Number Two of Twenty

In the world of thoughtful investing, Howard Marks wrote a helpful book with the title THE MOST IMPORTANT THING. However, Mr. Marks lists twenty different things that are “most important” to a thoughtful investor. In chapter one he said no rule always works. You cannot depend on a rule or a sure-thing formula. He calls on the reader to have second-level thinking which is a mix of science (of numbers and charts) and that investing is also an art. This type of thinking is more work. It is the difference between the design and usefulness of the iPhone and the flip phone.

The herd often has only first-level thinking that doesn’t involve much thinking. The combination of science and art in investing is not a mindless task.

Chapter 2: Understanding Market Efficiency (and Its Limitations)

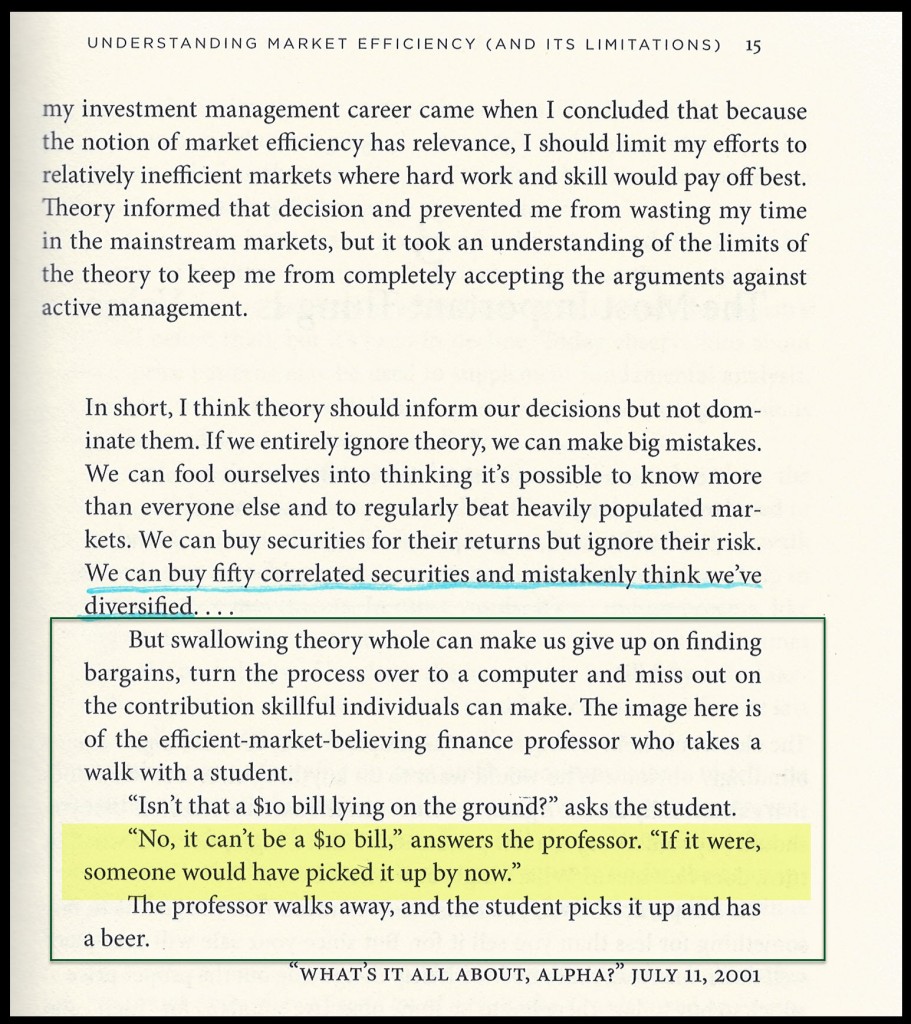

Because there are many participants in the market and we all have the same information (unless we are insider trading), then the theory is that the market accurately tells us what an investment is worth. This often (sometimes) makes the market an efficient measure of the value of each investment. The market is efficient because it is fast and incorporates new information as it becomes available. The problem is that kneejerk reactions are sometimes wrong.

If a stock was worth $50 on Friday and on Monday investors are paying $25 per share, were the Friday investors wrong? Perhaps not if the asset is examined in light of a long-term view. If the asset climbed to $100, doubling in value on Monday, is the asset price now a more accurate view of the real value of the stock? Perhaps and perhaps not: the market reflects the current consensus and sometimes the herd is euphoric and sometimes it is gloomy.

How Is This Knowledge Useful?

