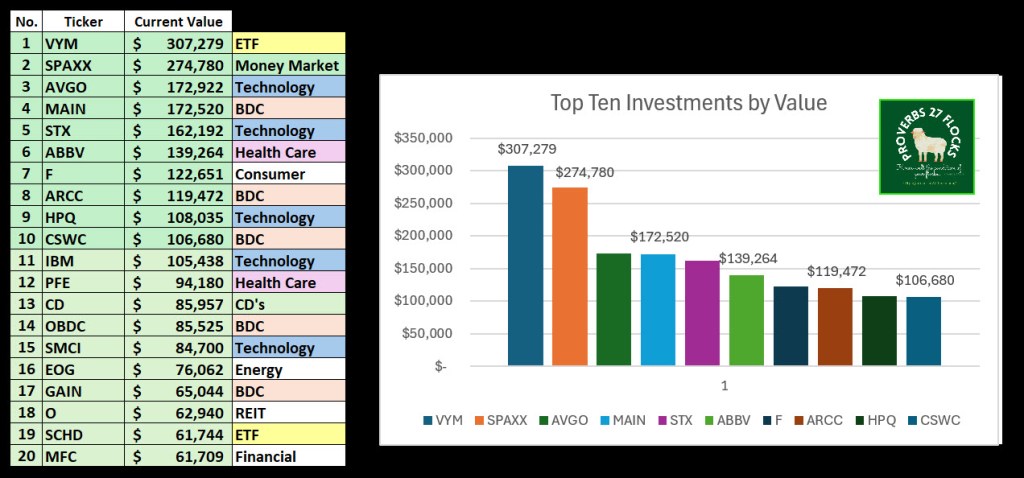

Diversity in Company Size and Sector

One of the things I consider is the nature of each investment I purchase. I prefer to have diversity in the sectors and have a strong preference for the financial (including BDCs), technology, and healthcare sectors. But industries are important as well. As you can see in this Watchlist download from Fidelity, information technology and other sectors are broken down into industries. This includes, Biotechnology, Technology Hardware Storage & Peripherals, Capital Markets, Semiconductors & Semiconductor Equipment, and Automobiles.

What I am not Buying

I would not be adding to AVGO at this time. I’m down to 100 shares after selling 200 shares in recent weeks. I’m also cautiously optimistic about Ford (F), but I have enough shares at the present time.

What I Would Buy

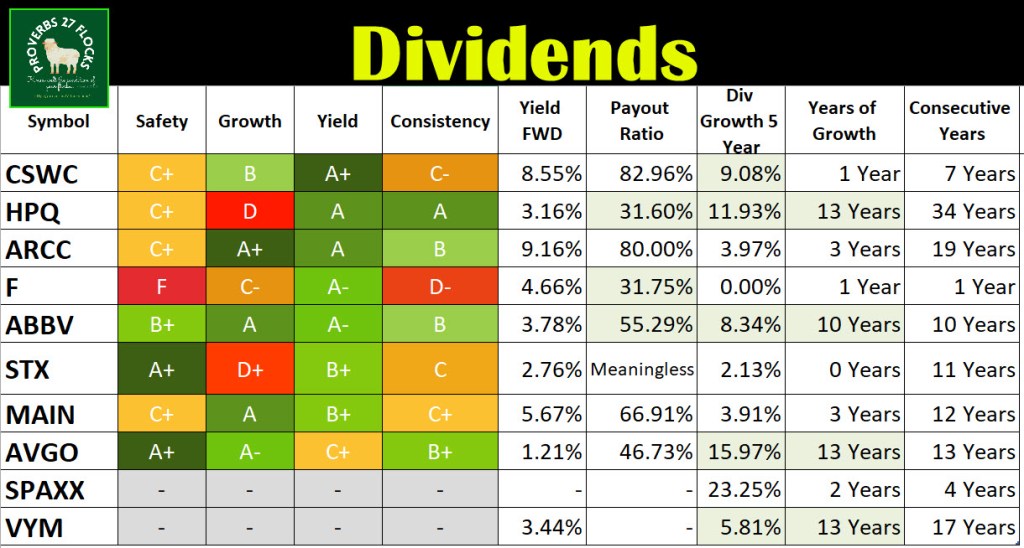

VYM is clearly still on my buy list. However, because it is my largest holding, I would be more prone to add to our SCHD and DGRO holdings. I’m also considering adding more ABBV and HPQ shares. The dividend yield for both is above three percent. More importantly, those two both have a 5-year dividend growth that is highly desirable in an inflationary economy.

Why We Hold SPAXX – FIDELITY GOVERNMENT MONEY MARKET FUND

The current yield on this money market mutual fund is almost five percent. Having a larger allocation of this fund is a good way to have cash available for buying opportunities that arise if one of my positions has a report that sends the shares lower. But this also serves as a pipeline for RMD’s and QCD giving in a way that makes it unnecessary for me to sell other positions if the market gets overly pessimistic.

