Democracy and the Average Voter

Winston Churchill apparently said, “The best argument against democracy is a five-minute conversation with the average voter.” I think he is right. Ignorance of the implications of electing certain ideologies is rife in our culture and (dare I say) every culture. People love politicians who promise something for “free” not realizing that they are enriching the promise giver and oftentimes harming the future of the nation in ways that may not be reversable.

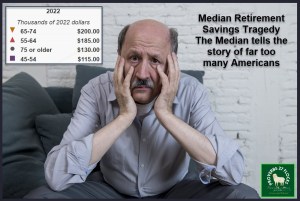

I have found the same to be true in many areas of life. When I ask those I help with their investments, I often ask them if they know about the “Rule of 72.” So far, no one has said, “yes.” There is a profound lack of knowledge about easy concepts like the true cost of debt, dividend yield, the price/earnings ratio, and the difference between an ETF and a mutual fund. They have no idea how expensive a 1.0% expense ratio really is.

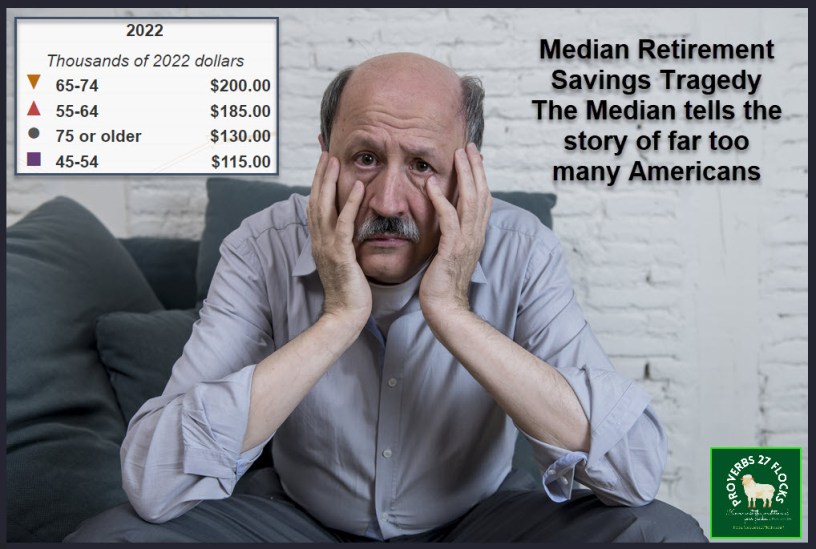

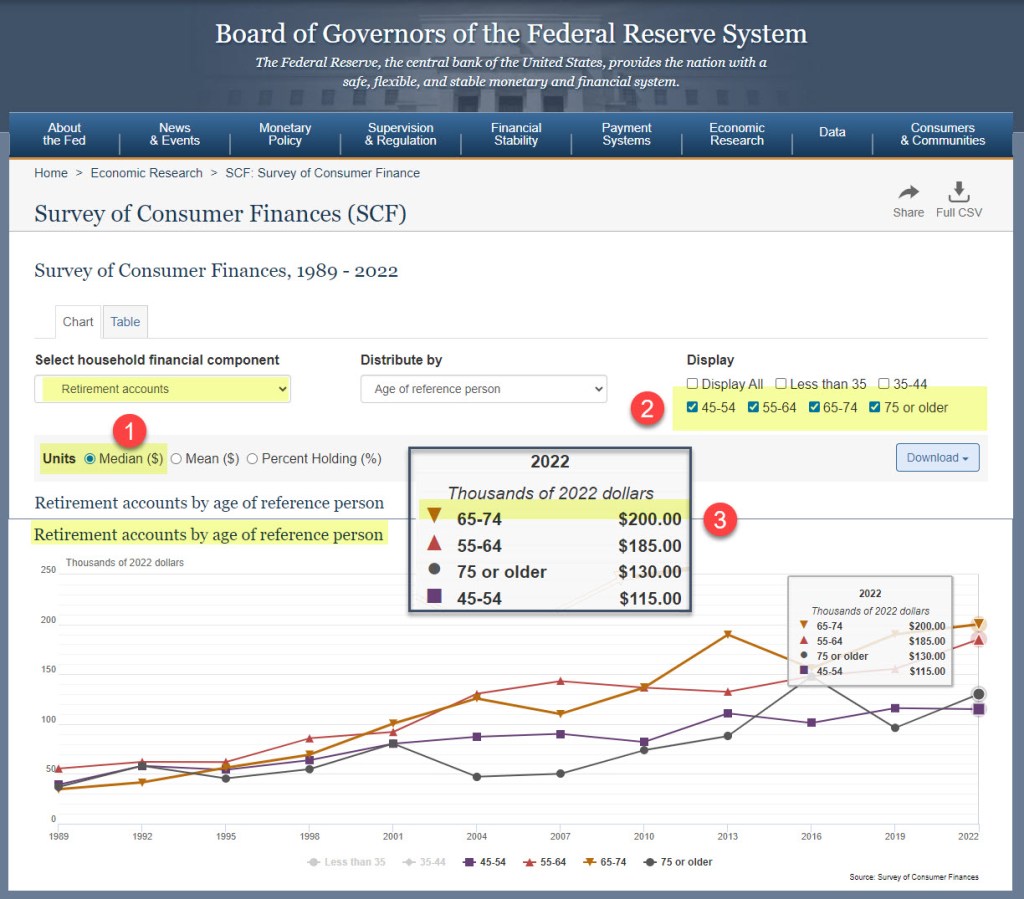

As a result many enter the retirement years with little or no retirement savings. Furthermore, it is ridiculous to look at the “average” retirement savings. The reason is simple: one percent of the population has saved millions of dollars for retirement, but the vast majority have saved far less. Therefore, it is better to consider the median retirement account balance by a person’s age.

The Federal Reserve Data 2022

The following chart helps illustrate the problem. The median retirement account balance of those ages 65-74 is $200,000. That may seem like a lot, but it isn’t. If you want income from that balance, and if you can get five percent from that balance, you can only expect about $10,000 per year in income from that balance. Bear in mind that this is the MEDIAN. That means over half of the people in this age group have less than $200K in retirement savings.

Social Security is designed to cover less than 40% of your retirement income needs. If you can only get about $10K in income from your retirement piggybank, then you will fall woefully short of cash for expenses during retirement.

