ETFs Can Provide Capital Growth and Dividend Growth

There are many choices when it comes to investing. As I get older, I am gradually shifting from individual stocks to ETFs that have a history of growing dividends. However, it is also possible to learn something from the ETF managers. For example, it is prudent to examine the top ten holdings of DGRO, SCHD, and VYM. If the fund manager loads up on those stocks, it is likely that they have a very good reason.

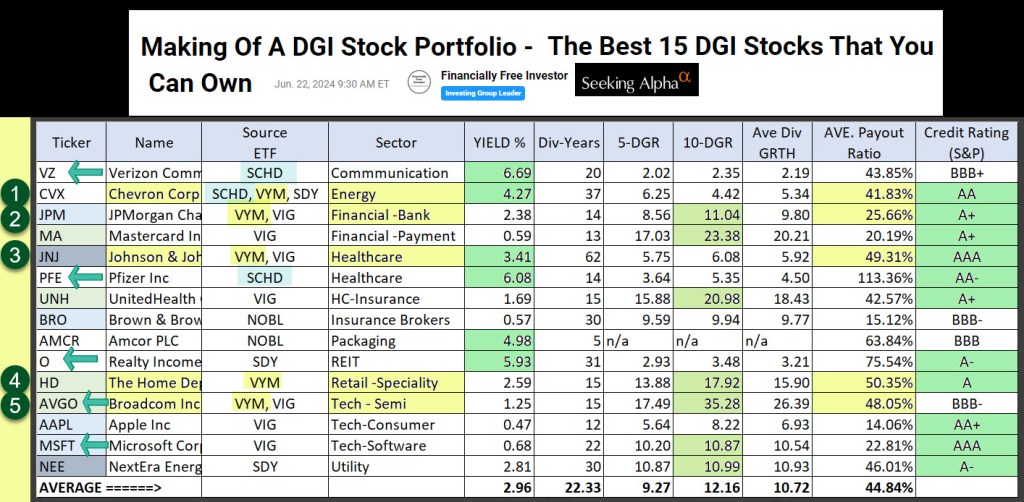

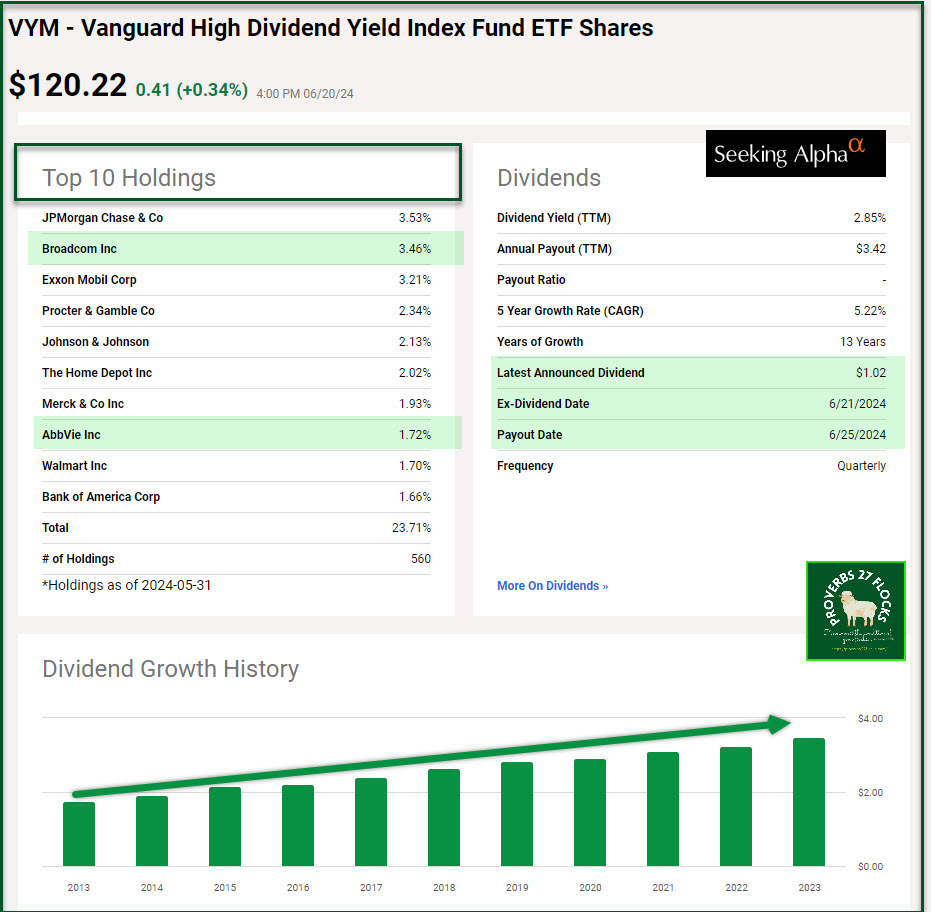

One Seeking Alpha author goes by the handle “Financially Free Investor.” In his article “Making Of A DGI Stock Portfolio – The Best 15 DGI Stocks That You Can Own,” he compared the top ten holdings of five ETFs: Schwab U.S. Dividend Equity ETF (SCHD), Vanguard High Dividend Yield Index ETF (VYM), Vanguard Dividend Appreciation Index ETF (VIG), SPDR S&P Dividend ETF (SDY), and ProShares S&P500 Dividend Aristocrats ETF (NOBL). We own shares of VYM and SCHD.

He looks at some key metrics for the top ten stocks in each ETF including, Dividend Yield %, Average of 5-DGR and 10-DGR (5-year and 10-year div growth rate), Payment Ratio (Average, based on Cash-flow and EPS), Credit Rating (from S&P), and the Number of Years of Dividend Growth. He also removes “duplicates” so that there isn’t too much overlap. For example, both Visa and Mastercard appeared in the analysis of 41 unique stocks, so Visa was removed because “MA had a slight edge in terms of dividend growth.”

Financially Free Investor Results

The following image shows the best DGI (Dividend Growth Income) stocks using his methodology. Of this list, we hold shares of AVGO, MSFT, O, PFE, and VZ. However, our holdings of VZ are small, and I am reducing our stake in AVGO because the price has risen and the yield, therefore, has diminished. I think there are better opportunities. I am tempted by JPM and UNH, but I will do more analysis of those before I buy. It might just be easier to buy more shares of DGRO, SCHD, and VYM.