BDC’s Generously Throw Off Cash

There are three business development companies in our top ten. This would be considered very aggressive by 99% of financial advisors. Part of the reason is that they prefer to have growth investments in their client’s portfolios that are less volatile. In addition, most BDCs are small-cap, medium-cap, or micro-cap investments. When investors get nervous, they tend to flee to either cash or large-cap investments. Because I don’t really care about the share price of a more thinly-traded investment on any given day, I’m more than happy to take the extra dividend yield.

CSWC has a current yield of 8.55%, MAIN pays monthly and yields 5.67% (better than CDs), and ARCC has them both beat with a current yield of 9.16%.

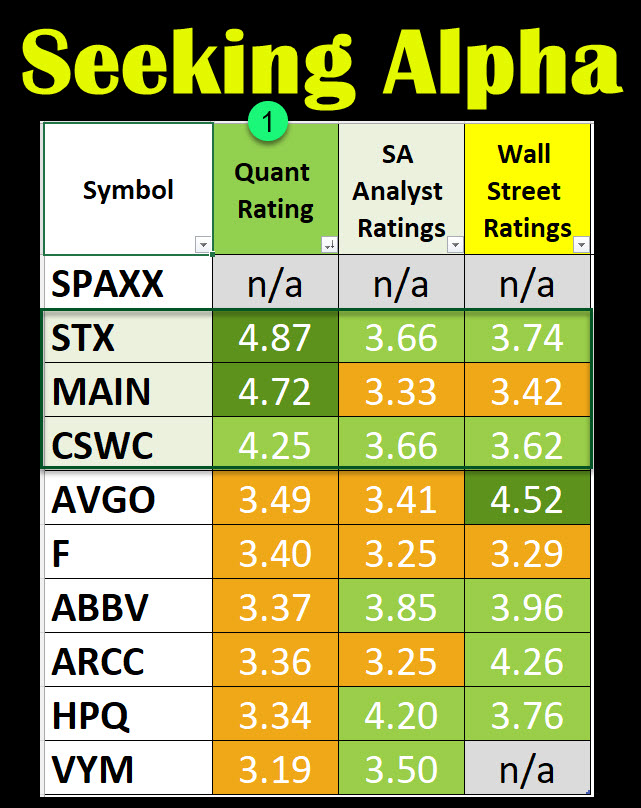

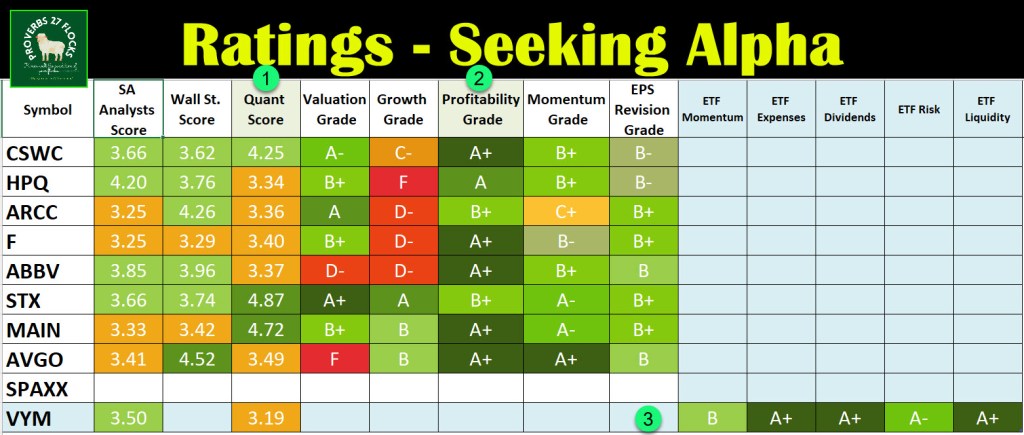

Seeking Alpha QUANT Ratings and Profitability

When buying an investment I always consider the Seeking Alpha QUANT Ratings. I also want to see a strong PROFITABILIY grade, and it helps to have positive MOMENTUM. Momentum is the power of the upward move, or the deterioration caused by falling stock prices. All of our top ten have positive profitability grades of B+ or better. All of them, except ARCC, have momentum grades of B- or better with the exception of ARCC.

VYM’s Seeking Alpha Ratings

One thing you want to have when you buy an ETF is liquidity. The reason is simple. You want to be able to buy and sell investments that have significant trading activity and potential. It is also important to keep expenses low and dividends high. VYM meets all of these requirements with A+ ratings.

Caution for New Investors

Don’t buy these ten just because I like them. Also bear in mind that the overall size of your entire investment portfolio matters, and smaller portfolios should stick to ETFs like SCHD, DGRO, and VYM. Finally, never make any single stock more than five percent of your total dollar investment. So, for example, you should not make ABBV 8% of your portfolio. Even though it is a good company, you don’t want to have a lopsided investment mix.