Is There a Lion in the Marketplace?

There are two times when you can buy an investment. You can buy when everyone else is selling, because that drives the price of the investment down, or you can buy when everyone else is buying, because that sometimes drives the price up (at least temporarily). This is an age old conundrum, puzzle or challenge. Even the Proverbs talk about the dangers we face in life:

“The sluggard says, ‘There is a lion outside! I shall be killed in the streets!’” Proverbs 22:13

“The sluggard says, ‘There is a lion in the road! There is a lion in the streets!’” Proverbs 26:13

“Know well the condition of your flocks and give attention to your herds.” Proverbs 27:23

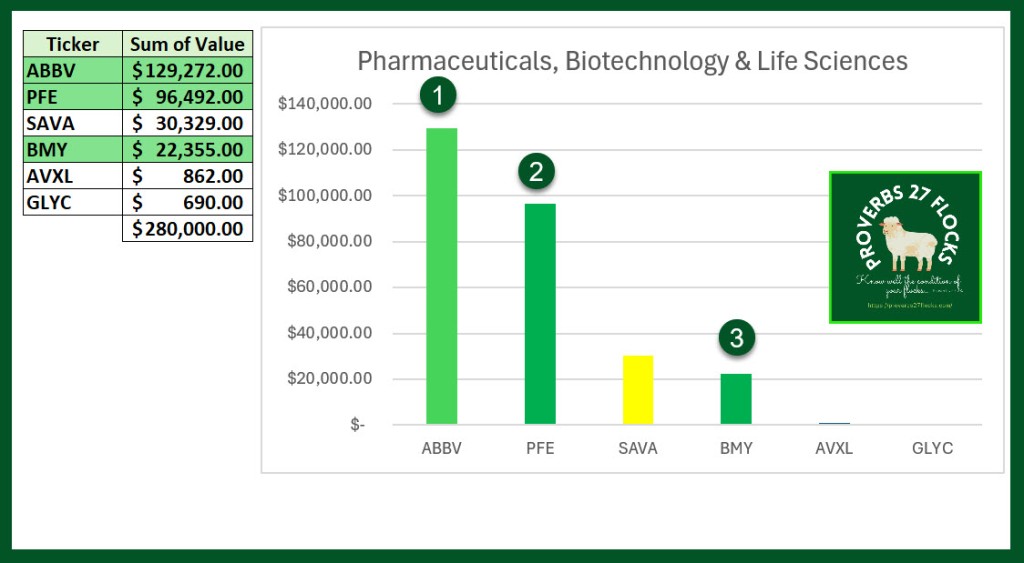

Our Healthcare Portfolio

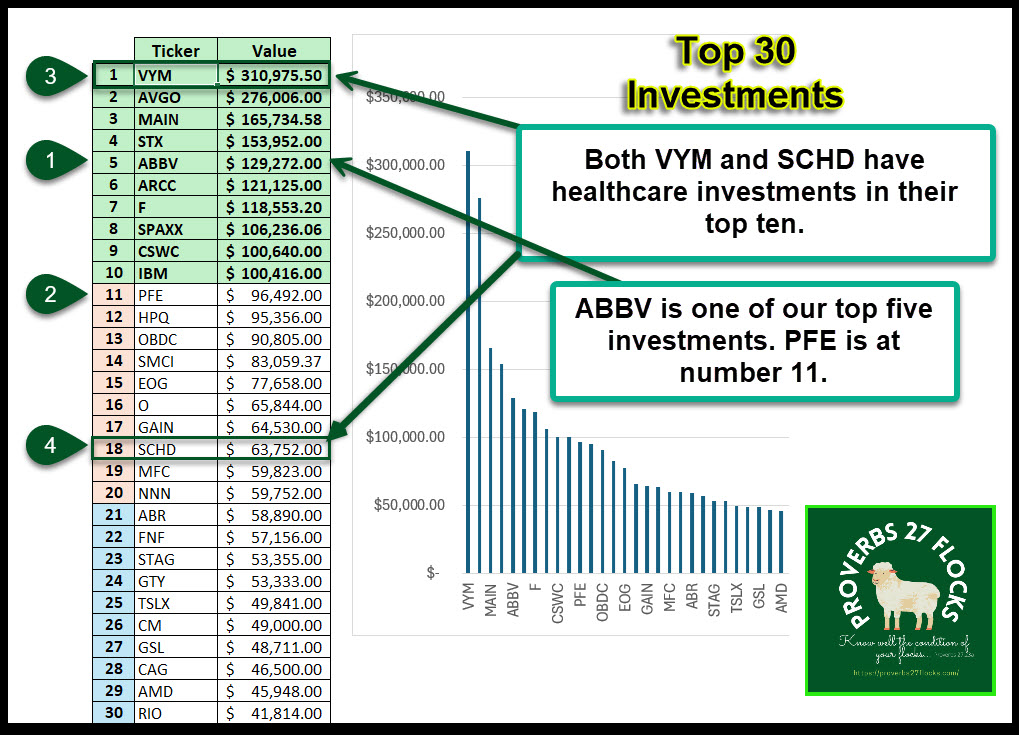

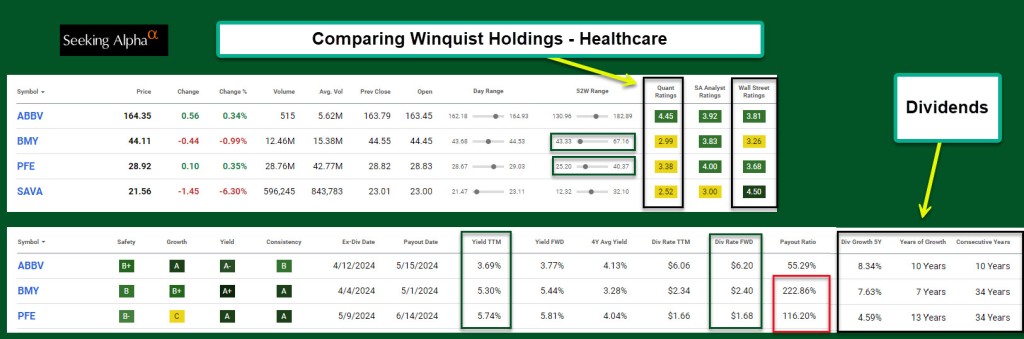

On the surface it would appear that our healthcare investments are focused on three main dividend paying stocks: ABBV, PFE, and BMY. ABBV is in our top five investments, and I hold shares of ABBV in my traditional IRA and in my ROTH. BMY is a recent addition. Sadly, the share price has dropped since I bought shares.

The question is: “Will this continue, or will the shares increase in value?” I don’t know, but I tend to like to buy an investment when it falls out of favor. Therefore, if I wanted more health care exposure, I would be adding shares of BMY. However, if I wanted another 500 shares, I would buy them gradually, not all at once.

Hidden Healthcare Investments

If you own shares of an S&P 500 index, like VOO, then you already own healthcare stocks. In fact, 12.33% of VOO is in healthcare. Furthermore, Eli Lilly and Co (LLY) is in the top ten. In addition, because we own shares of VYM and SCHD, we have shares of healthcare companies in those as well.