How Does This Tragedy Happen?

One of the participants in the Fidelity Investor Community recently posted the following question: “According to federal reserve consumer stats, the median retirement savings is only $200,000 for retirees! How do people end up like that in the wealthiest economy in the world? Is it bad decisions? Financial illiteracy? Divorces? Laziness? Bad luck?”

My Response to the Question

The median seems to fit with what I have personally experienced. Some approach their 60’s with less than $100K. They were not thinking like the ant mentioned by King Solomon in Proverbs. Based on helping 30-40 individuals and couples over the years, I’d say these were the key problems:

1. Lack of financial literacy. None of them had ever heard of the Rule of 72 and most thought keeping cash was less risky than the scary “stock market.” None of them were thinking about inflation or income taxes.

2. High consumer debt and so very little extra for savings or charitable giving. Big homes, new cars, cool boats, fancy clothing, many toys are the rulers in their lives.

3. Expensive choices like frequent purchases of new vehicles and luxury vacations.

4. Thinking that luxuries are necessities. “I have to have….”

5. A lack of due diligence: Selecting a financial advisor who was a crook and who wound up in federal prison. But even if your advisor isn’t a crook, it doesn’t mean he/she is wise or that they are a fiduciary. (Two individuals were working with the crooked advisor, and one was related to the crook.) Therefore, a lack of due diligence in picking an advisor.

6. Lack of diversification or picking asset classes or stocks based on news stories.

Are You as Wise as an Ant?

“Go to the ant, O sluggard; consider her ways, and be wise. Without having any chief, officer, or ruler, she prepares her bread in summer and gathers her food in harvest.” Proverbs 6:6-8

All scripture passages are from the English Standard Version except as otherwise noted.