Bubbles Look Pretty Until They Pop

Warren Buffett apparently said, “I always invest in companies that an idiot could run because one day they will.” What he is saying is you need to carefully examine the company and recognize that all companies are run by individuals who will make mistakes. However, over time a quality company can endure an idiot at the helm. Well, most of the time that is true, but sometimes a scoundrel can cause the collapse of even a good company.

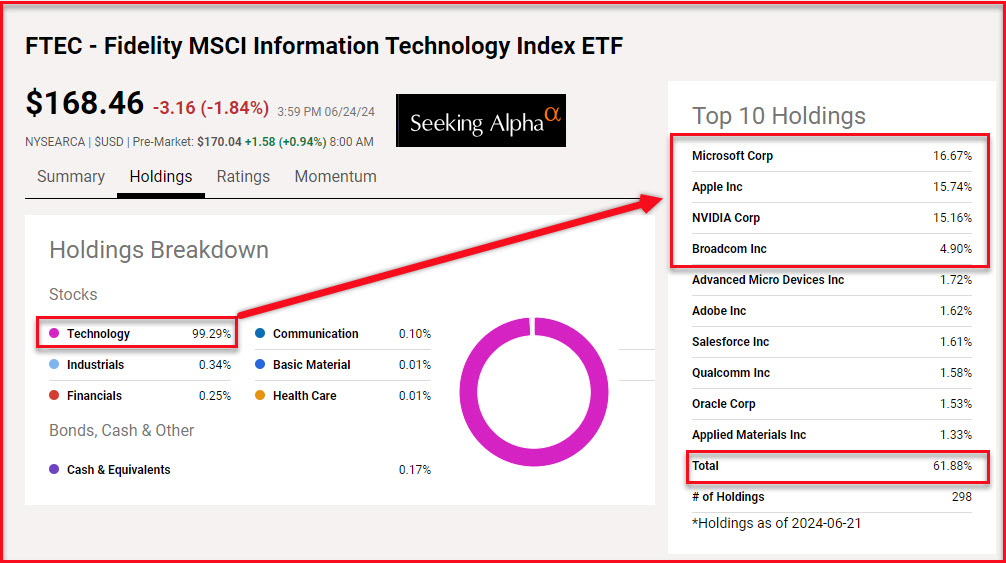

That is why it pays to be rational about investing. I have often suggested using ETF FTEC (Fidelity MSCI Information Technology Index ETF). It has been an excellent investment in our grandchildren’s UTMA accounts. Their shares of FTEC are now up about 360% since I purchased them.

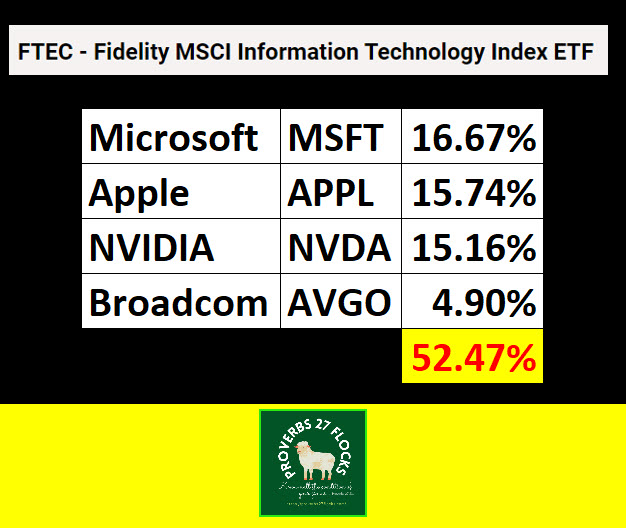

However, I am now very concerned about this ETF. One of the reasons is the reality of the top four investments. Those four are MSFT, AAPL, NVDA, and AVGO. Don’t get me wrong. These are all great businesses that an idiot could run (I hope). But to have an ETF where over fifty percent of the dollars are invested in four companies doesn’t strike me as prudent in diversification.

What I Plan To Do

It is time to liquidate (SELL) the shares of FTEC in the six UTMA accounts. I plan to take the proceeds from the sale of the FTEC shares and buy more diversified ETFs like VYM, SCHD, and/or DGRO.

DGRO, for example, has MSFT, AAPL, and AVGO in their top ten, but the total of the top then investments in DGRO comes to only 27%. VYM only holds AVGO in the top ten investments and the top ten make up only about 24% of the total dollars invested. SCHD doesn’t hold any of the four in its top ten. Rather, the SCHD top ten include Texas Instruments Inc, Amgen Inc, Lockheed Martin Corp, Coca-Cola Co, Pfizer Inc, Chevron Corp, Verizon Communications Inc, PepsiCo Inc, Cisco Systems Inc, and BlackRock Inc. In other words, it is less dependent on technology sector stocks which only make up about 9% of the total invested dollars. No position is more than five percent of the total.

Recommendation

If you own shares of a technology-focused ETF, consider your risk for appetite when there is a potential bubble. Bubbles are often created by greed and euphoria. Ecstasy can be a wonderful thing until it isn’t.

One additional example of a technology tech ETF is VGT. The Vanguard Information Technology Index Fund ETF has similar issues. Be careful. At the very least, consider selling some of your shares before the bubble pops. It might not, but when and if it does it can get ugly.