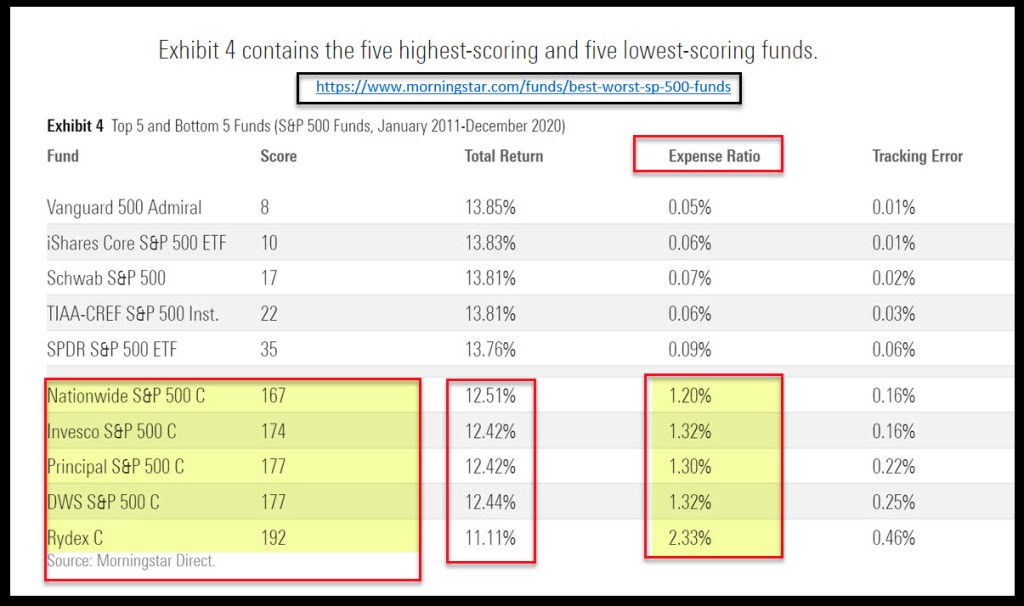

Far too often the reaction of the market is either overly pessimistic or overly optimistic. As a result, there can be a great deal of volatility and price variability. Mutual funds want you to believe that they can navigate this better than you can, and they charge you for their deeper wisdom or understanding. Sadly, the mutual fund managers are rarely going to return amazing results over the long-term. Paying one percent year-after-year for the expert’s help rarely makes sense.

That is why index funds have prospered. The index fund manager has a relatively easy task. If the index they track is the S&P 500, then they only have to buy the same investments (in the same relative quantities) to the index. If the index returns eight percent, then the index fund returns should closely mirror those returns. That is why you should never overpay for an index fund. If you can get one for zero percent or for 0.50%, choose the one with the zero percent cost.

Some Examples

FXAIX is the Fidelity 500 Index Fund Other. The current expense ratio is 0.02%. VOO (Vanguard S&P 500 ETF) has an expense ratio of 0.03%. However, SBSPX (Franklin S&P 500 Index Fund No Load) has an expense ratio of 0.54% and SXPAX (DWS S&P 500 Index Fund A) has an expense ratio of 0.55%.

Even worse, MIEAX (MM S&P 500® Index Fund Retirement) has an expense ratio of 0.64%. If that isn’t bad enough, RYSPX (Rydex S&P 500 Fund Other) has an expense ratio of 1.61%. What do you get for paying more for a fund that tracks the S&P 500 index? Nothing except lower long-term real returns.

Other Insights From The Most Important Thing

It is foolish to think that higher risk always results in higher returns. In the good times this is easily forgotten. Marks says, “if riskier investments could be counted on to produce higher returns, they wouldn’t be riskier.” p. 10 of The Most Important Thing

The market can be and sometimes is inefficient. The market makes mistakes every day, every week, every month, and every year. This quickly becomes evident when an asset drops quickly in value and then rises quickly to new highs. The examples are many but consider Tesla. TSLA shares are down almost 29% YTD. In November 2021 TSLA shares were trading over $400 per share. They are now trading at under $180 per share. For years TSLA traded in the teens, so if you bought shares at $15 you would be very happy as a long-term investor. Those investors were proven right and those that bought at $400 per share may regret their acceptance of the “efficient market.”

In contrast, Amazon’s shares are currently trading at about $185 per share. One year ago they were trading at about $115 per share. Amazon also traded in the teens ten years ago. Again, long-term investors should be very pleased with their returns.

One question wise buyers ask is “why is the other investor selling?” Do those other investors have a long-term perspective, or have they allowed the current “science” to cloud the “art” of the investment. Today might be a good day to buy TSLA and sell AMZN, but only time will really tell.

Here is an interesting illustration:

What Are an Investor’s Choices?

If you own shares of VOO, then you can participate in almost 100% of the returns of the S&P 500 index. If you own shares of RYSPX your broker is legally (but not ethically) giving you a raw deal. Don’t overpay for a product just because your broker tells you it is better.

Who Wins?

So you cannot do what everyone else is doing and expect to have results better than the herd. However, the index herd isn’t a bad place to me, as long as you can weather the bear markets and market volatility.

The Next Chapter is Value

The third “most important thing” is “Value.” We want to buy low and sell high. We want to understand the intrinsic (real underlying) value of an investment.