Even DGRO has allocations to healthcare: Johnson & Johnson, AbbVie Inc, and Merck & Co Inc. Therefore, my ABBV holdings are actually more than what is shown by just totaling the shares in my IRA and my ROTH.

The point is this: if you own shares of mutual funds and ETFs, understand the top ten investments in each of them. That might inform your choice of discrete healthcare investments like ABBV, PFE, and BMY.

Recommendation

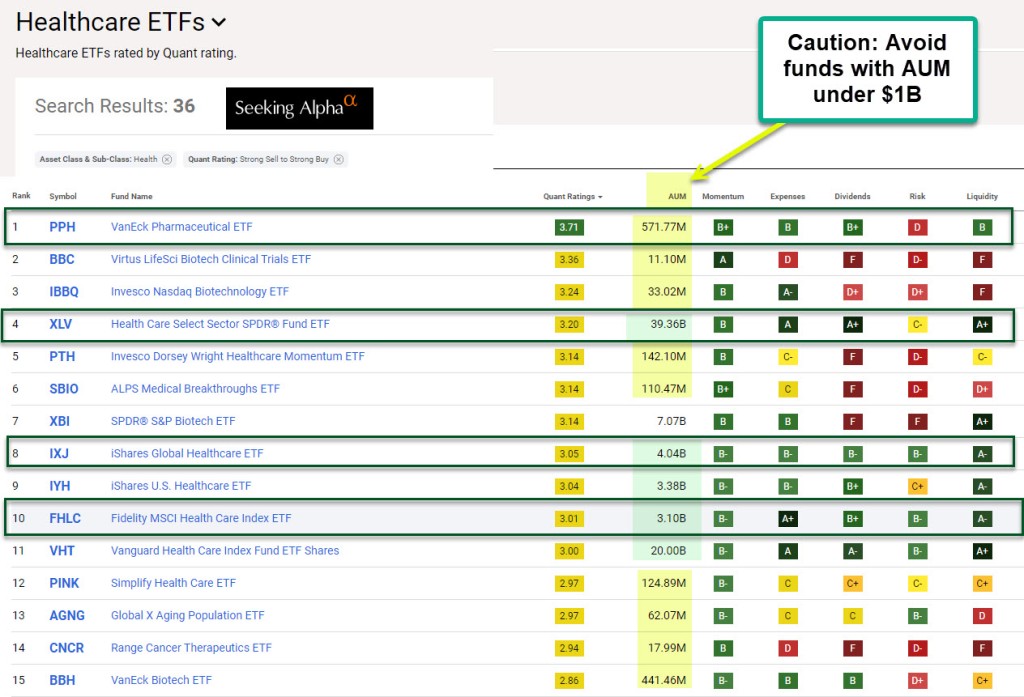

If you don’t have a lot of money to invest in healthcare, but you want some healthcare exposure, then I suggest you buy shares of one of the following ETFs: XLV, IXJ,or FHLC. FHLC is the one I use for our grandchildren’s UTMA accounts.

If you like the idea of buying when an investment is out of favor, then I would choose BMY and PFE in equal amounts. Obviously, I also like ABBV, because it is a top-five investment. I think ABBV has good long-term prospects. Perhaps you might want to buy equal dollar amounts of all three. NOTE: BMY and PFE appear to have ridiculous payout ratios. I looked at the earnings data and I don’t think this reflects reality going forward. Therefore, I don’t see the dividends as being at risk at this time.

Avoid SAVA unless you have an appetite for a great deal of risk. “Cassava Sciences, Inc., a clinical stage biotechnology company, develops drugs for neurodegenerative diseases. Its lead therapeutic product candidate is simufilam, a small molecule drug, which is completed Phase 2 clinical trial; and investigational diagnostic product candidate is SavaDx, a blood-based biomarker/diagnostic to detect Alzheimer’s disease. The company was formerly known as Pain Therapeutics, Inc. and changed its name to Cassava Sciences, Inc. in March 2019. Cassava Sciences, Inc. was incorporated in 1998 and is based in Austin, Texas.”

All scripture passages are from the English Standard Version except as otherwise noted.