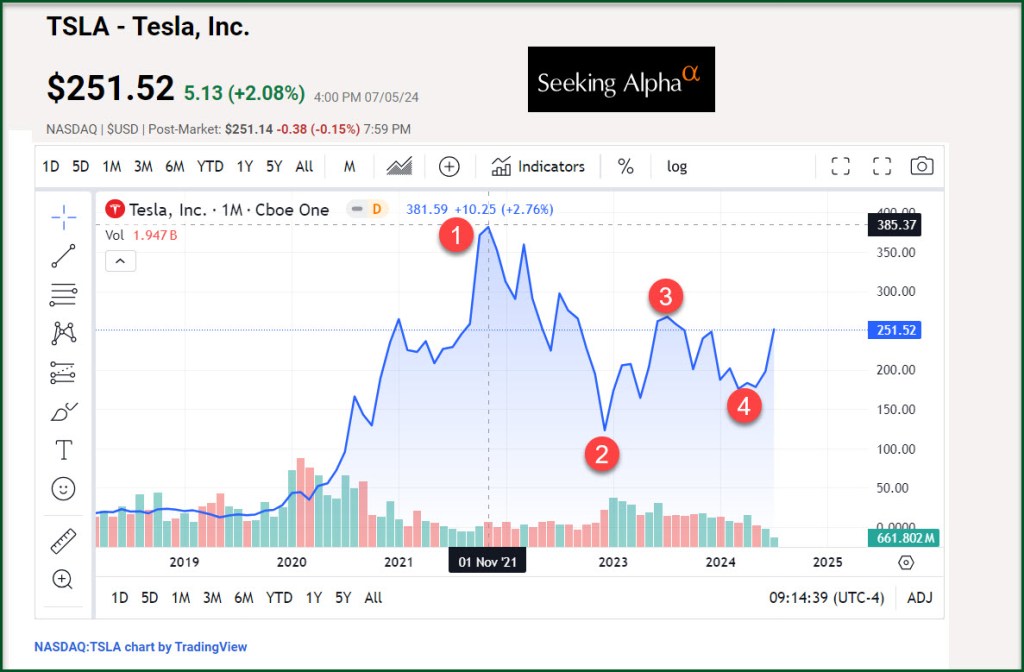

TSLA (Tesla, Inc.) has a ten-year return of 1,597% percent. However, that means you would have had to purchase TSLA at a price under $15 per share. The current share price is $251.52. However, some investors purchased TSLA shares on November 1, 2021 for over $405 per share. I hope they sold quickly before the price dropped to $265 on March 7, 2022. Even if they held their shares until today, they would still be facing a loss if they sold their shares.

The author reminds us that we think about value anytime we make a purchase. If you are purchasing a car, you want to know the value of the car before you agree on a price. The best way to do that is to see what others are willing to pay or have paid for the same type of car. He says, “No asset class or investment has a birthright of a high return. It’s only attractive if it’s priced right.” – The Most Important Thing, p.24.

Cash is King For Buying Opportunities

Cash can come from several sources, but the most common sources are dividends from existing investments or from earnings if you are working. You get to decide what you will do with the cash. However, there is no urgency to invest the cash immediately. Howard Marks also reminds us that, “there’s nothing better than buying from someone who has to sell regardless of price during a crash.” TMIT, p.26. Therefore, don’t feel compelled to always buy an investment as soon as cash is available.

The Popularity Contest

“Investing is a popularity contest, and the most dangerous thing is to buy something at the peak of its popularity. At that point, all favorable facts and opinions are already factored into its price, and no new buyers are left to emerge.” TMIT, p.27 What causes bubbles, like a tech bubble, or a housing bubble? It is caused by infatuation.

Four routes to Investing Profit

I will shorten the author’s text on this point. The first is a rise in an asset’s intrinsic or underlying core value. This is hard to predict and requires a lot of time to research sufficiently. I don’t have time for that type of investing work.

The second is buying investments with leverage or on “margin.” This is a fancy way of saying you borrow money to put to work in an investment, with the hope that you can sell at a profit and return the principle and interest to the lender. I dislike this option as it can really hurt if the investment drops in value.

The third one seems to make sense. You want to sell an asset for more than your asset is worth. But you have to find a greater fool or sell when the market is behaving irrationally. There are many wise investors, and most of them don’t want to overpay for any stock regardless of how attractive that stock might be.

The fourth, and final option is to buy an asset for less than its value. This often requires a bit of work and you have to have the patience for the rest of the market to realize they are missing out. Mr. Marks says this is where we should land. This does require some work, but it can be simplified by buying well-managed ETFs with the discipline to pick assets and then hold onto them. One way to judge this is by examining the five and ten year returns of the ETF, mutual fund, or stock investment.

How Is This Knowledge Useful?

While no one can predict future results, you really don’t want to buy junk. This is where various ratings and rankings come in handy. If you have a choice between one hundred investments all focused on healthcare biotech, you can pick from 498 companies (Seeking Alpha QUANT ratings).

ABBV is QUANT-ranked 107 out of the 498 in that industry category. So why didn’t I pick any of the stocks listed from rankings 1-106? The reasons are simple. ABBV is the only one that pays a dividend, and that dividend is increasing. Furthermore, at least 60 of the top 100 have market caps less than $1B. That means there are a lot of risky choices. One or two might skyrocket, but most will not.

The Next Chapter is Understanding Risk

The fifth “most important thing” is “Understanding Risk.” The author starts the chapter by saying, “risk is inescapable.” (p.31)

All scripture passages are from the English Standard Version except as otherwise noted.