When To Buy a ROTH IRA Investment

In some recent posts (November 2023), I talked about taxes related to ROTH conversions. One was titled, “Taxes: Reevaluating My ROTH Conversion Strategy – High Taxes Gobble Up Income.” A second one was “Income Taxes: Dividends and the ROTH Conversion Strategy – A Valid Question from a Reader.” One reader, Bill, raised a great question regarding this topic of ROTH conversions in May of this year. He said, “I have written myself some notes to keep myself straight, but I find myself having a hard time trying to figure out what things to convert from my IRA to my Roth. It seems like a simple idea; put the items you think will rise the most in value and put it in your IRA. Well, I can tell you that I have a wonderful batting record of trying some different ways, and usually the best ones are the ones I did not move.”

He then said, “Any suggestions, rules of thumb or some plan would be most helpful.”

An Investment Buying Strategy Example: AbbVie Inc.

This request for suggestions or rules of thumb intrigues me. I plan to write a couple of posts to share my thoughts. First of all, I think the conversion strategy should mirror your rules for buying an investment in the first place. In other words, why move an investment from your traditional IRA to your ROTH if you would not buy the investment today? A conversion is like a new buy, with a new cost basis.

For example, I have a cost basis of $163.02 for 150 shares of ABBV in my traditional IRA. I purchased 100 shares of ABBV on April 18, 2024, for $167.25 per share, and another 50 shares on May 30, 2024, for $154.55 per share. Why did I do this when I already have 700 shares of ABBV in my ROTH IRA?

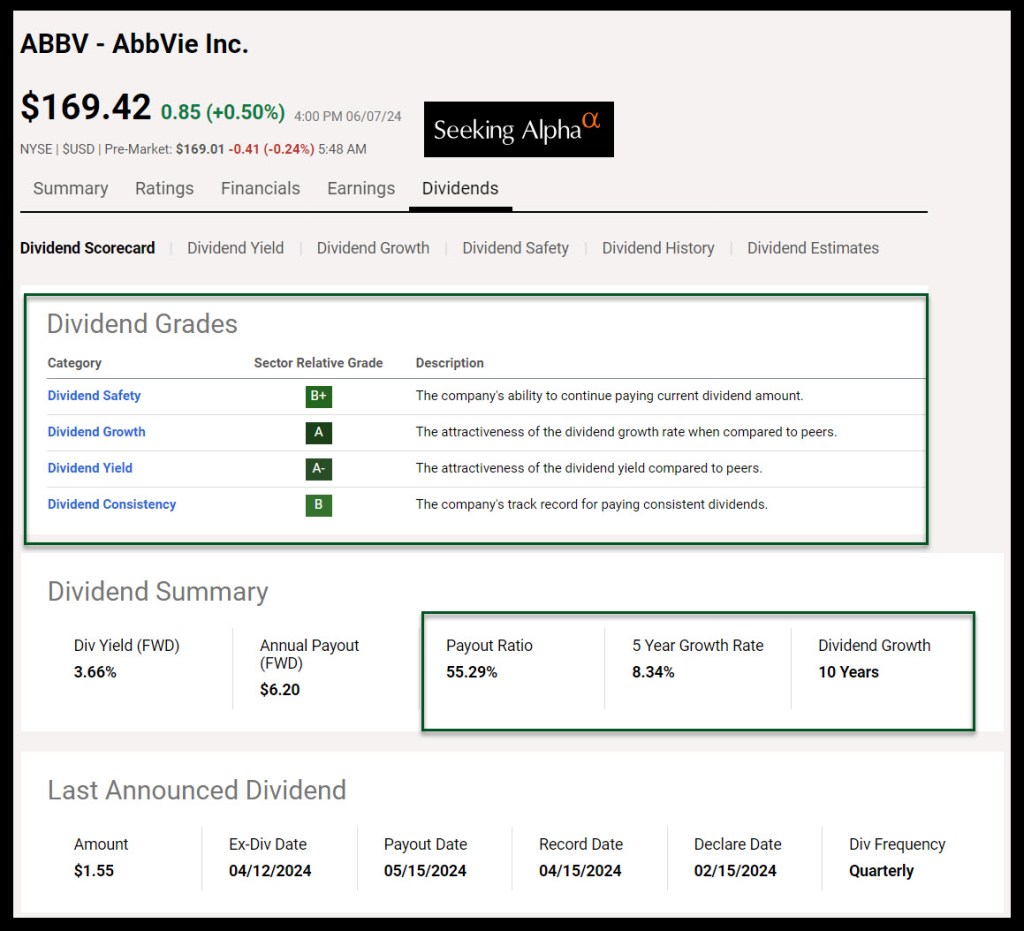

The answer is simple: ABBV is still a “BUY” in my mind based on my written investment buy rules. One of my buy rules is that the investment should have: “a long dividend growth history. Has either a history of increasing dividends or did not reduce dividends during the “Great Recession.” I prefer to see a 5-year annual growth rate of 5% or more for new positions. Increasing dividends for ten or more years is desirable.” ABBV has shown dividend growth for ten years with a five-year increase rate of 8.34%. Furthermore, the dividend payout ratio is a reasonably safe 55.29%.

Seeking Alpha Dividend Scorecard

It is helpful to look at the Seeking Alpha dividend grades when evaluating a buying opportunity. It isn’t the only criterion, but it is a good starting point. In ABBV’s case, the dividend safety grade is B+ (based on the payout ratio), the Dividend Growth grade is A, the Dividend Yield grade is A-, and the Dividend Consistency grade is B. This data point meets my buy criteria from a dividend perspective.

Will I Convert the ABBV Shares?

I don’t know yet, because I want to look at all opportunities in my IRA. However, I did a ROTH conversion of ABBV shares from my traditional IRA to my ROTH IRA on April 18, 2019, of 500 shares. (The other 200 shares were buys I made in my ROTH; they weren’t converted from the traditional IRA.) Since that date, I have received over $14,000 in tax-free dividend income from those 500 shares, plus the 200 I added.

But here is a noteworthy footnote: When I did the conversion in 2019, the market was fearful because of Covid. I was able to convert the shares at a lower tax basis. Converting the 150 shares of ABBV today would be at a higher cost basis. Perhaps I should wait for a day when the market is in a panic.

The Bottom Line

Conversions should be treated like new buys of a position with the understanding that taxes will be paid today on the conversion value of the shares. If I convert today, and the price of the shares at the market’s close is $170, then I have to pay income taxes on $25,500 ($170 x 150 shares). If the shares rise to $185, then doing the conversion at $170 makes sense and all of the capital gains and dividends will be tax free income in the future.

Full Disclosure

Cindie and I own 850 shares of ABBV as a long-term investment. This makes ABBV one of my top ten investments. The shares are currently worth about $144K