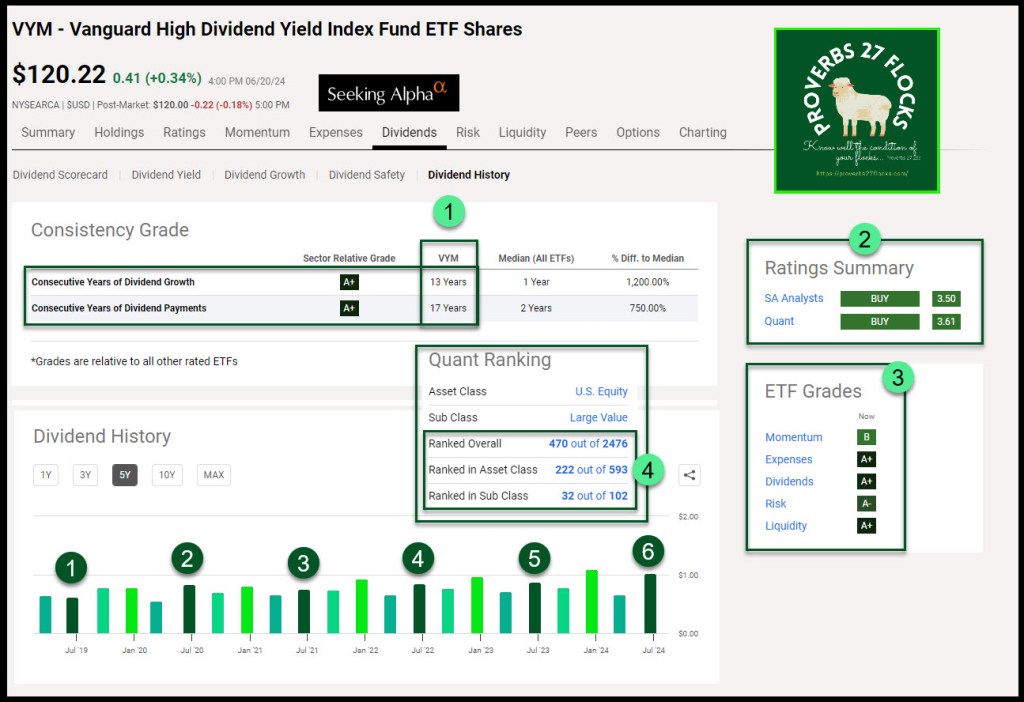

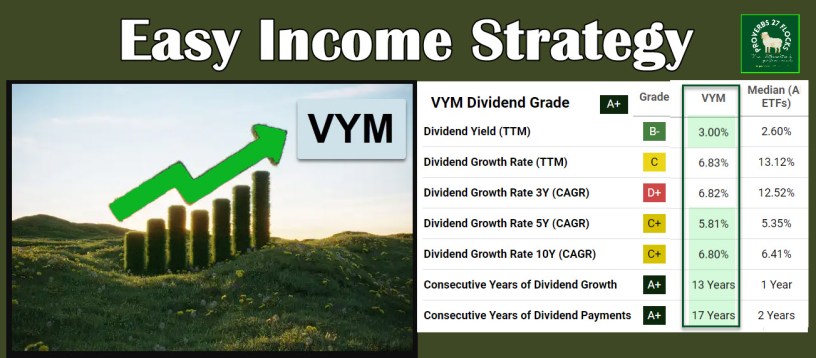

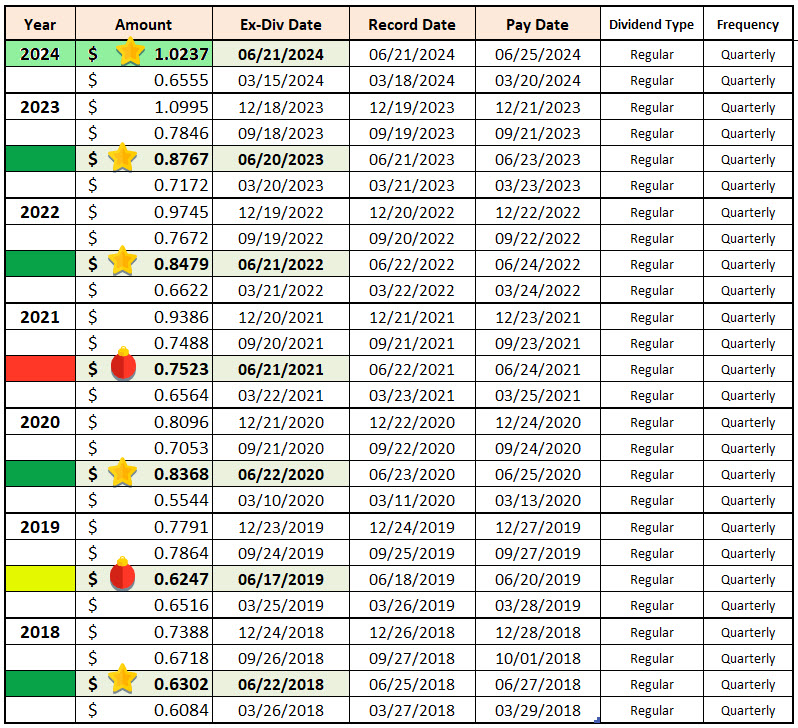

The good news is that VYM announced their next dividend. The new dividend for this quarter is $1.02 per share. This is up from $0.88/share from the same quarter in 2023. As a DGI investor, I would like to see this type of increase on a consistent basis.

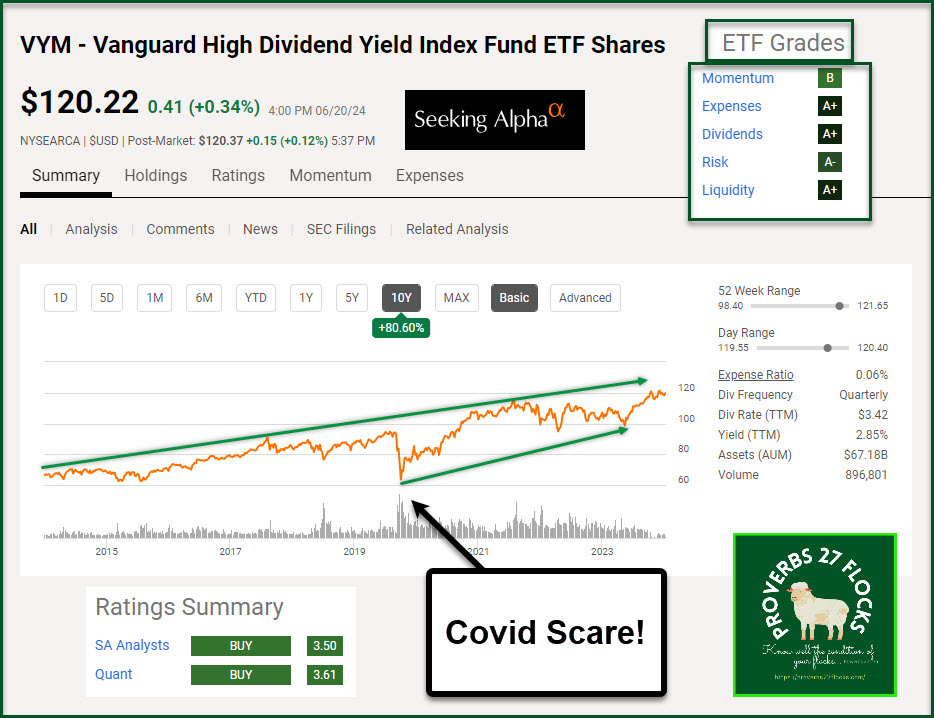

Total Returns Matter

As nice as dividend growth is to counter inflationary pressures on your budget, it is usually wise to also look at total returns. StockRover provides a helpful graph to show VYM’s total returns. I also use Seeking Alpha to see the ten-year returns. Seeking Alpha shows ten year returns of 80.6%, which is about 8.1% on average. While this is not as good as the returns on the S&P 500 (SPY, for example, has ten-year returns of 178.1%, you cannot live off of the dividends of SPY unless you have a huge portfolio. SPY’s yield is only 1.26%.

2018-2024 Comparisons by Quarter

Because the dividend for ETFs typically bounce around, quarter-by-quarter, I recommend comparing comparable quarters. This table from Seeking Alpha shows the second quarter dividend for the last six years plus the current YTD numbers. Before you get too excited about Q2, compare the Q1 results for 2023 and 2024. If you add the numbers for both years, VYM still has a dividend increase, but it isn’t as grand as it might first appear.

Diversification and Other Considerations

The sector allocations make sense to me. First of all, it is not surprising that the sector with the most representation is Financials. Although the Financials sector makes up less than 20% of the S&P 500 companies, Financials tend to deliver better dividends. (SPY is over 33% technology, which increases the risk if there are bubbles in the tech sector.) Consumer Defensive, Industrials, Health Care, Technology, and Energy round out the top six VYM sectors, with all of them essentially the same in percentage of the total.

The other thing to notice is the expense ratio of 0.06%. Vanguard often leads the way for rational expenses. VYM is also a robust fund with good trading activity. The AUM (Assets Under Management) is a very healthy $67B. VYM’s trading volume currently stands at 855,244 shares per day. This means it is easy to buy or sell knowing there are many buyers and sellers.

Easy Income Strategy Reminder

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends. Sometimes good news comes in groups, but that is, admittedly, rare. It really depends on the makeup of your investment portfolio. The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market.

Recommendation

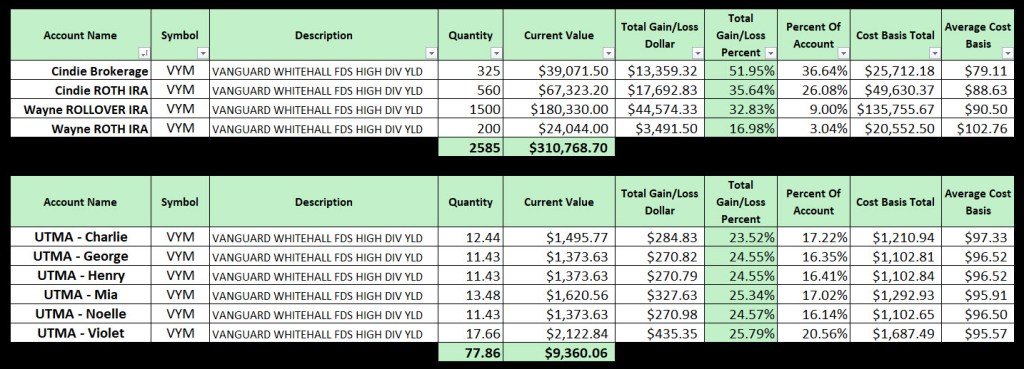

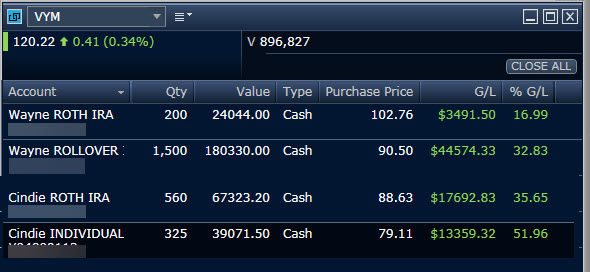

Because Cindie and I have 2,585 shares of VYM, we will receive $2,646.26 in dividends on the pay date of June 25. Our grandchildren also benefit from this dividend, as they each hold shares of VYM as well. I view VYM as a buy and plan to continue to add shares.

VYM Fund Profile

Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. The fund invests in dividend paying stocks of companies. The fund seeks to track the performance of the FTSE High Dividend Yield Index, by using full replication technique. Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF was formed on November 10, 2006 and is domiciled in the United States.

The investment seeks to track the performance of the FTSE High Dividend Yield Index that measures the investment return of common stocks of companies that are characterized by high dividend yield. The manager employs an indexing investment approach designed to track the performance of the index, which consists of common stocks of companies that pay dividends that generally are higher than average. The adviser attempts to replicate the target index by investing all, or substantially all, of the fund’s assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. Benchmark: FTSE High Dividend Yield TR USD